NEW GOLD ANNOUNCES CONTINUED GROWTH AT NEW AFTON’S K-ZONE AND HW ZONE

Highlights the Upside Potential from Multiple High-Grade Copper-Gold Porphyry Zones in the Eastern Sector of the Mine

New Gold Inc. (TSX: NGD) (NYSE American: NGD) is pleased to provide an update on its ongoing exploration program at its New Afton mine in British Columbia, Canada. Following successful exploration results at K-Zone earlier this year (see news release dated May 29, 2024), exploration drilling in the eastern part of the mine continues to intersect high-grade copper-gold porphyry mineralization.

“These exceptional results further highlight the exploration upside around the New Afton mine. The eastern sector of the mine, which includes the spectacular grades of K-Zone, new high-grade mineralization at HW Zone, and the existing East Extension mineral resource, is developing into a promising opportunity for a new high-grade mining area.” stated Patrick Godin, President and CEO. “Additionally, the location of these zones above the elevation of the C-Zone extraction level and close to existing infrastructure, could minimize the capital and time required to bring these zones into production.”

Exploration Drilling at K-Zone Delivers Results Exceeding Previously Reported Grades and Intersects Additional Mineralized Lenses to the North

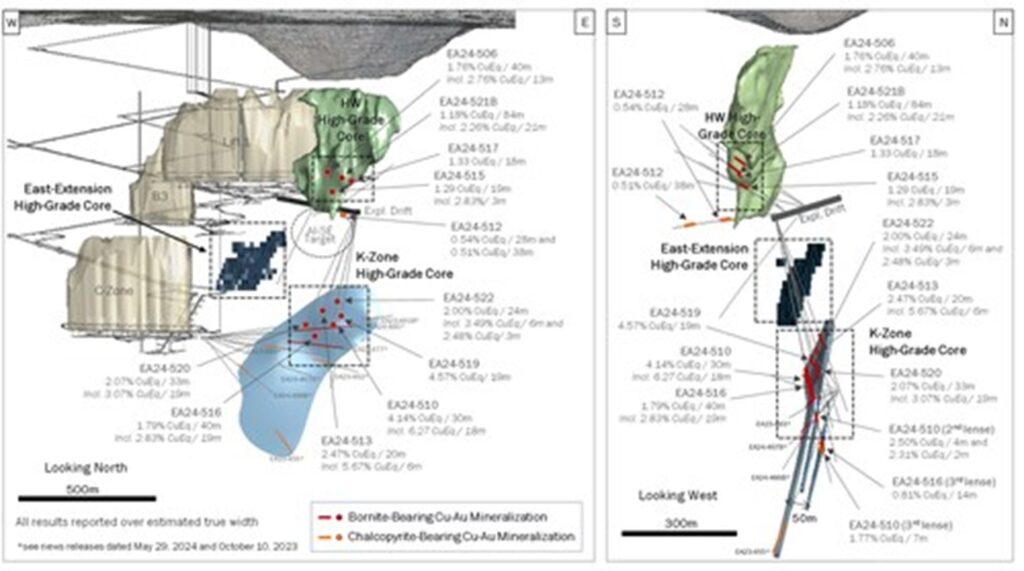

Drilling from the recently completed exploration drift intersected a series of high-grade bornite dominant lenses hosted within a broader chalcopyrite-bearing halo, together forming a copper-gold mineralized system extending over 300 metres in strike and locally exceeding 50 metres in width (Figure 1). Borehole EA24-510 intersected some of the best grade discovered to date at New Afton.

- K-Zone drilling highlights1,2:

- 2.83% copper mineralization and 1.90 g/t gold (4.14% CuEq) over 84 metres core length (30 metres estimated true width) in Borehole EA24-510 including:

- 4.18% copper mineralization and 3.03 g/t gold (6.27% CuEq) over 50 metres core length (18 metres estimated true width) in bornite-bearing zone

- 0.99% copper mineralization and 1.23 g/t gold and (1.79% CuEq) over 169 metres core length (40 metres estimated true width) in Borehole EA24-516 including:

- 1.60% copper mineralization and 1.87 g/t gold (2.83% CuEq) over 76 metres core length (19 metres estimated true width) in bornite-bearing zone

- 3.25% copper mineralization and 1.91 g/t gold (4.57% CuEq) over 36 metres core length (19 metres estimated true width) in Borehole EA24-519 in bornite-bearing zone

- 1.13% copper mineralization and 1.43 g/t gold and (2.07 CuEq%) over 93 metres core length (33 metres estimated true width) in Borehole EA24-520 including:

- 1.66% copper mineralization and 2.14 g/t gold (3.07 CuEq%) over 54 metres core length (19 metres estimated true width) in bornite-bearing zone

