Pan American Announces Preliminary Economic Assessment of the La Colorada Skarn Project

- Production averaging 17.2 million ounces of silver, 427 thousand tonnes of zinc and 218 thousand tonnes of lead annually during the first 10 years

- 50,000 tonnes per day sub-level cave mining method and conventional flotation plant

- 17-year mine life and continued exploration upside, with more than 40,000 metres of recent drilling not included in current mineral resource estimate

- After-tax NPV(8%) of $1,087 million, 14% IRR, and payback period of 4.3 years estimated using long-term prices of $22 per ounce of silver, $2,800 per tonne of zinc, and $2,200 per tonne of lead.

(All amounts are in United States Dollars unless otherwise indicated)

Pan American Silver Corp. (NYSE: PAAS) (TSX: PAAS) announces the results of a preliminary economic assessment of its 100% owned, long-life La Colorada Skarn project in Zacatecas, Mexico.

“Our objective is to provide investors with exposure to silver, and the La Colorada Skarn provides that exposure in scale, with annual silver production estimated to average 17.2 million ounces during the first 10 years. It is also expected to produce 427 thousand tonnes of zinc annually during that period, which we anticipate would coincide with decreasing zinc supply in the market. Given the volume of base metals in the deposit, Pan American is assessing interest from base metal producers and other capable parties to explore long-term partnerships to develop this polymetallic project, allowing Pan American to focus on the large amount of anticipated silver production,” said Michael Steinmann, President and Chief Executive Officer of Pan American.

“Discovering a deposit of this magnitude beneath our currently producing La Colorada mine is an exceptional opportunity to create long-term value for our shareholders. The mineral resource update released today does not include any drill results from 2023, which will continue to expand the resource envelope and provide opportunities to enhance the life-of-mine economics,” added Mr. Steinmann.

Project Highlights

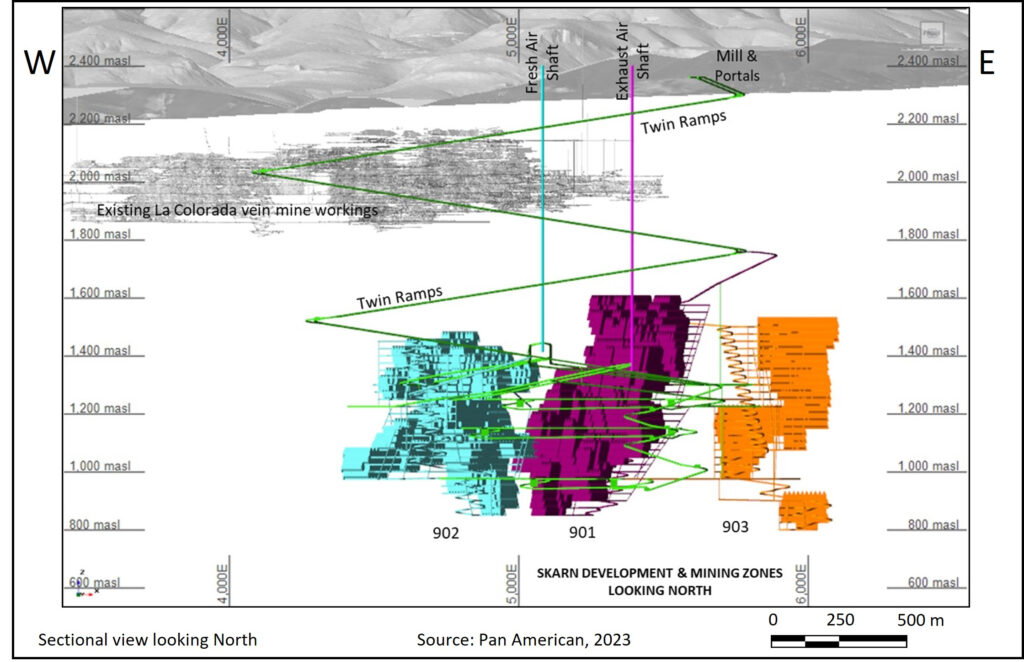

- The PEA for the La Colorada Skarn project envisions development of a mine utilizing a 50,000 tonnes per day sub-level cave mining method, accessed via decline ramps and two ventilation shafts. Initial development would be undertaken over a six-year period after permitting. A conventional 50,000 tpd capacity selective zinc and lead flotation processing plant and dry-stack tailings facility would produce silver-bearing mineral concentrates at an average rate of 2,003 tpd of zinc concentrate grading 59% Zinc and 846 tpd of lead concentrate grading 61% lead.

