ORENINC INDEX down as metals continue to show weakness

ORENINC INDEX – Monday, June 28th, 2021

North America’s leading junior mining finance data provider

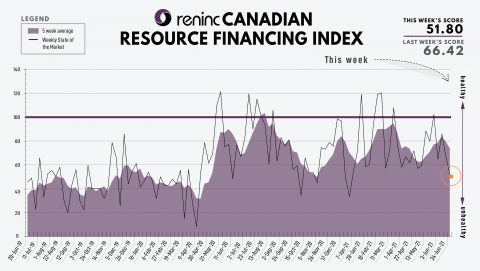

Last Week: 66.42

This week: 51.80

The Oreninc Index decreased in the trading week ending June 28th, 2021 to 51.80 from 66.42 a week ago as metals continue to show weakness across the board.

On to the money: the aggregate financings announced decreased to $97 million, a 7-week low, with 3 new brokered financings and 3 new bought-deal financing announced. The average offer size increased to $4 million, a 2-week high, and the number of financings decreased to 24.

Gold closed the week higher at $1,777/oz from $1,769/oz a week ago. The US dollar index closed lower at 91.85 from 92.32 a week ago.

The widely followed junior mining index, the VanEck managed GDXJ, closed the week flat at $47.73 from $47.73 a week ago. HUI Arca Gold BUGS Index, which follows the major gold miners, closed the week lower at 271.08.37 from 271.08 last week. The SPDR GLD ETF inventory closed the week higher at 1,053.06 tonnes, or 33.85 million ounces, from 1,043.16 tonnes last week.

In other commodities, Silver closed the week higher at $26.08/oz from $25.96/oz a week ago. Copper closed higher at $4.29/lb from $4.15/lb a week ago. Oil went higher as WTI closed higher at $74.05 a barrel from $71.64 a barrel a week ago.

The Dow Jones Industrial Average closed higher at 34,433 from 33,290 a week ago. Canada’s S&P/TSX Composite Index closed higher at 20,230 from 19,997 the previous week. The S&P/TSX Venture Composite Index closed higher at 948.51 from 946.83 a week ago.

Summary:

- Number of financings decreased to 24.

- Three brokered financings were announced this week for $47m, a 3-week low.

- Three bought-deal financing were announced this week for $47m, a 1-week high.

- Total dollars decreased to $97m, a 7-week low.

- Average offer increased to $4m, a 2-week high.

Major Financing Openings:

- Lucara Diamond Corp. (TSX-V:LUC) opened a $38 million offering underwritten by a syndicate led by BMO Capital Markets on a bought deal basis. The deal is expected to close on or about July 15, 2021.

- Azimut Exploration Inc. (TSX-V:AZM) opened a $25 million offering underwritten by a syndicate led by Paradigm Capital Inc. on a bought deal basis. The deal is expected to close on or about July 14, 2021.

- Tudor Gold Corp. (TSX-V:TUD) opened a $6 million offering on a best efforts basis.

- Patriot Battery Metals Inc. (CSE:PMET) opened a $5 million offering on a best efforts basis. Each unit includes 1 warrant that expires in 24 months.

Major Financing Closings:

- Nouveau Monde Graphite Inc. (TSX-V:NOU) closed a $73.06 million offering underwritten by a syndicate led by Evercore ISI on a best efforts basis. The deal is expected to close on or about June 23, 2021.

- Gold Mountain Mining Corp. (TSX-V:GMTN) closed a $12 million offering underwritten by a syndicate led by Canaccord Genuity Corp. on a bought deal basis. Each unit includes a 1/2 warrant that expires in 24 months. The deal is expected to close on or about June 30, 2021.

- E79 Resources Corp. (CSE:ESNR) closed a $8 million offering on a best efforts basis.

- Kore Mining Ltd. (TSX-V: KORE) closed a $8 million offering underwritten by a syndicate led by Canaccord Genuity Corp. on a bought deal basis. The deal is expected to close on or about June 3, 2021.

MORE or "UNCATEGORIZED"

JUGGERNAUT CLOSES FINANCING WITH CRESCAT CAPITAL AS LEAD INVESTOR FOR 19.97%

PLANS FOLLOW UP DRILLING ON EXTENSIVE HIGH-GRADE COPPER-GOLD TARG... READ MORE

KARORA REPORTS RECORD REVENUE AND STRONG CASH FLOW FOR Q1 2024

Karora Resources Inc. (TSX: KRR) announced financial and operatin... READ MORE

OceanaGold Completes IPO, Raises US$106M for the Sale of 20% Interest in OGPI

OceanaGold Corporation (TSX: OGC) (OTCQX: OCANF) is pleased to an... READ MORE

Drilling Continues to Expand Gold Resource at OKO

G2 Goldfields Inc. (TSX: GTWO) (OTCQX: GUYGF) is pleased to provi... READ MORE

CANTEX INTERSECTS UP TO 25.07% LEAD-ZINC WITH 72g/t SILVER AT ITS 100% OWNED NORTH RACKLA PROJECT, YUKON AND WILL COMMENCE DRILLING ITS COPPER PROJECT WHERE PREVIOUS DRILLING INTERSECTED 2.5m OF 3.93% COPPER

Cantex Mine Development Corp. (TSX-V: CD) (OTCQB: CTXDF) provides... READ MORE