ORVANA ANNOUNCES TAGUAS PROJECT PHASE I INFILL & GROWTH DRILLING RESULTS

Orvana Minerals Corp. (TSX: ORV) is pleased to announce the recent completion of Phase I of its infill and resource-growth drilling campaign targeting the Oxides Horizon of its 100%-owned Taguas Project in San Juan Province, Argentina. A five-month final Phase II is expected to start in November 2022.

Phase I consisted of 6,482.6 meters in 41 diamond drill holes (DDH’s), with over 4,900 assay samples. The main goal of the program was to upgrade Cerros Taguas Oxides Sector to Measured & Indicated Resource categories, as those terms are defined in National Instrument 43-101 – Standards of Disclosure for Mineral Projects) while moderately expanding the ore tonnage previously reported in the Company’s NI 43-101 compliant Taguas preliminary economic assessment report dated December 29, 2021 and filed on SEDAR on February 11, 2022. The second goal was to incorporate satellite Cerro Campamento Sector into the Oxides scope, going forward.

“The DDH’s average drilling results and key intercepts continue to support Orvana’s Oxides development strategy for our Taguas multimillion-ounce Au-Ag Oxides-Sulfides Project. Also, the decision to incorporate the satellite higher-grade Cerro Campamento Sector will be key to improving project economics. We are excited, and eagerly awaiting, resource re-modeling by July 2022. Completion of Phase II will be the foundation of the 43-101 Pre-Feasibility Study for our Oxides Project in Taguas”, said Orvana CEO Juan Gavidia.

Highlights:

- Phase I infill and growth drilling program on Taguas Oxides completed (41 holes totaling 6,482.6 meters).

- Mineralization encountered in all 41 holes.

- Grades generally equaling-improving average previous resource grades included in the Taguas 2021 PEA.

- Best drilling results included:

- TADD244: 61.2 meters @ 0.82 g/t Au and 16.59 g/t Ag

- TADD265: 72.8 meters @ 0.46 g/t Au and 6.04 g/t Ag

- TADD274: 27.7 meters @ 2.51 g/t Au and 10.61 g/t Ag

- Potential to reduce strip ratio in next open pit re-design.

- Phase II infill and growth drilling program expected to start in November 2022: additional 11,000 meters in Cerros Taguas Sector and 3,000 meters in Cerro Campamento Sector.

Drilling Program Overview:

Phase I was conducted between late-December 2021 and mid-May 2022. Out of the total 41 drill holes drilled in Phase I, assay results from the first 12 holes (TADD237 to TADD248) were outlined in Orvana’s March 31, 2022 news release. The assay results for the subsequent 29 holes are summarized in Table 1 and Table 2 of this news release.

Phases I & II results to be used for Taguas Oxides prefeasibility studies purposes.

