OUTCROP SILVER INTERCEPTS 1.89 METRES OF 468 GRAMS SILVER EQUIVALENT AND 1.53 METRES OF 516 GRAMS SILVER EQUIVALENT EXTENDING LOS NARANJOS SHOOT TO 300 METRES DEPTH

Outcrop Silver & Gold Corporation (TSX-V: OCG) (OTCQX: OCGSF) (DE: MRG1) is pleased to announce the encouraging assays from eleven drill holes with significant results from its delineation drill program at Los Naranjos vein on its 100% owned Santa Ana high-grade silver project in Colombia. Thirty-one holes have been drilled in Los Naranjos to date. Eighteen returned high-grade assays and one hole has pending assays.

The results of eighteen core holes show that Los Naranjos is one of the larger high-grade shoots on Santa Ana, with an average estimated true width of 0.75 metres and a weighted average grade of 926 grams equivalent silver per tonne. Los Naranjos is open to the north and south and at depth. Exploration will continue to both define limits to Los Naranjos shoot and to discover potential new shoots north within the extensions of the Los Naranjos Vein System.

Delineation and exploration drilling is ongoing at Santa Ana with three drill rigs.

Highlights

- Naranjos from eighteen holes has an average estimated true width of 0.75 metres with a weighted average grade of 926 grams equivalent silver per tonne.

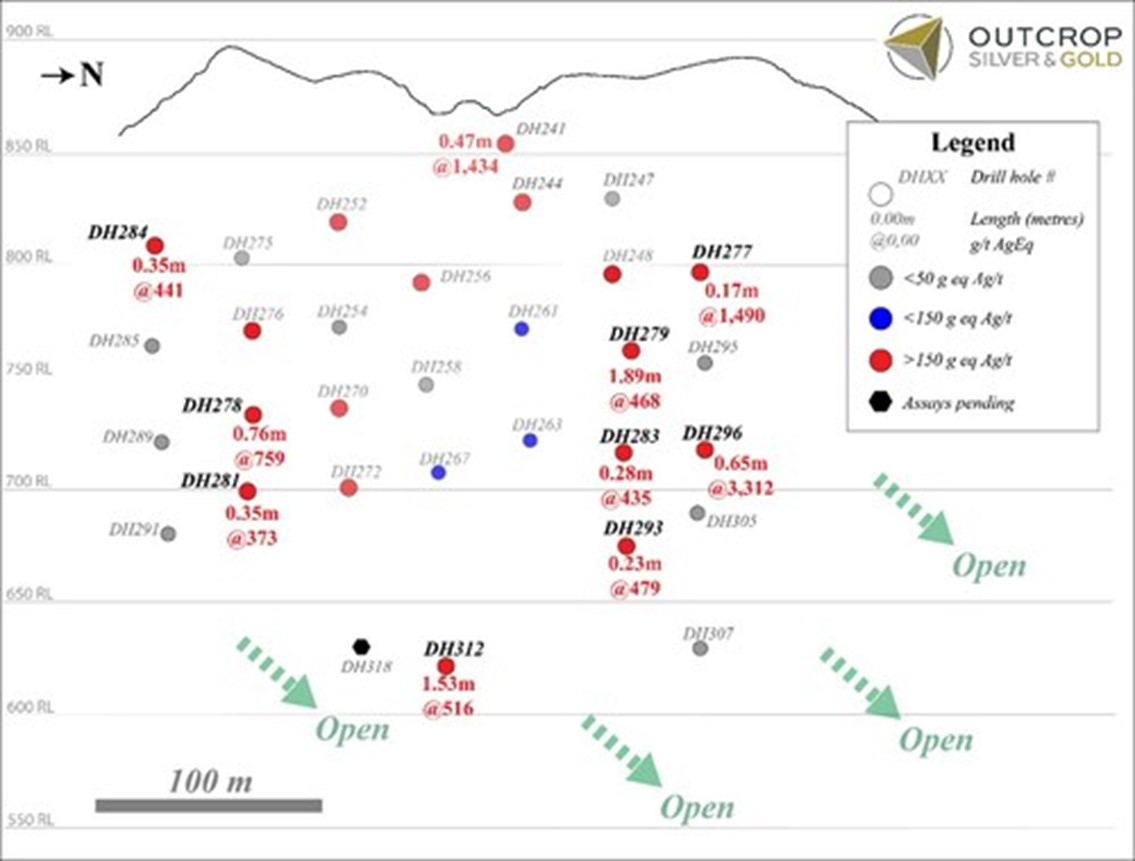

- Recent drilling extended high-grade mineralization in Los Naranjos to 250 metres along strike and 300 metres in depth (Figure 1).

