ORENINC INDEX up as deals increase again

ORENINC INDEX – Monday, November 30th 2020

North America’s leading junior mining finance data provider

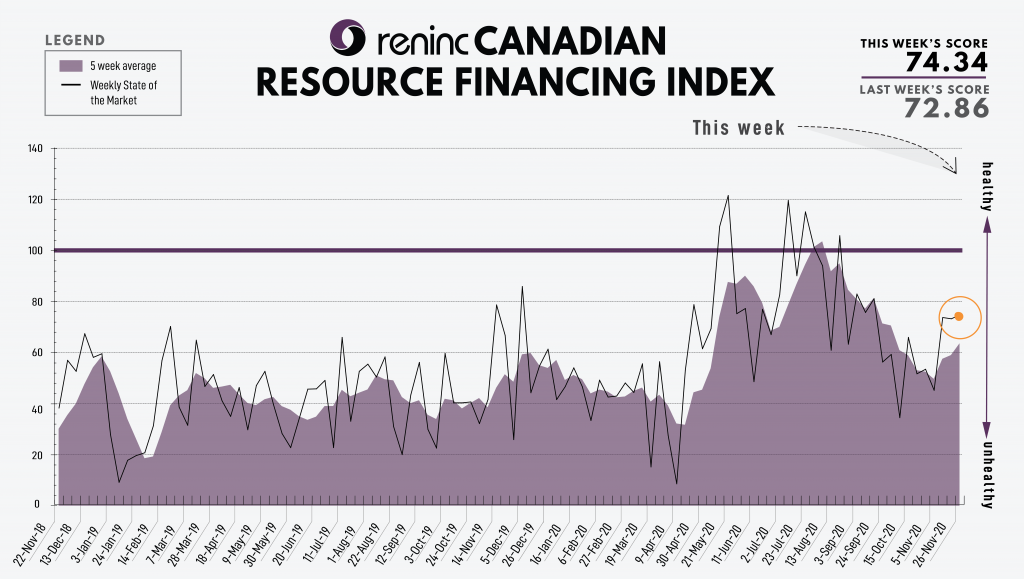

Last Week: 72.86

This week: 74.34

The Oreninc Index increased in the week ending November 27th, 2020 to 74.34 from 72.86 a week ago as the number of deals again increased.

The past week saw the annual Thanksgiving holiday in the US, a moment of reflection for many in what has been a challenging year.

The COVID-19 virus global death toll is approaching 1.5 million with almost 62 million cases reported worldwide. However, vaccine news continued to buoy stock markets at the expense of precious metals, which fell for a third consecutive week.

US president Donald Trump is slowly realising he lost the November election while president elect Joe Biden has been naming people to key posts of his administration, which takes office in January. The big question is whether or not there will be another round of fiscal stimulus before year end to cushion the economic impacts of the COVID-19 pandemic. And with the number of infections increasing again, whether or not there will be new restrictions which could restrict the economy.

On to the money: the aggregate financings announced increased to $187.8 million, a 14-week high, which included ten brokered financings for $50.5 million, a three-week low, and no bought deal financings. The average offer size increased to $4.6 million, a two-week high, while the number of financings increased to 41.

Gold took another hammering as it lost almost $100/oz as it closed down at $1,787/oz from $1,870/oz a week ago. The yellow metal is up 17.83 so far this year. The US dollar index softened as it closed down at 91.79 from 92.39 a week ago. The VanEck managed GDXJ closed down at $49.61 from $51.89 a week ago. The index is now up 17.39% so far this year. The HUI Arca Gold BUGS Index also closed down at 281.22 from 297.25 last week. The SPDR GLD ETF inventory closed the week down at 1,194.78 tonnes, or 38.41 million ounces, from 1,220.17 tonnestonnes last week.

In other commodities, Silver also fell as it closed the week down at $22.57/oz from $24.18/oz a week ago. Copper continued to strengthen as it closed up at $3.41/lb from $3.31/lb a week ago. Oil strengthened as WTI closed up at $45.53 a barrel from $42.42 a barrel a week ago.

