ORENINC INDEX slides as financings fizzle

ORENINC INDEX – Monday, September 30th 2019

North America’s leading junior mining finance data provider

Free newsletter sign-up at www.oreninc.com/subscribe

Silver Spruce Resources (TSX-V:SSE) signed a binding letter of intent to acquire the Melchett Lake Zn-Au-Ag VMS in Thunder Bay, Ontario, Canada.

Aura Resources (TSX-V:AUU) announced results from a district-wide surface rock sampling program at its Jefferson Canyon project in Nye county, Nevada, USA.

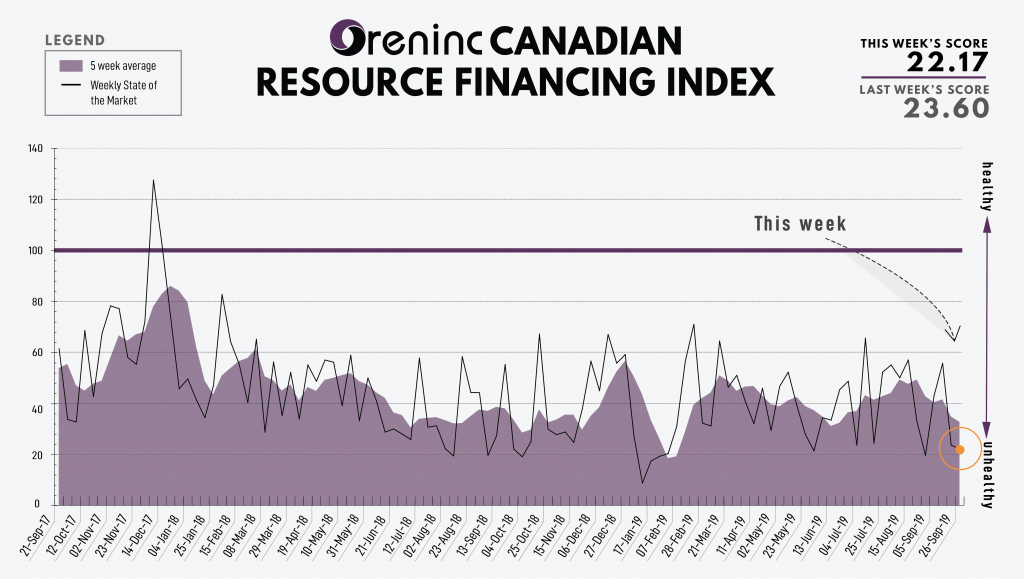

Last Week: 23.60

This week: 22.17

The Oreninc Index halved in the week ending September 27th, 2019 to 23.60 from an updated 55.75 as bought deals and brokered deals disappeared.

Gold wavered on profit-taking and a strengthening US dollar as financing activity slowed to a crawl.

On the trade front, while the US and China are due to sit down to talks in October, the US imposed penalties against some Chinese tanker firms for carrying Iranian crude after sanctions waivers lapsed in May. This development came after China granted companies waivers to buy between 2 and 3 million tons of US soybeans without being subject to retaliatory tariffs.

The Democrats are again looking at the possibility of impeaching US president Donald Trump, this time for a July call he made to Ukraine’s leader Volodymr Zelensky to allegedly seek information to discredit Democrat presidential candidate Joe Biden.

In the UK, the Supreme Court unanimously ruled that the decision by prime minister Boris Johnson to suspend Parliament until mid-October was unlawful.

On to the money: total fund raises announced fell to $32.1 million, a four-week low, which included no brokered financings and no bought-deal financings. The average offer size decreased to $1.7 million, a four-week low, while the number of financings increased to 19.

Volatility in gold continues to be the norm with the yellow metal crashing below the US$1,500/oz mark in the spot market after hitting a mid-week high of $1,531/oz to close down at $1,497/oz from $1,516/oz a week ago. The yellow metal is up 16.73% so far this year. The US dollar index continued to strengthen as it closed up at 99.10 from 98.51 last week. The VanEck managed GDXJ sold off as it closed down at US$37.60 from $39.24 a week ago. The index is now up 24.42% so far in 2019. The US Global Go Gold ETF closed down at US$15.84 from $16.37 a week ago. It is up 38.87% so far in 2019. The HUI Arca Gold BUGS Index closed down at 210.60 from 218.23 last week. The SPDR GLD ETF saw its inventory blast through the 900-tonne level, hitting a mid-week high of 924.94 tonnes before closing the week up at 922.88 tonnes from 894.15 a week ago.

In other commodities, silver closed down at US$17.65/oz from $17.99/oz a week ago. Copper continued to lose ground as it closed down at US$2.59/lb from $2.60/lb a week ago. Oil’s momentum faltered as WTI closed down at US$55.91 a barrel from $58.09 a barrel a week ago.

