Palisade Research – “Summer Drilling in the ‘Golden Triangle’ Means Big Gains For Investors”

The drills are finally turning in the ‘Golden Triangle’. . .

And after a longer than normal winter – the Golden Triangle in Northwestern British Columbia is finally accessible.

What there awaits is literally hundreds of billions of undiscovered gold and silver. Just so you have an idea, estimates peg that only 0.0006% of the Golden Triangle has been mined to date.

This place is home to some of the highest grade gold mines. . .

For instance – Eskay Creek, which became Canada’s highest-grade gold mine, produced 3.37 million ounces of gold grading 49 g/t (grams-per-ton) and 160 million ounces of silver grading 2,406 g/t.

Nonetheless – despite the outstanding grades – the remoteness of the Golden Triangle, along with depressed gold prices, halted significant exploration during the late 1990’s.

The area remained stagnant until glacial retreat, a new highway (Hwy 37), a high-voltage transmission line – and increasing gold prices made it busy again.

Since then, the area has undergone a renaissance and is home to some of the most notable recent discoveries – including: Seabridge Gold’s KSM project, Pretium Resources’ Brucejack Gold Mine, and Imperial Metals’ Red Chris Mine.

While new infrastructure and a higher gold price definitely helps – nothing can be done about ‘Mother Nature’. . .

During the winter months, cold weather makes working there very difficult. And exploration activity in the area plummets.

But, once the deep freeze is over and things warms up – the market gets excited again.

This is because the more they can drill, the more they can discover. . .

By looking at the ‘Palisade Golden Triangle Index’ below, you can see the correlation between weather and prices.

The snow-filled winter months (non-highlighted) are periods of flat and declining prices – due to the inactivity.

Yet – during the spring/summer months (highlighted yellow), which is when exploration companies can carry out their extensive

drilling – prices surge higher. . .

That’s why today – with summertime just beginning – it’s the best time to get involved in the Golden Triangle’s coming upswing.

And within our portfolio – we have one ‘Golden Triangle Play’ that not only has the project to justify much higher prices, but is also backed by some of the most prolific, well-known investors and geologists of the Golden Triangle. . .

Golden Ridge Resources (CVE:GLDN, FRA:44G) and the ‘Hank’ Property

Share Price: C$0.17

Shares Outstanding: 73.6M

Market Capitalization: C$12.5M

Cash: C$3.0M

Total Liabilities: C$0.6M

Due to the nature of the Golden Triangle’s cyclical weather, many explorers jump the gun simply to generate as much news flow as they can – when they can.

Mike Blady, originally profiled here, was meticulous in the first two years he held the option on GLDN’s flagship property, ‘The Hank’.

Mike and his team began by painstakingly reprocessing and digitizing the historical data, completing a deep-seeking 3D IP survey, sampling and expanding historic zones and cores to get a better grasp on the larger picture.

Through conceptual models of the epithermal gold and silver veins, and the advice of his serially successful technical advisors, Mike believes that there are bonanza grades associated with elevation-controlled boiling zones. This theory is validated by outcrop and disseminated low-grade gold sitting at surface.

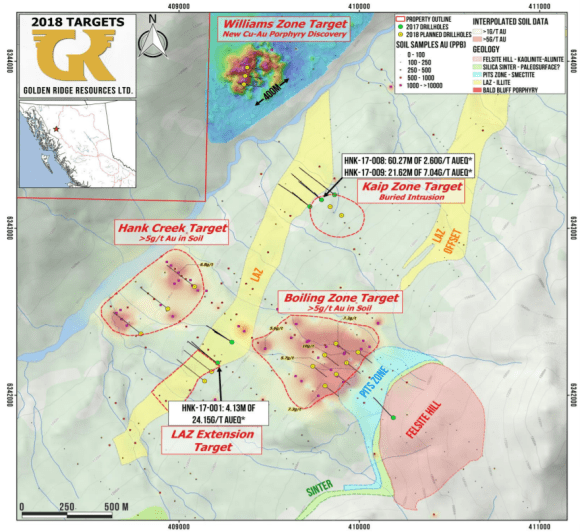

In the past, drilling was limited to shallow holes – completely missing the much deeper Boiling Zone target. But this summer, the lion’s share of the drilling will be allocated to this target.

