NEVADA KING INTERCEPTS 3.18 G/T AU OVER 44.2M, INCLUDING 8.25 G/T OVER 13.7M AT ATLANTA, EXTENDS WEST ATLANTA GRABEN MINERALIZATION WESTWARD

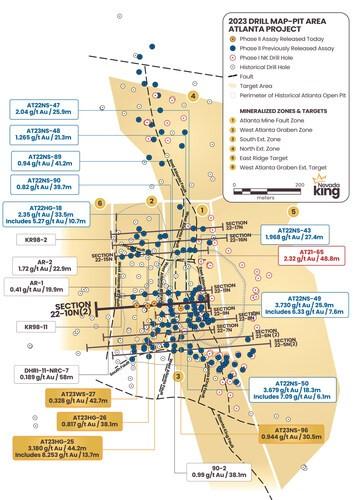

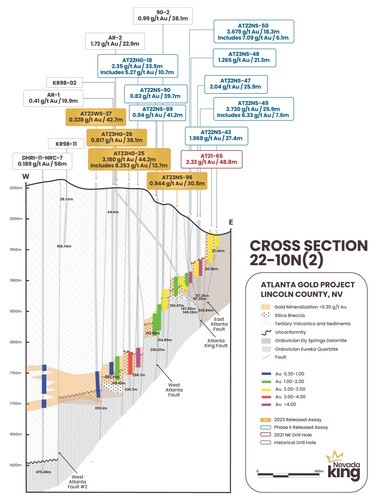

Nevada King Gold Corp. (TSX-V: NKG) (OTCQX: NKGFF) is pleased to announce assay results from four vertical reverse circulation holes recently completed at its Atlanta Gold Mine Project located 264km northeast of Las Vegas, Nevada, in the prolific Battle Mountain Trend. The four holes reported today are plotted in plan and along an updated Section 22-10N(2), initially released on April 20, 2023.

Highlights:

| Hole No. | From (m) | To (m) | Interval (m) | Au (g/t) | Ag (g/t) | Notes |

| AT23HG-25 | 271.3 | 315.5 | 44.2 | 3.180 | 53.2 | |

| Includes | 292.7 | 306.4 | 13.7 | 8.253 | 13 | |

| AT23HG-26 | 279.0 | 317.1 | 38.1 | 0.817 | 27 | Bottomed in Mineralization |

| AT23NS-96 | 105.2 | 135.7 | 30.5 | 0.944 | 51.0 | |

| AT23WS-27 | 306.4 | 349.1 | 42.7 | 0.328 | 14.3 | Bottomed in Mineralization |

| Table 1: Highlight holes released today along Section 22-10N(2). Mineralization occurs along sub-horizontal horizons generally dipping gently westward; true mineralized thickness in vertical holes is estimated to be between 85% and 95% of reported vertical drill intercept length. |

||||||

- Hole AT22-HG-18 reported April 20, 2023 was collared along the east side of the West Atlanta Graben and returned highlight intervals of 33.5m grading 2.35 g/t Au and 363 g/t Ag including 1.08 kg/t Ag over 10.7m. Today’s AT23HG-25 (44.2m @ 3.18 g/t Au and 53 g/t Ag) is located 14m west of AT22HG-18, thus extending the high-grade mineralization further westward into the WAG from the West Atlanta Fault (see Figure 2).

- AT23HG-26 stepped out a further 23m west of AT23HG-25 and was planned to deepen AR-1 (19.9m @ 0.41 g/t), a historical hole which did not penetrate into the gold-bearing silica breccia zone. While AT23HG-26 only partially penetrated the silica breccia, in turn bottoming in mineralization, it intercepted 38.1m of 0.82 g/t Au, which is considerably thicker and higher grade compared to the 19.9m of 0.41 g/t reported in AR-1.

- AT23WS-27 stepped a further 36m west into the WAG and returned 42.7m @ 0.328 g/t Au and 14.3 g/t Ag, providing further confirmation that higher grades are concentrated in a halo around the fault structures and decrease more distally into the graben.

- Drilling is currently ongoing with further step outs to the west in the approximately 100m gap between AT23WS-27 and historical hole DHRI-11-NRC-7, where grades may pick back up again approaching the West Atlanta Fault #2 (WAF2), as seen along sections to the north and south.