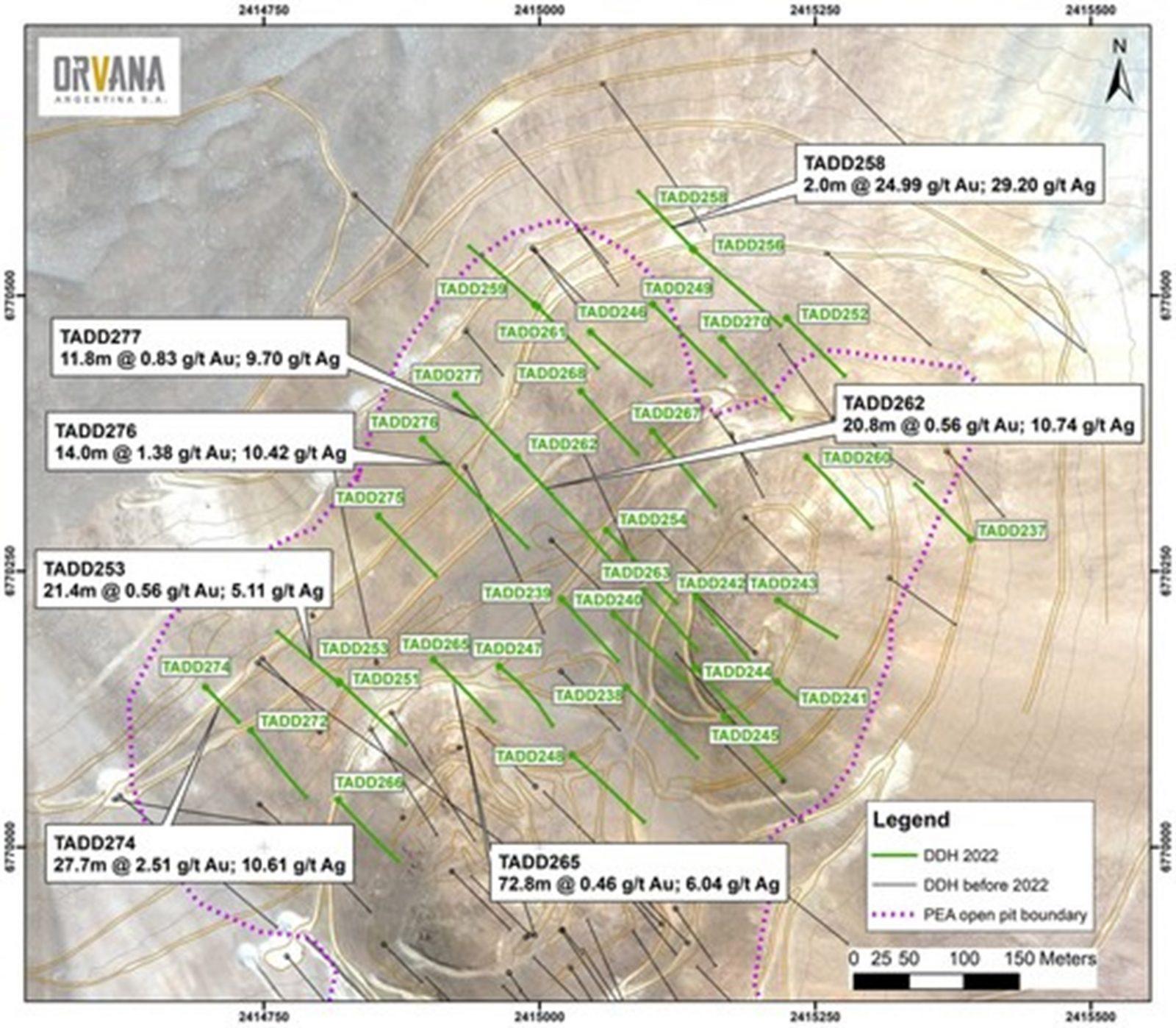

Cerros Taguas

- 34 core holes totaling 5,748.6 meters drilled.

- Targets:

- Oxides mineralization upgrade to Measured and Indicated categories.

- Resource growth with oxides extensions to the northeast and northwest.

- Resource growth in areas within the pit proposed in the Taguas 2021 PEA that were outside the block model due to lack of drilling (e.g., TADD246 and TADD249 in Figure 1).

- Table 1, below, shows promising results, identifying thicker high-grade structures than previously modeled:

- 27.7 meters @ 2.51 g/t Au and 10.61 g/t Ag

- 14.0 meters @ 1.38 g/t Au and 10.42 g/t Ag

- 72.8 meters @ 0.46 g/t Au and 6.04 g/t Ag

- Under-drilled area inside Taguas 2021 PEA open pit model is now preliminarily showing a high possibility to improve mining strip ratio.

- High grade structures like the ones intercepted in TADD258 leave open the possibility of increasing resources towards the northeast.

- Phase II (additional 11,000 meters) is expected to be completed by March 2023.