- 2.83% copper mineralization and 1.90 g/t gold (4.14% CuEq) over 84 metres core length (30 metres estimated true width) in Borehole EA24-510 including:

|

1All gold and copper grades are reported uncapped. It has yet to be determined whether further exploration will result in the target being delineated as a mineral resource. Additional data and further interpretation work are expected to better define the geometry and extent of the mineralized zones. |

| 2Indicative copper equivalent (CuEq) grades are included for context, estimated using price assumptions of US$3.50 per pound of copper, US$1,500 per ounce of gold, and US$21.00 per ounce of silver. |

High-Grade Copper-Gold Mineralization Intersected Within HW Zone

The exploration drift also provides a drilling platform for expanding and defining the HW Zone and testing the extents of the AI-Southeast target, which until recently were difficult to drill at favorable orientations. New drilling intersected high-grade copper-gold mineralization within the lower part of the HW Zone (Figure 1).

- HW Zone drilling highlights1,2:

- 1.05% copper mineralization and 1.08 g/t gold and (1.76 CuEq%) over 51 metres core length (40 metres estimated true width) in Borehole EA24-506 including:

- 1.75% copper mineralization and 1.49 g/t gold (2.76 CuEq%) over 16 metres core length (13 metres estimated true width) in bornite-bearing zone

- 0.49% copper mineralization and 1.08 g/t gold and (1.18 CuEq%) over 94 metres core length (84 metres estimated true width) in Borehole EA24-521B including:

- 0.90% copper mineralization and 2.12 g/t gold (2.26 CuEq%) over 24 metres core length (21 metres estimated true width) in bornite-bearing zone

- 1.05% copper mineralization and 1.08 g/t gold and (1.76 CuEq%) over 51 metres core length (40 metres estimated true width) in Borehole EA24-506 including:

| 1All gold and copper grades are reported uncapped. It has yet to be determined whether further exploration will result in the target being delineated as a mineral resource. Additional data and further interpretation work are expected to better define the geometry and extent of the mineralized zones. |

| 2Indicative copper equivalent (CuEq) grades are included for context, estimated using price assumptions of US$3.50 per pound of copper, US$1,500 per ounce of gold, and US$21.00 per ounce of silver. |

Exploration Budget Increased by $3 Million to the End of 2024

Based on the exploration successes to date, the Company intends to allocate an additional $3 million to the 2024 New Afton exploration program which will provide approximately 10,000 metres of additional drilling to continue defining the footprint of the eastern high-grade zones from the exploration drift.

“Similar to Rainy River, the exploration successes at New Afton support the Company’s approach to optimize net asset value with modest investment and leveraging the existing infrastructure,” added Mr. Godin. “With the completion of the underground exploration drift in the second quarter, we are well positioned to grow and define the eastern high-grade zones, with an objective to report initial mineral resources at K-Zone for year-end 2024.”

Table 1: New Afton Notable Exploration Drilling Results from Exploration Drift1,2

| Zone | Drill Hole | From (m) |

To (m) |

Interval (m) |

Estimated True Width (m) |

Cu (%) |

Au (g/t) |

Ag (g/t) |

CuEq (%) |

AuEq (g/t) |

|

| K-Zone | EA24-510 | 405.0 | 489.0 | 84.0 | 30 | 2.83 | 1.90 | 14.15 | 4.14 | 6.63 | |

| including (bornite zone) | 419.9 | 469.5 | 49.5 | 18 | 4.18 | 3.03 | 22.58 | 6.27 | 10.03 | ||

| EA24-510 | 543.0 | 599.0 | 56.0 | 18 | 1.22 | 0.30 | 1.78 | 1.42 | 2.28 | ||

| including (bornite zone) | 545.5 | 557.1 | 11.7 | 4 | 2.47 | 0.02 | 1.62 | 2.50 | 3.99 | ||

| including (bornite zone) | 574.0 | 579.0 | 5.0 | 2 | 1.71 | 0.91 | 3.77 | 2.31 | 3.70 | ||

| EA24-510 | 623.0 | 642.0 | 19.0 | 7 | 0.76 | 1.58 | 2.21 | 1.77 | 2.83 | ||

| EA24-513 | 389.2 | 425.0 | 35.9 | 20 | 1.70 | 1.11 | 9.05 | 2.47 | 3.96 | ||

| including (bornite zone) | 389.2 | 401.5 | 12.3 | 6 | 3.48 | 3.16 | 24.77 | 5.67 | 9.07 | ||

| EA24-516 | 451.0 | 620.0 | 169.0 | 40 | 0.99 | 1.23 | 3.89 | 1.79 | 2.87 | ||

| including (bornite zone) | 472.0 | 548.0 | 76.0 | 19 | 1.60 | 1.87 | 6.85 | 2.83 | 4.53 | ||