- Hole DH312 returned 1.53 metres (true width) of 516 grams of equivalent silver per tonne.

- Hole DH279 returned 1.89 metres of (true width) 468 grams of equivalent silver per tonne.

- Hole DH296 returned 0.65 metres of 3,312 grams of equivalent silver per tonne, for a grams x metre of 2,153 equivalent silver.

- Los Naranjos shoot remains open along strike and at depth (Figure 1).

“The recent good results at Naranjos confirm high-grade mineralization open at depth on both ends of, and central to, the current exploration focus on 18 kilometre long vein zones,” commented Guillermo Hernandez, Vice President of Exploration. “DH312 suggests that Los Naranjos may widen with depth. Outcrop Silver is encouraged to continue drilling Los Naranjos to increase its resource potential at depth.”

“The production level maps for the Frias Mine, and now Outcrop Silver drill results from Las Maras and Los Naranjos all show plus 300 metre depths to mineralization, we will likely significantly expand the vertical extent of mineralization at Santa Ana,” comments Joseph Hebert, Chief Executive Officer.

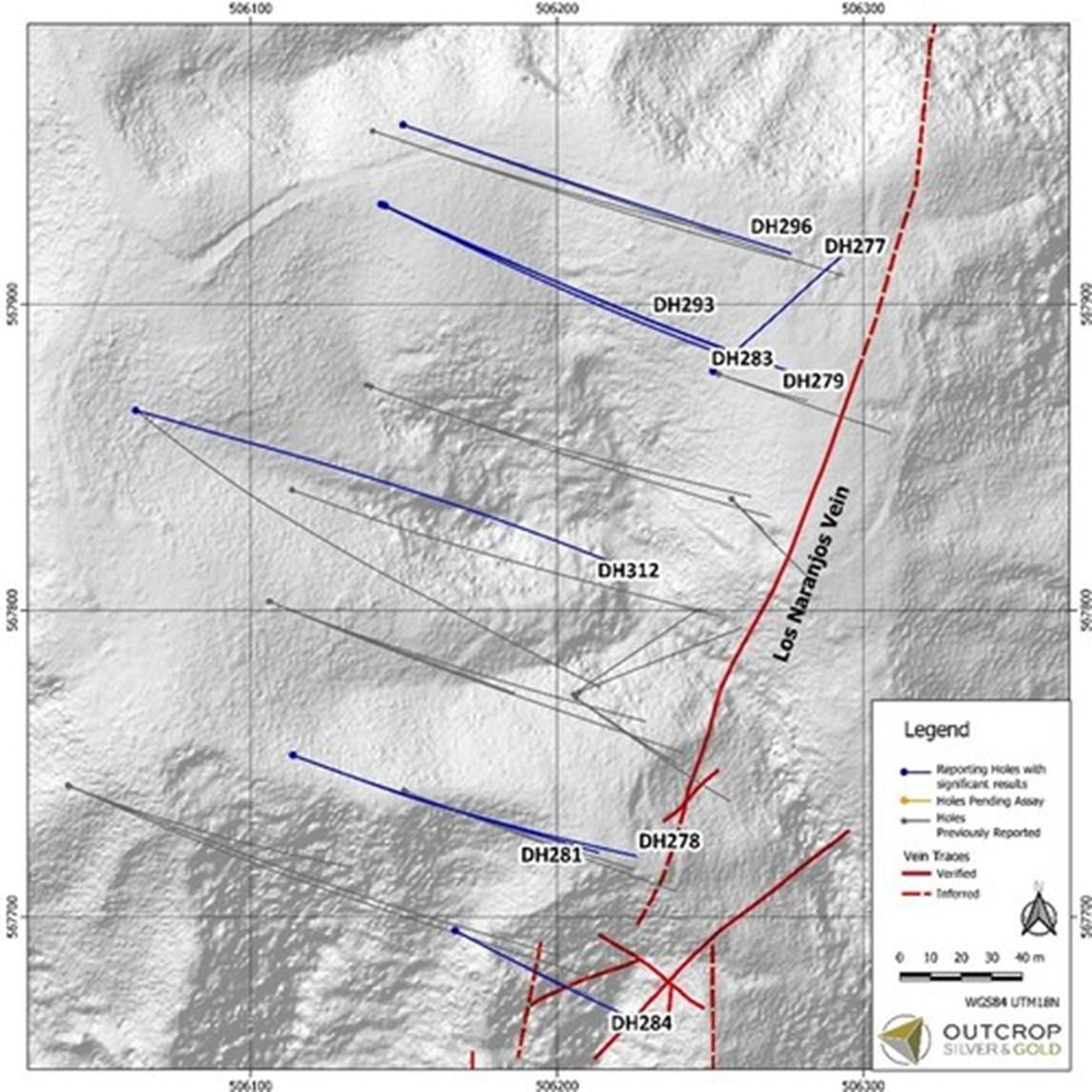

Los Naranjos vein is located 300 metres east of El Dorado, and like the Santa Ana vein system strikes north-northeast and dips steeply to the west. Holes DH312 and DH279 intercepted quartz veins with an estimated true width of 1.53 metres and 1.89 metres respectively, showing strong mineralization