NEVADA KING INTERCEPTS 1.34 G/T AU OVER 67.1M & 1.14 G/T AU OVER 77.3M IN THE WEST ATLANTA GRABEN ZONE AT ATLANTA

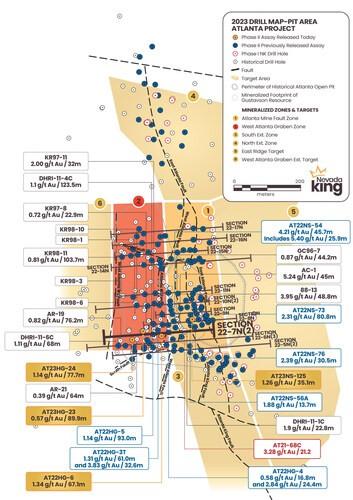

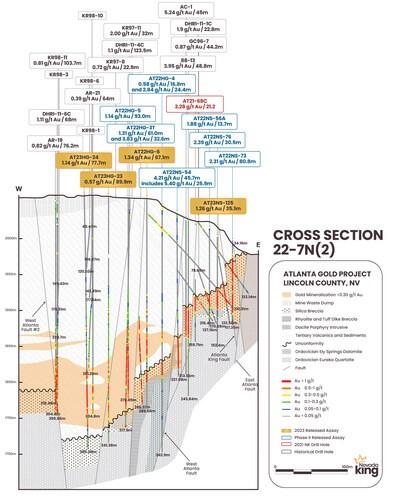

Nevada King Gold Corp. (TSX-V: NKG) (OTCQX: NKGFF) is pleased to announce assay results from four vertical, reverse circulation holes recently completed at its Atlanta Gold Mine Project located 264km northeast of Las Vegas, Nevada, in the prolific Battle Mountain Trend. Today’s holes are plotted in plan and along an updated Section 22-7N(2), initially released February 27, 2023.

Highlights:

| Hole No. | From (m) | To (m) | Interval (m) | Au (g/t) | Ag (g/t) |

| AT22HG-6 | 189.0 | 256.1 | 67.1 | 1.34 | 6.4 |

| AT23HG-24 | 247.0 | 324.7 | 77.7 | 1.14 | 4.0 |

| AT23HG-23 | 227.1 | 317.1 | 89.9 | 0.57 | 11.5 |

| AT23NS-125* | 74.7 | 109.8 | 35.1 | 1.26 | 31.9 |

| Table 1: Holes released today. *Denotes angle hole. Mineralization occurs along near-horizontal horizons with true mineralized thicknesses in vertical holes estimated to be 90% to 100% of reported drill intercept length, and approximately 94% in -68o angle hole AT23NS-125. | |||||

- Drilling by Nevada King has been focused on two primary zones – (1) the Atlanta Mine Fault Zone mineralization located east of the West Atlanta Fault shaded orange in Figure 1 below, and (2) the West Atlanta Graben Zone, mineralization located west of the WAF shaded red in Figure 1 below. The majority of the ounces in the Gustavson resource (Table 5) of 460,000 M+I and 142,000 Inferred are located within the AMFZ. Despite the presence of historical drilling in the parallel WAGZ, very little of it is factored into the resource model.

- The Company is focused on using its new geologic model to continue defining higher-grade fault zones within the WAGZ with the goal of bringing this large (150m wide x 500m long) and thickly mineralized zone into an updated resource model. Mineralization within the WAGZ is considerably thicker and covers a larger area than the parallel AMFZ.

- Three of today’s highlight holes were drilled across the center of the WAGZ intercepting 1.34 g/t Au over 67.1m in AT22HG-6, 1.14 g/t Au over 77.7m in AT23HG-24, and 0.57 g/t Au over 89.9m in AT23HG-23. The mineralization in these holes is particularly notable due their strong grades located in the central portion of the WAGZ away from the primary feeder faults, the West Atlanta and West Atlanta #2 Faults.

