The Prospector News

Osisko Development Announces Optimized Feasibility Study for Permitted Cariboo Gold Project with C$943 Million After-Tax NPV5% and 22.1% IRR at US$2,400/oz Base Case Gold Price; at US$3,300/oz Spot Gold C$2.1 Billion After-Tax NPV5% and 38.0% IRR

You have opened a direct link to the current edition PDF

Open PDF CloseOsisko Development Announces Optimized Feasibility Study for Permitted Cariboo Gold Project with C$943 Million After-Tax NPV5% and 22.1% IRR at US$2,400/oz Base Case Gold Price; at US$3,300/oz Spot Gold C$2.1 Billion After-Tax NPV5% and 38.0% IRR

Osisko Development Corp. (NYSE: ODV) (TSX-V: ODV) is pleased to announce the results of a positive optimized Feasibility Study for its permitted, 100%-owned Cariboo Gold Project, located in central British Columbia, Canada. The 2025 FS was completed by BBA Engineering Ltd. as lead independent consultant, and supported by other independent engineering firms, in accordance with National Instrument 43-101 – Standards of Disclosure for Mineral Projects. The Company intends to file the technical report in respect of the 2025 FS on SEDAR+ (www.sedarplus.ca) and on EDGAR (www.sec.gov) under Osisko Development’s issuer profile within 45 days of the date of this news release. The 2025 FS confirms strong economics for a low-impact underground operation using mechanized bulk mining methods, with attractive operating costs, manageable capital requirements, and well-positioned to benefit from favorable macroeconomic and gold price trends. The process facilities have been designed to accommodate potential future throughput expansions.

HIGHLIGHTS1

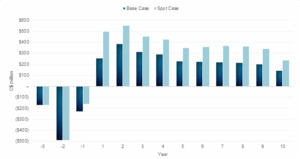

- Robust returns with base case after-tax NPV5% of $943 million, unlevered after-tax IRR of 22.1% and payback2 of 2.8 years at $2,400/oz gold price assumption. Using spot gold price of $3,300/oz, NPV5% improves to $2,066 million, IRR 38.0%, and payback2 of 1.6 years

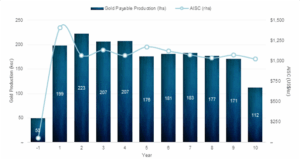

- Average annual production of ~190,000 ounces of gold over a 10-year mine life (202,000 ounces in the first 5 years) with first gold anticipated in H2 2027, assuming construction commences in Q3 2025, subject to progress on ongoing project financing discussions

- Average TCC of US$947/oz and AISC of US$1,157/oz over the LOM, placing the Cariboo Gold Project within the lower half of the global cost curve for gold mines3

- Average base case LOM annual FCF of $158 million ($296 million per year in the first 5 years)

- Improved single-phase build over 24 months and direct ramp-up to 4,900 tpd with total initial capital cost of $881 million and sustaining capital of $525 million over the LOM

- Streamlined processing facilities into a single location and improved flowsheet design with incorporation of a gravity circuit and production of higher-grade concentrate product

- Strong support for local employment with up to 613 direct jobs created during peak construction and 525 permanent jobs during operations

- Significant opportunities to potentially enhance Project economics and extend mine life through conversion of Mineral Resources adjacent to Mineral Reserves through infill drilling

Sean Roosen, Founder, Chairman and CEO, commented, “The completion of this optimized feasibility study represents a critical milestone for the Cariboo Gold Project, one of the few undeveloped, permitted gold projects in a Tier-1 jurisdiction4. The results reaffirm our view that Cariboo is a high-quality asset with robust returns and significant upside potential within the existing mine plan. Our immediate focus remains on advancing project financing and further de-risking the project toward FID, but, we believe additional work could support potential future production increases within the planned mine footprint. Additionally, our extensive land position around the Project area offers numerous opportunities for new discoveries in this prolific gold belt. With today’s favorable gold price backdrop and positive outlook, we believe this project is well-positioned to deliver substantial value to all stakeholders. We look forward to sharing further updates in the coming months.”

A formal positive final investment decision, along with securing of a project financing package in the coming months would enable certain construction activities to commence in the second half of 2025, with project completion targeted for the end of 2027.

Osisko Development will host a conference call and webinar presentation by management on the 2025 FS results on Monday, April 28, 2025 at 11:00 a.m. ET, followed by a question & answer session. Details for dial-in, webcast access, and replay archive are available at the end of this news release.

OPTIMIZED FEASIBILITY STUDY OVERVIEW

The Cariboo Gold Project is envisioned as a traditional underground operation, employing mechanized long-hole open stoping to extract ore from gold-bearing vein corridors—an intricate network of mineralized quartz veins predominantly hosted within unmineralized sandstone. An improved flowsheet from the 2023 FS (as defined herein5), supported by additional metallurgical testwork, envisions ore beneficiation to be exclusively completed at the Mine Site Complex. This would produce saleable gold doré from a gravity concentrate and ~66 tpd of high-grade flotation concentrate averaging ~133 g/t Au. The flotation concentrate would be transported by truck to the Port of Vancouver for transport and sale to a smelting partner. 2025 FS key summary results and assumptions are outlined in Table 1:

| Table 1: Cariboo Gold 2025 FS – Key Results and Assumptions (after-tax) | |||

| Metric | units | Base Case | Spot Case |

| Gold price | US$/oz | $2,400 | $3,300 |

| Exchange rate | USDCAD | 1.35 | 1.40 |

| Net Present Value at 5% discount | $ mm | 943 | 2,066 |

| Internal Rate of Return (IRR) | % | 22.1% | 38.0% |

| Payback, from commercial production | years | 2.8 | 1.6 |

| Average annual free cash flow1 | $ mm | 158 | 314 |

| Average AISC, LOM1 | US$/oz | 1,157 | 1,167 |

- All-in sustaining costs per ounce and free cash flow are non-IFRS measures or ratios. Refer to “Non-IFRS Financial Measures” at the end of this news release for more information.

- Spot case is based on the LBMA gold price as of the close of business on April 23, 2025, rounded to nearest $100/oz and the USDCAD exchange rate is based on the Bank of Canada daily exchange rate, rounded to nearest five cents.

Key Improvements and Optimizations vs. 2023 FS

The 2025 FS incorporates several important improvements and de-risking initiatives over the 2023 Feasibility Study that better position the Project from an execution, financing, and operational perspective. Notable changes include:

- Accelerated Development Sequence: Single-phase construction and ramp up directly to nameplate capacity of 4,900 tpd, which increases the LOM average gold production profile by 16% to 190,000 oz per year, and 202,000 oz per year in the first five years.

- Streamlined Processing: A single milling facility at the mine site removes the need (as had been previously contemplated) to transport flotation concentrate 116 km to the QR Mill. This reduces capital and operating costs by consolidating operations into one location.