The Dow Jones Industrial Average it closed up at 29,910 from 29,263 a week ago. Canada’s S&P/TSX Composite Index closed up at 17,396 from 17,019 the previous week. The S&P/TSX Venture Composite Index closed up at 749.20 from 740.45 a week ago.

Summary

- Number of financings increased to 41.

- Ten brokered financings were announced this week for $50.5 million, a three-week low.

- No bought-deal financings were announced this week.

- Total dollars increased to $187.8 million, a 14-week high.

- Average offer increased to $4.6 million, a two-week high.

Financing Highlights

Caldas Gold (TSX-V:CGC) commenced a private placement financing to raise $85 million.

- 8 million subscription receipts @ $2.25. Each subscription receipt will be automatically converted into one unit comprising one share and one warrant with each warrant exercisable @ $2.75 until July 2025.

- Group of investors principally referred by Aris Gold which will result in changes to the management and board, as well as a change in its name to Aris Gold. Once the financing is completed, majority owner Gran Colombia Gold (TSX:GCM) is expected to become a 45% shareholder.

- Arias will be led by a board with new nominees, including Ian Telfer as chair, David Garofalo, Peter Marrone, Attie Roux, Daniela Cambone and Neil Woodyer. GCMs nominees will be Serafino Iacono and Hernan Martinez. In addition, Frank Giustra will be a strategic advisor. The management team will be led by Neil Woodyer, as CEO.

- Following completion of the Aris transaction, the Marmato Deeps Zone expansion project in Caldas, Colombia will be fully-financed ahead of construction start, which is expected in 2H21.

Major Financing Openings

- Caldas Gold (TSX-V:CGC) opened a $85 million offering on a best efforts The deal is expected to close on or about November 27th.

- Trevali Mining (TSX:TV) opened a $30 million offering underwritten by a syndicate led by RBC Capital Markets on a best efforts The deal is expected to close on or about February 12th.

- Bonterra Resources (TSX-V:BTR) opened a $10 million offering on a best efforts The deal is expected to close on or about November 30th.

- Eskay Mining (TSX-V:ESK) opened a $10 million offering underwritten by a syndicate led by Echelon Wealth Partners on a best efforts Each unit includes half a warrant that expires in two years.

Major Financing Closings

- Kanadario Gold (TSX-V:ANA) closed a $6 million offering underwritten by a syndicate led by Sprott Capital Partners on a best efforts basis. Each unit included a warrant that expires in 18 months.

- Western Copper and Gold (TSX-V:WRN) closed a $75 million offering underwritten by a syndicate led by Cormark Securities on a best efforts basis.

- Copper Mountain Mining (TSX:CUM) closed a $25 million offering underwritten by a syndicate led by Industrial Alliance Securities on a bought deal basis.

- Nova Royalty (TSX-V:NOVR) closed a $42 million offering underwritten by a syndicate led by PI Financial on a best efforts basis.

MORE or "UNCATEGORIZED"

Koryx Copper Intersects 338.61 Meters At 0.38% Cu Eq Including 230.61 Meters At 0.45% Cu Eq and Multiple 2 Meters Intersections Over 1.00% Cu Eq

Significant copper and molybdenum intersections include: HM09: 13... READ MORE

Aya Gold & Silver Reports Q1-2024 Results; Maintains Guidance; Zgounder Expansion on Track

Aya Gold & Silver Inc. (TSX: AYA) (OTCQX: AYASF) is pleased t... READ MORE

Silver Mountain Delivers Positive Preliminary Economic Assessment For Its Reliquias Project, Peru; Pre-Tax NPV 5% Of C$107 million, Pre-Tax IRR Of 57%, And Payback Of 1.8 Years

Key Highlights – Preliminary Economic Assessment Pre-Tax Net Pr... READ MORE

ARIS MINING REPORTS Q1 2024 RESULTS WITH SEGOVIA GENERATING $13.8 MILLION IN OPERATING CASH FLOW

Aris Mining Corporation (TSX: ARIS) (NYSE-A: ARMN) announces its ... READ MORE

Orla Mining Reports First Quarter 2024 Results

Orla Mining Ltd. (TSX: OLA) (NYSE: ORLA) announces the results fo... READ MORE