Osisko Metals Releases 2024 Pine Point Mineral Resource Estimate: 49.5Mt of Indicated Mineral Resources Grading 5.52% ZnEq and 8.3Mt of Inferred Mineral Resources Grading 5.64% ZnEq

Osisko Metals Incorporated (TSX-V: OM) (OTCQX: OMZNF) (FRA: 0B51) is pleased to announce the 2024 Mineral Resource Estimate Update for the Pine Point Project, located near Hay River, in the Northwest Territories of Canada. The 2024 MRE was prepared by BBA Inc. and PLR Resources Inc. and will form the resource base for a Feasibility Study that is planned to officially start in Q3 2024. Cut-off grades are based on estimated long-term metal prices, mining costs, metal recoveries, concentrate transport, and smelter costs. The definition drill program supporting the 2024 MRE was executed between 2018 and 2024.

Highlights:

- Indicated Mineral Resources of 49.5Mt grading 4.22% zinc and 1.49% lead (5.52% Zinc Equivalent) containing approximately 4.6 billion pounds of zinc and 1.6 billion pounds of lead in situ (undiluted).

- Inferred Mineral Resources of 8.3Mt grading 4.18% zinc and 1.69% lead (5.64% Zinc Equivalent (“ZnEq”)) containing approximately 0.7 billion pounds of zinc and 0.3 billion pounds of lead in situ (undiluted).

- Compared to the previous MRE, the conversion of Inferred Mineral Resources (see press release dated July 13, 2022) increased the tonnage of the current Indicated Mineral Resources by 214% with an associated decrease in the quantity of Inferred Mineral Resources.

- Mineral Resources reported for the 2024 MRE used variable cut-off grades between 1.41% and 1.51% ZnEq for open pit resources and between 4.10% and 4.40% ZnEq for underground resources.

- The project’s East Mill, Central, and North Zones now contain approximately 36.2Mt of Indicated Mineral Resources grading 5.22% ZnEq, or 3.2 billion pounds of zinc and 1.1 billion pounds of lead in situ.

- New metallurgical test work is in progress. Previous metallurgical test work described in the 2022 PEA (see press release August 29, 2022) highlighted Pine Point as a potential producer of among the cleanest, high-grade zinc and lead concentrates globally. This adds value to the project as any and probably most smelter clients would want some Pine Point concentrate for blending purposes.

A Technical Report supporting this 2024 MRE will be filed within 45 days.

Robert Wares, CEO and Chairman of the Board, commented, “We are very happy to have met a critical milestone with this MRE that successfully converted the majority of the mineral resources to the Indicated category. With our partner Appian Capital Advisory LLP, we can now rapidly advance Pine Point to the Feasibility Stage following finalization of trade-off studies.”

Jeff Hussey, CEO of Pine Point Mining Limited, stated, “This represents the culmination of a multi-year definition drill program that raised the confidence level in the mineral resource base for the Feasibility Study. We will also continue exploring for new deposits and should significant discoveries be made this summer; they will be rapidly incorporated into the final inventory.”

The project has significant supporting infrastructure, including access by paved roads, a railhead in Hay River, and an on-site hydroelectric substation. Additionally, the project benefits from one hundred kilometres of pre-existing mine haul roads from the original mining operations. These provide access to most of the deposits in the 2024 MRE. The future concentrator and camp location will be adjacent to the original concentrator area.

