Moon River Moly Ltd. Announces Preliminary Economic Assessment of Potential Restart of 25% Owned Endako Molybdenum Mine

HIGHLIGHTS:

- Pre-tax net present value of $1.1 billion, internal rate of return of 46%, an after-tax NPV of $790 million and an IRR of 40% at an 8% discount rate and assuming a long-term molybdenum price of US$49.73 per kg (US$22.50 per pound);

- 10-year mine life based on 75,000 tonnes of mill throughput per day or 27.3 million tonnes per-year;

- Initial capital cost of $550.9 million including $83.7 million of contingency;

- Annual average production of 9.3 million kg or 20.5 million pounds of Mo;

- Average cash cost of US$25.60 per kg or US$11.61 per lb and All-In Sustaining Cost of US$29.85 per kg or US$13.54 per lb of Mo;

- Open pit mine with flotation processing facilities on site;

- A measured and indicated mineral resource of 335.7 million tonnes grading 0.072% MoS2 (0.0 43 % Mo) (see Table 1.1;

- A 2.2-year payback;

- Life-of-mine direct income and mining taxes in excess of $609 million;

- Potential Project enhancements from the use of ore bucket sorting technology and ore particle sorting (“OPS”) technology.

All dollar amounts are stated in Canadian Dollars unless otherwise noted.

Moon River Moly Ltd. (TSX-V: MOO) is pleased to announce the results of a Preliminary Economic Assessment for the Endako mine complex in British Columbia, currently on care and maintenance, comprised of an open-pit molybdenum mine, concentrator, and roaster, located approximately 190 kilometres west of Prince George, British Columbia. The PEA examines the potential restart of operations at the Endako Mine.

Paul Parisotto, President and Chief Executive Officer, says of the PEA results: “We are very pleased with the positive results of the PEA as it presents a very convincing case for the rapid advancement of the necessary work to restart mining operations at the Endako Mine.”

Ian McDonald, Chairman, commented: “My involvement with this Project first began twenty years ago, and I firmly believe that the time for the restart of production at the Endako Mine has arrived. The compelling, robust economics, together with a Tier One jurisdiction in a mining-friendly province, indicate that the Endako Mine can recapture its position as Canada’s largest molybdenum producer.”

The PEA was prepared by A-Z Mining Professionals Ltd. and contemplates the restart of open pit mining with potentially economic mineralization processed in the existing on-site processing facilities. The open pit will produce approximately 26 to 27 million tonnes per year of potentially economic molybdenum mineralization. Run of Mine potentially economic mineralization will be crushed, ground in the SAG mill located in the New Plant (as defined below), ground in ball mills located in both the New Plant and Old Plant, as described further below, and followed by Mo concentrate produced by flotation. The resulting Life of Mine is 10 years.

BACKGROUND

The Endako Mine is a past producing mine with flooded open pits, an original mothballed processing facility which had processing capacity of approximately 30,000 tonnes per day, a larger 52,000 tonnes per day processing facility on care and maintenance since 2015 and all support infrastructure and facilities in place (also on care and maintenance). Both processing facilities employed flotation recovery producing molybdenum concentrate.

The Endako Mine is located in the Bulkley-Nechako region of central British Columbia, approximately 190 kilometres (km) west of Prince George and about 400 km east of Prince Rupert, British Columbia. The nearest town is Fraser Lake, about 15 km east of the Endako Mine and is located about 10 km south of Highway 16 (the Yellowhead Highway) on a paved road.

On May 30, 2024, Moon River completed the indirect acquisition of a 25% interest in the Endako Mine from Sojitz Corporation, a Japanese multi-national company. The Endako Mine is jointly owned by Moon River (25%) and Centerra Gold Inc. (75%) and operates through a joint venture company. While Centerra is aware that this PEA was being prepared for Moon River, it has neither participated in nor endorsed the work.

PROJECT RESTART PLAN

The restart mining plan comprises:

- Mining measured and indicated potentially economic mineralization, located mainly in the walls and floors, of the existing Endako and Denak open pits.

- Rebuilding existing blast hole drills and rope shovels from the past operation and lease major mining equipment and purchase smaller support equipment for the mine.

- Relocating the existing primary crusher and a second new crusher to outside of the new ultimate open pit limits.

- Adding pumping capacity to split the mill feed between the New Plant and the Old Plant ball mills and add extra rougher flotation capacity to the New Plant to allow for the planned higher throughput.

- Refurbishing a portion of the Old Plant grinding circuit to provide an extra 20,000 – 25,000 tonnes per day grinding capacity and connecting this grinding circuit to the New Plant flotation circuit.