of silver and associated sulphides (Figure 2). DH312’s intercept is more than 250 metres from surface at the absolute elevation of 630 metres, which is regionally considered below the top-of-ore and most favourable zone.

| Target | Hole ID | From (m) |

To (m) |

Interval Length (m) |

Estimated True Width (m) |

Au g/t |

Ag g/t | Pb % | Zn % |

AgEq g/t |

| Los Naranjos | SANR22DH277 | 111.00 | 111.30 | 0.30 | 0.17 | 17.92 | 43 | 0.28 | 0.28 | 1,490 |

| SANR22DH278 | 200.92 | 201.80 | 0.88 | 0.76 | 1.73 | 668 | 0.26 | 0.31 | 759 | |

| SANR22DH279 | 183.03 | 185.40 | 2.37 | 1.89 | 0.82 | 427 | 0.23 | 0.29 | 468 | |

| Including | 183.85 | 184.70 | 0.85 | 0.68 | 1.42 | 850 | 0.46 | 0.57 | 914 | |

| SANR22DH281 | 217.00 | 217.47 | 0.47 | 0.35 | 0.85 | 331 | 0.09 | 0.12 | 373 | |

| SANR22DH283 | 217.55 | 217.97 | 0.42 | 0.28 | 0.69 | 415 | 0.10 | 0.10 | 435 | |

| SANR22DH284 | 79.55 | 79.95 | 0.40 | 0.35 | 1.26 | 374 | 0.09 | 0.05 | 441 | |

| SANR22DH285 | NSR | |||||||||

| SANR22DH289 | NSR | |||||||||

| SANR22DH291 | NSR | |||||||||

| SANR22DH293 | 248.62 | 248.96 | 0.34 | 0.23 | 0.94 | 424 | 0.13 | 0.44 | 479 | |

| SANR22DH293 | 251.51 | 251.81 | 0.30 | 0.20 | 6.74 | 6 | 0.01 | 0.01 | 545 | |

| SANR22DH295 | NSR | |||||||||

| SANR22DH296 | 211.40 | 212.29 | 0.89 | 0.65 | 7.95 | 2,919 | 0.94 | 0.62 | 3,312 | |

| Including | 211.70 | 212.29 | 0.59 | 0.43 | 11.88 | 4,376 | 1.40 | 0.85 | 4,958 | |