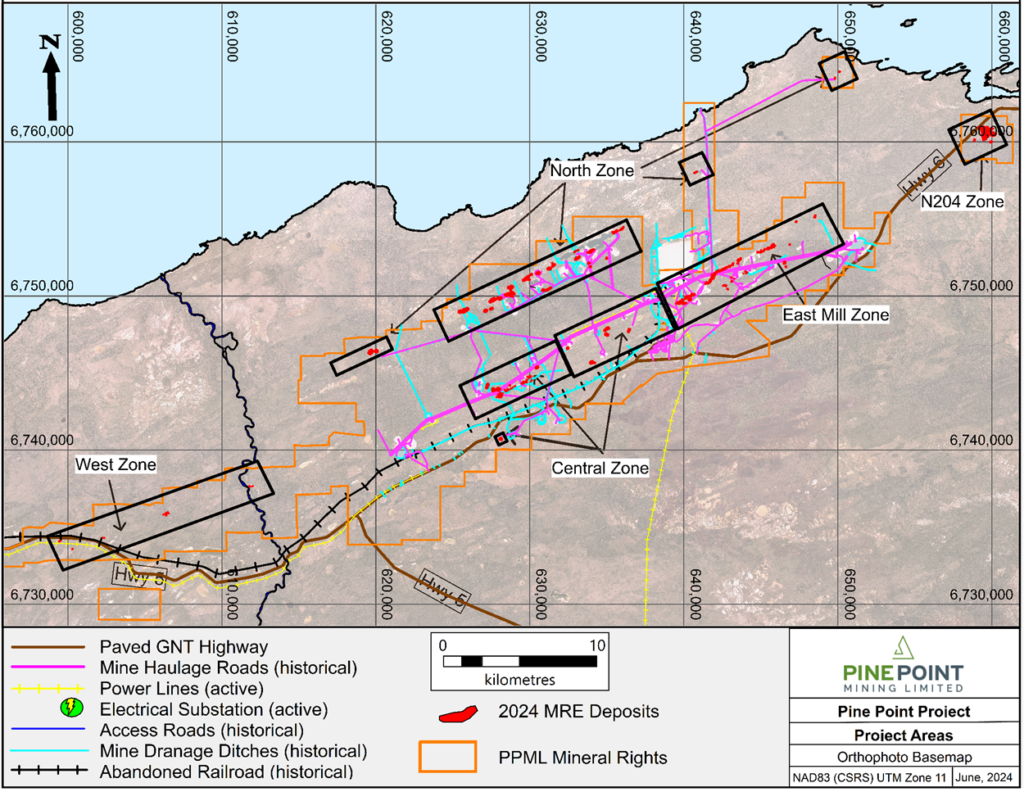

The 2024 MRE is divided into five geographic zones, each composed of one or more individual deposits (see Map 1 and Table 1).

Table 1: 2024 Mineral Resource Estimate for Pine Point

| Indicated | Inferred | |||||||||||||

| Method | Zone | Cut-off Grade |

Tonnage | ZnEq | Pb | Zn | Tonnage | ZnEq | Pb | Zn | ||||

| (ZnEq %) | (kt) | (%) | (%) | (%) | (kt) | (%) | (%) | (%) | ||||||

| Pit Constrained Mineral Resources |

Central | 1.41 | 7,400 | 6.21 | 1.50 | 4.91 | 498 | 4.50 | 0.75 | 3.84 | ||||

| East Mill | 1.41 | 10,047 | 4.69 | 1.11 | 3.72 | 1,051 | 3.54 | 0.73 | 2.90 | |||||

| North | 1.41 – 1.44 | 18,763 | 5.10 | 1.47 | 3.82 | 680 | 4.08 | 0.65 | 3.52 | |||||

| N204 | 1.51 | 8,923 | 4.05 | 0.90 | 3.27 | 3,027 | 4.20 | 0.92 | 3.40 | |||||

| Underground Mineral Resources |

Central | 4.40 | 121 | 6.66 | 0.81 | 5.95 | 63 | 5.62 | 1.44 | 4.37 | ||||

| West | 4.10 – 4.40 | 4,215 | 11.21 | 3.69 | 8.00 | 2,934 | 8.44 | 3.55 | 5.35 | |||||

| Total Pit Constrained | 1.41 – 1.51 | 45,133 | 4.99 | 1.28 | 3.87 | 5,256 | 4.08 | 0.65 | 3.52 | |||||

| Total Underground | 4.10 – 4.40 | 4,336 | 11.08 | 3.61 | 7.94 | 2,997 | 8.38 | 3.51 | 5.33 | |||||

| Total Combined | 49,469 | 5.52 | 1.49 | 4.22 | 8,253 | 5.64 | 1.69 | 4.18 | ||||||

| Notes: | ||

| 1) | All tonnages are rounded to the nearest thousand tonnes. | |

| 2) | ZnEq percentages are calculated using metal prices, forecasted metal recoveries, concentrate grades, transport costs, smelter payable metals and charges. | |

| 3) | Pit-constrained cut-off grades vary primarily due to variable transportation distances to the presumed concentrator location. | |

| The weighted average strip ratio for all modelled pit-constrained mineralization is 5.8:1. | ||

Compared to the 2022 Mineral Resource Estimate, there is a decrease in overall tonnage, however grades remain similar. The key factors include:

- Tighter parameters guiding reasonable prospects for eventual economic extraction driven by increased knowledge on project OPEX and mining parameters.

- Open Pit: Whittle optimization parameters as well as the increased cutoff grade (+13%) and an increase in tonnage [+0.4%], due to the conversion of the Underground Central zone that is now being declared as Open Pit resources.