- This central portion of the WAGZ will be critical in a future resource and today’s intervals present a different picture of the WAGZ on this section line when compared to the historical intercepts. For example, Goldfields’ RC hole AR-21 hit 64m grading 0.39 g/t Au, while Nevada King’s two nearby holes show a 113% increase in grade and a 30% increase in thickness within the central portion of the WAGZ, a difference primarily attributed to the lack of penetration of the mineralized zone by historical drilling. Referring to Figure 2, several historical angle holes in fact completely missed mineralization in the WAGZ on this section line including KR98-1, 98-6, 98-3 and 98-10.

- One historical Kinross hole located in the vicinity of the westernmost boundary of the WAGZ drilled across the WAF2 and intercepted an impressive 32m of 2.0 g/t Au in KR98-11, indicating the WAF2 fault that bounds the WAGZ to the west is an important control for high-grade gold. Nevada King is currently working to drill this newly recognized feature which could positively impact overall grade of the WAGZ if ongoing drilling returns similar results. Mineralization west of the WAF2 (west of the WAGZ) remains wide open.

Cal Herron, Exploration Manager of Nevada King, stated, “The Company’s closer spaced, deeper holes and attention to high-angle, higher-grade feeder structures is paying off. There are five historical holes drilled in the WAGZ along Section 22-7N(2) that encountered mineralization and average 0.96 g/t AuEq over 87.1m thickness. The same section length now includes seven Nevada King holes with an average grade of 2.07 g/t AuEq over 76.1m thickness, representing a 116% increase in grade. The WAGZ is an important target where thick mineralization can rapidly add ounces to the resource and we look forward to the receipt of additional results.”

| Hole No. | From (m) |

To

(m) |

Interval

(m) |

Au

(g/t) |

Ag

(g/t) |

Notes |

| AT23HG-30 | 169.2 | 269.8 | 100.6 | 3.39 | 9.6 | |

| Includes | 227.1 | 240.9 | 13.7 | 12.67 | 38.2 | |

| And | 294.2 | 373.5 | 79.3 | 0.27 | 0.4 | |

| AT23HG-28 | 150.9 | 224.1 | 73.2 | 2.67 | 13.6 | |

| Includes | 204.3 | 216.5 | 12.2 | 7.59 | 45.9 | |

| AT23HG-22 | 181.4 | 323.2 | 141.8 | 0.55 | 4.0 | |

| AT22RC-11 | 0.0 | 33.5 | 33.5 | 1.28 | 0.5 | |

| AT22HG-5 | 186.0 | 279.0 | 93.0 | 1.14 | 2.1 | Bottomed in Mineralization |

| AT22HG-3T | 170.4 | 231.4 | 61.0 | 1.31 | 0.158 | |

| And | 252.7 | 285.4 | 32.6 | 3.83 | 48.7 | Bottomed in Mineralization |

| Includes | 261.0 | 266.0 | 5.0 | 10.94 | 33.2 | |

| combined average | 93.6 | 2.18 | 17.1 | Bottomed in Mineralization | ||

| AT22HG-4 | 175.3 | 192.1 | 16.8 | 0.58 | 0.5 | |

| And | 216.5 | 240.9 | 24.4 | 2.84 | 38.0 | |

| combined average | 41.2 | 1.92 | 22.7 | |||

| AT22NS-54 | 170.7 | 216.5 | 45.7 | 4.21 | 79.6 | |

| Includes | 173.8 | 199.7 | 25.9 | 5.40 | 113.8 | |

| AT22NS-56A | 93.0 | 106.7 | 13.7 | 1.88 | 38.5 | |

| AT22NS-76 | 70.1 | 100.6 | 30.5 | 2.39 | 41.5 | |

| AT22NS-73 | 22.9 | 103.7 | 80.8 | 2.31 | 47.4 | |

| AT21-68C | 99.1 | 120.3 | 21.2 | 3.28 | 34.4 | |

| Table 2: Previously reported holes used along updated Section 22-7N(2). AT22 series holes were drilled by Nevada King in 2022 and the AT21 series holes were drilled in 2021. True thickness of gold mineralization interpreted in today’s release is 90% to 100% of the reported intercept length in vertical holes. | ||||||