- Improved Flowsheet Design: Updated metallurgical studies and testing has resulted in the addition of a gravity circuit which, combined with a rougher and cleaner flotation circuit, resulted in overall project gold recovery of 92.6% and the production of ~66 tpd higher-grade concentrate product (reduction from 590 tpd in 2023 FS Phase II) averaging ~133 g/t Au (vs. 28 g/t Au in 2023 FS Phase II). Approximately 46% of gold is expected to be recovered by gravity.

- Underground Mine Design: Increased average stope size by ~60% compared to the 2023 FS, significantly reducing the total number of stopes required to achieve average daily throughput. Optimization of the geotechnical design of the mined stopes, supported by recent trial mining, allows for more operational flexibility of underground operations.

- Mineral Reserves: Probable Mineral Reserves remained largely unchanged, increasing slightly to 2.071 million ounces Au (17.8 Mt grading 3.62 g/t Au).

- Permitted: Project design and sequencing contemplated in the 2025 FS is aligned with the BC Mines Act and Environmental Management Act permits obtained in Q4 2024.

| Table 2: Cariboo Gold 2025 FS vs. 2023 FS – Project Operating and Financial Metrics | |||

| Assumptions | units | 2023 FS | 2025 FS |

| Gold price | US$/oz | 1,700 | 2,400 |

| Exchange rate | USDCAD | 1.30 | 1.35 |

| Discount rate | % | 5.0% | 5.0% |

| Production | |||

| Mine life | yrs | 12.0 | 10.0 |

| Total ore mined | kt | 16,703 | 17,815 |

| Peak annual throughput | tpd | 4,900 | 4,900 |

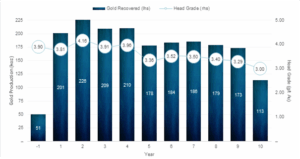

| Average gold head grade | g/t Au | 3.78 | 3.62 |

| Total contained gold | koz | 2,031 | 2,071 |

| Avg. gold recovery | % | 92.0% | 92.6% |

| Total recovered gold, payable | koz | 1,869 | 1,894 |

| Avg. gold production, LOM | koz/yr | 164 | 190 |

| Avg. gold production, first 5 yrs | koz/yr | 96 | 202 |

| Operating Unit Costs | |||

| Underground mining | $/t mined | 53.6 | 62.3 |

| Processing | $/t mined | 31.2 | 23.2 |

| Water and waste management | $/t mined | 7.2 | 5.0 |

| Electrical transmission line | $/t mined | — | 4.9 |

| General and administrative | $/t mined | 10.7 | 15.4 |

| Total unit operating costs | $/t mined | 102.6 | 110.7 |

| Total operating costs | $ mm | 1,714 | 1,921 |

| Royalty payments | $ mm | 206 | 292 |

| Offsite charges | $ mm | 5 | 143 |

| Operating Costs | |||

| Total cash costs2 | US$/oz | $792 | $947 |

| AISC2 | US$/oz | $968 | $1,157 |

| Capital Expenditures | |||

| Initial costs | $ mm | 137.3 | 881 |

| Expansion costs | $ mm | 451.1 | — |

| Sustaining costs | $ mm | 466.6 | 426 |

| Closure costs, net3 | $ mm | (38.9) | 99 |

| Total capex | $ mm | 1,016 | 1,406 |

| Economics (after-tax) | |||

| Total free cash flow, LOM2 | $ mm | 901 | 1,577 |

| Net Present Value (NPV5%) | $ mm | 502 | 943 |

| Internal Rate of Return (IRR) | % | 20.7% | 22.1% |

| Payback, from commercial production | yrs | 5.9 | 2.8 |

| Average free cash flow, first 5 yrs2 | $ mm | (63) | 296 |

| Average free cash flow, LOM2 | $ mm | 75 | 158 |

- Total may not add up due to rounding.

- Cash costs, all-in sustaining costs per ounce and free cash flow are non-IFRS measures or ratios. Refer to “Non-IFRS Financial Measures” at the end of this news release for more information. Total cash costs are presented on a per ounce payable basis inclusive of total operating costs mining costs, processing costs, site G&A costs, royalties, smelting, refining, and transports costs. AISC are presented on a per ounce payable basis and include cash costs plus sustaining and closure costs.

- Closure costs are shown net of salvage value.

- Pre-final investment decision capital costs total $38.6 million.

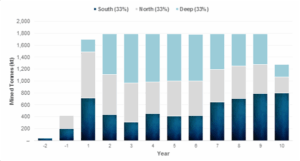

Figure 1: Payable Gold Production and AISC1 Profile by Year

- All-in sustaining costs per ounce is a non-IFRS ratio. Refer to “Non-IFRS Financial Measures” at the end of this news release for more information.

Figure 2: Free Cash Flow1 by Year

- Free cash flow is a non-IFRS measure. Refer to “Non-IFRS Financial Measures” at the end of this news release for more information.

ECONOMIC SENSITIVITY ANALYSIS

The Company used a base case gold price assumption of US$2,400/oz and a USDCAD exchange rate of 1.35 in its analysis and incorporated only Probable Mineral Reserves (as defined herein). Based on these assumptions, the Project generates an after-tax NPV5% of $943 million, an after-tax unlevered IRR of 22.1% and a payback of 2.8 years (from commercial production). The 2025 FS economics are most sensitive to fluctuations in the following inputs (in order of magnitude of impact): gold price, foreign exchange, operating costs, and capital costs.

| Table 3: Cariboo Gold 2025 FS – Economic Sensitivity Analysis, after-tax (base case in bold) | ||||

| Gold Price | NPV5% | IRR | Payback | Avg. FCF |

| (US$/oz) | ($ mm) | (%) | (yrs) | ($ mm per yr) |

| $1,800 | 251 | 9.9% | 5.3 | 65 |

| $2,100 | 610 | 16.5% | 3.5 | 113 |

| $2,400 | 943 | 22.1% | 2.8 | 158 |

| $2,700 | 1,275 | 27.2% | 2.2 | 204 |

| $3,000 | 1,604 | 31.9% | 1.9 | 250 |

| $3,300 | 1,934 | 36.3% | 1.7 | 296 |

| $3,600 | 2,263 | 40.5% | 1.5 | 342 |

| $3,900 | 2,592 | 44.5% | 1.3 | 388 |

| $4,200 | 2,921 | 48.3% | 1.2 | 433 |

| $4,500 | 3,249 | 51.9% | 1.1 | 479 |

| Table 4: Cariboo Gold 2025 FS – NPV5% Sensitivity Analysis, after-tax, $ mm (base case in bold) | |||||