- The estimated average annual silver, zinc and lead production would be 17.2 million ounces, 427 thousand tonnes and 218 thousand tonnes, respectively, during the first 10 years of production.

- Estimated 17-year life of mine (“LOM”), which does not take into account the 2023 drill results that were disclosed in Pan American’s news releases dated May 2, 2023 and December 5, 2023.

- Metallurgical test work programs conducted included mineralogical analysis, detailed comminution, flotation, and thickening and filtration of the tailings. The flotation concentrates produced from the proposed processing plant are expected to be high-grade, high-quality zinc concentrate and high silver-bearing lead concentrate and are therefore readily marketable. LOM average zinc recovery of 93.7% with concentrate grading 59% zinc and 97 grams per tonne silver along with lead recovery of 84.3% with concentrate grading 61% lead and 1,438 g/t silver, yielding an overall silver recovery of 84.8% with 72.5% reporting to the lead concentrate.

- The unit operating cost (including mine, mill and general & administrative costs) averages $40.88 per tonne over the LOM. The unit operating cost when at full production averages $38.50 per tonne.

- Estimated initial capital cost of $2,829 million over a six-year construction period, with peak spending in years four and five when the mill is being constructed. The payback period of the initial investment is expected to be 4.3 years. The current La Colorada vein mining operation would continue during the Skarn construction and development period.

- Total LOM sustaining capital estimated at $951 million.

- Cumulative after-tax cash flow of $5,689 million.

- After-tax net present value (“NPV”) of $1,087 million at an 8% discount rate with an after-tax internal rate of return (“IRR”) of 14%, an NPV of $1,572 million at a 6.5% discount rate, and an NPV of $2,182 million at a 5% discount rate, using average LOM metal prices of $2,800 per tonne zinc, $2,200 per tonne of lead and $22 per ounce of silver.

- The proposed SLC mining method has been identified as a technically viable method of developing the Skarn deposit. Further extension and definition of the mineralisation could complement and expand the initial SLC mining inventory. Expanded SLC and block cave mining methods will be further evaluated in future studies.

- The PEA for the La Colorada Skarn project is based on the mineral resource estimate as at December 15, 2023, which reflects 242,000 metres of drilling. The geological model was completed in December 2022, and neither the mineral resource estimate nor the PEA include the more than 40,000 metres of drilling that was completed during 2023. Further exploration and infill drilling is aimed at expanding the current mineral resource envelope, and is expected to be reflected in an updated mineral resource estimate in mid-2024.

- The La Colorada Skarn is located below and adjacent to our currently producing La Colorada mine on the Company’s existing mining concessions. Pan American owns the surface rights required for the facilities envisaged in the PEA, and owns the mineral concessions in which the mineral resources included in the PEA are located. Pan American has also negotiated preliminary terms for a joint venture arrangement on certain adjacent mineral concessions, which would allow it to utilize these concessions for the proposed Skarn project, and present further opportunities for exploration and project expansion.

- Permits would be required to develop a SLC mine, a new processing facility, a dry-stack tailings facility and other surface infrastructure. Some existing permits are expected to benefit the Skarn project in development and operations. The Skarn project will also likely be subject to additional authorizations, consultations and agreements in the normal course of business, as well as other risks and uncertainties.

- The use of existing La Colorada site infrastructure for the Skarn project will be included as part of the design where it is practical to do so. The design of the new facilities and the underground mine will focus on the application and incorporation of automation, electrification, energy efficiency, and the use of renewable energy sources to minimize the carbon footprint of the Skarn project.

An updated technical report, prepared in accordance with National Instrument 43-101 Standards of Disclosure for Mineral Projects on Pan American’s La Colorada property will be filed with Canadian securities regulators within 45 days of this news release, and will include the PEA on the La Colorada Skarn project. The technical report will be available under the Company’s profile on SEDAR+ (www.sedarplus.ca) and at panamericansilver.com.

Production Metrics and Financial Analysis (based on 50,000 tpd production rate)

| Construction period | 6 years |

| Production mine life | 17 years |

| Production rate | 50,000 tpd (or 18.25 million tonnes per annum) |

| Mineable inventory | 284.7 million tonnes |

| Average annual silver produced first 10 years | 17.2 million ounces |

| Average annual zinc produced first 10 years | 427 thousand tonnes |

| Average annual lead produced first 10 years | 218 thousand tonnes |

| Unit operating costs | $40.88 per tonne |

| Total LOM revenue | $23,853 million |

| Initial capital | $2,829 million |

| Total LOM sustaining capital | $951 million |

| Total LOM operating cost | $11,638 million |

| Cumulative after-tax cash flow | $5,689 million |

| After-tax NPV(5%) | $2,182 million |

| After-tax NPV(6.5%) | $1,572 million |

| After-tax NPV(8%) | $1,087 million |

| After-tax IRR | 14% |

| Pay-back period (after tax, undiscounted) | 4.3 years |

Notes:

- Assumes metal prices of $2,800 per tonne zinc, $2,200 per tonne of lead and $22 per ounce of silver.