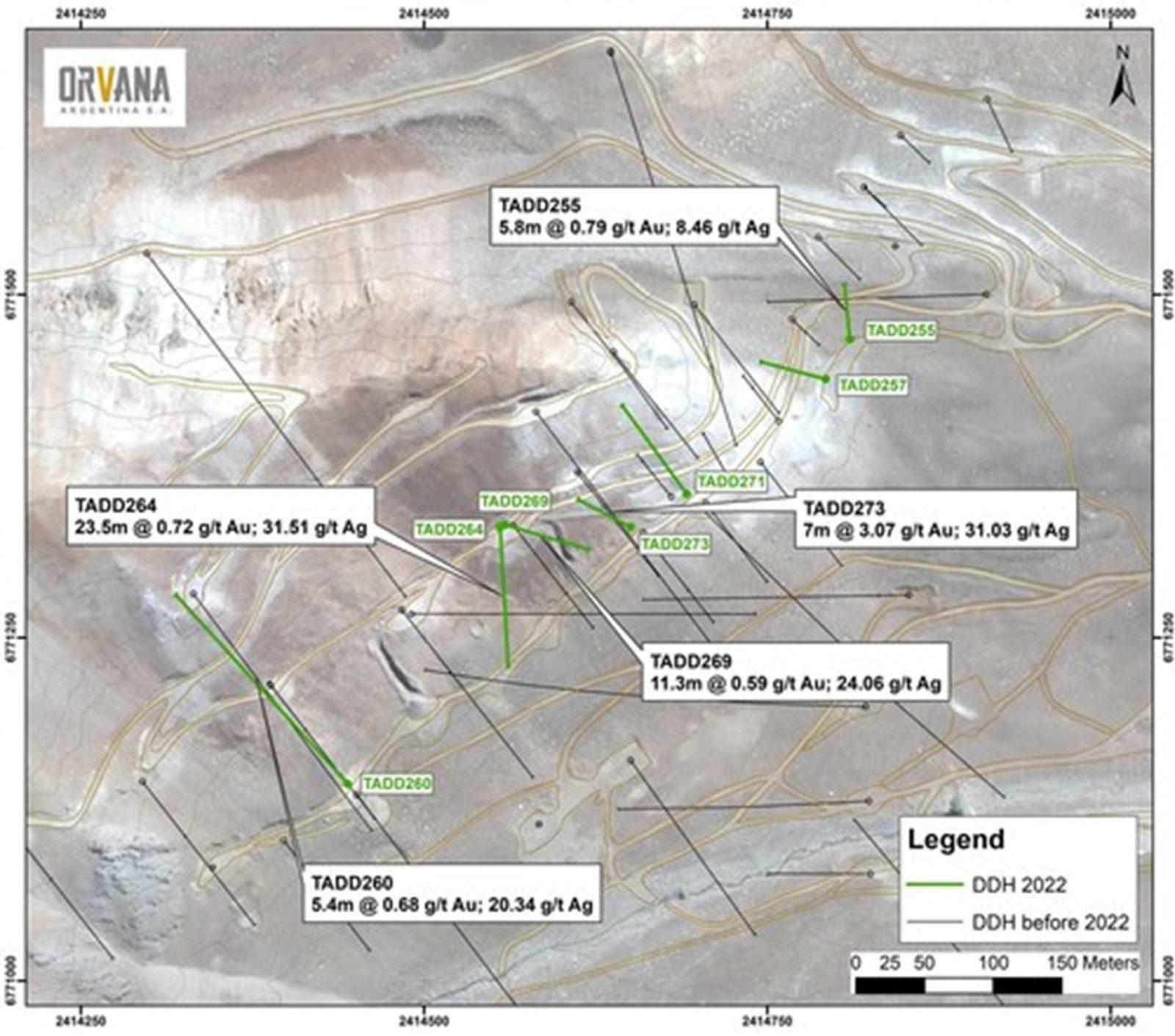

Cerro Campamento

- 7 core holes totaling 734 meters drilled.

- Focused on defining the shallower part of high gold grade oxides, which can potentially be mined by open pit.

- First interpretations show the existence of a low-grade envelope around high-grade veins. Additional drilling is necessary to continue delineating shallower parts of high gold grade veins; with the aim for open pit mining modeling.

- Best intercepts shown in Table 2. Highlights:

- 7.0 meters @ 3.07 g/t Au and 31.03 g/t Ag

- 23.5 meters @ 0.72 g/t Au and 31.51 g/t Ag

- 11.3 meters @ 0.59 g/t Au and 24.06 g/t Ag

- Phase II (additional 3,000 meters) is expected to be completed by March 2023.

Quality Assurance-Quality Control

Samples were prepared and analyzed by Alex Stewart International Argentina SA Laboratory in Mendoza. This laboratory is ISO 9001; ISO 17025, and ISO 14001 certified. Samples were prepared following the P-5 laboratory preparation code: the samples were dried, crushed to passing 10 mesh (>80%), riffle split of 1kg sample and pulverized to 106 microns (>95%). The assays included 50 g Au by fire assay (FA), AA finish and 39 element package with aqua regia dilution and ICP OES finish. Over limits for Au and Ag were run in 50 g sample by FA and gravimetric method finish. Coarse and pulp rejects were returned and are stored in the Piuquenes storage facilities.