| SANR22DH305 | NSR | |||||||||

| SANR22DH307 | NSR | |||||||||

| SANR22DH312 | 44.19 | 44.66 | 0.47 | 0.34 | 0.57 | 281 | 0.03 | 0.03 | 300 | |

| SANR22DH312 | 311.02 | 313.15 | 2.13 | 1.53 | 1.31 | 444 | 0.13 | 0.20 | 516 | |

| Including | 311.02 | 311.37 | 0.35 | 0.25 | 1.98 | 981 | 0.17 | 0.30 | 1,059 | |

| And | 312.60 | 313.15 | 0.55 | 0.39 | 3.49 | 1,074 | 0.39 | 0.54 | 1,277 | |

| Table 1. Significant drill assays reported from the Los Naranjos vein in this release. NSR: No significant result. |

||||||||||

There is a 60% drilling success rate for Los Naranjosis due to recognizing the geometry and dip of the shoot. The drilling program at Los Naranjos continues with additional delineation holes targeting to expand the high-grade shoot at depth towards the north (Figure 1).

| Hole ID | Easting | Northing | Elevation (m) |

Depth (m) | Azimuth | Dip |

| SANR22DH277 | 506250.844 | 567878.122 | 880.856 | 130.14 | 49 | -63 |

| SANR22DH278 | 506113.750 | 567752.841 | 896.815 | 220.37 | 111 | -59 |

| SANR22DH279 | 506142.347 | 567932.724 | 896.769 | 211.22 | 116 | -46 |

| SANR22DH281 | 506113.853 | 567752.814 | 896.822 | 248.62 | 111 | -66 |

| SANR22DH283 | 506142.782 | 567939.582 | 896.308 | 236.22 | 116 | -56 |

| SANR22DH284 | 506166.702 | 567695.650 | 861.960 | 97.01 | 119 | -45 |

| SANR22DH285 | 506166.998 | 567695.450 | 861.956 | 120.54 | 119 | -67 |

| SANR22DH287 | 506040.386 | 567742.967 | 892.284 | 138.68 | 112 | -45 |

| SANR22DH289 | 506040.688 | 567742.770 | 892.282 | 256.73 | 112 | -45 |

| SANR22DH291 | 506040.766 | 567742.738 | 892.338 | 281.33 | 112 | -54 |

| SANR22DH293 | 506142.347 | 567932.724 | 896.769 | 266.33 | 116 | -63 |

| SANR22DH295 | 506149.948 | 567958.472 | 892.759 | 219.21 | 110 | -46 |

| SANR22DH296 | 506149.745 | 567958.562 | 892.676 | 228.96 | 109 | -56 |

| SANR22DH305 | 506141.205 | 567956.214 | 894.347 | 271.88 | 109 | -61 |

| SANR22DH307 | 506140.814 | 567956.347 | 894.208 | 295.65 | 116 | -67 |

| SANR22DH312 | 506063.582 | 567865.038 | 897.528 | 356.92 | 105 | -62 |

| Table 2. Collar and survey table for drill holes reported in this release. | ||||||

Equivalent Silver Calculations

Metal prices used for equivalent calculations were US$1,827/oz for gold, US$21.24/oz for silver, US$0.90/lb for lead and US$1.56/lb for zinc. Metallurgical recoveries assumed are 93% for gold, 90% for silver, 90% for lead and 92% for zinc.

QA/QC

Core and rock samples are sent to either Actlabs or SGS in Medellin, Colombia, for preparation and AA assaying on Au and Ag; Pb and Zn for Actlabs as well and then sent to SGS Lima, Peru, for multi-element analysis. Samples sent to Actlabs are then shipped to Actlabs Mexico for multi-element analysis. In line with QA/QC best practice, approximately three control samples are inserted per twenty samples (one blank, one standard and one field duplicate). The samples are analyzed for gold using a standard fire assay on a 30-gram sample with a gravimetric finish when surpassing over limits. Multi-element geochemistry is determined by ICP-MS using aqua regia digestion. Comparison to control samples and their standard deviations indicate acceptable accuracy of the assays and no detectible contamination.