- Underground (West): Tighter stope optimization parameters; decrease in tonnage [-29%]

- Underground (Central): Tighter stope optimization parameters and most of the 2022 underground material that is now tonnage declared inside pit shells [-93%]

The in-pit MRE is constrained within pit shells that were developed from a pit optimization analysis that was done with Geovia Whittle 2022 software using the economic and operating parameters presented below:

Table 2: Pit Optimization Parameters

| Parameter | Unit | Input | |

| Mine Site Costs | |||

| Mining Cost – Overburden1 | C$/t mined | 2.63 | |

| Mining Cost – Mineralized Material1 | C$/t mined | 3.85 | |

| Mining Cost – Waste1 | C$/t mined | 3.85 | |

| Transport Mineralized Material to Mill | C$/t mined | 0.13 | |

| Processing Cost | C$/t milled | 11.00 | |

| Power Cost2 | C$/t milled | 5.00 | |

| Waste and Water Management Cost | C$/t milled | 2.00 | |

| G&A Cost | C$/t mined | 8.50 | |

| Recoveries | |||

| Average Zinc | % | 87 | % |

| Average Lead | % | 93 | % |

| Zinc Concentrate Grade | % | 60 | % |

| Lead Concentrate Grade | % | 65 | % |

| Zinc Concentrate Costs | |||

| Transport from mine to Smelter | C$/wmt | 215.80 | |

| Smelter Cost | C$/dmt | 266.50 | |

| Lead Concentrate Costs | |||

| Transport from mine to Smelter | C$/wmt | 261.30 | |

| Smelter Cost | C$/dmt | 152.10 | |

| Metal Prices | |||

| Zinc | US$/lb | 1.30 | |

| Lead | US$/lb | 1.00 | |

| Exchange Rate | 1.30 | ||

1 – Includes dewatering costs

2 – Process plant power cost is included in Power Cost

Table 3: Underground Parameters

| Parameter | Unit | Input | |

| Mine Site Costs | |||

| Mining Cost – LHS1 | C$/t mined | 54.22 | |

| Mining Cost – R&P1 | C$/t mined | 59.99 | |

| Processing Cost | C$/t milled | 11.00 | |

| Power Cost2 | C$/t milled | 5.00 | |

| Waste and Water Management Cost | C$/t milled | 2.00 | |

| G&A Cost | C$/t mined | 8.50 | |

| Recoveries | |||

| Average Zinc | % | 87 | % |

| Average Lead | % | 93 | % |

| Zinc Concentrate Grade | % | 60 | % |

| Lead Concentrate Grade | % | 65 | % |

| Zinc Concentrate Costs | |||

| Transport from mine to Smelter | C$/wmt | 215.80 | |

| Smelter Cost | C$/dmt | 266.50 | |

| Lead Concentrate Costs | |||

| Transport from mine to Smelter | C$/wmt | 261.30 | |

| Smelter Cost | C$/dmt | 152.10 | |

| Metal Prices | |||

| Zinc | US$/lb | 1.30 | |

| Lead | US$/lb | 1.00 | |

| Exchange Rate | 1.30 | ||

1 – Includes dewatering costs.

2 – Process plant power cost is included in Power Cost

Open Pit and Underground Mineralization

Prismatic-style deposits are defined by greater than 10 metres of greater than 10% zinc + lead, with a distinct vertical aspect of the deposit outline that crosscuts stratigraphy. Vertical thicknesses of mineralization can exceed 70 metres, and they have horizontal cross-sections of less than 200 by 200 metres.

Tabular-style deposits comprise sub-horizontal, stratabound mineralization extending over a significant strike length at varying lateral widths from 50 to 200 metres wide. The strike extent can be in the order of kilometres. Mineralization thickness averages about 3 metres and can range from 1 metre to, very locally, greater than 10 metres.

The open pit portion of the 2024 MRE includes mostly shallow tabular-style deposits, with the remainder being shallow prismatic-style deposits. The underground portion of the 2024 MRE includes deeper prismatic-style mineralization and easily accessible tabular-style mineralization found adjacent to the pit wall boundaries of certain deposits.

Metallurgy

Metallurgical test work is in progress and will provide data to support the flow-sheet design for the process plant, including comminution tests, pre-concentration tests (Ore Sorting and Dense Media Separation (DMS)), flotation tests and dewatering tests. The Company is also investigating concentrations of the critical metals Indium (In), Germanium (Ge), and Gallium (Ga) in the Zinc concentrate produced from flotation tests and in sphalerite mineralization within the various Zones.

