Osino Drills 109m @ 2.30g/t Gold at Ondundu Gold Project, Namibia, Best Intercept in Company History

Highlights

- Osino announces assay results from orientation drilling at Ondundu Gold Project, Namibia

- Drilling campaign identifies previously unknown extensional veins

- New zones of mineralization intersected east of the resource, in an area never previously drilled

- Assays received from eight of the fifteen RC infill holes at Ondundu including:

- ONRC23-017: 109m @ 2.30g/t (68-177m), 5m @ 7.81g/t (50-55m) and 3m @ 7.49g/t (15-18m)

- ONRC23-018: 93m @ 1.24g/t (102-195m) and 13m @ 3.54g/t (42-55m)

- ONRC22-008: 70m @ 1.24g/t (112-182m) incl. 2m @ 7.54g/t and 20m @ 1.61g/t

- ONRC22-007: 55m @ 1.45g/t (130-185m) incl. 25m @ 1.65g/t

- ONRC23-013: 65m @ 0.93g/t (53-118m) incl. 13m @ 1.59g/t

- 3,148m of drilling completed in fifteen holes since maiden mineral resource estimate, aimed at infill and upgrading previous drilling as well as drilling and assay method optimisation

- Scissor holes at Razorback and Margarethental intersect previously unknown mineralization to the east of current resource indicating significant upside potential

- Assay results of seven holes still to be reported, expected by end of April

Osino Resources Corp. (TSX-V:OSI) (FSE:RSR1) (OTCQX:OSIIF) is pleased to provide an update on the recently completed infill and scissor hole drill programs at the Ondundu Gold Project including the best intercepts recorded in the Company’s history.

Dave Underwood, Osino’s VP Exploration commented: “The infill drilling program at Ondundu is producing exciting results which complement and expand on previous drilling at Razorback by B2Gold in 2016. The wide intercepts at good grades confirm the robust nature at Razorback with hole ONRC23-017 [109m @ 2.30g/t] being the best intercept Osino has had anywhere in Namibia. Two scissor holes were drilled westwards to check for extensional veins at right angles to the resource drilling. Not only did these holes confirm the presence of previously unknown extensional veins, but also intersected new zones of mineralization to the east of the resource in an area never previously drilled due to difficult access. This new eastern zone will be drilled out when the resource upgrade drilling gets underway.”

Ondundu is a sedimentary hosted, structurally controlled orogenic gold deposit located 130km to the north-west of Osino’s flagship Twin Hills Gold Project. The Project has a long history of mining and exploration, most recently by B2Gold Corp. who drilled 122 DD and RC holes during the period 2016 until 2021.

Osino completed the acquisition of Ondundu from B2Gold on July 21, 2022 and on October 27, 2022 announced a maiden mineral resource estimate for Ondundu comprising 26 million tonnes at an average grade of 1.13g/t Au for a total of 0.9 million ounces (Moz) of gold in the Inferred mineral resource category (0.5g/t cut-off).

These mineral resources are compliant with National Instrument 43-101—Standards of Disclosure for Mineral Projects and are disclosed in the Company’s current technical report entitled, Ondundu Gold Project, Namibia, NI 43-101 Technical Report, dated effective October 7, 2022 by Anton Geldenhuys, MEng, MGSSA, PrSciNat (nr. 400313/04) and Glenn Bezuidenhout, Nat Dip (Ex Met), FSAIMM (nr. 705704) who are both independent qualified persons pursuant to NI 43-101.

Osino’s recent Ondundu drill program was designed to upgrade the mineral resource around Razorback and conduct an orientation program to optimize drilling and assay methodology. Two scissor holes were drilled to check the frequency and grade of extensional quartz veins perpendicular to the main mineralization.

