More strong drilling results outside current resource point to further growth

Results include Cygnus’ first hole at Cedar Bay which returned a wide interval of 10.6m at 4.1g/t AuEq, including high-grade gold up to 29.1g/t AuEq

HIGHLIGHTS:

- First hole at the Cedar Bay prospect within the Chibougamau Project returns up to 29.1g/t AuEq over 0.4m within a wide interval of:

- 10.6m at 4.1g/t AuEq (3.6g/t Au, 0.3% Cu & 2.8g/t Ag) (CDR-25-11W1)

- Including 2.9m @ 6.7g/t AuEq (6.2g/t Au, 0.3% Cu & 6.3g/t Ag)

- 10.6m at 4.1g/t AuEq (3.6g/t Au, 0.3% Cu & 2.8g/t Ag) (CDR-25-11W1)

- This intersection is 200m outside the recently released Mineral Resource, which is based on drilling before Cygnus took ownership of the Chibougamau Project

- Cedar Bay has a high-grade gold-dominant Resource containing 67koz at 8.1g/t AuEq (M&I) and 205koz at 7.8g/t AuEq (Inferred) with significant potential for growth

- At the Corner Bay deposit, the flagship asset of the Chibougamau Project, results have also been received outside the recent Resource, including:

- 3.1m @ 4.9% CuEq (4.5% Cu, 0.3g/t Au & 21.7g/t Ag) (CB-25-137)

- The Corner Bay Resource contains 137kt CuEq metal at 2.8% CuEq (Indicated) and 159kt CuEq metal at 3% CuEq (Inferred)

- Cygnus continues to identify targets through the ongoing review of historical data and drill logs using Cygnus’ innovative custom-built AI solution

- Cygnus recently demonstrated significant growth at the Chibougamau Project by increasing the global Resource by 29%. The current Mineral Resource Estimate totals 6.4Mt at 3.0% CuEq for 193kt CuEq (M&I) and 8.5Mt at 3.5% CuEq for 295kt CuEq (Inferred)

- Work is ongoing to incorporate the current resource into an updated economic study which will also reflect current metal prices

- Chibougamau is a premier near-term development copper-gold opportunity with established infrastructure including a 900 ktpa processing facility, sealed highway, airport, regional rail infrastructure, and 25 kV hydro power to the processing site.

| Cygnus Executive Chairman David Southam said: “The Chibougamau Project is now clearly on a fast-growth trajectory, having recently increased our global resource by 29% and now generating wide, high-grade intersections outside the resource boundary.

“The growth outlook is highlighted by the results from Cedar Bay, which is a historic high-grade, gold-rich mine which remains totally open down plunge. To hit grades of up to 29.1g/t AuEq with a wide +40 gram metre intersection is exciting by anyone’s standard, especially in this gold market, and points to more growth at Chibougamau. “We are keeping the drill rigs turning as we continue to drive resource growth and push Chibougamau towards development”. |

|

Cygnus Metals Limited (ASX: CY5) (TSX-V: CYG) (OTCQB: CYGGF) is pleased to announce strong intersections outside the current Resource boundary at its Chibougamau Copper-Gold Project in Quebec.