| Hole No. | From (m) |

To

(m) |

Interval

(m) |

Au

(g/t) |

Ag

(g/t) |

Notes |

| AR-19 | 228.6 | 304.8 | 76.2 | 0.82 | 3.52 | |

| DHRI-11-6C | 227.1 | 295.1 | 68 | 1.11 | 15.72 | Bottomed in Mineralization |

| KR98-11* | 239.3 | 343.0 | 103.7 | 0.81 | 3.0 | Bottomed in Mineralization |

| AR-21 | 240.8 | 304.8 | 64 | 0.39 | 4.21 | Bottomed in Mineralization |

| KR97-08* | 172.2 | 195.1 | 22.9 | 0.72 | 0.72 | |

| DHRI-11-4C | 178.3 | 301.8 | 123.5 | 1.1 | 9.0 | |

| KR97-11* | 173.8 | 205.8 | 32 | 2.00 | 9.75 | |

| AC-1 | 118.6 | 163.6 | 45 | 5.24 | 40.7 | |

| 88-13 | 121.9 | 170.7 | 48.8 | 3.95 | 46.9 | |

| DHRI-11-1C* | 74.7 | 97.5 | 22.8 | 1.9 | 19.72 | |

| GC96-7* | 152.4 | 108.2 | 44.2 | 0.87 | 23.18 | |

| Table 3: Historical holes used in updated Section 22-7N(2). DHRI series holes were drilled by Meadow Bay in 2011. KR98 series holes were drilled by Kinross in 1998. AR and AC series holes were drilled by Goldfields in 1991. GC series hole drilled by Golden Chief in 1996, and 88 series hole drilled by Bobcat in 1988. True thickness of gold mineralization interpreted in today’s release is 90% to 100% of the reported intercept length in vertical holes. *Denotes angle hole. | ||||||

| Operator | West Atlanta Graben | Atlanta Mine Fault Zone | ||||

| No. of Holes |

Average Au eq. (g/t) |

Average Thickness (m) |

No. of Holes |

Average Au eq. (g/t) |

Average Thickness (m) |

|

| NKG | 8 | 2.07 | 76.1 | 7 | 2.56 | 41.1 |

| Historical | 5 | 0.96 | 87.1 | 6 | 3.07 | 36.0 |

| Table 4. Comparison of Nevada King and historical drill results along section line 22-7N(2), using weighted averages. Gold equivalents calculated using Au/Ag prices of $1,919/oz and $22.91/oz, respectively, (Sep 8, 2023 $US spot prices). | ||||||

QA/QC Protocols

All Reverse Circulation samples from the Atlanta Project are split at the drill site and placed in cloth and plastic bags utilizing a nominal 2kg sample weight. CRF standards, blanks, and duplicates are inserted into the sample stream on-site on a one-in-twenty sample basis, meaning all three inserts are included in each 20-sample group. Samples are shipped by a local contractor in large sample shipping crates directly to American Assay Lab in Reno, Nevada, with full custody being maintained at all times. At American Assay Lab, samples were weighed then crushed to 75% passing 2mm and pulverized to 85% passing 75 microns in order to produce a 300g pulverized split. Prepared samples are initially run using a four acid + boric acid digestion process and conventional multi-element ICP-OES analysis. Gold assays are initially run using 30-gram samples by lead fire assay with an OES finish to a 0.003 ppm detection limit, with samples greater than 10 ppm finished gravimetrically. Silver samples that run greater than 100ppm are also finished gravimetrically. Every sample is also run through a cyanide leach for gold with an ICP-OES finish. The QA/QC procedure involves regular submission of Certified Analytical Standards and property-specific duplicates.

Qualified Person

The scientific and technical information in this news release has been reviewed and approved by Calvin R. Herron, P.Geo., who is a Qualified Person as defined by National Instrument 43-101.

