ORENINC INDEX down although dollars announced increased

ORENINC INDEX – Monday, November 25th 2019

North America’s leading junior mining finance data provider

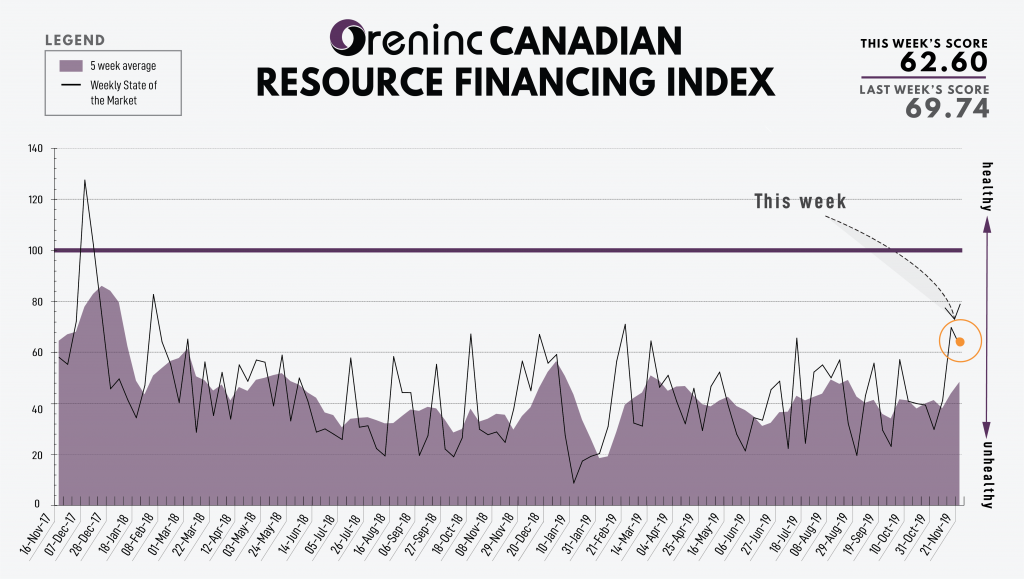

Last Week: 69.74 (updated)

This week: 62.60

The Oreninc Index pulled back in the week ending November 22nd, 2019 to 62.60 from an updated 69.74 a week ago as brokered deals dried up although total aggregate dollars increased.

With investors starting their tax-loss selling, some junior stocks are beginning to get pounded, which for the contrarians means it is bargain-hunting time.

The gold price continued to try and mount a recovery from its recent sell-down but ended the week ceding ground. The general stock markets also continue to ride high unphased by the apparent lack of progress and even stagnation in trade talks between the US and China. The minutes from the October Federal Open Market Committee meeting indicated it is unlikely there will be further interest rate cuts in the US for the remainder of the year as several FOMC members now have an optimistic view of the US economy.

A relatively quiet week in the US news cycle as it continued its focus on the House of Representative impeachment hearings of President Donald Trump and one crowned when the president called into the Fox & Friends TV show on Friday for a 55-minute download of what he thinks of things.

As the UK prepares for a general election in mid-December, both main parties—the incumbent Conservatives and opposition Labour—have unveiled plans to significantly increase public spending which signal an end to the era of austerity. Labour, in particular, has planted a vision of increased spending on healthcare and homes, but also the renationalisation of utilities and rail companies.

Colombia is the latest Latin American country to experience mass protests against an ineffectual government, although not on the scale and without the level of violence which protests in other countries have seen.

In Bolivia, police have used live ammunition to quell protests by groups of largely indigenous people. Interim president Jeanine Añez has called for new elections in which ousted president Evo Morales said he would not run.

On to the money: total fund raises announced increased to $195.9 million, a 61-week high, which included no brokered financings and two bought-deal financings for $6.3 million, a three-week low. The average offer size increased to $5.4 million, a 61-week high, while the number of financings increased to 36.