| Gold Price | USDCAD Exchange Rate | ||||

| (US$/oz) | 1.25 | 1.30 | 1.35 | 1.40 | 1.45 |

| $1,800 | 59 | 166 | 251 | 335 | 419 |

| $2,100 | 439 | 525 | 610 | 695 | 780 |

| $2,400 | 750 | 847 | 943 | 1,040 | 1,136 |

| $2,700 | 1,058 | 1,167 | 1,275 | 1,382 | 1,490 |

| $3,000 | 1,364 | 1,484 | 1,604 | 1,724 | 1,845 |

| $3,300 | 1,669 | 1,801 | 1,934 | 2,066 | 2,198 |

| $3,600 | 1,974 | 2,118 | 2,263 | 2,408 | 2,552 |

| $3,900 | 2,279 | 2,436 | 2,592 | 2,749 | 2,905 |

| $4,200 | 2,584 | 2,753 | 2,921 | 3,089 | 3,258 |

| $4,500 | 2,888 | 3,069 | 3,249 | 3,430 | 3,610 |

| Table 5: Cariboo Gold 2025 FS – IRR Sensitivity Analysis, after-tax, % (base case in bold) | |||||

| Gold Price | USDCAD Exchange Rate | ||||

| (US$/oz) | 1.25 | 1.30 | 1.35 | 1.40 | 1.45 |

| $1,800 | 6.2% | 8.3% | 9.9% | 11.5% | 13.0% |

| $2,100 | 13.4% | 15.0% | 16.5% | 18.0% | 19.4% |

| $2,400 | 18.9% | 20.6% | 22.1% | 23.7% | 25.2% |

| $2,700 | 23.9% | 25.6% | 27.2% | 28.8% | 30.3% |

| $3,000 | 28.5% | 30.2% | 31.9% | 33.5% | 35.2% |

| $3,300 | 32.8% | 34.6% | 36.3% | 38.0% | 39.7% |

| $3,600 | 36.8% | 38.7% | 40.5% | 42.3% | 44.1% |

| $3,900 | 40.7% | 42.7% | 44.5% | 46.3% | 48.1% |

| $4,200 | 44.4% | 46.4% | 48.3% | 50.1% | 52.0% |

| $4,500 | 47.9% | 49.9% | 51.9% | 53.8% | 55.7% |

MINERAL RESOURCES AND MINERAL RESERVES

Vein corridors that make up the Cariboo Gold Project Mineral Resources and Mineral Reserves comprise a high-density network of mineralized quartz veins hosted within unmineralized sandstone. Individual mineralized veins within these corridors have widths varying from centimeters to several meters and strike lengths from a few meters to over 50 m. These corridors have been defined from surface to a vertical depth of 650 m, averaging 300m, and remain open for expansion at depth and along strike. Gold grades are intimately associated with quartz vein-hosted pyrite as well as pyritic, intensely silicified wall rock haloes in close proximity to the veins.

Figure 3: Vein Corridor in Lowhee Bulk Sample Area

Mineral Resources Estimate

The Mineral Resources estimate included in the 2025 FS have an effective date of April 22, 2025, and are reported exclusive of Mineral Reserves. Mineral Resources that are not Mineral Reserves do not have demonstrated economic viability. The Mineral Resources estimate have been updated to account for depletion in the Lowhee Zone, due to ongoing development and bulk sample activities, as well as for changes in costs and cut-off grade assumptions. This resulted in an aggregate increase of 3% of the total contained gold ounces in the Indicated Resources category and an increase of 8% of the total contained gold ounces in the Inferred Resources category as compared to the 2023 FS.

There is no certainty that Mineral Resources will be converted into Mineral Reserves. Mineral Resources include Inferred Mineral Resources which have had insufficient work to classify them as Indicated Mineral Resources. It is uncertain but reasonably expected that Inferred Mineral Resources could be upgraded to Indicated Mineral Resources with continued exploration.

| Table 6: Cariboo Gold 2025 FS – Mineral Resources Statement (April 22, 2025) | |||

| Category / Zone | Tonnage | Gold Grade | Contained Gold |

| (000’s tonnes) | (g/t) | (000’s oz) | |

| Measured | |||

| Bonanza Ledge | 47 | 5.06 | 8 |

| Indicated | |||

| Bonanza Ledge | 32 | 4.02 | 4 |

| BC Vein | 1,057 | 3.00 | 102 |

| KL | 527 | 2.80 | 47 |

| Lowhee | 1,333 | 2.76 | 118 |

| Mosquito | 1,553 | 2.96 | 148 |

| Shaft | 6,121 | 2.92 | 575 |

| Valley | 2,718 | 2.70 | 236 |

| Cow | 3,991 | 2.91 | 374 |

| Total Indicated Resources | 17,332 | 2.88 | 1,604 |

| Total Measured & Indicated | 17,380 | 2.88 | 1,612 |

| Inferred | |||

| BC Vein | 596 | 3.17 | 61 |

| KL | 2,514 | 2.53 | 205 |

| Lowhee | 486 | 3.01 | 47 |

| Mosquito | 1,883 | 3.08 | 186 |

| Shaft | 7,457 | 3.44 | 826 |

| Valley | 2,470 | 3.01 | 239 |

| Cow | 3,368 | 2.78 | 301 |

| Total Inferred Resources | 18,774 | 3.09 | 1,864 |

- The independent and qualified persons for the Mineral Resources estimates, as defined by NI 43-101, are Carl Pelletier, P.Geo., and Tessa Scott, P.Geo. (Norda Stelo). The effective date of the 2025 Feasibility Study Mineral Resource Estimate is April 22, 2025.

- These Mineral Resources, exclusive of the reserves, are not Mineral Reserves and do not have demonstrated economic viability.

- The Mineral Resources estimate follows the 2014 CIM Definition Standards on Mineral Resources and Reserves and the 2019 CIM Estimation of Mineral Resources and Mineral Reserves Best Practice Guidelines.

- A total of 481 vein zones were modelled for the Cow Mountain (Cow and Valley), Island Mountain (Shaft and Mosquito), Barkerville Mountain (BC Vein, KL, and Lowhee) deposits and one gold zone for Bonanza Ledge. A minimum true thickness of 2.0 m was applied, using the gold grade of the adjacent material when assayed or a value of zero when not assayed.

- The estimate is reported for a potential underground scenario at a cut-off grade of 1.8 g/t Au, except for Bonanza Ledge at a cut-off grade of 3.5 g/t Au. The cut-off grade for the Cow, Valley, Shaft, Mosquito, BC Vein, KL, and Lowhee deposits was calculated using a gold price of US$2,400/oz; a USDCAD exchange rate of 1.35; an underground mining cost of $66.3/t; a processing and transport cost of $30.80/t; a G&A plus Environmental cost of $22.40/t; and a sustaining CAPEX cost of $45.6/t. No changes have been applied for the Bonanza Ledge. The cut-off grade for the Bonanza Ledge deposit was calculated using a gold price of US$1,700/oz; a USDCAD exchange rate of 1.27; an underground mining cost of $79.13/t; a processing and transport cost of $65.00/t; and a G&A plus Environmental cost of $51.65/t. The cut-off grades may be re-evaluated in light of future prevailing market conditions (metal prices, exchange rate, mining cost, etc.).