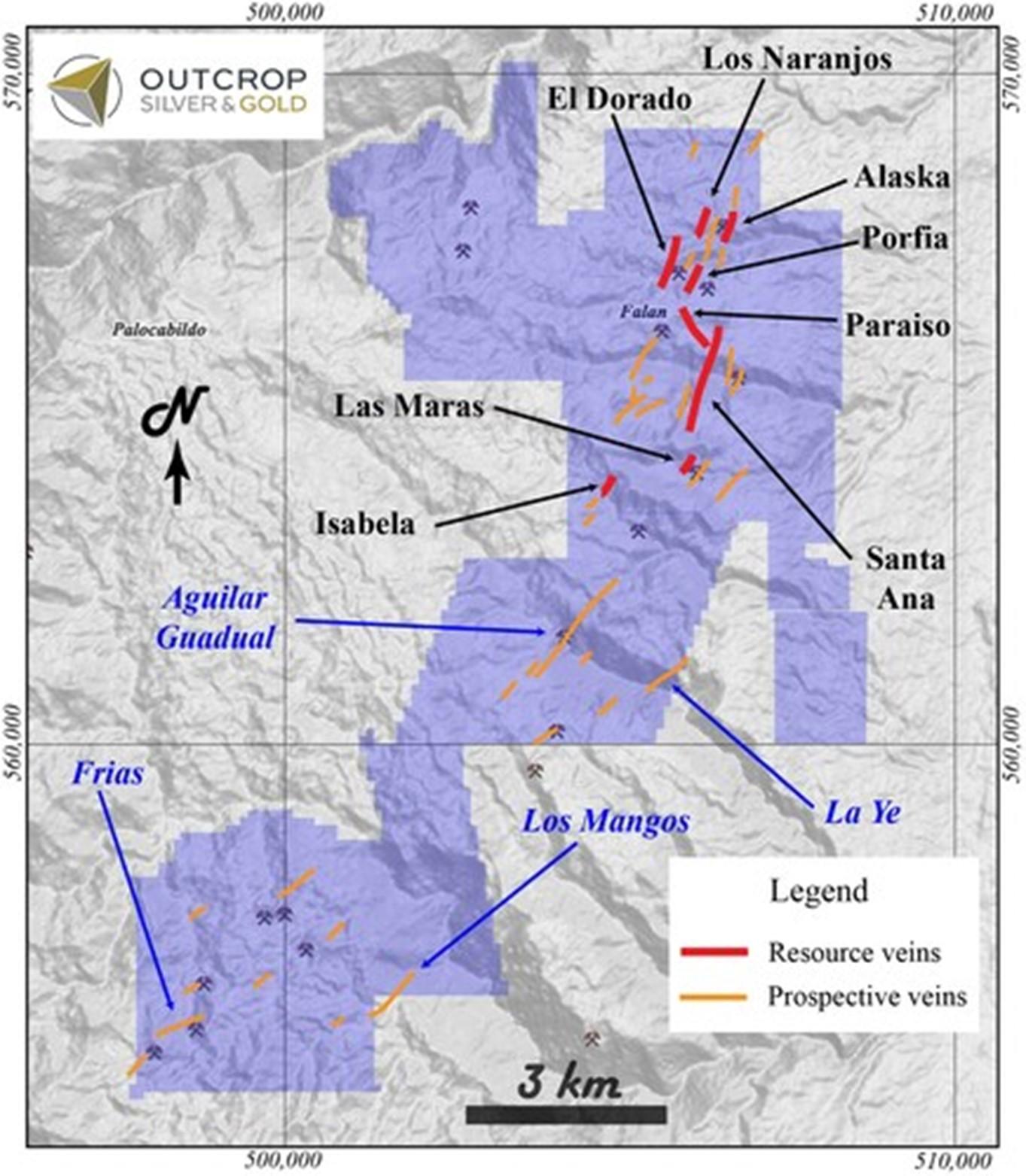

About Santa Ana

The 100% owned Santa Ana project comprises 36,000 hectares located in the northern Tolima Department, Colombia, 190 kilometres from Bogota. The project consists of five or more regional scale parallel vein systems across a trend 12 kilometres wide and 30 kilometres long. The Santa Ana project covers a majority of the Mariquita District, where mining records date to at least 1585. The Mariquita District is the highest-grade primary silver district in Colombia, with historic silver grades reported to be among the highest in Latin America from dozens of mines. Historic mining depths support a geologic and exploration model for composite mesothermal and epithermal vein systems having mineralization that likely extends to great depth. At Santa Ana, it is unlikely that there is sharp elevation restriction common to high-grade zones in many epithermal systems with no mesozonal component. The extremely high silver and gold values on Santa Ana reflect at least three recognized overprinting mineralization events.