- It is important to note the large difference in intercept grade across the WAG in the historical holes versus Nevada King’s holes. In the Gustavson 2020 resource model, only two historical holes were drilled in this area, DHRI-11-NRC-7 and AR-1. Both are dramatically lower in grade compared to Nevada King’s closer spaced holes (AT23WS-27, AT23HG-26, AT23HG-25, AT22HG-18, AT22NS-89, AT22NS-90). On a weighted average basis, the two historical holes average 0.25 g/t Au and 24.7 g/t Ag over 39m, while the Company’s six holes average 1.41 g/t Au and 88.0 g/t Ag over 40m.

- Numerous historical holes were collared within the WAG, but as seen in Figure 2 with Kinross angle holes KR98-2 and KR98-11, these holes failed to reach the mineralized zone, leaving a sizeable data gap between DHRI-11-NRC-7 and AR-1. This same gap occurs north and south of Section 22-10N(2) – gaps the Company is currently filling with more closely spaced vertical holes that stand a good chance of similarly boosting average grade.

Cal Herron, Exploration Manager of Nevada King, commented, “Nevada King’s drilling appears to show that historic holes consistently under estimated interval grades, primarily from not drilling near higher grade feeder structures and not fully penetrating the mineralized zones. Our drilling continues to discover new zones of mineralization that were not intersected in the historic programs including areas of high-grade mineralizaiton proximate to key sub-vertical fault structures. Based on our drill results to date and ongoing modelling of the mineralization we are optimistic that we can significantly increase the size and grade of the resource base at Atlanta from that reported in the Gustavson (2020) report.”

| Hole No. | From (m) | To (m) | Interval (m) | Au (g/t) | Ag (g/t) | Notes |

| AT22HG-18 | 257.6 | 291.2 | 33.5 | 2.35 | 363.0 | Bottomed in mineralization |

| includes | 259.1 | 269.8 | 10.7 | 5.27 | 1084.1 | |

| AT22NS-89 | 172.3 | 213.4 | 41.2 | 0.94 | 67.8 | Bottomed in mineralization |

| AT22NS-90 | 182.9 | 222.6 | 39.7 | 0.82 | 52.3 | |

| AT23NS-48 | 91.5 | 112.8 | 21.3 | 1.27 | 35.1 | |

| AT22NS-50 | 89.9 | 108.2 | 18.3 | 3.68 | 27.1 | |

| includes | 93.0 | 99.1 | 6.1 | 7.09 | 33.1 | |

| AT22NS-47 | 64.0 | 89.9 | 25.9 | 2.04 | 27.8 | |

| AT22NS-49 | 62.5 | 88.4 | 25.9 | 3.73 | 46.1 | |

| Including | 67.1 | 74.7 | 7.6 | 6.33 | 28.8 | |

| AT22NS-43 | 0.0 | 27.4 | 27.4 | 1.97 | 25.1 | Bottomed in mineralization |

| Table 2: All holes reported today along Section22-10N(2). Mineralization occurs along sub-horizontal horizons generally dipping gently westward; true mineralized thickness in vertical holes is estimated to be between 85% and 95% of reported vertical drill intercept length. |

||||||

| Hole No. | From (m) | To (m) | Interval (m) | Au (g/t) | Ag (g/t) | Notes |

| AT21-65 | 3.0 | 51.8 | 48.8 | 2.32 | 32.9 | |

| AR-1 | 283.5 | 303.4 | 19.9 | 0.41 | 16.2 | Bottomed in mineralization |

| AR-2^ | 182.9 | 205.8 | 22.9 | 1.72 | 47.0 | |

| 90-2 | 135.7 | 173.8 | 38.1 | 0.99 | 90.4 | |

| DHRI-11-NRC-7 | 295.7 | 371.9 | 58 | 0.19 | 27.6 | Aggregate grades |

| Table 3: Previously reported and historic holes used in Section 22-10N(2). AT21 series hole was drilled by Nevada King in 2021. AR series holes were drilled by Goldfields in 1990. “90” series hole drilled by Bobcat in 1990, while DHRI series hole was drilled by Meadow Bay in 2011. Mineralization occurs along sub-horizontal horizons generally dipping gently westward; true mineralized thickness in vertical holes is estimated to be between 85% and 95% of reported vertical drill intercept length. ^Denotes angle hole. |

||||||

Nevada King Engages GRA Enterprises LLC

The Company is pleased to announce that it has engaged a third-party investor relations provider, GRA Enterprises LLC to disseminate news releases and newsworthy related events, provide communications and media services, produce and publish investor bulletins on the National Inflation Association website, and distribute e-mail alerts to the Consultant’s National Inflation e-mail list about the Company and its projects.