- Density values for Cow, Shaft, Lowhee, and BC Vein were estimated using the ID2 interpolation method, with a value applied for the non-estimated blocks of 2.80 g/cm3 for Cow, 2.78 g/cm3for Shaft, 2.74 g/cm3 for Lowhee, and 2.69 g/cm3 for BC Vein. Median densities were applied for Valley (2.81 g/cm3), Mosquito (2.79 g/cm3), and KL (2.81 g/cm3). A density of 3.20 g/cm3 was applied for Bonanza Ledge.

- A four-step capping procedure was applied to composited data for Cow (3.0 m), Valley (1.5 m), Shaft (2.0 m), Mosquito (2.5 m), BC Vein (2.0 m), KL (1.75 m), and Lowhee (1.5 m). Restricted search ellipsoids ranged from 7 to 50 g/t Au at four different distances ranging from 25 m to 250 m for each deposit. High grades at Bonanza Ledge were capped at 70 g/t Au on 2.0 m composited data.

- The gold Mineral Resources for the Cow, Valley, Shaft, Mosquito, BC Vein, KL, and Lowhee vein zones were estimated using Datamine StudioTM RM 1.9 software using hard boundaries on composited assays. The dilution halo gold mineralization was estimated using Datamine StudioTM RM Pro 1.11. The OK method was used to interpolate a sub-blocked model (parent block size = 5 m x 5 m x 5 m). Mineral Resources for Bonanza Ledge were estimated using GEOVIA GEMSTM 6.7 software using hard boundaries on composited assays. The OK method was used to interpolate a block model (block size = 2 m x 2 m x 5 m).

- Results are presented in situ. Ounce (troy) = metric tons x grade / 31.10348. Calculations used metric units (metres, tonnes, g/t). The number of tonnes were rounded to the nearest thousand. Any discrepancies in the totals are due to rounding effects. Rounding followed the recommendations as per NI 43-101.

- The qualified persons responsible for this section of the technical report are not aware of any environmental, permitting, legal, title, taxation, socio-economic, marketing, political, or other relevant factors that could materially affect the Mineral Resource estimate other than those disclosed in this news release and in the Technical Report.

Mineral Reserves Estimate

The 2025 FS outlines Probable Mineral Reserves estimate (with an effective date of April 10, 2025) which is increased slightly from the 2023 FS due to the adjustment of the cut-off-grade dictated by an accelerated ramp-up schedule to 4,900 tpd throughput relative to the 2023 FS.

| Table 7: Cariboo Gold 2025 FS – Mineral Reserves Statement (April 10, 2025) | |||

| Category / Zone | Tonnage | Gold Grade | Contained Gold |

| (tonnes) | (g/t) | (oz) | |

| Proven | — | — | — |

| Probable | |||

| Cow | 3,999,971 | 3.35 | 430,548 |

| Valley | 3,238,636 | 3.59 | 374,058 |

| Shaft | 8,548,295 | 3.72 | 1,021,599 |

| Mosquito | 1,105,370 | 3.94 | 140,102 |

| Lowhee | 923,162 | 3.52 | 104,491 |

| Total Proven & Probable | 17,815,435 | 3.62 | 2,070,798 |

- Totals may not add up due to rounding.

- The Mineral Reserve estimate follows the 2014 CIM Definition Standards on Mineral Resources and Reserves and the 2019 CIM Estimation of Mineral Resources and Mineral Reserves Best Practice Guidelines.

- Mineral Reserves used the following assumptions: US$1,915/oz gold price, USD:CAD exchange rate of 1.32, and variable cut-off value from 1.70 g/t to 2.0 g/t Au

- Mineral Reserves include both internal and external dilution along with mining recovery. The external dilution is estimated to be 10.1%. The average mining recovery factor was set at 91.3% to account for ore left in each block in the margins of the deposit.

PRODUCTION PROFILE

The 2025 FS outlines an average annual gold production profile of 190,000 ounces over a 10-year mine life. Total payable gold recovered is 1.894 million ounces with an average head grade of 3.62 g/t Au, total metallurgical recovery of 92.6% and a 97.75% concentrate payability factor.

Figure 4: Recovered Gold and Grade Profile by Year

MINING AND MINE DESIGN

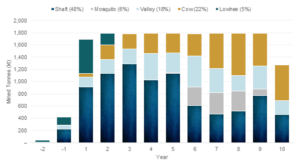

Underground mining will target five mineralized zones along 4,400 m of strike, accessed via two ramps: the currently operational Cow portal and a new Valley portal. Each zone includes several vein systems extending to a vertical depth of approximately 650 m. Following a 24-month development period, underground mining will ramp up to a design rate of 4,900 tpd over 10 months. The bulk-tonnage long-hole mining method was chosen for its cost-effectiveness, flexibility, and suitability for the sub-vertical vein geometry. To reduce the impacts of dilution, ore sorting technology will be used to separate gold-bearing sulphide ore (pyrite) from the lower-density unmineralized sandstone rock prior to milling and beneficiation (see Processing and Recovery).

The stope design parameters include a minimum width of 3.7 meters, stope heights of approximately 30 meters, and strike lengths ranging from 15 to 25 meters, depending on the zone. The average stope size tonnage has been adjusted based on insights gained from the Bonanza Ledge Phase II operation and the ongoing Lowhee Bulk Sample mining test work. Based on this information stope sizing has been standardized for the 2025 FS resulting in a ~60% increase in the average tonnes extracted per mine shape compared to the 2023 FS. Average stope size for the Project increased to 5,577 tonnes from 3,490 tonnes previously.

Mined ore will be extracted using a fleet of 10 tonne Load Haul Dump and 50 tonne haul trucks to be transported to an underground crushing facility where it will be sized and transported to surface by an inclined conveyor for pre-concentration ore sorting and subsequent flotation concentration and gravity separation.

Underground development will rely on a combination of traditional jumbos and roadheaders. The Company has previously successfully deployed a roadheader in excavating the Cow portal, ramp and one drift in Bonanza Ledge, demonstrating that the underground rock conditions are amenable to the use of roadheaders under certain conditions.

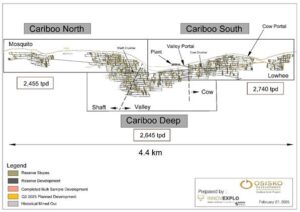

Figure 5: Mining Plan by Deposit Area

Figure 6: Mining Plan by Zone

As noted in Figure 7, mining is envisioned to occur in three distinct areas: Cariboo North, South, and Deep. Each area is expected to operate independently of one another and provide a maximum ore feed of 2,455 tpd from Cariboo North, 2,740 tpd from Cariboo South, and 2,645 tpd from Cariboo Deep, such that at any given time an aggregate of 4,900 tpd is mined across all deposit areas.

Figure 7: Mining Plan by Zone Long Section

PROCESSING AND RECOVERY

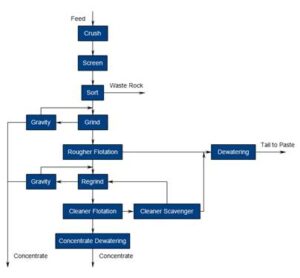

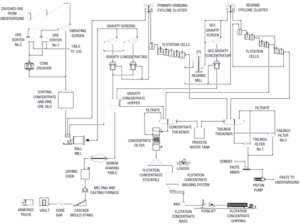

The processing flowsheet is designed for a single processing facility outside of Wells at the Mine Site Complex utilizing a combination of gravity and flotation processing circuits to produce two gold concentrates. Following the construction phase, processing will progressively ramp up to its 4,900 tpd nameplate capacity.