2024 Drill Program

A brownfield exploration campaign is underway. The program is focused on discovering high-grade prismatic-style deposits. One drill was active in March and tested three high-potential target areas. Results are pending. Additional targets are ready for drilling, and new targets are continually being developed. The plan is to diligently test these exploration targets this summer.

Induced polarization and magnetic surveys are best suited for geophysical targeting of these types of deposits. Surveys over in situ prismatic-style deposits were used for calibration purposes for these geophysical methods. Targets are generated by using a combination of airborne gravity gradiometry data, LiDAR, AeroTEM survey, structural lineament interpretation, and trend analysis. The search has been expanded to adjacent carbonate formations that the Company believes are fertile for discovery.

Notes Regarding This Mineral Resource Estimate

Mineral Resource Estimate

- The independent qualified person for the 2024 MRE, as defined by National Instrument 43-101 guidelines, is Pierre-Luc Richard, P.Geo., of PLR Resources Inc and subcontracted by BBA Inc. The effective date of the 2024 MRE is May 31, 2024. Mr. Richard has also approved the technical contents of this press release.

- These mineral resources are not mineral reserves as they have not demonstrated economic viability. The quantity and grade of reported Inferred Resources in this MRE are uncertain in nature, and there has been insufficient exploration to define these Inferred Resources as Indicated or Measured. However, it is reasonably expected that the majority of Inferred Mineral Resources could be upgraded to Indicated Mineral Resources with continued exploration.

- Resources are presented as undiluted and in situ for an open-pit and underground scenario and are considered to have reasonable prospects for economic extraction.

- The 2024 MRE was prepared using Leapfrog Edge v.2023.2.1 and is based on 20,682 surface drill holes and 181,313 samples, of which 17,428 drill holes and a total of 92,652 assays were included in the modelled mineralization. The drill hole database includes recent drilling of 148,026 metres in 2,258 drill holes since 2017 and also incorporates Cominco Ltd.’s historical drill holes, the use of which was partially validated by a drill hole collar survey, twinning programs and a partial core resampling program. The cut-off date for the drill hole database was April 30, 2024.

- The 2024 MRE encompasses 103 zinc-lead-bearing zones, each defined by a series of individual wireframes with a minimum true thickness of 2.5 metres.

- High-grade capping was done on the composited assay data and established on a per-zone basis for zinc and lead. Capping grades vary from 15% to 45% Zn and 5% to 40% Pb.

- Density values were calculated based on the formula established and used by Cominco Ltd. during their operational period between 1964 and 1987. Density values were calculated from the density of dolomite, adjusted by the amount of sphalerite, galena, and marcasite/pyrite as determined by metal assays. A porosity of 5% was assumed. Waste material was assigned the density of porous dolomite.

- Grade model resource estimation was calculated from drill hole data using an Ordinary Kriging interpolation method in a sub-blocked block model using blocks measuring 5 m x 5 m x 2.5 m in size and sub-blocks down to 1.25 metres x 1.25 metres x 0.625 metres.

- Zinc equivalency percentages are calculated using long-term metal prices indicated below in (10), forecasted metal recoveries, concentrate grades, transport costs, smelter payable metals and charges.

- The estimate is reported using a ZnEq cut-off varying from 1.41% to 1.51% for open-pit resources and 4.10% to 4.40% for underground resources. Variations consider trucking distances from the pit-constrained mineralization to the mill and metallurgical parameters for each area. The cut-off grade was calculated using the following parameters (amongst others): zinc price = USD1.30/lb; lead price = USD1.00/lb; CAD:USD exchange rate = 1.30. The cut-off grade will be re-evaluated considering future prevailing market conditions and costs.

- The Inferred Mineral Resource category is constrained to areas where drill spacing is less than 100 metres, and where reasonable geological and grade continuity is shown. The Indicated Mineral Resource category is constrained to areas where modern drilling has been completed, where drill spacing is less than 30 metres, and where reasonable geological and grade continuity is shown. When needed, a series of clipping boundaries were created manually in plan views to either upgrade or downgrade classification. The maximum drill spacing judged acceptable when creating these clipping boundaries was 50m for the indicated category.

- The pit optimization used to develop the Mineral Resource-constraining pit shells was done using Geovia Whittle 2022. The constraining pit shells were developed using overall pit slopes per area and by individual pits based on a preliminary geotechnical report. The rock slopes range from 38° to 52° with an average of 49°, and the overburden slopes range from 33° to 45° with an average of 38°.

- Calculations used metric units (metre, tonne). Metal contents are presented in percentages or pounds. Metric tonnages were rounded, and any discrepancies in total amounts are due to rounding errors.