The Dow Jones Industrial Average it closed down at 26,820 from 26,935 a week ago. Canada’s S&P/TSX Composite Index also closed down at 16,694 from 16,899 the previous week. The S&P/TSX Venture Composite Index closed down as well at 569.58 from 590.45 last week.

Summary

- Number of financings increased to 19.

- No brokered financings announced, a four-week low.

- No bought-deal financings were announced this week, a four-week low.

- Total dollars diminished to $32.1m, a four-week low.

- Average offer lowered to $1.7m, a four-week low.

Financing Highlights

Rubicon Minerals (TSX:RMX) opened a fully-marketed private placement to raise up to $12 million.

- Offering @ $1.00 per share.

- Consortium led by Cormark Securities and including Canaccord Genuity, Mackie Research Capital, BMO Capital Markets, Industrial Alliance Securities, Laurentian Bank Securities, Legacy Hill Capital and TD Securities.

- Proceeds will be used for exploration and development expenditures at the Phoenix gold project in Ontario, Canada.

Major Financing Openings

- Rubicon Minerals (TSX:RMX) opened a $12.0 million offering on a best efforts

- Troilus Gold (TSX-V:TLG) opened a $5.0 million offering on a best efforts The deal is expected to close on or about October 7th.

- Mawson Resources (TSX:MAW) opened a $5.0 million offering on a best efforts Each unit includes half a warrant that expires in two years.

- Metallis Resources (TSX-V:MTS) opened a $2.0 million offering on a best efforts

Major Financing Closings

- Coro Mining (TSX:COP) closed a $16.77 million offering on a bought deal basis.

- O3 Mining (TSX-V:OIII) closed a $10.08 million offering on a bought deal

- Aurania Resources (TSX-V:ARU) closed a $4.46 million offering on a best efforts Each unit included half a warrant that expires in 18 months.

- Silver Viper Minerals (TSX-V:VIPR) closed a $4.0 million offering on a best efforts Each unit included half a warrant that expires in two years.

Company News

Aura Resources (TSX-V:AUU) announced results from a district-wide surface rock sampling program at its Jefferson Canyon project in Nye county, Nevada, USA.

- Jefferson Canyon consists of 57 unpatented claims and comprises a volcanic-hosted epithermal Au-Ag system similar in style and age to the nearby Round Mountain deposit.

- Gold and silver values from the 47 rock samples collected in 2019 support the aerial expansion of the B zone several hundred metres to the north. Gold and silver mineralization was identified in a broad area in the northwest part of the project measuring several hundred metres across.

Analysis

The identification of strongly anomalous gold and silver values is positive. When combined with historical reverse circulation drill data, they will help define new targets for drilling in 2020.

Silver Spruce Resources (TSX-V:SSE) signed a binding letter of intent to acquire the Melchett Lake Zn-Au-Ag VMS in Thunder Bay, Ontario, Canada.

- The principal terms include C$150,000 in cash payments and $250,000 in Silver Spruce shares, payable on signing and annual payments spread over three years.

- Minimum work expenditures total $1.0 million, with $100,000 during the first year, $200,000 in the second year and $700,000 prior to the third anniversary.

- The vendors will retain a 2% NSR of which 1% can be purchased $1.0 million and the remaining 1% at market price.

Analysis

Melchett Lake has a multi-kilometre strike length of known areas of mineralization and the presence of high-grade values of precious metals and base metals and represents a strong exploration opportunity.

MORE or "UNCATEGORIZED"

Minera’s Copper Subsidiary Acquires Suaqui Verde Copper Project in Sonora, Mexico

Minera Alamos Inc. (TSX-V:MAI) is pleased to announce the executi... READ MORE

SILVERCORP TO ACQUIRE ADVENTUS, CREATING A GEOGRAPHICALLY DIVERSIFIED MINING COMPANY BY ADDING THE ADVANCED EL DOMO PROJECT

Silvercorp Metals Inc. (TSX: SVM) (NYSE American: SVM) and Advent... READ MORE

Vortex Metals Announces Closing of Upsized Private Placement

Vortex Metals Inc. (TSXV: VMS) (FSE: DM8) (OTCQB: VMSSF) is plea... READ MORE

Gatos Silver Reports South-East Deeps Drilling Results at Cerro Los Gatos and Announces Executive Appointment

Gatos Silver, Inc. (NYSE:GATO) (TSX: GATO) provided an update on ... READ MORE

Eldorado Gold Reports First Quarter 2024 Financial and Operational Results; Steady Start to 2024

Eldorado Gold Corporation (TSX: ELD) (NYSE: EGO) reports the Comp... READ MORE