The reported work has been completed using industry standard procedures, including a quality assurance/quality control program consisting of the insertion of quarter core field duplicates, coarse duplicates split after laboratory crushing, pulp duplicates split after laboratory pulverization, coarse analytical blank samples and 2 different CRMs inserted in batches of roughly 50 samples.

The exploration update was prepared under the supervision of Raúl Alvarez Cifuentes, a qualified person for the purposes of NI 43-101 and an employee of the company.

Table 1 – Intercepts from Cerros Taguas

The assay results from the first 12 holes (TADD237 to TADD248) were outlined in the news release dated March 31, 2022. The assay results for the subsequent 29 holes are summarized below:

| DDH | FROM | TO | Downhole length |

True width* |

Au (g/t) | Ag (g/t) | Cu (%) | Ore Type | ||||||||

| TADD249 | 18.20 | 40.30 | 22.10 | 14.37 | 0.28 | 10.77 | 0.02 | Oxide | ||||||||

| TADD249 | 111.50 | 114.20 | 2.70 | 1.76 | 0.25 | 22.15 | 0.03 | Oxide | ||||||||

| TADD250 | 59.00 | 67.00 | 8.00 | 5.20 | 0.26 | 7.12 | 0.10 | Oxide | ||||||||

| TADD250 | 157.00 | 163.00 | 6.00 | 3.90 | 1.61 | 122.43 | 0.44 | Sulfide | ||||||||

| TADD251 | 8.00 | 10.00 | 2.00 | 1.30 | 0.25 | 2.30 | <0.01 | Oxide | ||||||||

| TADD251 | 21.00 | 34.20 | 13.20 | 8.58 | 0.23 | 2.27 | 0.01 | Oxide | ||||||||

| TADD251 | 61.00 | 62.00 | 1.00 | 0.65 | 0.77 | 1.50 | <0.01 | Oxide | ||||||||

| TADD251 | 82.40 | 135.00 | 52.60 | 34.19 | 0.44 | 4.31 | <0.01 | Oxide | ||||||||

| TADD251 | 143.40 | 148.80 | 5.40 | 3.51 | 0.32 | 6.20 | 0.02 | Oxide | ||||||||

| TADD251 | 158.10 | 160.30 | 2.20 | 1.43 | 0.27 | 1.20 | 0.01 | Oxide | ||||||||

| TADD252 | 43.50 | 48.50 | 5.00 | 3.25 | 0.21 | 13.87 | <0.01 | Oxide | ||||||||

| TADD252 | 81.10 | 83.60 | 2.50 | 1.63 | 0.21 | 6.32 | 0.01 | Oxide | ||||||||

| TADD252 | 103.60 | 107.15 | 3.55 | 2.31 | 0.31 | 6.94 | <0.01 | Oxide | ||||||||

| TADD252 | 111.50 | 113.70 | 2.20 | 1.43 | 0.27 | 6.46 | <0.01 | Oxide | ||||||||

| TADD252 | 132.55 | 135.10 | 2.55 | 1.66 | 0.61 | 12.26 | <0.01 | Oxide | ||||||||

| TADD252 | 138.90 | 144.00 | 5.10 | 3.32 | 1.54 | 26.52 | 0.11 | Sulfide | ||||||||

| TADD253 | 18.00 | 20.00 | 2.00 | 1.30 | 0.24 | 7.10 | <0.01 | Oxide | ||||||||

| TADD253 | 24.95 | 57.90 | 32.95 | 21.42 | 0.56 | 5.11 | <0.01 | Oxide | ||||||||

| TADD253 | 81.45 | 101.20 | 19.75 | 12.84 | 0.23 | 6.89 | 0.03 | Oxide | ||||||||

| TADD254 | 8.00 | 24.40 | 16.40 | 10.66 | 0.30 | 11.58 | <0.01 | Oxide | ||||||||