- CIM definitions and guidelines for Mineral Resource Estimates have been followed.

- The QP is unaware of any known environmental, permitting, legal, title-related, taxation, socio-political or marketing issues or any other relevant issues that could materially affect this MRE.

Other Inputs to the 2024 MRE

- The independent qualified person providing the pit shells, and cut-off grades for the 2024 MRE is Alexandre Dorval, ing., of G Mining Services. Mr. Dorval has approved the technical contents of this press release.

- The independent qualified person providing the underground mining shapes and cut-off grades for the 2024 MRE is Carl Michaud, ing., of G Mining Services. Mr. Michaud has approved the technical contents of this press release.

- The independent qualified person providing the metallurgical components relating to the 2024 MRE is Colin Hardie, P. Eng., of BBA Inc. Mr. Hardie has approved the technical contents of this press release.

About Osisko Metals

Osisko Metals Incorporated is a Canadian exploration and development company creating value in the critical metals space, more specifically copper and zinc. The Company is in a joint venture with Appian Capital Advisory LLP for the advancement of one of Canada’s premier past-producing zinc mining camps, the Pine Point Project, located in the Northwest Territories, for which current mineral resources have been calculated for the 2024 MRE (as defined herein). The Project is held under the joint venture company Pine Point Mining Limited. The current mineral resource estimate consists of 49.5Mt grading 5.52% ZnEq of Indicated Mineral Resources and 8.3Mt grading 5.64% ZnEq of Inferred Mineral Resources (in accordance with National Instrument 43-101 – Standards of Disclosure for Mineral Projects). A technical report will follow this press release within 45 days. The Pine Point Project is located on the south shore of Great Slave Lake in the Northwest Territories, near infrastructure, with paved highway access, an electrical substation, and 100 kilometres of viable haulage roads.

In addition, and outside of the Pine Point JV, the Company acquired in July 2023, from Glencore Canada Corporation, a 100% interest in the past-producing Gaspé Copper Mine, located near Murdochville in the Gaspé peninsula of Québec. The Company is currently focused on resource evaluation of the Copper Mountain Expansion Project that hosts a current mineral resource consisting of an Indicated Mineral Resource of 495Mt grading 0.37% CuEq and an Inferred Mineral Resource of 6.3Mt grading 0.37% CuEq (in accordance with National Instrument 43-101 – Standards of Disclosure for Mineral Projects); see May 6, 2024 news release of Osisko Metals entitled “Osisko Metals announces updated mineral resource estimate at Gaspé Copper – indicated resource of 495 mt grading 0.37% copper equivalent”. Gaspé Copper hosts the largest undeveloped copper resource in Eastern North America, strategically located near existing infrastructure in the mining-friendly province of Québec.

About Appian Capital Advisory

Appian Capital Advisory LLP is a London-headquartered investment advisor to long-term value-focused private capital funds that invest solely in mining and mining-related companies.

Appian is a leading investment advisor in the metals and mining industry, with global experience across South America, North America, Europe, Australia and Africa and a successful track record of supporting companies to achieve their development targets, with a global operating portfolio overseeing nearly 6,300 employees. Appian has a global team of 65 experienced professionals with presences in London, Toronto, Vancouver, Montreal, New York, Lima, Belo Horizonte, Perth, Mexico City and Dubai. The Appian team, through its private capital funds, has a long history of successfully bringing mines through development and into production, having completed 9 mine builds in the last 6 years.

Map 1: Pine Point Project

MORE or "UNCATEGORIZED"

Eloro Resources Announces Closing of Bought Deal LIFE Private Placement for Gross Proceeds of C$17 Million

Eloro Resources Ltd. (TSX: ELO) (FSE: P2QM) is pleased to announce the closing of its previously an... READ MORE

Minera Alamos Updates Resources and Reserves for the Pan Gold Mine in Nevada

Minera Alamos Inc. (TSX-V: MAI) (OTCQX: MAIFF) is pleased to announce updated Mineral Resource and M... READ MORE

Ero Copper Reports Fourth Quarter and Full Year 2025 Operating and Financial Results

Ero Copper Corp. (TSX: ERO) (NYSE: ERO) is pleased to announce its operating and financial results f... READ MORE

Rare Element Resources Announces Results of Oversubscribed Rights Offering of Common Shares

Rare Element Resources Ltd. (OTCQB: REEMF) is pleased to report that its previously announced... READ MORE

TRX Gold Reports Record Q2 2026 Production and Company Update

TRX Gold Corporation (TSX: TRX) (NYSE American: TRX) is pleased to announce preliminary resu... READ MORE