ORVANA REPORTS Q2 FY2025 PRODUCTION AND EXPLORATION RESULTS FROM OROVALLE, SPAIN

Orvana Minerals Corp. (TSX: ORV) is pleased to report production and exploration updates for the second quarter of fiscal year 2025 ending March 31, 2025 from Orovalle (Spain).

Juan Gavidia, CEO of Orvana, commented, “Gold production was lower than planned due to maintenance issues. We are implementing the necessary measures to achieve guidance. Notably, our copper production is outperforming expectations, which should assist us in achieving guidance for the year. We remain focused on maintaining operating discipline while advancing our growth strategy with exploration in Orovalle“.

Orovalle – Q2 FY2025 Production Results

- The mill processed approximately 111,272 tones, 6% lower than the prior quarter. The plant was shut down 28 days in the quarter: 17 days to carry out maintenance activities and 11 days in accordance with the scheduled workforce calendar. By March 31, 2025, approximately 18,000 tones of ore had been stockpiled for processing in the third quarter.

- 6,792 gold ounces produced in Q2 FY2025. Orovalle is targeting to reach the lower end of the 2025 production guidance of 37,000 – 41,000 Oz.

- 0.9 million copper pounds produced in Q2 FY2025. Orovalle expects to exceed the higher end of the 2025 production guidance of 2,400 – 2,700 K lbs.

| Q2 FY2025 | Q1 FY2025 | Q2 FY2024 | YTD Q2

FY2025 |

FY 2025

Guidance |

||

| Ore milled (tones) | 111,272 | 118,649 | 136,371 | 229,921 | ||

| Gold equivalent

(oz)(1) |

8,416 | 9,694 | 10,101 | 18,110 | ||

| Gold | ||||||

| Grade (g/t) | 2.06 | 2.16 | 1.97 | 2.11 | ||

| Recovery (%) | 92.0 | 92.7 | 90.0 | 92.4 | ||

| Production (oz) | 6,792 | 7,631 | 7,775 | 14,424 | 37,000 – 41,000 | |

| Copper | ||||||

| Grade (%) | 0.43 | 0.48 | 0.47 | 0.45 | ||

| Recovery (%) | 84.0 | 85.5 | 78.0 | 84.8 | ||

| Production (K

lbs) |

885 | 1,068 | 1,095 | 1,953 | 2,400 – 2,700 | |

| Silver | ||||||

| Grade (g/t) | 9.81 | 10.78 | 8.17 | 10.31 | ||

| Recovery (%) | 80.1 | 81.0 | 74.6 | 80.6 | ||

| Production (oz) | 28,129 | 33,306 | 26,728 | 61,435 |

- Gold Equivalent Ounces (“GEO”) is a Non-GAAP Financial Performance Measure. For further information and detailed reconciliations, please see the “Non-GAAP Financial Performance Measures” section of the Company’s latest MD&A. GEO were calculated using the following average market prices:

Q2 FY2025: _$2,862.56/oz Au, $31.91/oz Ag, $4.24/lb Cu

Q1 FY2025: _$2,661.61/oz Au, $31.34/oz Ag, $4.16/lb Cu

Q2 FY2024: _$2,071.76/oz Au, $23.36/oz Ag, $3.83/lb Cu

Orovalle – Q2 FY2025 Drilling Update

| Drilled Meters | Infill | Brownfield | Greenfield | TOTAL |

| El Valle Boinás

Area 208 (A2) |

636 | 2,485 | – | 3,121 |

| Ortosa-Godán | – | – | 1,380 | 1,380 |

| TOTAL | 636 | 2,485 | 1,380 | 4,501 |

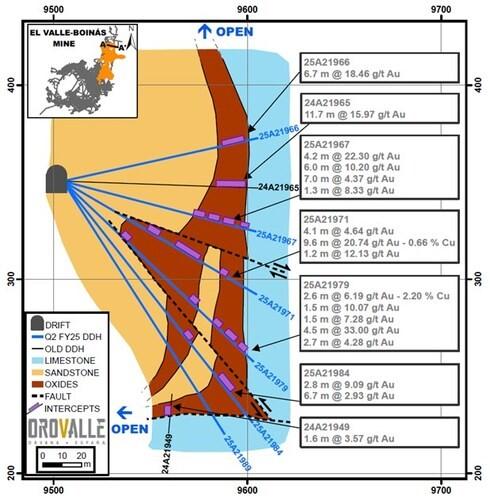

El Valle Boinás

The drilling program in Q2 FY2025 continued focused on Area 208, oxide orebody, in order to define new inferred resources and targeting to convert inferred resources into indicated resources.