Crushing would occur underground in the Cariboo South region of the ore body (see Figure 7). Material would be conveyed from the secondary crusher to the surface ore sorter. The crushed material is then screened, with fines bypassing the tertiary crusher and reporting directly to the mill feed bin while coarser material would be screened into two suitable feed streams for sorting. The sorted product will be tertiary crushed and returned to the mill feed bin.

As part of the milling circuit, and as an addition to the previous 2023 FS, centrifugal gravity separators have been incorporated into the design. This is expected to contribute to overall gold recovery and recover a significant portion of the gold. Following gravity separation, the milled product (at 80% passing ~189µm) will be floated to produce a rougher concentrate for regrinding at a similar grade to the previous study. This rougher product will be reground to a target 24µm to further liberate gold and enable cleaner flotation. As significant additional gravity recoverable gold was observed in the laboratory test work, the 2025 FS design also features an additional centrifugal gravity unit in the regrind circuit. A scavenger will be included on the cleaner circuit. All flotation tails are disposed of as paste backfill into the underground.

Overall project gold recovery over the LOM is expected to be 92.6%.

Figure 8: Simplified processing flowsheet

Metallurgical Optimization

The metallurgical flowsheet has been improved since the publication of the 2023 FS based on updated metallurgical studies focused on the possibility of cleaner flotation and gravity recovery potential.

| Table 8: Cariboo Gold 2025 FS – Concentrate Comparison versus 2023 FS | |||

| Metric | units | 2023 FS | 2025 FS |

| Recovery | % | 92.01 | 92.6 |

| Average concentrate grade | g/t Au | 25 – 33 | 133 |

| Concentrate production, daily | dmt | 5903 | 66 |

| Transport trucks per day | # | 15 | <3 |

| Gravity concentrate | tonnes | n/a | ~5 tpd |

| Gravity concentrate, total recovery2 | % | n/a | 46% |

| Primary grind size | % | 125 | 189 |

- 93.6% recovery for phase I (1,500 tpd), and 91.8% recovery for phase II (4,900 tpd). 92.0% total overall recovery.

- Recovery as a percentage of total gold recovered.

- During phase II of the operation.

The higher grade and lower volumes of flotation concentrate is expected to result in a 97.75% concentrate payability factor and reduced transportation costs. This will also reduce the number of concentrate trucks on local roads by approximately 80%.

Subsequent to the bulk ore sorter testwork incorporated in the 2023 FS, laboratory scale test work has been completed over the course of 2024 and 2025. The laboratory scale testwork was used to identify gold associations with various mineral phases and their response to x-ray transmission. These results have helped quantify the expected efficiency of the ore sorting machines, allowing for a reduction in the quantity of units required. This has been factored into the updated capital cost estimates used for the 2025 FS.

Flotation Circuit

Rougher flotation testwork was completed at a larger particle size than for the 2023 FS. This has allowed a revision to a larger primary grind size. Additional cleaner flotation testwork has allowed engineering of a cleaner circuit including regrinding to the 20-24µm range for cleaner flotation.

Gravity Recovery

Additional gravity recoverable gold testing, as well as testing of combined gravity and flotation testwork has contributed to the grade of concentrates. Based on averages of testwork to date 46% of the gold recovered is recovered by gravity.

Additional Metallurgical Work

The following metallurgical work is in progress to support refined basic and detailed engineering:

- Pilot sorter testwork

- Grinding variability testwork

- Flotation variability testwork

- Confirmatory dewatering testwork

Mineral Ore Sorting

The Company has refined the ore sorting model for this deposit, including the identification of primary gold-bearing particle morphologies and determination of sorter mass pull-gold recovery behavior for each zone. These learnings have improved the precision of the recovery model.

Waste Disposal

Ore sorter waste is to be disposed in the same manner as mined waste rock—in the surface waste rock storage facility. This removes material from the mill circuit and allows a lower cost disposal method for barren rock than is utilized for mill tails streams. Whole flotation tails will be used as paste backfill underground.

Figure 9: Cariboo Gold Process Flowsheet

OPERATING COSTS

Operating costs estimate includes mining, processing costs to produce a gold doré and gold concentrate, as well as transportation. It also includes costs for waste, water management and treatment, and general and administration costs. The average operating costs over the 10-year mine life is estimated to be $110.7 per tonne mined. At its peak, the mine will employ up to 525 persons during operations and 613 during construction.

Mining costs include underground crushing cost and material handing costs, including backfilling costs without the binder content of the paste backfill, which is included in the processing cost.

| Table 9: Cariboo Gold 2025 FS – Operating Costs | ||||

| Metric | Total LOM | Unit Cost | Unit Cost | Split |

| ($ mm) | ($/t mined) | (US$/oz) | (%) | |

| Mining | 1,080 | 62.25 | 434 | 56% |

| Processing | 403 | 23.21 | 162 | 21% |

| Water and waste management | 86 | 4.97 | 35 | 4% |

| Electrical transmission line | 86 | 4.93 | 34 | 4% |

| General and administrative | 266 | 15.36 | 107 | 14% |

| Total site operating costs | 1,921 | 110.73 | 772 | 100% |

| Table 10: Cariboo Gold 2025 FS – Total Cash Costs and All-in Sustaining Costs | ||

| Metric | Total LOM | Unit Cost |

| ($ mm) | (US$/oz) | |

| Total site operating costs | 1,921 | 772 |

| Royalties | 292 | 117 |

| Transport and refining costs | 143 | 58 |

| Total cash costs1 | 2,356 | 947 |

| Sustaining costs, LOM | 426 | 171 |

| Equipment salvage value | (36) | (14) |

| Reclamation and closure costs | 135 | 54 |

| All-in sustaining costs1 | 2,881 | 1,157 |

- Total cash costs and all-in sustaining costs per ounce are non-IFRS ratios. Refer to “Non-IFRS Financial Measures” at the end of this news release for more information.

PROJECT ROYALTIES

A 5.0% Net Smelter Royalty payable to Osisko Gold Royalties Ltd is the only royalty that applies to the Mineral Resources and Mineral Reserves area of the Project and has been incorporated into the economic analysis of the 2025 FS.

CAPITAL COSTS

The 2025 FS focused on presenting a mine plan consistent with the objective of minimizing the overall environmental and carbon footprint of the Project on the surrounding communities and providing a direct 24-month exclusive construction period leading to a 10 month ramp up to full nameplate production, with 60% reached after 6 months.