GRA is a limited liability company with an office at 112 Camp Lane, Mooresville, NC, USA 28117-8925, and is headed by Gerard Adams. GRA is in the business of providing communication services including assisting public companies in the marketing of corporate activities. The Company is at arm’s length from GRA and Gerard Adams. The term of the agreement with GRA (the “Agreement“) is for 12 months ending August 9, 2024. GRA will be paid an upfront cash fee of US$15,000 and three additional quarterly cash fees of US$15,000 each for a total of US$60,000 for the services.

Qualified Person

The scientific and technical information in this news release has been reviewed and approved by Calvin R. Herron, P.Geo., who is a Qualified Person as defined by National Instrument 43-101.

About Nevada King Gold Corp.

Nevada King is the third largest mineral claim holder in the State of Nevada, behind Nevada Gold Mines (Barrick/Newmont) and Kinross Gold. Starting in 2016 the Company has staked large project areas hosting significant historical exploration work along the Battle Mountain trend located close to current or former producing gold mines. These project areas were initially targeted based on their potential for hosting multi-million-ounce gold deposits and were subsequently staked following a detailed geological evaluation. District-scale projects in Nevada King’s portfolio include (1) the 100% owned Atlanta Mine, located 100km southeast of Ely, (2) the Lewis and Horse Mountain-Mill Creek projects, both located between Nevada Gold Mines’ large Phoenix and Pipeline mines, and (3) the Iron Point project, located 35km east of Winnemucca, Nevada.

The Company is well funded with cash of approximately $17 million as of August 2023.

The Atlanta Mine is a historical gold-silver producer with a NI 43-101 compliant pit-constrained resource of 460,000 oz Au in the measured and indicated category (11.0M tonnes at 1.3 g/t) plus an inferred resource of 142,000 oz Au (5.3M tonnes at 0.83 g/t). See the NI 43-101 Technical Report on Resources titled “Atlanta Property, Lincoln County, NV” with an effective date of October 6, 2020, and a report date of December 22, 2020, as prepared by Gustavson Associates and filed under the Company’s profile on SEDAR (www.sedar.com).

NI 43-101 Mineral Resources at the Atlanta Mine

| Resource Category | Tonnes

(000s) |

Au Grade

(ppm) |

Contained Au Oz |

Ag Grade

(ppm) |

Contained Ag Oz |

| Measured | 4,130 | 1.51 | 200,000 | 14.0 | 1,860,000 |

| Indicated | 6,910 | 1.17 | 260,000 | 10.6 | 2,360,000 |

| Measured + Indicated | 11,000 | 1.30 | 460,000 | 11.9 | 4,220,000 |

| Inferred | 5,310 | 0.83 | 142,000 | 7.3 | 1,240,000 |

Figure 1. Location map for holes reported in this news release along drill section22-010N relative to the perimeter of the historical Atlanta Pit and footprint of the Gustavson 2020 NI 43-101 resource. Shallow drillholes on the mine dumps have been removed from the plot for clarity. (CNW Group/Nevada King Gold Corp.)

Figure 2. Cross section 22-10N(2) looking north across the southern portion of the Atlanta Mine Fault Zone. Higher grade mineralization is concentrated within narrow fault blocks formed between the East Atlanta and Nevada King Fault and along the western side of the West Atlanta Fault. (CNW Group/Nevada King Gold Corp.)

MORE or "UNCATEGORIZED"

Eloro Resources Announces Closing of Bought Deal LIFE Private Placement for Gross Proceeds of C$17 Million

Eloro Resources Ltd. (TSX: ELO) (FSE: P2QM) is pleased to announce the closing of its previously an... READ MORE

Minera Alamos Updates Resources and Reserves for the Pan Gold Mine in Nevada

Minera Alamos Inc. (TSX-V: MAI) (OTCQX: MAIFF) is pleased to announce updated Mineral Resource and M... READ MORE

Ero Copper Reports Fourth Quarter and Full Year 2025 Operating and Financial Results

Ero Copper Corp. (TSX: ERO) (NYSE: ERO) is pleased to announce its operating and financial results f... READ MORE

Rare Element Resources Announces Results of Oversubscribed Rights Offering of Common Shares

Rare Element Resources Ltd. (OTCQB: REEMF) is pleased to report that its previously announced... READ MORE

TRX Gold Reports Record Q2 2026 Production and Company Update

TRX Gold Corporation (TSX: TRX) (NYSE American: TRX) is pleased to announce preliminary resu... READ MORE