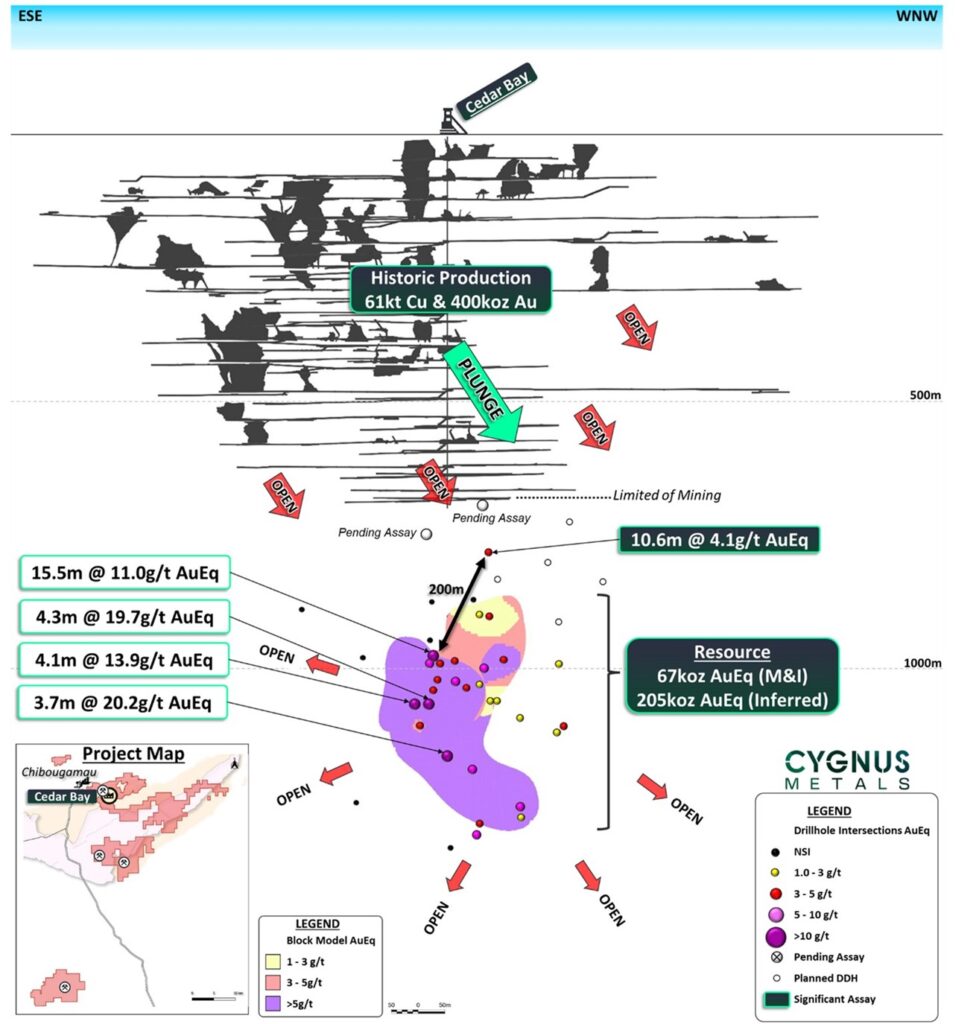

The results highlight the potential for further resource growth and include Cygnus’ first drill hole at Cedar Bay as well as additional drill holes at Corner Bay. Cedar Bay is the current focus of exploration with two rigs targeting growth opportunities surrounding the current resource, which remains open in all directions. The Cedar Bay mine closed in 1990 and was historically one of the highest-grade deposits in the camp, producing 400koz Au and 61kt Cu at an average grade of 5.2g/t AuEq.1

The current Cedar Bay Mineral Resource is gold-dominant and contains 67koz at 8.1g/t AuEq (Indicated) and 205koz at 7.8g/t AuEq (Inferred). Drill intersections already included within the Mineral Resource highlight the significant grade and potential at Cedar Bay. These include:2

- 15.5m @ 11.0g/t AuEq (8.6g/t Au, 1.7% Cu & 12.3g/t Ag) (CB-27-6A)

- 4.3m @ 19.7g/t AuEq (16.3g/t Au, 2.4% Cu & 13.3g/t Ag) (CB-27-3)

- 4.1m @ 13.9g/t AuEq (12.2g/t Au, 1.2% Cu & 10.0g/t Ag) (CDR-18-02W2)

- 3.7m @ 20.2g/t AuEq (14.0g/t Au, 4.4% Cu & 21.6g/t Ag) (CB-27-9)

Current drilling is targeting the down plunge continuity of the historic mine which remains open at depth. The first result from this exploration program has intersected a wide gold-rich zone of mineralisation:

- 10.6m @ 4.1g/t AuEq (3.6g/t Au, 0.3% Cu & 2.8g/t Ag) (CDR-25-11W1)

- Including 2.9m @ 6.7g/t AuEq (6.2g/t Au, 0.3% Cu & 6.3g/t Ag)

This result includes high grade gold up to 29.1g/t AuEq over 0.4m and extends the current interpreted mineralisation by 200m. Results are pending for two additional drill holes while the Company continues to target the plunge continuity of the Cedar Bay mineralisation with two drill rigs.