| EA24-516 | 630.0 | 676.0 | 46.0 | 14 | 0.35 | 0.72 | 0.96 | 0.81 | 1.29 | ||

| EA24-516 | 704.0 | 718.0 | 14.0 | 6 | 0.44 | 0.58 | 0.42 | 0.81 | 1.29 | ||

| EA24-519 | Bornite zone | 385.0 | 421.0 | 36.0 | 19 | 3.25 | 1.91 | 14.72 | 4.57 | 7.32 | |

| EA24-520 | 424.0 | 517.1 | 93.1 | 33 | 1.13 | 1.43 | 5.21 | 2.07 | 3.31 | ||

| including (bornite zone) | 442.0 | 496.0 | 54.0 | 19 | 1.66 | 2.14 | 8.55 | 3.07 | 4.92 | ||

| EA24-522 | 343.0 | 381.0 | 38.0 | 24 | 1.67 | 0.47 | 4.50 | 2.00 | 3.20 | ||

| including (bornite zone) | 343.0 | 357.0 | 14.0 | 6 | 2.74 | 1.07 | 9.46 | 3.49 | 5.59 | ||

| including (bornite zone) | 371.0 | 377.0 | 6.0 | 3 | 2.21 | 0.41 | 1.87 | 2.48 | 3.97 | ||

| HW Zone | EA24-506 | 105.8 | 118.0 | 12.2 | 10 | 0.37 | 0.48 | 0.92 | 0.68 | 1.09 | |

| EA24-506 | 125.7 | 136.0 | 10.3 | 8 | 0.43 | 0.57 | 1.27 | 0.79 | 1.27 | ||

| EA24-506 | 202.0 | 252.9 | 50.9 | 40 | 1.05 | 1.08 | 4.04 | 1.76 | 2.82 | ||

| including (bornite zone) | 215.1 | 231.5 | 16.5 | 13 | 1.75 | 1.49 | 8.57 | 2.76 | 4.41 | ||

| EA24-506 | 263.2 | 271.7 | 8.5 | 7 | 0.15 | 0.69 | 0.63 | 0.59 | 0.94 | ||

| EA24-507 | 167.3 | 175.0 | 7.7 | 6 | 0.30 | 0.13 | 0.45 | 0.38 | 0.61 | ||

| EA24-515 | 68.0 | 94.0 | 26.0 | 23 | 0.28 | 0.35 | 2.21 | 0.52 | 0.83 | ||

| EA24-515 | 114.0 | 136.0 | 22.0 | 19 | 0.61 | 1.07 | 1.56 | 1.29 | 2.07 | ||

| including (bornite zone) | 124.0 | 128.0 | 4.0 | 3 | 1.48 | 2.11 | 3.55 | 2.83 | 4.53 | ||

| EA24-515 | 182.0 | 208.0 | 26.0 | 23 | 0.42 | 0.55 | 1.57 | 0.78 | 1.24 | ||

| EA24-517 | 154.0 | 176.0 | 22.0 | 18 | 0.55 | 1.23 | 1.27 | 1.33 | 2.13 | ||

| EA24-521B | 121.0 | 215.0 | 94.0 | 84 | 0.49 | 1.08 | 1.90 | 1.18 | 1.89 | ||

| including (bornite zone) | 167.0 | 191.0 | 24.0 | 21 | 0.90 | 2.12 | 3.58 | 2.26 | 3.61 | ||

| AI-Southeast | EA24-512 | 152.2 | 182.0 | 29.8 | 28 | 0.30 | 0.36 | 1.95 | 0.54 | 0.87 | |

| EA24-512 | 226.8 | 266.9 | 40.1 | 38 | 0.29 | 0.34 | 0.58 | 0.51 | 0.81 | ||

| 1Notable drilling intervals are defined with average grade above mining cut-off grade of 0.4% CuEq. | |||||||||||

| 2Indicative gold equivalent (AuEq) grades are included for context, estimated using price assumptions of US$3.50 per pound of copper, US$1,500 per ounce of gold and US$21.00 per ounce of silver. |

New Afton Exploration Drilling Results

Exploration efforts at New Afton remain focused on potential near-mine mineralized zones located near the C-Zone extraction level to minimize capital investment and maximize free cash flow generation. Earlier this year (see May 29, 2024 news release), the Company reported the discovery of high-grade copper-gold porphyry mineralization at K-Zone over strike lengths exceeding 200 metres and estimated true widths up to 40 metres. Completion of the underground exploration drift in the second quarter allows the Company to drill K-Zone from a better angle. The exploration drift provides a better platform to define and extend other zones to the east of the existing mine, including HW Zone and AI-Southeast target.