Ondundu Infill Drill Program

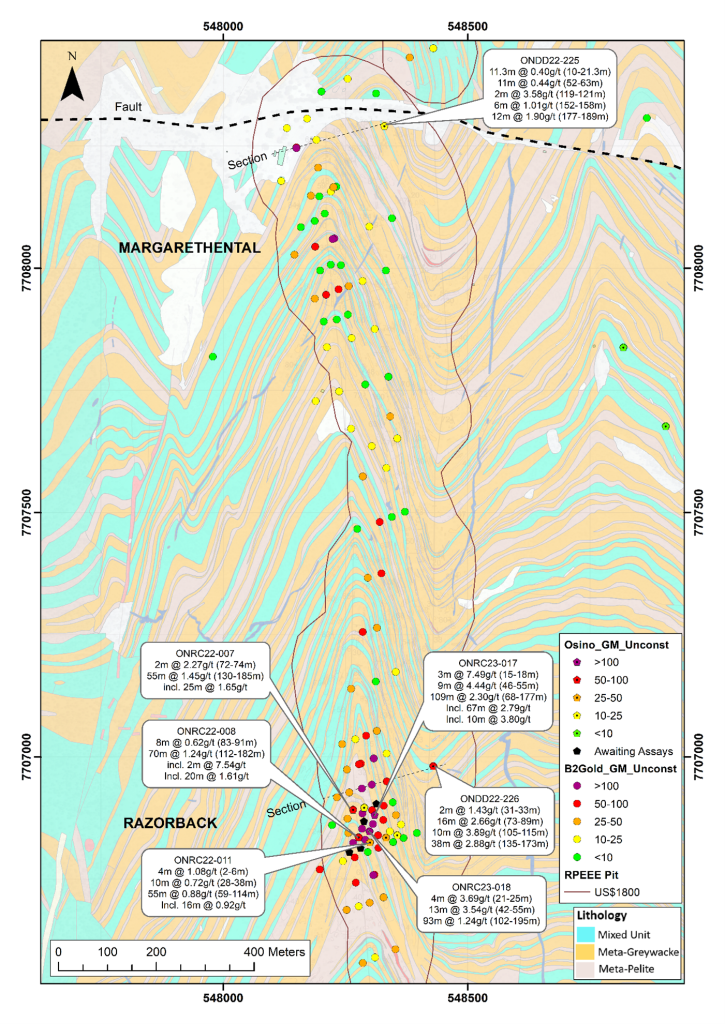

A total of 15 RC holes were drilled at Razorback to infill previous drilling carried out by B2Gold in 2016 with a net combined spacing between collars of ~16m (refer to Figure 1). Assays have been received for eight holes to date with results presented in Table 1 below.

The RC program was also designed as an orientation program to assist in optimising the drilling and assay techniques, given that the mineralization at Ondundu displays very nuggety, coarse gold characteristics.

The following parameters are being assessed:

- Comparison of larger RC sample size with previous diamond drilling by B2Gold

- Comparison of three different sample preparation and assay techniques, namely:

- a) Conventional 50g fire assay

- b) Metallic screen fire assay [Sample sieved to 150µm, the +150µm sample is weighed and fire-assayed in a single shot while the -150µm fine fraction is weighed and two 50g fire-assays are completed to test for homogeneity. A final Au concentration is then calculated from a weighted average].

- c) Leachwell [Sample pulverised to 85% passing -70µm, 1kg bottle roll cyanide leach].

All samples have been prepared and shipped to the respective laboratories for assay. The results from this orientation program will be used to plan a larger infill and resource expansion drill program for the Ondundu deposit.

Drill Intercept Table

| HOLE | X (UTM_33S) | Y (UTM_33S) | FROM | TO | WIDTH (m) | GRADE (g/t) |

| ONRC22-007 | 548265 | 7706892 | 130 | 185 | 55 | 1.45 |

| ONRC22-008 | 548277 | 7706835 | 112 | 182 | 70 | 1.24 |

| ONRC22-009 | 548355 | 7706840 | 56 | 69 | 13 | 1.74 |

| ONRC22-010 | 548333 | 7706835 | 3 | 43 | 40 | 1.18 |

| ONRC22-011 | 548300 | 7706825 | 59 | 114 | 55 | 0.88 |

| ONRC22-013 | 548313 | 7706904 | 53 | 118 | 65 | 0.93 |

| ONRC23-017 | 548309 | 7706881 | 15 | 18 | 3 | 7.49 |

| and | 50 | 55 | 5 | 7.81 | ||

| and | 68 | 177 | 109 | 2.30 | ||

| ONRC23-018 | 548299 | 7706848 | 21 | 25 | 4 | 3.69 |

| and | 42 | 60 | 18 | 2.60 | ||

| and | 102 | 195 | 93 | 1.24 |

Table 1: Mineralized Intercepts for Ondundu Infill RC Holes Received to Date

Notes on Drill Assay Reporting:

- Total intercepts reported are unconstrained – all combined intercepts above 0.4g/t reported. GM values based on unconstrained intercepts. All reported intercepts are apparent widths rounded to the nearest meter. Included (incl.) intercepts are constrained at 0.4g/t cut-off, minimum 2m wide and no more that 2m internal dilution. True widths are unknown at this stage. Collar positions are in UTM WGS84 surveyed by digital GPS.