- The PEA is preliminary in nature, includes inferred mineral resources that would be considered too speculative geologically to have the economic considerations applied to them that would enable them to be categorized as mineral reserves, and there is no certainty that the preliminary economic assessment will be realized.

SENSITIVITY ANALYSIS

The following tables provide sensitivities for NPV(8%) and NPV(6.5%) at various silver and zinc prices and based on a production capacity of 50,000 tpd.

| NPV(8%) $ millions | Ag prices ($/oz) | ||||||

| Zn prices ($/t) | 18.00 | 20.00 | 22.00 | 24.00 | 26.00 | 28.00 | |

| 2,200 | 75 | 177 | 276 | 376 | 475 | 574 | |

| 2,500 | 484 | 583 | 682 | 781 | 880 | 979 | |

| 2,800 | 889 | 988 | 1,087 | 1,186 | 1,285 | 1,384 | |

| 3,100 | 1,295 | 1,394 | 1,493 | 1,592 | 1,690 | 1,789 | |

| 3,400 | 1,699 | 1,798 | 1,897 | 1,996 | 2,094 | 2,193 | |

| NPV(6.5%) $ millions | Ag prices ($/oz) | ||||||

| Zn prices ($/t) | 18.00 | 20.00 | 22.00 | 24.00 | 26.00 | 28.00 | |

| 2,200 | 368 | 489 | 606 | 723 | 840 | 957 | |

| 2,500 | 855 | 972 | 1,089 | 1,206 | 1,323 | 1,440 | |

| 2,800 | 1,338 | 1,455 | 1,572 | 1,689 | 1,806 | 1,923 | |

| 3,100 | 1,820 | 1,937 | 2,054 | 2,171 | 2,288 | 2,405 | |

| 3,400 | 2,302 | 2,419 | 2,536 | 2,652 | 2,769 | 2,886 | |

Pan American also considered an alternative development scenario based on a 30,000 tpd production rate, as shown in the following table. The initial capital was reduced appropriately, and the unit operating costs were increased to reflect the lower throughput. The result was an after-tax NPV(8%) of $498 million and an IRR of 10%. Due to the superior economics, the 50,000 tpd production case was the preferred scenario in this PEA. Pan American will continue to evaluate development options and opportunities to enhance the life-of-mine economics.

Production Metrics and Financial Analysis (based on 30,000 tpd production rate)

| Construction period | 6 years |

| Production mine life | 27 years |

| Production rate | 30,000 tpd (or 10.95 million tonnes per annum) |

| Mineable inventory | 283.9 million tonnes |

| Average annual silver produced first 10 years | 11.1 million ounces |

| Average annual zinc produced first 10 years | 268 thousand tonnes |

| Average annual lead produced first 10 years | 143 thousand tonnes |

| Unit operating costs | $42.38 per tonne |

| Total LOM revenue | $23,797 million |

| Initial capital | $2,642 million |

| Total LOM sustaining capital | $1,024 million |

| Total LOM operating cost | $12,035 million |

| Cumulative after-tax cash flow | $5,663 million |

| After-tax NPV(5%) | $1,560 million |

| After-tax NPV(6.5%) | $952 million |

| After-tax NPV(8%) | $498 million |

| After-tax IRR | 10% |

Notes:

- Assumes metal prices of $2,800 per tonne zinc, $2,200 per tonne of lead and $22 per ounce of silver.

ESTIMATED MINERAL RESOURCE

The indicated mineral resource is estimated to total 173.6 million tonnes containing 183 million ounces of silver, 4.8 million tonnes of zinc and 2.3 million tonnes of lead. In addition, the inferred mineral resource is estimated to total 103.6 million tonnes containing 116 million ounces of silver, 2.6 million tonnes of zinc and 1.1 million tonnes of lead. The mineral resource estimate is based on a $50 per tonne net smelter return and the caving constraints and geometry for an underground SLC mining method.

| Classification | Tonnes (millions) |

Zn (%) |

Pb (%) |

Ag (g/t) |

| Indicated | 173.6 | 2.79 | 1.32 | 33 |

| Inferred | 103.6 | 2.47 | 1.03 | 35 |

Notes:

- The effective date of the mineral resources estimate is December 15, 2023. The geological model was completed in December 2022 and diamond drilling from 2023 is not included in this estimate.