| TADD254 | 34.20 | 37.35 | 3.15 | 2.05 | 0.35 | 5.40 | <0.01 | Oxide | ||||||||

| TADD254 | 68.90 | 75.20 | 6.30 | 4.10 | 0.29 | 7.63 | 0.04 | Oxide | ||||||||

| TADD254 | 92.20 | 128.00 | 35.80 | 23.27 | 0.39 | 3.51 | <0.01 | Oxide | ||||||||

| TADD254 | 132.60 | 134.45 | 1.85 | 1.20 | 0.68 | 12.50 | <0.01 | Oxide | ||||||||

| TADD254 | 146.40 | 149.00 | 2.60 | 1.69 | 0.67 | 29.58 | 0.66 | Sulfide | ||||||||

| TADD254 | 162.45 | 185.00 | 22.55 | 14.66 | 0.49 | 15.03 | 0.19 | Sulfide | ||||||||

| TADD256 | 2.00 | 6.00 | 4.00 | 2.60 | 0.25 | 10.05 | <0.01 | Oxide | ||||||||

| TADD256 | 42.80 | 44.50 | 1.70 | 1.11 | 1.00 | 71.10 | 0.01 | Oxide | ||||||||

| TADD258 | 77.45 | 79.30 | 1.85 | 1.20 | 0.42 | 21.40 | 0.01 | Oxide | ||||||||

| TADD258 | 121.80 | 124.80 | 3.00 | 1.95 | 24.99 | 29.20 | 0.02 | Oxide | ||||||||

| TADD259 | 0.00 | 2.80 | 2.80 | 1.82 | 0.38 | 3.20 | <0.01 | Oxide | ||||||||

| TADD259 | 47.30 | 50.30 | 3.00 | 1.95 | 0.21 | 9.59 | <0.01 | Oxide | ||||||||

| TADD259 | 54.00 | 55.20 | 1.20 | 0.78 | 0.41 | 24.30 | 0.02 | Oxide | ||||||||

| TADD259 | 61.20 | 64.60 | 3.40 | 2.21 | 0.40 | 11.74 | <0.01 | Oxide | ||||||||

| TADD259 | 106.00 | 107.80 | 1.80 | 1.17 | 0.77 | 47.80 | 0.01 | Oxide | ||||||||

| TADD261 | 12.10 | 15.70 | 3.60 | 2.34 | 0.33 | 12.70 | 0.02 | Oxide | ||||||||

| TADD261 | 51.10 | 53.10 | 2.00 | 1.30 | 0.41 | 18.55 | 0.01 | Oxide | ||||||||

| TADD261 | 56.90 | 64.30 | 7.40 | 4.81 | 0.59 | 8.51 | <0.01 | Oxide | ||||||||

| TADD262 | 0.00 | 2.00 | 2.00 | 1.30 | 0.55 | 7.90 | <0.01 | Oxide | ||||||||

| TADD262 | 38.20 | 70.20 | 32.00 | 20.80 | 0.56 | 10.74 | <0.01 | Oxide | ||||||||

| including | 40.20 | 44.20 | 4.00 | 2.60 | 2.82 | 39.90 | 0.01 | Oxide | ||||||||

| TADD262 | 78.20 | 80.20 | 2.00 | 1.30 | 0.94 | 6.20 | <0.01 | Oxide | ||||||||

| TADD262 | 86.20 | 89.00 | 2.80 | 1.82 | 0.31 | 13.00 | 0.02 | Oxide | ||||||||

| TADD262 | 98.00 | 100.00 | 2.00 | 1.30 | 0.30 | 11.50 | <0.01 | Oxide | ||||||||

| TADD262 | 125.60 | 127.60 | 2.00 | 1.30 | 0.34 | 14.00 | <0.01 | Oxide | ||||||||

| TADD262 | 183.20 | 184.70 | 1.50 | 0.98 | 2.49 | 35.00 | 0.04 | Oxide | ||||||||

| TADD262 | 230.50 | 233.00 | 2.50 | 1.63 | 0.41 | 5.24 | 0.01 | Oxide | ||||||||

| TADD262 | 244.00 | 251.10 | 7.10 | 4.62 | 0.22 | 6.31 | 0.01 | Oxide | ||||||||

| TADD262 | 258.00 | 262.00 | 4.00 | 2.60 | 0.46 | 8.40 | <0.01 | Oxide | ||||||||