Initial capital cost for the Project is estimated at $881 million, with sustaining capital costs over the LOM estimated at $525 million. Total cumulative LOM capital costs are estimated at $1,307 million, not including site reclamation and closure costs of $135 million and estimated salvage value of $36 million. The overall capital cost estimate developed in this 2025 FS generally meets the AACE International Class 3 requirements. A total of $72 million in contingency capital (P50) was included, representing approximately 16.5% of initial capital, not including underground mine costs. Underground development costs incorporate contingencies directly into the mine plan by adjusting planned advance and mining rates.

| Table 11: Cariboo Gold 2025 FS – Capital Cost Summary | |||

| Item ($ mm) | Initial CAPEX | Sustaining CAPEX | Total CAPEX |

| Underground mine | 313 | 397 | 710 |

| Waste & Water management | 98 | 24 | 123 |

| Power & electrical | 19 | — | 19 |

| Surface infrastructure | 42 | 1 | 43 |

| Process plant – Mine Site Complex | 180 | — | 180 |

| Construction indirects | 95 | — | 95 |

| Contingency (16.5%) | 72 | 4 | 76 |

| Capital costs | 819 | 426 | 1,246 |

| Pre-production net revenue | (150) | — | (150) |

| Pre-production operating costs | 212 | — | 212 |

| Equipment salvage value | — | (36) | (36) |

| Reclamation and closure costs | — | 135 | 135 |

| Total capital costs | 881 | 525 | 1,406 |

- Pre-final investment decision capital costs total $38.6 million.

PERMITTING, ENVIRONMENTAL AND CLOSURE

Following the positive decision by the Environmental Assessment Office to grant the project an Environmental Assessment Certificate (#M23-01), the Project underwent a robust and rigorous review by a dedicated Mine Review Committee, set up by the Major Mines Office, and subsequently received the following permits for the Cariboo Gold Project:

- M-247 – Mines Act permit for the Mine Site Complex and Bonanza Ledge;

- M-198 – Mines Act permit for the QR Mill;

- PE-111511 – Environmental Management Act Permit for the Mine Site Complex;

- PE-17876 – Environmental Management Act Permit for Bonanza Ledge; and

- PE-12601 – Environmental Management Act Permit for QR Mill.

The Mines Act (British Columbia) permits received on November 20, 2024, grant the Company the ability to proceed with the construction, operation and reclamation activities on each of the sites outlined within the scope of the Project. The Environmental Management Act (British Columbia) permits pertain to any project-related discharges to the environment, including water and air, and the framework and limitations thereof, within the areas outside of the immediate mine site boundaries. These approvals mark the successful completion of the permitting process for key approvals, solidifying the Project’s shovel-ready status.

Work is ongoing with the Ministry of Water, Land and Resource Stewardship and the Ministry of Forests on obtaining all necessary approvals for the construction of the transmission line, expected for H2 2025.

Changes as compared to the 2023 FS have been implemented in the Project’s 2025 FS to align with the obtained permits. Major areas include:

- Adjustment of the reclamation costs and bonding requirements;

- Adjustment to the water balance and quality model;

- Design of the water treatment to align fully with discharge permits; and

- Design of the surface infrastructure and layout to align with the community impacts and mitigations.

STAKEHOLDER, COMMUNITY, AND PARTNER ENGAGEMENT

The Company is committed to advancing collaborative partnerships with Indigenous nations related to the Project as evidenced by many years of extensive consultation and the signing and ongoing implementation of the participation agreements with each of the Lhtako Dené Nation (in 2020) and the Williams Lake First Nation (in 2022).

The Company is working towards an agreement with the Xatśūll First Nation. While an agreement has not yet been reached, the Company remains committed to ongoing engagement and consultation. This includes good faith and reasonable offers for financial and other benefits along substantially similar frameworks as those agreed to by Lhtako Dené Nation and Williams Lake First Nation.

The Company continues to engage the District of Wells and signed an agreement to fund a Liaison Position which will be executed once a suitable candidate is found. The Liaison Position is a requirement of the EAC and will work with the local community to ensure communication between the District of Wells and the Company reflect the views of all community members. Further discussions on a community agreement will commence in Q2 2025.

The Company is dedicated to developing a modern, safe and sustainable operation at the Cariboo Gold Project, and remains committed to engaging in constructive dialogue to ensure all Indigenous nations and stakeholders benefit from the development of the Project, whilst ensuring it remains viable.

ADDITIONAL OPTIMIZATION OPPORTUNITIES

There are significant opportunities not included in the 2025 FS that could materially enhance the Project’s economics, timing, and/or permitting—beyond those typical to all mining projects (such as changes in metals prices, exchange rates, and other variables). Additional information and further assessments are recommended to fully understand, quantify and potentially incorporate these opportunities into the Project’s NI 43-101 feasibility-level economics.

The most significant opportunities identified to date are summarized below and have been broadly categorized based on their potential magnitude of positive impact on the Project’s economics. A comprehensive list of all identified potential areas of opportunity will be discussed in greater detail in the Technical Report to be filed within 45 days of this news release.

High potential value opportunities:

- Significant conversion potential of existing Mineral Resources to Mineral Reserves with sufficient drilling density and incorporating appropriate modifying factors. Priority focus areas include such Mineral Resource that are not in the current mine plan, but located directly adjacent to or, in some cases, as extensions of planned Mineral Reserve stopes. By leveraging existing planned infrastructure, this could potentially increase recoverable ounces with minimal additional capital expenditures and potentially have a material impact on Project economics. Total Measured and Indicated Mineral Resources outside of the Mineral Reserves include 17.38 Mt at an average grade of 2.88 g/t for contained 1.61 Moz of gold. Total Inferred Resources outside of the Mineral Reserves include 18.77 Mt at an average grade of 3.09 g/t for contained 1.86 Moz of gold.

- The planned processing plant and surface infrastructure design have been strategically optimized to accommodate potential future expansion options. Opportunities for low capital cost expansion scenarios to increase throughput within the planned Project footprint will be explored and evaluated, provided sufficient additional Mineral Resources are converted to Mineral Reserves, and any required permit amendments are granted.

Medium potential value opportunities:

- Opportunities exist to increase mill recoveries by potentially disposing of rougher flotation tailings co-mingled with the ore sorter and development waste on surface.

- Pre-production ore toll milling of development material to generate revenue during the construction.

- Utilize pre-owned equipment to reduce upfront capital costs and development timelines.

- Explore alternative funding sources for certain off-site infrastructure.

CONFERENCE CALL AND WEBCAST DETAILS

| Live event date and time | Monday, April 28, 2025 at 11:00 a.m. ET |

| Conference call details | USA / International Toll +1 (646) 307-1963 USA – Toll-Free (800) 715-9871 Canada – Toronto (647) 932-3411 Canada – Toll-Free (800) 715-9871 |

Conference ID: 5457156

Additional international dial-in numbers are available here:

https://registrations.events/directory/international/itfs.htmlWebcast detailshttps://events.q4inc.com/attendee/466021363

TECHNICAL INFORMATION AND QUALIFIED PERSONS

The 2025 FS was prepared in accordance with NI 43-101 with an effective date of April 22, 2025 and will be filed on SEDAR+ (www.sedarplus.ca) and on EDGAR (www.sec.gov) under Osisko Development’s issuer profile within 45 days of the date of this news release.