In addition, further results have been received from drilling at Corner Bay, which are also outside the recently released Mineral Resource, including:

- 3.1m @ 4.9% CuEq (4.5% Cu, 0.3g/t Au & 21.7g/t Ag) (CB-25-137)

This result again highlights the potential to grow resources around Corner Bay, which is the flagship deposit within the Chibougamau Project, with a copper dominant resource containing 137kt CuEq metal @ 2.8% CuEq (Indicated) and 159kt CuEq metal @ 3.0% CuEq (Inferred). Drilling will recommence at Corner Bay once drilling at Cedar Bay concludes and once access improves with the onset of the Quebec winter.

Cygnus is continuing its exploration strategy focussed on resource growth and resource conversion, to drive the Project forward towards development and deliver maximum returns to shareholders. In the background, the team continues to process historic data and generate additional drill targets surrounding the known high-grade copper-gold mineralisation. This is a low-risk approach which is playing a significant role in unlocking this historic district.

The Chibougamau area has well-established infrastructure giving the Project a significant head start as a copper-gold development opportunity. This infrastructure includes a 900,000tpa processing facility, local mining town, sealed highway, airport, regional rail infrastructure and 25kV hydro power to the processing site. Significantly, the Chibougamau processing facility is the only base metal processing facility within a 250km radius which includes a number of other advanced copper and gold projects.

Figure 1: Cedar Bay with high grade intersections2 included within the current Mineral Resource plus recent result of 10.6m @ 4.1g/t AuEq (CDR-25-11W1).

About Cygnus Metals

Cygnus Metals Limited is a diversified critical minerals exploration and development company with projects in Quebec, Canada and Western Australia. The Company is dedicated to advancing its Chibougamau Copper-Gold Project in Quebec with an aggressive exploration program to drive resource growth and develop a hub-and-spoke operation model with its centralised processing facility. In addition, Cygnus has quality lithium assets with significant exploration upside in the world-class James Bay district in Quebec, and REE and base metal projects in Western Australia. The Cygnus team has a proven track record of turning exploration success into production enterprises and creating shareholder value.

APPENDIX A – Significant Intersections from Exploration Drilling

Coordinates given in UTM NAD83 (Zone 18). Intercept lengths may not add up due to rounding to the appropriate reporting precision. At Cedar Bay significant intersections reported above 2g/t AuEq over widths of greater than 3m. True width estimated to be 90% of downhole thickness. At Corner Bay significant intersections reported above 2% CuEq over widths of greater than 1.5m. True width estimated to be 90% of downhole thickness.

| Hole ID | X | Y | Z | Azi | Dip | Depth (m) |

From (m) |

To (m) |

Interval (m) |

Au (g/t) |

Cu (%) |

Ag (g/t) |

AuEq (g/t) |

CuEq (%) |

| CDR-25-11W1 | 549084 | 5526803 | 380 | 63 | -48 | 1203 | 1017.9 | 1028.4 | 10.6 | 3.6 | 0.3 | 2.8 | 4.1 | 3.0 |

| Inc | 1017.9 | 1018.3 | 0.4 | 25.3 | 2.7 | 9.0 | 29.1 | 21.5 | ||||||

| & Inc | 1025.5 | 1028.4 | 2.9 | 6.2 | 0.3 | 6.3 | 6.7 | 5.0 | ||||||

| CB-25-136 | 554920 | 5509857 | 400 | 90 | -54 | 429 | 416.6 | 418.7 | 2.0 | 0.3 | 2.1 | 6.8 | 3.1 | 2.3 |

| CB-25-137 | 555071 | 5509889 | 403 | 83 | -52 | 255 | 233.9 | 237.0 | 3.1 | 0.3 | 4.5 | 21.7 | 6.7 | 4.9 |

| CB-25-139 | 555109 | 5509933 | 400 | 102 | -45 | 210 | 188.6 | 190.5 | 1.8 | 0.2 | 1.9 | 8.8 | 2.9 | 2.1 |

APPENDIX B – Mineral Resource Estimate for the Chibougamau Project as at 16 September 2025