| TADD263 | 20.40 | 24.10 | 3.70 | 2.41 | 0.23 | 13.82 | <0.01 | Oxide | ||||||||

| TADD263 | 28.10 | 36.00 | 7.90 | 5.14 | 0.25 | 9.60 | 0.01 | Oxide | ||||||||

| TADD263 | 55.10 | 78.90 | 23.80 | 15.47 | 0.32 | 5.12 | 0.06 | Oxide | ||||||||

| TADD263 | 89.00 | 120.00 | 31.00 | 20.15 | 0.23 | 5.47 | 0.12 | Sulfide | ||||||||

| TADD263 | 126.00 | 132.00 | 6.00 | 3.90 | 0.18 | 10.30 | 0.32 | Sulfide | ||||||||

| TADD265 | 14.00 | 23.00 | 9.00 | 5.85 | 0.21 | 6.07 | 174.00 | Oxide | ||||||||

| TADD265 | 41.00 | 153.00 | 112.00 | 72.80 | 0.46 | 6.04 | <0.01 | Oxide | ||||||||

| Including | 149.80 | 151.80 | 2.00 | 1.30 | 11.75 | 70.30 | 0.04 | Oxide | ||||||||

| TADD266 | 0.00 | 60.90 | 60.90 | 39.59 | 0.37 | 9.27 | <0.01 | Oxide | ||||||||

| TADD266 | 66.80 | 143.60 | 76.80 | 49.92 | 0.30 | 15.03 | 0.03 | Oxide | ||||||||

| TADD267 | 141.00 | 145.00 | 4.00 | 2.60 | 0.32 | 5.50 | 0.01 | Oxide | ||||||||

| TADD267 | 166.30 | 169.00 | 2.70 | 1.76 | 2.59 | 51.93 | 1.18 | Sulfide | ||||||||

| TADD268 | 24.00 | 30.00 | 6.00 | 3.90 | 0.28 | 12.73 | 36.00 | Oxide | ||||||||

| TADD268 | 37.40 | 43.00 | 5.60 | 3.64 | 0.39 | 3.81 | <0.01 | Oxide | ||||||||

| TADD268 | 53.00 | 55.00 | 2.00 | 1.30 | 0.26 | 10.10 | <0.01 | Oxide | ||||||||

| TADD268 | 59.40 | 60.20 | 0.80 | 0.52 | 5.03 | 57.30 | <0.01 | Oxide | ||||||||

| TADD268 | 64.00 | 66.60 | 2.60 | 1.69 | 0.28 | 14.17 | <0.01 | Oxide | ||||||||

| TADD268 | 99.60 | 101.00 | 1.40 | 0.91 | 0.26 | 5.40 | 0.02 | Oxide | ||||||||

| TADD270 | 85.00 | 88.50 | 3.50 | 2.28 | 0.24 | 9.63 | <0.01 | Oxide | ||||||||

| TADD270 | 97.00 | 99.00 | 2.00 | 1.30 | 0.89 | 6.00 | <0.01 | Oxide | ||||||||

| TADD270 | 124.00 | 126.00 | 2.00 | 1.30 | 0.36 | 12.40 | 0.02 | Oxide | ||||||||

| TADD270 | 136.00 | 143.50 | 7.50 | 4.88 | 0.39 | 13.43 | <0.01 | Oxide | ||||||||

| TADD270 | 182.50 | 188.20 | 5.70 | 3.71 | 0.80 | 27.58 | 0.24 | Sulfide | ||||||||

| TADD272 | 22.00 | 36.00 | 14.00 | 9.10 | 0.24 | 1.90 | <0.01 | Oxide | ||||||||

| TADD272 | 50.30 | 58.90 | 8.60 | 5.59 | 0.30 | 3.15 | <0.01 | Oxide | ||||||||

| TADD272 | 60.90 | 62.90 | 2.00 | 1.30 | 0.17 | 2.00 | <0.01 | Oxide | ||||||||

| TADD272 | 66.90 | 75.50 | 8.60 | 5.59 | 0.39 | 2.93 | <0.01 | Oxide | ||||||||

| TADD272 | 82.00 | 84.50 | 2.50 | 1.63 | 0.44 | 10.50 | 0.03 | Oxide | ||||||||

| TADD274 | 35.40 | 37.00 | 1.60 | 1.04 | 17.45 | 387.00 | 1.28 | Sulfide | ||||||||