The Technical Report supersedes the 2023 FS, which should no longer be replied upon.

For readers to fully understand the information in this news release, reference should be made to the full text of the Technical Report, once filed, including all assumptions, qualifications and limitations therein. The Technical Report is intended to be read as a whole, and sections should not be read or relied upon out of context.

The 2025 FS has been prepared by independent representatives of BBA, InnovExplo, a subsidiary of Norda Stelo, Alius, Falkirk, WSP, Okane, Integrated Sustainability, Clean Energy, and JDS, each of whom is a “qualified person” (within the meaning of NI 43-101). Each QP is independent of Osisko Development and has reviewed and approved that this news release fairly and accurately reflects, in the form and context in which it appears, the information contained in the respective sections of the 2025 FS for which they are responsible. At the effective date of the 2025 FS, each QP has certified that, to the best of their knowledge, information, and belief, the parts of the 2025 FS for which they were responsible, contain all scientific and technical information required to be disclosed to make the 2025 FS not misleading. The affiliation and areas of responsibility for each QP involved in preparing the 2025 FS are provided below.

BBA QPs

- Mathieu Belisle, P.Eng. – Metallurgical test work analysis, Process Plant design, Process Plant capital and operating cost estimate

- Amanda Fitch, P.Eng. – Financial Cashflow and overall study integration

InnovExplo QPs

- Carl Pelletier, P.Geo. – Mineral Resources estimate

- Tessa Scott, P.Geo. – Mineral Resources estimate

- Eric Lecomte, P.Eng. – Mineral Reserves estimate, underground mine design and cost estimate

Alius QPs

- Sebastien Guido, P.Eng. – Geomechanical (rock mechanics) aspects of underground mine design

Falkirk QPs

- Katherine Mueller, P. Eng. – Environment, Permitting and Engagement

- Rob Griffith, P.Eng. – Site-wide water balance model

- Nikolay Sidenko, P. Geo. – Mine waste geochemistry and water quality predictions

WSP QPs

- Paul Gauthier, P.Eng. – Design and costs for underground paste fill network distribution and underground ore crushing system

Integrated Sustainability QPs

- AJ MacDonald, M.A.Sc., P.Eng., P.E. – Design and costs, water treatment plants

Okane QPs

- Rachel Sawyer, P.Eng. – Design of the surface waste rock storage facility

- Yapo Allé-Ando, M.A.Sc., P.Eng. – Design of the water management infrastructure on surface

Clean Energy QPs

- Philip Clark, P.Eng., P.E. – Power Supply Estimate

JDS QPs

- Jean-François Maillé, P.Eng. – Costs for waste, tailings and water management infrastructure. Indirect costs and construction costs

End Notes (excluding tables)

- In this news release the Company uses certain abbreviations, including: net present value (“NPV“); NPV at a 5% discount rate (“NPV5%“); internal rate of return (“IRR“); measured and indicated (“M&I“); million (“m“); thousand (“k“); metric tonne (“t“); troy ounce (“oz“); grams per tonne (“g/t“); gold (“Au“); silver (“Ag“); life of mine (“LOM“); tonnes per day (“tpd“); free cash flow (“FCF“); years (“yrs“); per annum (“pa“); average (“avg.“); life-of-mine (“LOM“); versus (“vs.“).

- Payback is calculated from commercial production, which is defined as the achievement of reaching a minimum of 30 consecutive days of operations during which the mill operated at an average of 60% of nameplate throughput of 4,900 tpd.

- Based on S&P’s Global Market Intelligence, Metals & Mining, 2024 global gold cost curve for TCC and AISC.

- Based on the Investment Attractive Index as outlined in the Fraser Institute Annual Survey of Mining Companies (2023).

- Technical report titled “NI 43-101 Technical Report, Feasibility Study for the Cariboo Gold Project, District of Wells, British Columbia” (as amended) dated January 12, 2023 (with an effective date of December 30, 2022) (the “2023 FS“).

ABOUT OSISKO DEVELOPMENT CORP.

Osisko Development Corp. is a North American gold development company focused on past-producing mining camps located in mining friendly jurisdictions with district scale potential. The Company’s objective is to become an intermediate gold producer by advancing its flagship permitted 100%-owned Cariboo Gold Project, located in central B.C., Canada. Its project pipeline is complemented by the Tintic Project in the historic East Tintic mining district in Utah, U.S.A., and the San Antonio Gold Project in Sonora, Mexico—brownfield properties with significant exploration potential, extensive historical mining data, access to existing infrastructure and skilled labour. The Company’s strategy is to develop attractive, long-life, socially and environmentally responsible mining assets, while minimizing exposure to development risk and growing mineral resources.

For further information, visit our website at www.osiskodev.com or contact:

Appendix A: Detailed Cash Flow Model and Select Key Assumptions (excel file download of the below table)

| Year | Unit | Total (to Yr 12) |

|||||||||||||||

| -3 | -2 | -1 | 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 | 11 | 12 | |||

| Production Summary | |||||||||||||||||

| Total Tonnes Mined | kt | 1.7 | 43.2 | 419.8 | 1,695.1 | 1,788.6 | 1,789.0 | 1,786.9 | 1,793.4 | 1,783.1 | 1,788.5 | 1,788.6 | 1,793.4 | 1,272.7 | 71.5 | – | 17,815.4 |

| Total Tonnes Processed | kt | – | – | 464.7 | 1,695.1 | 1,788.6 | 1,789.0 | 1,786.9 | 1,793.4 | 1,783.1 | 1,788.5 | 1,788.6 | 1,793.4 | 1,272.7 | 71.5 | – | 17,815.4 |

| Head Grade Au | g/t | – | – | 3.90 | 3.80 | 4.16 | 3.91 | 3.96 | 3.36 | 3.52 | 3.50 | 3.40 | 3.29 | 3.00 | 3.55 | – | 3.62 |

| Payable Gold | koz | – | – | 50.0 | 198.8 | 223.0 | 206.6 | 207.5 | 176.2 | 181.3 | 183.3 | 177.0 | 171.1 | 112.0 | 7.3 | – | 1,894.0 |

| Revenue | |||||||||||||||||

| Exchange Rate | USD:CAD | 1.35 | 1.35 | 1.35 | 1.35 | 1.35 | 1.35 | 1.35 | 1.35 | 1.35 | 1.35 | 1.35 | 1.35 | 1.35 | 1.35 | 1.35 | 1.35 |

| Net Smelter Return (NSR) Revenue | $M | – | – | – | 629.4 | 707.5 | 654.7 | 657.9 | 556.5 | 573.3 | 579.8 | 559.4 | 540.2 | 353.1 | 23.2 | – | 5,834.9 |