- The GM number indicated by color coding in Figure 1 is a commonly used short-hand method of representing gold grade (g/t) and unconstrained intercept width (m) as a single metric by multiplying the average intercept grade with the intercept width.

The main geological feature in the project area is the low amplitude Ondundu anticline, a major north-trending

antiformal fold which plunges approximately 30° to the south. Parasitic folds within the regional anticline have

concentrated gold mineralization mainly in conformable (bedding parallel) veins.

The main mineralized zone extends sub-vertical from surface and trends in a north-south direction, with the conformable mineralization dipping to the west and pinching out to the east and west. Mineralization is hosted by finely interlayered, upward fining tubiditic sediments belonging to the Kuiseb Formation.

Ondundu includes two zones of mineralized zones namely Razorback and Margarethental which have a combined mineral resource estimate of 0.9Moz @ 1.13g/t Au in the Inferred Category, reported within a US$1800/oz RPEEE (reasonable prospects for eventual economic extraction) pit shell, as disclosed in the Technical Report described above.

Figure 1: Margarethental and Razorback Zones, showing assay results for recently drilled holes

Scissor Drill Hole Program

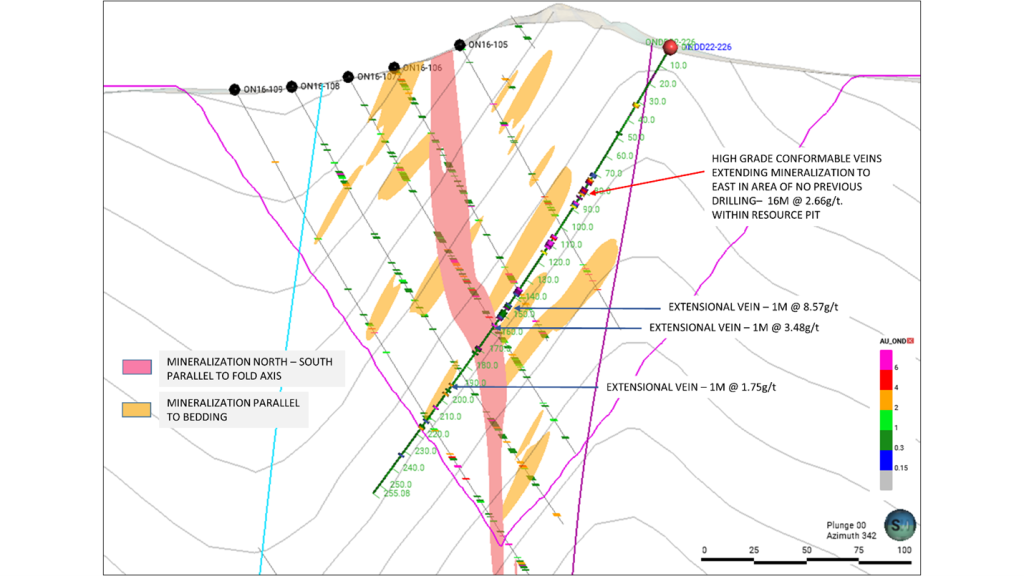

Two diamond holes were drilled in the opposite direction (250 degrees) to the resource drilling, to test for extensional veins which are perpendicular to the bedding and would therefore not have been included in the resource.

Diamond hole ONDD022-226 was drilled across Razorback approximately parallel to the conformable veins – see Figure 2 below. The hole intersected a zone of conformable mineralization between 73 and 89m of 16m @ 2.66g/t.

This mineralization is outside of the orange resource area in Figure 2 and indicates that the conformable mineralization extends further eastwards than the current model.

This drill hole also intersected several cm-scale extensional quartz veins in massive sand units with good gold grades including: 1m @ 8.57g/t, 1m @ 3.48g/t and 1m @ 1.75g/t.

This mineralization would probably have been missed by the previous resource drilling as the extensional veins are parallel to the drill azimuth.