| TADD274 | 44.00 | 86.60 | 42.60 | 27.69 | 2.51 | 10.61 | 0.01 | Oxide | ||||||||

| TADD275 | 9.00 | 21.00 | 12.00 | 7.80 | 0.39 | 5.84 | 0.01 | Oxide | ||||||||

| TADD275 | 23.80 | 25.90 | 2.10 | 1.37 | 0.21 | 2.13 | <0.01 | Oxide | ||||||||

| TADD275 | 65.00 | 80.80 | 15.80 | 10.27 | 0.29 | 6.15 | 0.02 | Oxide | ||||||||

| TADD275 | 123.00 | 131.00 | 8.00 | 5.20 | 0.77 | 19.73 | <0.01 | Oxide | ||||||||

| TADD276 | 40.00 | 42.00 | 2.00 | 1.30 | 0.68 | 15.70 | <0.01 | Oxide | ||||||||

| TADD276 | 49.80 | 71.40 | 21.60 | 14.04 | 1.38 | 10.42 | <0.01 | Oxide | ||||||||

| TADD276 | 79.15 | 81.30 | 2.15 | 1.40 | 0.16 | 8.75 | 0.01 | Oxide | ||||||||

| TADD276 | 84.80 | 90.00 | 5.20 | 3.38 | 0.27 | 14.14 | <0.01 | Oxide | ||||||||

| TADD276 | 98.45 | 100.65 | 2.20 | 1.43 | 0.31 | 12.45 | 0.01 | Oxide | ||||||||

| TADD276 | 146.60 | 148.60 | 2.00 | 1.30 | 0.42 | 1.90 | <0.01 | Oxide | ||||||||

| TADD276 | 178.35 | 181.40 | 3.05 | 1.98 | 0.52 | 29.39 | <0.01 | Oxide | ||||||||

| TADD276 | 268.65 | 269.65 | 1.00 | 0.65 | 2.00 | 6.80 | 0.02 | Oxide | ||||||||

| TADD277 | 33.80 | 51.90 | 18.10 | 11.77 | 0.83 | 9.70 | 0.01 | Oxide | ||||||||

| TADD277 | 84.70 | 87.40 | 2.70 | 1.76 | 0.31 | 4.40 | <0.01 | Oxide | ||||||||

| TADD277 | 90.90 | 95.70 | 4.80 | 3.12 | 0.34 | 5.74 | 0.01 | Oxide | ||||||||

| *True width is averaged to 65% of the down-hole intercept, although ranges from 60-70% subject to intersection with sub-vertical veins and drilling dip. | ||||||||||||||||

Table 2 – Intercepts from Cerro Campamento

The table shows the most significant results:

| DDH | FROM | TO | Downhole length |

True width* |

Au (g/t) | Ag (g/t) | Cu (%) | Ore Type | ||||||||

| TADD255 | 44.00 | 61.30 | 17.30 | 5.76 | 0.79 | 8.46 | 0.02 | Oxide | ||||||||

| including | 55.85 | 61.30 | 5.45 | 1.81 | 1.74 | 21.61 | 0.04 | Oxide | ||||||||

| TADD255 | 65.85 | 68.20 | 2.35 | 0.78 | 0.27 | 2.78 | <0.01 | Oxide | ||||||||

| TADD257 | 41.00 | 43.60 | 2.60 | 0.87 | 0.22 | 3.90 | 0.01 | Oxide | ||||||||

| TADD257 | 61.70 | 71.00 | 9.30 | 3.10 | 0.98 | 6.73 | 0.07 | Sulfide | ||||||||

| TADD260 | 0.00 | 3.00 | 3.00 | 1.67 | 0.32 | 11.15 | <0.01 | Oxide | ||||||||

| TADD260 | 19.00 | 21.00 | 2.00 | 1.11 | 0.24 | 4.80 | <0.01 | Oxide | ||||||||

| TADD260 | 44.60 | 48.00 | 3.40 | 1.89 | 0.37 | 2.15 | <0.01 | Oxide | ||||||||

| TADD260 | 110.00 | 119.80 | 9.80 | 5.44 | 0.68 | 20.34 | 0.02 | Oxide | ||||||||