At the core Royal Santa Ana project, located at the northern extent of just one of the regional vein systems controlled by Outcrop Silver, thirteen high-grade shoots have been discovered to date – La Ivana hanging-wall and footwall (La Porfia vein system); San Antonio, Roberto Tovar, San Juan (Royal Santa Ana vein systems); Las Maras (Las Penas vein system); El Dorado, La Abeja (El Dorado vein systems); Megapozo, Paraiso (El Paraiso vein system); Espiritu Santo (Aguilar vein system); La Isabela and Los Naranjos. Each zone commonly contains multiple parallel veins. The veins can show both high-grade silver and high-grade gold mineralization, and low-angle veins appear to connect to more common high-angle veins.

Outcrop drilling indicates that mineralization extends from surface or near surface to depths of at least 370 metres. Cumulatively, over 60 kilometres of mapped and inferred vein zones occur on the Santa Ana project. The Frias Mine on the south-central part of the project, 16 kilometres south of the Royal Santa Ana Mines, produced 7.8 million ounces of silver post-production in the Spanish colonial era at a recovered grade of 1.3 kg Ag/t. The Frias Mine is considered an analogue to each of the thirteen shoots discovered to date by Outcrop Silver. Numerous priority drill targets have been discovered along this 16 kilometres trend with outcropping veins up to 4.7 metres wide and surface values up to 9,740 grams silver per tonne.

About Outcrop Silver & Gold

Outcrop Silver & Gold is rapidly advancing the Santa Ana high-grade silver discovery with ongoing expansion drilling and an initial resource to be released in the coming months. Outcrop Silver is also progressing exploration on four gold projects with world-class discovery potential in Colombia. These assets are being advanced by a highly disciplined and seasoned professional team with decades of experience in Colombia.

Qualified Person

The technical information in this news release has been approved by Joseph P Hebert, a qualified person as defined in NI43-101 and President and Chief Executive Officer of Outcrop.

Figure 1. Long section of Los Naranjos showing open mineralization at approximately 300 metres. (CNW Group/Outcrop Silver & Gold Corporation)

Map1. Los Naranjos Vein area with drill hole traces. (CNW Group/Outcrop Silver & Gold Corporation)

Figure 2. Core photo from hole DH279 at 183.85 m depth in Los Naranjos shoot with silver sulfosalts and sulfides. (CNW Group/Outcrop Silver & Gold Corporation)

Figure3 . Map of Los Naranjos, in relation to other resource veins and advanced targets. (CNW Group/Outcrop Silver & Gold Corporation)

MORE or "UNCATEGORIZED"

Eloro Resources Announces Closing of Bought Deal LIFE Private Placement for Gross Proceeds of C$17 Million

Eloro Resources Ltd. (TSX: ELO) (FSE: P2QM) is pleased to announce the closing of its previously an... READ MORE

Minera Alamos Updates Resources and Reserves for the Pan Gold Mine in Nevada

Minera Alamos Inc. (TSX-V: MAI) (OTCQX: MAIFF) is pleased to announce updated Mineral Resource and M... READ MORE

Ero Copper Reports Fourth Quarter and Full Year 2025 Operating and Financial Results

Ero Copper Corp. (TSX: ERO) (NYSE: ERO) is pleased to announce its operating and financial results f... READ MORE

Rare Element Resources Announces Results of Oversubscribed Rights Offering of Common Shares

Rare Element Resources Ltd. (OTCQB: REEMF) is pleased to report that its previously announced... READ MORE

TRX Gold Reports Record Q2 2026 Production and Company Update

TRX Gold Corporation (TSX: TRX) (NYSE American: TRX) is pleased to announce preliminary resu... READ MORE