Figure 2: Section across Razorback Zone including scissor hole ONDD022-226 – looking north

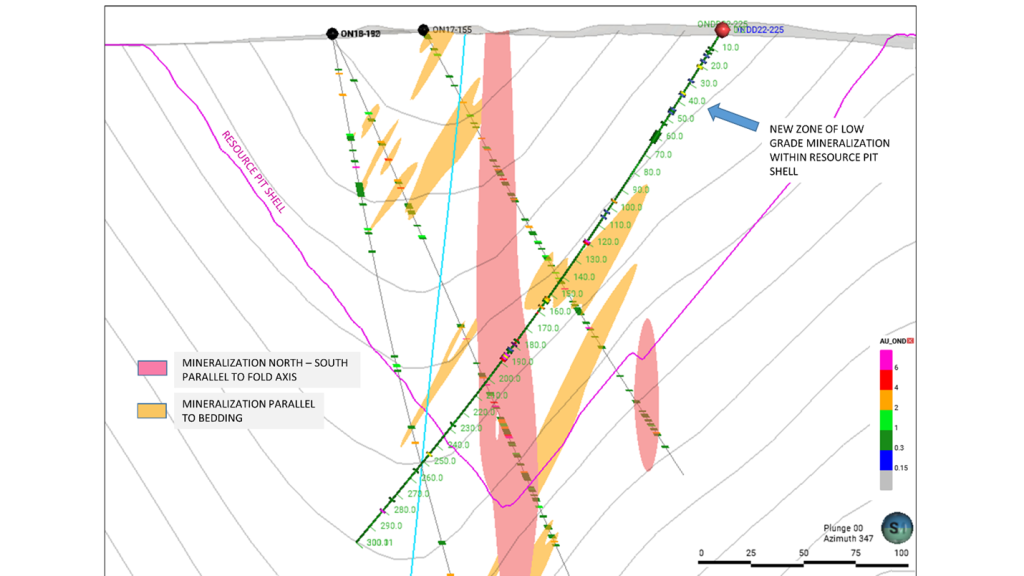

Diamond hole OND022-225 was drilled across the Margarethental Zone also parallel to the conformable veins – see Figure 3 below. The hole intersected a wide zone of low grade gold mineralization between 10 and 63m which is made up of both conformable and extensional quartz veins.

Although this material is low grade, it lies within the current resource pit and is therefore of immediate value. In addition there is no drilling between the north-south mineralization (pink zone in Figure 3) and the new drill collar, indicating significant upside potential.

Figure 3: Section across Margarethenthal Zone including scissor hole OND022-225 – looking north

In the high grade quartz vein zone between 177 and 189m there are several cm scale extensional pyrite veins, which are perpendicular to the quartz veins and would probably not have been sampled during the resource drilling, resulting in underreporting of grade in this area.

Extensional Veins and Upside Potential

The main mineralized extensional veins at Ondundu are physically linked to the conformable veins and pinch out over short distances into the wall rock.

In addition to the known extensional veins, this orientation program demonstrates that there are also gold bearing extensional veinlets on a cm or mm scale, which are present particularly in the massive sandstone units and not necessarily connected to the conformable mineralization.

These extensional veinlets are not well represented in the current resource model and indicate upside potential.

Both scissor holes also indicate that the mineralization is open to the east of the current mineral resource model but still within the resource pit.

The holes thus represent upside potential both in terms of additional ounces and conversion of material previously modelled as unmineralized, into the mineralized category. Additional drilling is planned to drill out this area and bring this upside potential into the mineral resource estimate.

Qualified Person’s Statement

David Underwood, BSc. (Hons) is Vice President Exploration of Osino Resources Corp. and has reviewed and approved the scientific and technical information in this news release and is a registered Professional Natural Scientist with the South African Council for Natural Scientific Professions (Pr. Sci. Nat. No.400323/11) and a Qualified Person for the purposes of National Instrument 43-101.

About Ondundu

Ondundu is a sedimentary hosted, structurally controlled orogenic gold deposit located 130km to the north-west of Osino’s Twin Hills gold project, in an area of known gold deposits hosted within the inland arm of the Pan African Neoproterozoic Damara Belt. The Project lies in the Northern Zone of the Damara Belt, lying to the north of the prominent regional scale Autseib/Otjohorongo Fault. The Project area is underlain entirely by meta-sedimentary rocks of the Kuiseb Formation of the upper Swakop Group, comprising schistose quartz feldspar mica metagreywacke and meta-pelite rocks, which are often calcareous.