| TADD260 | 138.00 | 141.70 | 3.70 | 2.05 | 0.34 | 38.94 | 0.02 | Oxide | ||||||||

| TADD260 | 169.00 | 181.50 | 12.50 | 6.94 | 0.54 | 12.69 | 0.03 | Oxide | ||||||||

| TADD264 | 84.00 | 107.45 | 23.45 | 23.45 | 0.72 | 31.51 | 0.03 | Oxide | ||||||||

| TADD264 | 131.25 | 147.35 | 16.10 | 16.10 | 0.76 | 9.68 | 0.03 | Oxide | ||||||||

| TADD264 | 161.00 | 163.15 | 2.15 | 2.15 | 0.32 | 16.15 | 0.39 | Sulfide | ||||||||

| TADD269 | 62.50 | 76.05 | 13.55 | 11.29 | 0.59 | 24.06 | 0.01 | Oxide | ||||||||

| Including | 66.30 | 66.90 | 0.60 | 0.50 | 8.96 | 389.00 | 0.09 | Oxide | ||||||||

| TADD271 | 13.40 | 16.20 | 2.80 | 1.55 | 0.39 | 5.50 | <0.01 | Oxide | ||||||||

| TADD271 | 29.90 | 33.25 | 3.35 | 1.86 | 1.57 | 9.33 | 0.01 | Oxide | ||||||||

| TADD271 | 57.00 | 59.70 | 2.70 | 1.50 | 0.36 | 18.28 | 0.05 | Sulfide | ||||||||

| TADD271 | 71.60 | 73.60 | 2.00 | 1.11 | 0.37 | 7.90 | 0.11 | Sulfide | ||||||||

| TADD271 | 79.00 | 83.50 | 4.50 | 2.50 | 0.33 | 37.31 | 0.22 | Sulfide | ||||||||

| TADD273 | 0.00 | 2.70 | 2.70 | 1.35 | 0.53 | 4.87 | <0.01 | Oxide | ||||||||

| TADD273 | 13.60 | 27.60 | 14.00 | 7.00 | 3.07 | 31.03 | 0.01 | Oxide | ||||||||

| Including | 15.60 | 23.60 | 8.00 | 4.00 | 5.19 | 45.12 | 0.02 | Oxide | ||||||||

| *True width varies between 33 and 100% of the down-hole intercept, subject to intersection with sub-vertical veins and drilling dip. | ||||||||||||||||

ABOUT ORVANA

Orvana is a multi-mine gold-copper-silver company. Orvana’s assets consist of the producing El Valle and Carlés gold-copper-silver mines in northern Spain, the Don Mario gold-silver property in Bolivia, currently in care and maintenance, and the Taguas property located in Argentina.

Figure 1. Summary Map of 2022 Drilling Campaign in Cerros Taguas, with selected intercepts (CNW Group/Orvana Minerals Corp.)

Figure 2. Summary Map of 2022 Drilling Campaign in Cerro Campamento, with selected intercepts (CNW Group/Orvana Minerals Corp.)

MORE or "UNCATEGORIZED"

Eloro Resources Announces Closing of Bought Deal LIFE Private Placement for Gross Proceeds of C$17 Million

Eloro Resources Ltd. (TSX: ELO) (FSE: P2QM) is pleased to announce the closing of its previously an... READ MORE

Minera Alamos Updates Resources and Reserves for the Pan Gold Mine in Nevada

Minera Alamos Inc. (TSX-V: MAI) (OTCQX: MAIFF) is pleased to announce updated Mineral Resource and M... READ MORE

Ero Copper Reports Fourth Quarter and Full Year 2025 Operating and Financial Results

Ero Copper Corp. (TSX: ERO) (NYSE: ERO) is pleased to announce its operating and financial results f... READ MORE

Rare Element Resources Announces Results of Oversubscribed Rights Offering of Common Shares

Rare Element Resources Ltd. (OTCQB: REEMF) is pleased to report that its previously announced... READ MORE

TRX Gold Reports Record Q2 2026 Production and Company Update

TRX Gold Corporation (TSX: TRX) (NYSE American: TRX) is pleased to announce preliminary resu... READ MORE