- Estimation and reporting of mineral resources were carried out in accordance with Canadian Institute of Mining, Metallurgy and Petroleum guidelines.

- Mineral resources have been classified into indicated and inferred confidence categories.

- Mineral resources have reasonable prospects for eventual economic extraction demonstrating sufficient spatial continuity of mineralisation constrained within a potentially mineable shape. Mineral resources that are not mineral reserves do not have demonstrated economic viability. No mineral reserves are reported at this time for the La Colorada Skarn project.

- Prices used to report mineral resources were: $22 per ounce of silver, $2,800 per tonne of zinc and $2,200 per tonne of lead.

- An estimated NSR (in US$/t) was calculated using metallurgical recoveries of 87.4% Ag, 88% Pb and 93% Zn with mineral concentrate qualities of 67% Pb in lead concentrate and 60% Zn in zinc concentrate, obtained from metallurgical testing. Estimates for transport, payability and refining/selling costs, based on experience and long-term views of the marketing, treatment and refining of these types of mineral concentrates, were included.

- Reasonable prospects for eventual economic extraction were assessed by determining the total in-situ tonnes and metal grades constrained inside volumes that are based on a SLC mining method. To determine the constraining SLC shapes an initial elevated cutoff value of $50/t NSR was applied. Then geotechnical, geometry and caving rules were applied to ensure practical mining shapes and sequences were achieved. Each level, in each zone, was individually tested for overall economics, and then tested as part of the caving sequence. The resulting constraining shapes were then considered to be practical mining outlines. The tonnes and grades are inclusive of the must-take low grade material within the volume. No other mining recovery, ring recovery, dilution or mineral losses have been applied.

- This mineral resource estimate was prepared under the supervision of, or was reviewed by, Christopher Emerson, FAusIMM, Vice President Exploration and Geology, who is a Qualified Person as that term is defined in NI 43-101.

- Grades are shown as contained metal before mill recoveries are applied. The Company has undertaken a verification process with respect to the data disclosed in this news release.

- A total of 298 diamond drill holes with a total length of 242,000 metres were used in the geological interpretation and resource estimate. Several old historic drill holes were included in the modeling. Drilling of the La Colorada Skarn deposit has been completed from both surface and underground drill platforms.

- All drill hole samples used in the mineral resource estimate have been previously reported in news releases dated October 23, 2018, February 21, 2019, May 8, 2019, August 1, 2019, October 30, 2019, February 13, 2020, August 4, 2020, May 12, 2021, November 10, 2021, February 24, 2022, and May 9, 2022.

General Notes with Respect to Technical Information

The drill hole samples were prepared by the internal La Colorada mine laboratory, SGS of Durango, Activation Laboratories Ltd of Zacatecas, Bureau Veritas of Hermosillo and ALS Global, Mexico. The SGS, Actlabs, Bureau Veritas and ALS Global laboratories are independent from Pan American. Pan American implements a quality assurance and quality control (“QAQC”) program, including the submission of certified standards, blanks, and duplicate samples to the laboratories.

Actlabs, SGS and ALS Global all used fire assay with gravimetric finish for gold, and acid digestion with ICP finish for silver, lead, zinc, and copper. Samples delivered to ALS Global were prepared in Zacatecas, Mexico laboratory and sent to Vancouver, BC laboratory for assay. Bureau Veritas used fire assay with gravimetric finish for gold and by acid digestion with ICP finish for silver, lead, zinc, and copper in their Vancouver, Canada laboratory. The La Colorada mine laboratory, which is operated by our employees, used fire assay with gravimetric finish for gold and silver, and acid digestion with atomic absorption finish for lead, zinc, and copper.

The results of the QAQC samples submitted to SGS, Actlabs, Bureau Veritas, ALS Global and the La Colorada mine laboratory all demonstrate acceptable accuracy and precision.

The Qualified Person for the mineral resource estimate is of the opinion that the sample preparation, analytical, and security procedures followed for the samples are sufficient and reliable for the purpose of this news release and for the purpose of any future mineral resource and mineral reserve estimates. There were no limitations on the Qualified Persons’ verification process. Pan American is not aware of any drilling, sampling, recovery or other factors that could materially affect the accuracy or reliability of the data reported herein.