At K-Zone, boreholes drilled from the exploration drift support the estimated true widths of previously disclosed intercepts with grades locally exceeding past mineralized intervals. Additionally, the new boreholes from the exploration drift extend beyond the footwall of the main zone and intersect additional sub-parallel high-grade zones forming an overall system reaching 50 metres in width and over 300 metres in strike length. K-Zone remains open in all directions and drilling is ongoing to define the size of the K-Zone system.

At HW Zone, Boreholes EA24-506 and EA24-521B intersected high-grade bornite-bearing copper-gold mineralization interpreted as a high-grade core. The ongoing drilling program targets both the continuation of the high-grade HW Zone to the east and the down-dip extension of the mineralized zone previously intersected in Borehole EA21-302 (see October 10, 2023 news release) which constitutes the AI-Southeast target.

All new notable K-Zone, HW Zone, and AI-Southeast drilling intercepts are summarized in Table 1 and Figure 1 below. Locations and orientations of all drilling are listed in Table 2. Indicative copper equivalent (CuEq) and gold equivalent (AuEq) grades are included for context, estimated using price assumptions of US$3.50 per pound of copper, US$1,500 per ounce of gold, and US$21.00 per ounce of silver.

Figure 1: New Afton Notable Drill Intercepts from Exploration Drift

Table 2: All New Exploration Diamond Drilling Location and Orientation from Exploration Drift at New Afton

| Drill Hole | Azimuth | Dip | Length (m) | UTM Easting (m) | UTM Northing (m) | Elevation (m) |

| EA24-506 | 165 | +34 | 341 | 675,595 | 5,614,949 | -12 |

| EA24-507 | 191 | +28 | 305 | 675,596 | 5,614,949 | -12 |

| EA24-508 | 174 | +14 | 299 | 675,597 | 5,614,946 | -13 |

| EA24-509 | 211 | -48 | 405 | 675,597 | 5,614,947 | -11 |

| EA24-510 | 314 | -73 | 642 | 675,763 | 5,615,015 | -36 |

| EA24-511 | 210 | -7 | 200 | 675,695 | 5,614,980 | -26 |

| EA24-512 | 174 | -8 | 308 | 675,695 | 5,614,980 | -26 |

| EA24-513 | 313 | -65 | 608 | 675,763 | 5,615,015 | -36 |

| EA24-514 | 193 | -30 | 281 | 675,696 | 5,614,977 | -23 |

| EA24-515 | 192 | +29 | 269 | 675,697 | 5,614,978 | -23 |

| EA24-516 | 302 | -68 | 768 | 675,767 | 5,615,017 | -39 |

| EA24-517 | 109 | +37 | 296 | 675,698 | 5,614,978 | -23 |

| EA24-518 | 95 | +24 | 398 | 675,696 | 5,614,977 | -23 |

| EA24-519 | 279 | -74 | 686 | 675,763 | 5,615,016 | -38 |

| EA24-520 | 251 | -63 | 641 | 675,759 | 5,615,015 | -39 |

| EA24-521B | 125 | +39 | 366 | 675,696 | 5,614,977 | -23 |

| EA24-522 | 280 | -67 | 567 | 675,763 | 5,615,016 | -38 |

About New Gold

New Gold is a Canadian-focused intermediate mining company with a portfolio of two core producing assets in Canada, the Rainy River gold mine and the New Afton copper-gold mine. The Company also holds other Canadian-focused investments. New Gold’s vision is to build a leading diversified intermediate gold company based in Canada that is committed to the environment and social responsibility.

MORE or "UNCATEGORIZED"

Tectonic Raises Over C$92 Million; Completes Upsized Private Placement With Full Over-Allotment Exercised

Tectonic Metals Inc. (TSX-V: TECT) is pleased to announce the successful closing of the Company’s ... READ MORE

Cerro de Pasco Resources Enters Project Development Funding Agreement with U.S. International Development Finance Corporation for Quiulacocha

Cerro de Pasco Resources Inc. (TSX-V: CDPR) (OTCQB: GPPRF) (BVL: CDPR) announces that it has ... READ MORE

NorthWest Announces Updated Mineral Resource at Kwanika Reflecting Strategic Shift to Higher-Grade Copper-Gold Focus

NorthWest Copper Corp. (TSX-V: NWST) is pleased to announce an updated mineral resource estimate for... READ MORE

Monument Reports Second Quarter Fiscal 2026 Results

Monument Mining Limited (TSX-V: MMY) (FSE: D7Q1) today announced its financial results for the three... READ MORE

Taseko announces First Cathode Harvest at Florence Copper

Taseko Mines Limited (TSX: TKO) (NYSE American: TGB) (LSE: TKO) is pleased to announce its F... READ MORE