| Cu Project |

Classification | COG CuEq |

Tonnage | Average Grade | Contained Metal | ||||||||

| Cu | Au | Ag | CuEq | AuEq | Cu | Au | Ag | CuEq | AuEq | ||||

| % | Mt | % | g/t | g/t | % | g/t | kt | koz | koz | kt | koz | ||

| Corner Bay | Indicated | 1.2 | 4.9 | 2.5 | 0.3 | 8.4 | 2.8 | 4.1 | 124 | 43 | 1,316 | 137 | 638 |

| Inferred | 5.4 | 2.7 | 0.2 | 8.9 | 3.0 | 4.3 | 146 | 41 | 1,543 | 159 | 744 | ||

| Devlin | Measured | 1.5 | 0.1 | 2.7 | 0.3 | 0.5 | 2.9 | 4.7 | 4 | 1 | 2 | 4 | 19 |

| Indicated | 0.6 | 2.0 | 0.2 | 0.2 | 2.1 | 3.4 | 13 | 4 | 5 | 13 | 69 | ||

| M&I | 0.8 | 2.1 | 0.2 | 0.3 | 2.3 | 3.6 | 16 | 5 | 7 | 17 | 88 | ||

| Inferred | 0.3 | 2.0 | 0.2 | 0.3 | 2.1 | 3.4 | 7 | 2 | 3 | 7 | 36 | ||

| Joe Mann | Inferred | 2.0 | 0.7 | 0.2 | 6.0 | – | 4.6 | 6.3 | 2 | 143 | – | 34 | 151 |

| Cedar Bay | Indicated | 1.8 | 0.3 | 1.6 | 6.0 | 9.9 | 6.4 | 8.1 | 4 | 50 | 82 | 16 | 67 |

| Inferred | 0.8 | 2.0 | 5.1 | 11.8 | 6.1 | 7.8 | 17 | 134 | 309 | 50 | 205 | ||

| Golden Eye | Indicated | 0.5 | 1.0 | 4.3 | 9.9 | 4.4 | 5.6 | 5 | 69 | 161 | 22 | 91 | |

| Inferred | 1.2 | 0.9 | 3.4 | 7.9 | 3.6 | 4.6 | 11 | 134 | 313 | 45 | 182 | ||

| Project | Classification | Tonnage | Average Grade | Contained Metal | |||||||||

| Cu | Au | Ag | CuEq | AuEq | Cu | Au | Ag | CuEq | AuEq | ||||

| Mt | % | g/t | g/t | % | g/t | kt | koz | koz | kt | koz | |||

| Hub and Spoke | Measured | 0.1 | 2.7 | 0.3 | 0.5 | 2.9 | 4.7 | 4 | 1 | 2 | 4 | 19 | |

| Indicated | 6.3 | 2.3 | 0.8 | 7.8 | 3.0 | 4.3 | 146 | 166 | 1,563 | 189 | 865 | ||

| M&I | 6.4 | 2.3 | 0.8 | 7.6 | 3.0 | 4.3 | 149 | 167 | 1,565 | 193 | 884 | ||

| Inferred | 8.5 | 2.1 | 1.7 | 7.9 | 3.5 | 4.8 | 182 | 454 | 2,168 | 295 | 1,318 | ||

Notes:

- Cygnus’ Mineral Resource Estimate for the Chibougamau Copper-Gold project, incorporating the Corner Bay, Devlin, Joe Mann, Cedar Bay, and Golden Eye deposits, is reported in accordance with the JORC Code and the Canadian Institute of Mining, Metallurgy and Petroleum (“CIM”) (2014) definitions in NI 43-101.

- Mineral Resources are estimated using a long-term copper price of US$9,370/t, gold price of US$2,400/oz, and silver price of US$30/oz, and a US$/C$ exchange rate of 1:1.35.