About Nevada King Gold Corp.

Nevada King is the third largest mineral claim holder in the State of Nevada, behind Nevada Gold Mines (Barrick/Newmont) and Kinross Gold. Starting in 2016 the Company has staked large project areas hosting significant historical exploration work along the Battle Mountain trend located close to current or former producing gold mines. These project areas were initially targeted based on their potential for hosting multi-million-ounce gold deposits and were subsequently staked following a detailed geological evaluation. District-scale projects in Nevada King’s portfolio include (1) the 100% owned Atlanta Mine, located 100km southeast of Ely, (2) the Lewis and Horse Mountain-Mill Creek projects, both located between Nevada Gold Mines’ large Phoenix and Pipeline mines, and (3) the Iron Point project, located 35km east of Winnemucca, Nevada.

The Atlanta Mine is a historical gold-silver producer with a NI 43-101 compliant pit-constrained resource of 460,000 oz Au in the measured and indicated category (11.0M tonnes at 1.3 g/t) plus an inferred resource of 142,000 oz Au (5.3M tonnes at 0.83 g/t). See the NI 43-101 Technical Report on Resources titled “Atlanta Property, Lincoln County, NV” with an effective date of October 6, 2020, and a report date of December 22, 2020, as prepared by Gustavson Associates and filed under the Company’s profile on SEDAR+ (www.sedarplus.ca).

Table 5: NI 43-101 Mineral Resources at the Atlanta Mine

| Resource Category | Tonnes

(000s) |

Au Grade

(ppm) |

Contained Au Oz |

Ag Grade

(ppm) |

Contained Ag Oz |

| Measured | 4,130 | 1.51 | 200,000 | 14.0 | 1,860,000 |

| Indicated | 6,910 | 1.17 | 260,000 | 10.6 | 2,360,000 |

| Measured + Indicated | 11,000 | 1.30 | 460,000 | 11.9 | 4,220,000 |

| Inferred | 5,310 | 0.83 | 142,000 | 7.3 | 1,240,000 |

Figure 1. Location map for holes reported in this news release along updated drill section22-7N(2) relative to the perimeter of the historical Atlanta Pit and footprint of the Gustavson 2020 NI 43-101 resource. Shallow drillholes on the mine dumps have been removed from the plot for clarity. (CNW Group/Nevada King Gold Corp.)

Figure 2. Updated cross section 22-7N(2) looking north across WAF that divides AMFZ target on east from WAGZ target on west. Along the AMFZ Au/Ag mineralization is largely hosted within silica breccia horizon developed on top the Paleozoic dolomite and quartzite units, whereas mineralization within WAGZ is largely hosted within volcanic tuff and sediments above Paleozoic basement. The WAGZ is bounded on west by the WAF2 Fault, but mineralization remains open to the west in sections further north (CNW Group/Nevada King Gold Corp.)

MORE or "UNCATEGORIZED"

Eloro Resources Announces Closing of Bought Deal LIFE Private Placement for Gross Proceeds of C$17 Million

Eloro Resources Ltd. (TSX: ELO) (FSE: P2QM) is pleased to announce the closing of its previously an... READ MORE

Minera Alamos Updates Resources and Reserves for the Pan Gold Mine in Nevada

Minera Alamos Inc. (TSX-V: MAI) (OTCQX: MAIFF) is pleased to announce updated Mineral Resource and M... READ MORE

Ero Copper Reports Fourth Quarter and Full Year 2025 Operating and Financial Results

Ero Copper Corp. (TSX: ERO) (NYSE: ERO) is pleased to announce its operating and financial results f... READ MORE

Rare Element Resources Announces Results of Oversubscribed Rights Offering of Common Shares

Rare Element Resources Ltd. (OTCQB: REEMF) is pleased to report that its previously announced... READ MORE

TRX Gold Reports Record Q2 2026 Production and Company Update

TRX Gold Corporation (TSX: TRX) (NYSE American: TRX) is pleased to announce preliminary resu... READ MORE