See the Company’s Annual Information Form dated February 22, 2023, available at www.sedarplus.ca, or Pan American’s most recent Form 40-F filed with the United States Securities and Exchange Commission for further information on the La Colorada mine, including detailed information concerning associated QA/QC and data verification matters, the key assumptions, parameters and methods used by the Company to estimate mineral reserves and mineral resources, and for a detailed description of known legal, political, environmental, and other risks that could materially affect the Company’s business and the potential development of the Company’s mineral reserves and mineral resources.

Technical information contained in this news release with respect to the PEA and the La Colorada mine has been reviewed and approved by Christopher Emerson, FAusIMM, Vice President Exploration and Geology, and Martin Wafforn, P.Eng., Senior Vice President Technical Services and Process Optimization, each of whom is a Qualified Person for the purposes of National Instrument 43-101 – Standards of Disclosure for Mineral Projects. Pan American Silver Corp is authorized by The Association of Professional Engineers and Geoscientists of the Province of British Columbia to engage in Reserved Practice under Permit to Practice number 1001470.

Cautionary Note to US Investors

This news release has been prepared in accordance with the requirements of Canadian NI 43-101 and the CIM, which differ from the requirements of U.S. securities laws. NI 43-101 is a rule developed by the Canadian Securities Administrators that establishes standards for all public disclosure an issuer makes of scientific and technical information concerning mineral projects.

Canadian public disclosure standards, including NI 43-101, differ significantly from the requirements of the SEC, and information concerning mineralization, deposits, mineral reserve and mineral resource information contained or referred to herein may not be comparable to similar information disclosed by U.S. companies. In particular, and without limiting the generality of the foregoing, this news release uses the terms ”indicated mineral resources”, and ”inferred mineral resources”. U.S. investors are advised that, while such terms are recognized and required by Canadian securities laws, the SEC does not recognize them. The requirements of NI 43-101 for identification of ”reserves” are not the same as those of the SEC, and may not qualify as ”reserves” under SEC standards. Under U.S. standards, mineralization may not be classified as a ”reserve” unless the determination has been made that the mineralization could be economically and legally produced or extracted at the time the reserve determination is made. U.S. investors are cautioned not to assume that any part of an “indicated mineral resource” will ever be converted into a “reserve”. U.S. investors should also understand that “inferred mineral resources” have a great amount of uncertainty as to their existence and great uncertainty as to their economic and legal feasibility. It cannot be assumed that all or any part of “inferred mineral resources” exist, are economically or legally mineable or will ever be upgraded to a higher category. Under Canadian securities laws, estimated “inferred mineral resources” may not form the basis of feasibility or pre-feasibility studies except in rare cases. Disclosure of “contained metal” in a mineral resource is permitted disclosure under Canadian securities laws. However, the SEC normally only permits issuers to report mineralization that does not constitute “reserves” by SEC standards as in place tonnage and grade, without reference to unit measures. Accordingly, information concerning mineral deposits set forth herein may not be comparable with information made public by companies that report in accordance with U.S. standards.

About Pan American Silver

Pan American Silver is a leading producer of precious metals in the Americas, operating silver and gold mines in Canada, Mexico, Peru, Bolivia, Argentina, Chile and Brazil. We also own the Escobal mine in Guatemala that is currently not operating, and we hold interests in exploration and development projects. We have been operating in the Americas for nearly three decades, earning an industry-leading reputation for sustainability performance, operational excellence and prudent financial management. We are headquartered in Vancouver, B.C.

La Colorada Skarn Development and Mining Zones (as at December 2023)

La Colorada Skarn Inferred + Indicated Mineral Resources (as at December 2022)

MORE or "UNCATEGORIZED"

Eloro Resources Announces Closing of Bought Deal LIFE Private Placement for Gross Proceeds of C$17 Million

Eloro Resources Ltd. (TSX: ELO) (FSE: P2QM) is pleased to announce the closing of its previously an... READ MORE

Minera Alamos Updates Resources and Reserves for the Pan Gold Mine in Nevada

Minera Alamos Inc. (TSX-V: MAI) (OTCQX: MAIFF) is pleased to announce updated Mineral Resource and M... READ MORE

Ero Copper Reports Fourth Quarter and Full Year 2025 Operating and Financial Results

Ero Copper Corp. (TSX: ERO) (NYSE: ERO) is pleased to announce its operating and financial results f... READ MORE

Rare Element Resources Announces Results of Oversubscribed Rights Offering of Common Shares

Rare Element Resources Ltd. (OTCQB: REEMF) is pleased to report that its previously announced... READ MORE

TRX Gold Reports Record Q2 2026 Production and Company Update

TRX Gold Corporation (TSX: TRX) (NYSE American: TRX) is pleased to announce preliminary resu... READ MORE