Gold failed to maintain its recovery as the spot price closed down at US$1,461/oz from $1,468/oz a week ago. The yellow metal is up 13.99% so far this year. The US dollar index pushed higher again as it closed up at 98.27 from 97.99 a week ago. The VanEck managed GDXJ closed down at US$36.66 from $37.14 a week ago. The index is now up 21.31% so far in 2019. The US Global Go Gold ETF closed down at US$15.42 from $15.59 a week ago. It is up 35.14% so far in 2019. The HUI Arca Gold BUGS Index closed up at 210.77 from 210.09 last week. The SPDR GLD ETF reversed its recent trend and added to its inventory as it closed up at 891.79 tonnes from 986.77 tonnes a week ago.

In other commodities, silver closed up again at US$17.02/oz from $16.96/oz a week ago. Copper closed the week flat at US$2.65/lb. The oil price shed a few cents as WTI closed down at US$57.77 a barrel from $57.85 a barrel a week ago.

The Dow Jones Industrial Average had an off week as it closed down at 27,875 from 28,004 a week ago. Canada’s S&P/TSX Composite Index also closed down at 16,954 from 17,028 the previous week. The S&P/TSX Venture Composite Index closed up at 530.02 from 528.58 last week.

Summary

- Number of financings increased to 36.

- No brokered financing was announced this week.

- Two bought-deal financings were announced this week for $6.27m, a 3-week low.

- Total dollars increased to $195.9m, a 61-week high.

- Average offer heightened to $5.4m, a 61-week high.

Financing Highlights

McEwen Mining (TSX:MUX) announced an underwritten public offering of 37.8 million units to raise US$50 million.

- Each unit consists of one share and half a warrant @ US$1.325.

- Each warrant is exercisable @ US$1.7225 for five years.

- Roth Capital Partners and Cantor Fitzgerald Canada are acting as joint book-running managers.

- Proceeds will be used to advance the company’s mining projects and exploration prospects.

Major Financing Openings

- McEwen Mining (TSX:MUX) opened a $49 million offering on a best efforts basis. Each unit includes half a warrant that expires in five years.

- Paramount Resources (TSX:POU) opened a $56 million offering on a best efforts basis.

- Return Energy (TSX-V:RTN) opened a $25 million offering on a best efforts Each unit includes a warrant that expires in five years. The deal is expected to close on or about December 16th.

- Skyharbour Resources (TSX-V:SYH) opened a $12 million offering on a best efforts Each unit includes half a warrant that expires in three years.

- Cordoba Minerals (TSX-V:CDB) opened a $11 million offering on a strategic deal The deal is expected to close on or about January 1st, 2020.

Major Financing Closings

- Paramount Resources (TSX:POU) closed a $56 million offering on a best efforts basis.

- Compass Gold (TSX-V:CVB) closed a $39 million offering on a strategic deal basis.

- Royal Road Minerals (TSX-V:RYR) closed a $3 million offering on a best efforts

- Treasury Metals (TSX:TML) closed a $8 million offering underwritten by a syndicate led by PI Financial on a bought deal basis.

MORE or "UNCATEGORIZED"

NEW GOLD COMPLETES US$173 MILLION BOUGHT DEAL FINANCING

New Gold Inc. (TSX: NGD) (NYSE American: NGD) is pleased to annou... READ MORE

SILVER VIPER CLOSES LIFE OFFERING

Silver Viper Minerals Corp. (TSX-V: VIPR) (OTC: VIPRF) announces... READ MORE

MAX Power Closes $1.9 Million Private Placement

MAX Power Mining Corp. (CSE: MAXX) (OTC: MAXXF) (FRANKFURT: 89N) ... READ MORE

McEwen Copper Announces Completion of the Feasibility Drilling Program

70,000 meters completed, highlights include: 349.0 m of 0.77... READ MORE

Rupert Resources Reports Results From Project Drilling Including 120m at 6.2g/t Gold

Rupert Resources Ltd. (TSX:RUP) reports assay results from projec... READ MORE