| Operating Expenses | |||||||||||||||||

| Mining | $M | – | – | – | 113.3 | 118.9 | 119.6 | 114.1 | 106.8 | 111.1 | 111.8 | 104.1 | 106.8 | 68.8 | 4.9 | – | 1,080.2 |

| Processing | $M | – | – | – | 40.1 | 42.0 | 41.2 | 39.9 | 39.9 | 38.8 | 40.2 | 40.3 | 39.1 | 35.4 | 6.0 | – | 402.8 |

| Waste and Water Management | $M | – | – | – | 8.5 | 8.1 | 8.6 | 8.6 | 8.6 | 8.6 | 8.6 | 8.6 | 8.6 | 8.5 | 0.7 | – | 86.3 |

| Electrical Transmission Line | $M | – | – | – | 9.4 | 9.4 | 9.4 | 9.4 | 9.4 | 9.4 | 9.4 | 9.4 | 9.4 | 0.5 | 0.5 | – | 85.6 |

| General and Administration | $M | – | – | – | 28.2 | 25.6 | 26.8 | 26.6 | 26.4 | 26.4 | 26.3 | 26.1 | 26.1 | 24.7 | 3.3 | – | 266.5 |

| Royalty Payments | $M | – | – | – | 31.5 | 35.4 | 32.7 | 32.9 | 27.8 | 28.7 | 29.0 | 28.0 | 27.0 | 17.7 | 1.2 | – | 291.7 |

| Total Operating Expenses | $M | – | – | – | 230.9 | 239.5 | 238.3 | 231.5 | 219.0 | 223.0 | 225.3 | 216.5 | 216.9 | 155.5 | 16.5 | – | 2,213.0 |

| Total Cash Costs | US$/oz | – | – | – | 1,070 | 857 | 900 | 876 | 961 | 972 | 969 | 959 | 997 | 1,016 | -621 | – | 947 |

| All-in Sustaining Costs | US$/oz | – | – | – | 1,409 | 1,071 | 1,135 | 1,069 | 1,175 | 1,122 | 1,076 | 1,036 | 1,073 | 1,024 | 5,840 | – | 1,157 |

| Capital Expenditures | |||||||||||||||||

| Initial | $M | 168.2 | 487.3 | 225.3 | – | – | – | – | – | – | – | – | – | – | – | – | 880.8 |

| Sustaining | $M | – | – | – | 91.2 | 64.3 | 65.5 | 54.1 | 50.8 | 36.6 | 26.4 | 18.4 | 17.6 | 1.2 | – | – | 426.1 |

| Reclamation | $M | – | – | – | – | – | – | – | – | – | – | – | – | – | 36.7 | – | 36.7 |

| Salvage Value | $M | – | – | – | – | – | – | – | – | – | – | – | – | – | -36.0 | – | -36.0 |

| Total Capital Expenditures | $M | 168.2 | 487.3 | 225.3 | 91.2 | 64.3 | 65.5 | 54.1 | 50.8 | 36.6 | 26.4 | 18.4 | 17.6 | 1.2 | 0.7 | – | 1,307.7 |

| Changes in Working Capital | $M | – | – | – | 41.4 | 3.5 | -2.0 | -0.5 | -4.6 | 0.9 | 0.4 | -1.5 | -0.6 | -11.7 | -23.2 | -2.2 | – |

| Pre-Tax Cash Flow | |||||||||||||||||

| Pre-Tax Cash Flow | $M | -168.2 | -487.3 | -225.3 | 265.9 | 400.1 | 352.9 | 372.8 | 291.4 | 312.7 | 327.6 | 326.0 | 306.3 | 208.0 | -34.0 | -3.5 | 2,245.4 |

| Cumulative Pre-Tax Cash Flow | $M | -168.2 | -655.5 | -880.8 | -614.9 | -214.8 | 138.1 | 510.9 | 802.2 | 1,114.9 | 1,442.6 | 1,768.5 | 2,074.8 | 2,282.9 | 2,248.9 | 2,245.4 | |

| Taxes and Duties | |||||||||||||||||

| British Columbia Mining Duties | $M | – | – | 0.4 | 8.6 | 10.0 | 8.9 | 9.2 | 7.3 | 26.6 | 46.1 | 45.6 | 43.0 | 27.6 | – | – | 233.3 |

| Federal Corporate Income Tax | $M | – | – | – | – | – | 15.2 | 39.6 | 30.3 | 32.7 | 33.3 | 34.1 | 33.6 | 19.1 | -18.6 | -5.2 | 214.1 |

| British Columbia Corporate Income Tax | $M | – | – | – | – | – | 12.2 | 31.7 | 24.3 | 26.1 | 26.7 | 27.3 | 26.9 | 15.2 | -14.9 | -4.2 | 171.3 |

| Carbon Tax | $M | 0.5 | 1.6 | 1.9 | 1.1 | 1.4 | 1.7 | 1.5 | 2.0 | 2.0 | 1.9 | 1.8 | 1.9 | 1.5 | 0.3 | – | 21.4 |

| Total Taxes and Duties | $M | 0.5 | 1.6 | 2.3 | 9.7 | 11.4 | 38.1 | 81.9 | 63.9 | 87.5 | 108.0 | 108.8 | 105.4 | 63.4 | -33.1 | -9.4 | 640.1 |

| After-Tax Cash Flow | |||||||||||||||||

| After- Tax Cash Flow | $M | -168.8 | -488.9 | -227.7 | 256.2 | 388.7 | 314.8 | 290.8 | 227.5 | 225.3 | 219.6 | 217.1 | 200.9 | 144.6 | -0.9 | 6.0 | 1,605.3 |

| Cumulative After- Tax Cash Flow | $M | -168.8 | -657.7 | -885.3 | -629.1 | -240.4 | 74.4 | 365.2 | 592.7 | 818.0 | 1,037.6 | 1,254.7 | 1,455.6 | 1,600.2 | 1,599.3 | 1,605.3 |

Appendix B: Proposed Conceptual Site Layout

MORE or "UNCATEGORIZED"

Eloro Resources Announces Closing of Bought Deal LIFE Private Placement for Gross Proceeds of C$17 Million

Eloro Resources Ltd. (TSX: ELO) (FSE: P2QM) is pleased to announce the closing of its previously an... READ MORE

Minera Alamos Updates Resources and Reserves for the Pan Gold Mine in Nevada

Minera Alamos Inc. (TSX-V: MAI) (OTCQX: MAIFF) is pleased to announce updated Mineral Resource and M... READ MORE

Ero Copper Reports Fourth Quarter and Full Year 2025 Operating and Financial Results

Ero Copper Corp. (TSX: ERO) (NYSE: ERO) is pleased to announce its operating and financial results f... READ MORE

Rare Element Resources Announces Results of Oversubscribed Rights Offering of Common Shares

Rare Element Resources Ltd. (OTCQB: REEMF) is pleased to report that its previously announced... READ MORE

TRX Gold Reports Record Q2 2026 Production and Company Update

TRX Gold Corporation (TSX: TRX) (NYSE American: TRX) is pleased to announce preliminary resu... READ MORE