The mineralization at Ondundu shows many similarities to turbidite hosted orogenic gold systems known elsewhere. The main area of gold mineralization stretches about 1.9km from Margarethental in the north to Razorback in the south (the Ondundu Main Zone or OMZ) and occurs on the steep, west-facing limb of a parasitic syncline-anticline pair (previously termed the “Common Limb”) on the eastern limb of the south-eastern part of the Ondundu anticline.

The bulk of the gold at Ondundu is free gold associated with bedding-parallel quartz‐Fe‐carbonate-pyrite veins, commonly with related sericite alteration. These veins occur as extensional and shear veins along the west‐southwest dipping common limb and form as single or in sets of parallel veins which occur in zones up to 1 m wide in outcrop.

The Ondundu Project has a long history of mining and exploration, dating back to the first Europeans to note gold in the area in 1917. Between 1922 and 1964, it was reported that a significant amount of gold was recovered by small scale miners on various mining claims in what is now known as the OMZ. Gold was recovered from alluvial, eluvial and shallow oxidised gold bearing rocks. The project has been extensively drilled by various operators, most recently by B2Gold, who completed extensive exploration and drilled 119 diamond drillholes (24,490m) and 3 RC holes (564m) on the OMZ and Margarethental North areas during the period 2015 until 2021.

On 6 January 2022, Osino Resources Corp. announced the acquisition of the 100% owned Ondundu Gold Project from B2Gold and completed the transaction on July 21, 2022. Osino has since completed initial metallurgical testwork which indicates that after milling to 80% passing 75 micron, gold recovery in the range of 76-79% to gravity concentrate (containing less than 5% of the solid feed to the circuit) could be achieved. This suggests that gravity concentration on site, with subsequent transport to and further processing at Twin Hills could be a feasible process route for Ondundu material.

As initially announced in its news release dated October 27, 2022, the maiden MRE for the Ondundu Gold Project comprises 26 million tonnes (Mt) at an average grade of 1.13g/t Au for a total of 0.9 million ounces (Moz) of gold in the Inferred mineral resource category (0.5g/t cut-off).

About Osino Resources

Osino is a Canadian gold exploration and development company focused on the fast-tracked development of our wholly owned, Twin Hills Gold Project (“Twin Hills”) in central Namibia. Since its grassroots discovery by Osino in August 2019 the Company has completed more than 225,000m of drilling and has completed a suite of specialist technical studies culminating in the recently published Twin Hills PFS. The PFS describes a technically simple and economically robust open-pit gold operation with a 13-year mine life and average annual gold production of over 169koz per annum.

Osino has a commanding ground position of approximately 8,000km2 located within Namibia’s prospective Damara sedimentary mineral belt, mostly in proximity to and along strike of the producing Navachab and Otjikoto Gold Mines. The Company is actively exploring a range of gold prospects and targets along the belt by utilizing a portfolio approach geared towards discovery, targeting gold mineralization that fits the broad orogenic gold model.

Our core projects are favorably located north and north-west of Namibia’s capital city Windhoek. By virtue of their location, the projects benefit significantly from Namibia’s well-established infrastructure with paved highways, railway, power and water in close proximity. Namibia is mining-friendly and lauded as one of the continent’s most politically and socially stable jurisdictions. Osino continues to evaluate new ground with a view to expanding our Namibian portfolio.

MORE or "UNCATEGORIZED"

Eloro Resources Announces Closing of Bought Deal LIFE Private Placement for Gross Proceeds of C$17 Million

Eloro Resources Ltd. (TSX: ELO) (FSE: P2QM) is pleased to announce the closing of its previously an... READ MORE

Minera Alamos Updates Resources and Reserves for the Pan Gold Mine in Nevada

Minera Alamos Inc. (TSX-V: MAI) (OTCQX: MAIFF) is pleased to announce updated Mineral Resource and M... READ MORE

Ero Copper Reports Fourth Quarter and Full Year 2025 Operating and Financial Results

Ero Copper Corp. (TSX: ERO) (NYSE: ERO) is pleased to announce its operating and financial results f... READ MORE

Rare Element Resources Announces Results of Oversubscribed Rights Offering of Common Shares

Rare Element Resources Ltd. (OTCQB: REEMF) is pleased to report that its previously announced... READ MORE

TRX Gold Reports Record Q2 2026 Production and Company Update

TRX Gold Corporation (TSX: TRX) (NYSE American: TRX) is pleased to announce preliminary resu... READ MORE