- Mineral Resources are estimated at a CuEq cut-off grade of 1.2% for Corner Bay and 1.5% CuEq for Devlin. A cut-off grade of 1.8 g/t AuEq was used for Cedar Bay and Golden Eye; and 2.0 g/t AuEq for Joe Mann.

- Corner Bay bulk density varies from 2.85 tonnes per cubic metre (t/m3) to 3.02t/m3 for the estimation domains and 2.0 t/m3 for the overburden. At Devlin, bulk density varies from 2.85 t/m3 to 2.90 t/m3. Cedar Bay, Golden Eye, and Joe Mann use a bulk density of 2.90 t/m³ for the estimation domains.

- Assumed metallurgical recoveries are as follows: Corner Bay copper is 93%, gold is 78%, and silver is 80%; Devlin copper is 96%, gold is 73%, and silver is 80%; Joe Mann copper is 95%, gold is 84%, and silver is 80%; and Cedar Bay and Golden Eye copper is 91%, gold is 87%, and silver is 80%.

- Assumptions for CuEq and AuEq calculations (set out below) are as follows: Individual metal grades are set out in the table. Commodity prices used: copper price of US$9,370/t, gold price of US$2,400/oz and silver price of US$30/oz. Assumed metallurgical recovery factors: set out above. It is the Company’s view that all elements in the metal equivalent calculations have a reasonable potential to be recovered and sold.

- CuEq Calculations are as follows: (A) Corner Bay = grade Cu (%) + 0.68919 * grade Au (g/t) + 0.00884 * grade Ag (g/t) ; (B) Devlin = grade Cu (%) + 0.62517 * grade Au (g/t) + 0.00862 * grade Ag (g/t); (C) Joe Mann = grade Cu (%) + 0.72774* grade Au (g/t); and (D) Golden Eye and Cedar Bay = grade Cu (%) + 0.78730* grade Au (g/t) + 0.00905 * grade Ag (g/t).

- AuEq Calculations are as follows: (A) Corner Bay = grade Au (g/t) + 1.45097* grade Cu(%)+0.01282* grade Ag (g/t); (B) Devlin = grade Au (g/t) + 1.59957* grade Cu(%)+0.01379* grade Ag (g/t); (C) Joe Mann = grade Au (g/t) + 1.37411* grade Cu (%); and (D) Cedar Bay and Golden Eye = grade Au (g/t) + 1.27016 * grade Cu (%) + 0.01149 * grade Ag (g/t).

- Wireframes were built using an approximate minimum thickness of 2 m at Corner Bay, 1.8 m at Devlin, 1.2 m at Joe Mann, and 1.5 m at Cedar Bay and Golden Eye.

- Mineral Resources are constrained by underground reporting shapes.

- Mineral Resources that are not Mineral Reserves do not have demonstrated economic viability.

- Totals may vary due to rounding.

MORE or "UNCATEGORIZED"

Eloro Resources Announces Closing of Bought Deal LIFE Private Placement for Gross Proceeds of C$17 Million

Eloro Resources Ltd. (TSX: ELO) (FSE: P2QM) is pleased to announce the closing of its previously an... READ MORE

Minera Alamos Updates Resources and Reserves for the Pan Gold Mine in Nevada

Minera Alamos Inc. (TSX-V: MAI) (OTCQX: MAIFF) is pleased to announce updated Mineral Resource and M... READ MORE

Ero Copper Reports Fourth Quarter and Full Year 2025 Operating and Financial Results

Ero Copper Corp. (TSX: ERO) (NYSE: ERO) is pleased to announce its operating and financial results f... READ MORE

Rare Element Resources Announces Results of Oversubscribed Rights Offering of Common Shares

Rare Element Resources Ltd. (OTCQB: REEMF) is pleased to report that its previously announced... READ MORE

TRX Gold Reports Record Q2 2026 Production and Company Update

TRX Gold Corporation (TSX: TRX) (NYSE American: TRX) is pleased to announce preliminary resu... READ MORE