Drill holes were completed along 160 m following the mineral continuity between sandstone and limestone and extending the structure around 70 m at depth.

Mineralization in the sections drilled is related with porphyry dikes and faults which plays an important role in the mineral remobilization. Sections close to the porphyry dikes show two types of mineralization, one of them enriched in gold and another one enriched in copper. Oxide skarn, massive sulphides, polymictic breccias, fault zones and silicified zones were intersected (Figure 1).

Drilling program in third quarter will be focused on defining skarn mineralization in Boinás East and Boinás South.

Ortosa-Godán

The Ortosa-Godan Project is located three kilometers northwest of our Carlés mine, within the same gold belt. The exploration program is currently focused on the Godán area, where FY2024 drilling proved mineralization at the contact between the intrusive and sedimentary rocks, with calcic skarn bands dipping 60-70º ESE over 200 meters of strike potential.

FY2025 program is underway. As of March 2025, two drill holes have been completed and a third is in progress, expected to be completed by May 2025. The target is to extend skarn mineralization 200 m deeper. Based on the dip, there is potential for this mineralization to connect with the Carles skarn. No grade values or economic significance is implied until additional results are obtained from at least the completion of the third drill hole.

Quality Control

Greenfield drill hole samples were sent to an external laboratory (ALS Laboratory) for analyses. Infill and brownfield drill holes samples were analyzed in Orovalle’s Laboratory.

Sample preparation was carried out at the El Valle facility. All diamond core samples have been prepared using the following procedure, once split:

The core samples are dried at a temperature of 105ºC and then crushed through a jaw crusher to 70%

After sample preparation, 30g samples are analyzed for Au by fire assay with an atomic absorption spectroscopy (AAS) finish and one-gram samples for Ag, As, Bi, Cu, Hg, Pb, Sb, Se, and Zn by ICP-optical emission spectroscopy (ICP-OES) after an aqua regia digestion.

For A208 core samples is used a 1000 g sub-sample of each split and 250 g sub-samples are split. 50 g samples are twice analyzed. In case of the twice analysis don´t match, a metalling screening method is used to confirm the grade.

In case of the samples sent to an external laboratory, 30 g samples are analyzed for Au by fire assay with an atomic absorption (Au AA-25) and 35 elements by ICP (ME-ICP41) after an aqua regia digestion. When Au and Ag values are >100 ppm and Cu and As values are >10,000 ppm, specific analysis methods are used to determinate the final grade.

The reported work has been completed using industry standard procedures, including a quality assurance/quality control program consisting of the insertion of certified reference material, blanks and duplicates samples into the sample stream.

The exploration update was prepared under the supervision of Guadalupe Collar Menéndez, a qualified person for the purposes of NI 43-101 and an employee of Orovalle Minerals S.L., a subsidiary of Orvana.

Consolidated Operational and Financial Performance & FY2025 Guidance:

Project updates for Bolivia and Argentina, and Q2 FY2025 financial highlights will be released with the second quarter financials, expected mid-May, 2025.

ABOUT ORVANA

Orvana is a multi-mine gold-copper-silver company. Orvana’s assets consist of the producing El Valle and Carlés gold-copper-silver mines in northern Spain, the Don Mario gold-silver property in Bolivia, and the Taguas property located in Argentina. Additional information is available at Orvana’s website (www.orvana.com).

Figure 1. A-A’ Longitudinal section A208. (Intercepts not true widths). (CNW Group/Orvana Minerals Corp.)

MORE or "UNCATEGORIZED"

Eloro Resources Announces Closing of Bought Deal LIFE Private Placement for Gross Proceeds of C$17 Million

Eloro Resources Ltd. (TSX: ELO) (FSE: P2QM) is pleased to announce the closing of its previously an... READ MORE

Minera Alamos Updates Resources and Reserves for the Pan Gold Mine in Nevada

Minera Alamos Inc. (TSX-V: MAI) (OTCQX: MAIFF) is pleased to announce updated Mineral Resource and M... READ MORE

Ero Copper Reports Fourth Quarter and Full Year 2025 Operating and Financial Results

Ero Copper Corp. (TSX: ERO) (NYSE: ERO) is pleased to announce its operating and financial results f... READ MORE

Rare Element Resources Announces Results of Oversubscribed Rights Offering of Common Shares

Rare Element Resources Ltd. (OTCQB: REEMF) is pleased to report that its previously announced... READ MORE

TRX Gold Reports Record Q2 2026 Production and Company Update

TRX Gold Corporation (TSX: TRX) (NYSE American: TRX) is pleased to announce preliminary resu... READ MORE