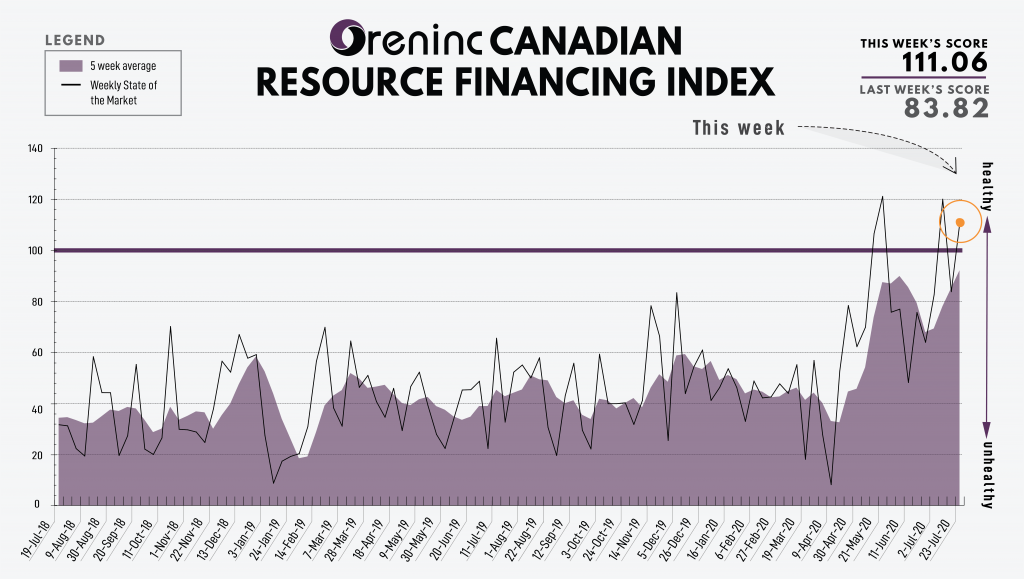

ORENINC INDEX over 100 again as brokered deals strong

ORENINC INDEX – Monday, July 27th 2020

North America’s leading junior mining finance data provider

Subscribe for our weekly updates at oreninc.com/subscribe

Last Week: 83.82 (Updated)

This week: 111.06

Another exceptional week for Canadian junior mining financings as the Oreninc Index increased in the week ending July 24th, 2020 to 111.06 from an updated 83.82 a week ago as eleven brokered deals were announced.

The COVID-19 virus global death toll has reached 634,000 and 15.6 million cases reported worldwide. The disease is hitting its stride in the Americas with cases in Brazil surging and Texas reporting its largest daily death.

The gold spot price broke US$1,900/oz on Friday, its highest level since September 2011, the last time it reached this mark, as geopolitics increasingly weigh-in on the global economic situation caused by the COVID-19 pandemic. For its part, silver passed $20/oz for the first time since 2016 in a good week for precious metals. Silver topped $23/oz, marking an increase of more than 94% from its bottom under $12/oz in March.

The deterioration in US-China relations has reached the level of consulate closures with China ordering the US to shutter its consulate in Chengdu following the US ordering China to shutter its Houston consulate, accusing China of stealing intellectual property. China is especially aggrieved by what it deems Western interference in its region of influence including a critical reception of the implementation of a new security law in Hong Kong, and the US, Australia and UK sending warships to the disputed South China Sea on freedom of navigation missions.

In the US, gold shrugged off positive new home sales figures which increased 13.8% in June according to Commerce Department figures compared to a 4% expectation. New home sales were at a seasonally adjusted annualized rate of 776,000 homes while May’s figures were revised upwards to 682,000.

European Union leaders agreed a €750 billion coronavirus pandemic recovery fund following a long-weekend of debate at its longest summit in nearly two decades. Under the deal, the EU will jointly borrow debt to be disbursed through grants and low interest loans. All expenditure must be consistent with the greenhouse gas targets of the Paris Agreement. Europe’s economy is also starting to recover from the COVID-19 slump with purchasing managers indices showing expansion in services and manufacturing.

People are buying homes, but they also continue to lose their jobs. Initial weekly jobless claims rose 109,000 to 1.4 million this past week, according to Labor Department data, more than the 1.3 million forecast by economists, with the four-week moving average falling to 1.36 million. Continuing jobless claims fell by 1 million to 16.2 million while the four-week moving average fell to 17.5 million.

On to the money: aggregates financings announced jumped $100 million to $258.8million, a 137-week high, which included eleven brokered financings for $125.72 million, a two-week high, and six bought deal financings for $73 million, a two-week high. The average offer size increased to $4.17 million, a nine-week high, while the number of financings increased to 62.