So, what can we expect?

Golden Ridge will be drilling 8,000 meters this summer. . .

In addition to the Boiling Zone target – the company plans on drilling Kaip, the LAZ Extension, Hank Creek, and Williams.

The ‘Williams Zone’ target is a new copper-gold porphyry discovery which was made following up on a copper/gold soil and airborne magnetic anomaly.

Golden Ridge actually had a rig on site last year, however, winter forced operations to shutdown. At least 1,500 meters of the planned drilling campaign is allocated to the Williams zone.

Golden Ridge is backed by the who’s-who of the Golden Triangle.

The company is chaired by Larry Nagy, a mining veteran who was part of the discovery team at both Eskay Creek and the high-grade Snip Mine – the two most prolific mines discovered in the Golden Triangle.

Also on the Board is Dr. William Linqvist, who brings over 35 years of mining experience and has participated in several major gold discoveries. Such as: Chimney Creek, Mule Canyon, Ruby Hill and the Gold Hill deposits in Nevada; Mesquite gold deposit in California; Ortiz gold deposit in New Mexico; and Extensions of Eskay Creek gold-silver deposit in British Columbia.

Golden Ridge’s share structure has consolidated nicely. On January 1, 40.2 million shares became free-trading from the RTO financing of $5.24 million. Since then, 38.2 million shares have traded, now giving almost a clear runway to the next overhang, which is 16.4 million warrants at C$0.25.

Since the New Year, Mike added 550,000 shares to his position, while VP Exploration, Chris Paul, added 362,000.

Wrapping it all up. . .

Golden Ridge Resources is our top pick to have in the Golden Triangle.

Not only will the company benefit from the spring/summer time that we see every year. But they have the high-quality asset to back it all up. Getting involved now gives investors an asymmetric opportunity (low risk – high reward).

This makes them an exciting stock with huge upside in the coming months. . .

Palisade Global Investments Limited holds shares of Golden Ridge Resources. We receive either monetary or securities compensation for our services. We stand to benefit from any volume this write-up may generate. The information contained in such write-ups is not intended as individual investment advice and is not designed to meet your personal financial situation. Information contained in this report’s from sources we believe to be reliable, but its accuracy cannot be guaranteed. The opinions expressed in this report are those of Palisade Global Investments and are subject to change without notice. The information in this report may become outdated and there is no obligation to update any such information. Do your own due diligence.

MORE or "UNCATEGORIZED"

Koryx Copper Intersects 338.61 Meters At 0.38% Cu Eq Including 230.61 Meters At 0.45% Cu Eq and Multiple 2 Meters Intersections Over 1.00% Cu Eq

Significant copper and molybdenum intersections include: HM09: 13... READ MORE

Aya Gold & Silver Reports Q1-2024 Results; Maintains Guidance; Zgounder Expansion on Track

Aya Gold & Silver Inc. (TSX: AYA) (OTCQX: AYASF) is pleased t... READ MORE

Silver Mountain Delivers Positive Preliminary Economic Assessment For Its Reliquias Project, Peru; Pre-Tax NPV 5% Of C$107 million, Pre-Tax IRR Of 57%, And Payback Of 1.8 Years

Key Highlights – Preliminary Economic Assessment Pre-Tax Net Pr... READ MORE

ARIS MINING REPORTS Q1 2024 RESULTS WITH SEGOVIA GENERATING $13.8 MILLION IN OPERATING CASH FLOW

Aris Mining Corporation (TSX: ARIS) (NYSE-A: ARMN) announces its ... READ MORE

Orla Mining Reports First Quarter 2024 Results

Orla Mining Ltd. (TSX: OLA) (NYSE: ORLA) announces the results fo... READ MORE