The Gold spot price leapt past $1,900/oz as it closed up at $19,02/oz from $1,810/oz a week ago. The yellow metal is up 25.36% so far this year. The US dollar index continued its losing streak as it closed down at 94.43 from 95.94 last week. The VanEck managed GDXJ continues on a tear as it closed up at $59.16 from $54.83 a week ago. The index is now up 39.99% so far this year. The US Global Go Gold ETF also closed up at $24.61 from $22.90 a week ago. It is up 40.15% so far this year. The HUI Arca Gold BUGS Index closed up at 341.60 from 317.89 from 311.54 last week. The SPDR GLD ETF inventory continued to increase, closing the week up at 1,228.81 tonnes or 39.5 million ounces from 1,206.89 tonnes last week.

In other commodities, Silver continued on a tear as the spot price burst through $23/oz before pulling back to close the week up at $22.77/oz from $19.33/of a week ago. Copper rose to its highest price since April 2019, peaking at $2.95/lb before pulling back to close the week up a cent at as it closed down a cent at $2.89/lb from $2.90/lb a week ago. Oil was flat as WTI closed up $41.34 a barrel from $40.59 a barrel a week ago.

The Dow Jones Industrial Average closed down at 26,469 from 26,671 a week ago. Canada’s S&P/TSX Composite Index closed down at 15,997 from 16,123 the previous week. The S&P/TSX Venture Composite Index increased to 691.41 from 674.95 last week.

Summary

- Number of financings increased to 62.

- Eleven brokered financings were announced this week for $125.72 million, a two-week high.

- Six bought-deal financings were announced this week for $73 million, a two-week high.

- Total dollars increased to $258.8 million, a 137-week high.

- Average offer increased to $4.17 million, a nine-week high.

Financing Highlights

Amarillo Gold (TSX-V:AGC) entered into a $35.7 million underwritten private placement and a $21.5 million bought deal for $57.2 million.

- Proceeds will be used to build the Posse gold mine at its Mara Rosa project in Goais, Brazil and advance the Lavras do Sul exploration project.

- Mackie Research Capital as sole underwriter and bookrunner to purchase 119 million shares @ $0.30 under a private placement for proceeds of $35.7 million. Eric Sprott and Baccarat Trade Investments committed to and subscribed for the whole private placement.

- Mackie is also lead underwriter and sole bookrunner for a bought deal of 71.7 million shares on the same terms for proceeds of $21.5 million.

Major Financing Openings

- Amarillo Gold (TSX-V:AGC) opened a $57.2 million offering underwritten by a syndicate led by Mackie Research Capital on a best efforts basis. The deal is expected to close on or about August 13th.

- Lion One Metals (TSX-V:LIO) opened a $20 million offering underwritten by a syndicate led by Haywood Securities on a bought deal basis. Each unit includes half a warrant that expires in a year. The deal is expected to close on or about August 11th.

- Erdene Resource Development (TSX:ERD) opened a $20 million offering on a best efforts basis.

- West Vault Mining (TSX-V:WVM) opened a $15.7 million offering underwritten by a syndicate led by Haywood Securities on a best efforts basis.

Major Financing Closings

- Rupert Resources (TSX-V:RUP) closed a $25.6 million offering on a best efforts basis.

- Miramont Resources (CSE:MONT) closed a $12.34 million offering underwritten by a syndicate led by Cormark Securities on a best efforts basis.

- Fosterville South Exploration (TSX-V:FSX) closed a $7.85 million offering underwritten by a syndicate led by Clarus Securities on a best efforts basis. Each unit included half a warrant that expires in two years.

- Norsemont Mining (CSE:NOM) closed a $5.5 million offering on a best efforts basis.

MORE or "UNCATEGORIZED"

NEW GOLD COMPLETES US$173 MILLION BOUGHT DEAL FINANCING

New Gold Inc. (TSX: NGD) (NYSE American: NGD) is pleased to annou... READ MORE

SILVER VIPER CLOSES LIFE OFFERING

Silver Viper Minerals Corp. (TSX-V: VIPR) (OTC: VIPRF) announces... READ MORE

MAX Power Closes $1.9 Million Private Placement

MAX Power Mining Corp. (CSE: MAXX) (OTC: MAXXF) (FRANKFURT: 89N) ... READ MORE

McEwen Copper Announces Completion of the Feasibility Drilling Program

70,000 meters completed, highlights include: 349.0 m of 0.77... READ MORE

Rupert Resources Reports Results From Project Drilling Including 120m at 6.2g/t Gold

Rupert Resources Ltd. (TSX:RUP) reports assay results from projec... READ MORE