- Refurbishing of major equipment and refurbishing or replacing smaller equipment components (as required) in the processing plants.

- Construction of a new concentrate dewatering and drying circuit and building.

- Construction of a tailings sand plant to produce cycloned tailings to facilitate tailings dams height and storage capacity increases to meet the restart mine plan.

- Refurbishing and/or upgrading, as required, of the site infrastructure buildings, facilities, and services.

- Construction of a water treatment plant to treat all contact water (water from disturbed areas of the mine) not recycled in the mining and processing operations.

- Reconfiguring and installation of water pipelines to store and remove water (water from the disturbed areas of the mine) not recycled in the mining and processing operations.

- Construction of water pipelines from TP-1 to the WTP and from the WTP to the discharge to the environment location on the Endako River.

- Sale of molybdenum concentrate to domestic and international smelters.

Mining would employ open pit techniques using conventional rubber tired, diesel-powered mobile equipment, track mounted drills, and rope shovels.

The LOM measured and indicated potentially economic mineralization production is scheduled at approximately 26 to 27 million tonnes per year. The mine schedule prioritizes mining of higher-grade material from within the open pits for the first approximately 10 years. The LOM strip ratio is favourable at 0.68 tonnes of waste per 1 tonne of potentially mineable resources.

The mine schedule is based on the optimised pit shell with mining recovery and mining dilution rates of 95% and 5%, respectively.

Mining will be performed on a 24 hour, 7 days per week basis. Mining equipment will be a combination of leased and owned.

The potentially mineable resources from the open pit optimisation were used to develop the mine plan, which would extract 273 million tonnes at an average grade of 0.075% MoS2 (0.045% Mo) after dilution and mining losses.

PROCESSING

Recovery of a molybdenum concentrate from potentially economic mineralization will be achieved using the refurbished existing processing plant facilities. The addition of new processing equipment is required for concentrate leaching, dewatering, and drying. The processing plant will have a capacity to treat 75,000 tonnes per day or 27 million tonnes per annum.

The existing in-pit primary crusher and a new second crusher, located close to the New Plant, will process the potentially economic ROM mineralization. The crushed potentially economic mineralization will be ground in the SAG mill located in the New Plant followed by grinding in ball mills located in both the New Plant and the Old Plant.

The grinding products from the Old Plant and the New Plant will be combined at the beginning of the New Plant flotation circuits. Concentrate will be produced by rougher/scavenger flotation, primary concentrate regrinding, first cleaner/scavenger flotation, secondary concentrate regrinding, secondary cleaner flotation, and final concentrate thickening.

Final concentrate leaching and product dewatering and drying will be performed in a new facility constructed on the footprint of the existing ultra-pure plant (to be demolished).

The forecast average processing plant molybdenum recovery is 75.7%.

INFRASTRUCTURE

Existing infrastructure includes:

- access roads, BC power grid-power supply to site, nearby railway line and fresh water supply network;

- primary crushing plant; (to be moved);

- one new processing plant capable of processing 52,000 tonnes/day;

- one old decommissioned processing plant capable of processing 30,000 tonnes/day;

- tailings management facility with 2 disposal areas TP-1 and TP-3;

- reclaim water ponds;

- administration, warehouse, change house, laboratory, mine shops and buildings; and

- one reclaimed tailings disposal area TP-2; and

- two non-operational roasters.

Refurbishing and upgrading of all facilities, other than the existing roasters which will remain non-operational, will be required and are included in the restart plan and cost estimates.

MANPOWER

The operation would employ a total of approximately 500 hourly and staff personnel.

ENVIRONMENT AND PERMITTING

The Endako Mine is in compliance with all necessary permits for its status as an operation on care and maintenance. A restart of mining operations will necessitate the reactivation and refreshing of all necessary water and operating permits. Additionally, an amendment to the existing tailings management facility permit will be required, prior to production. This will allow placement of classified tailings to increase the dam heights, in order to accommodate LOM tailings disposal. It is anticipated that the required permits for a restart of mining operations will be obtained as a matter of course.

PROJECT SCHEDULE

The Endako Mine restart schedule requires approximately 1.5 to 2 years from the approval of restart to the start of production. During the first year, detailed engineering on the open pit mining, processing plants reconfiguration and upgrades, support facilities refurbishment and upgrades, preparation and awarding of contractor and supplier major contracts will be completed. Construction and start of commissioning will require an additional year.

MINERAL RESOURCE

The data used to generate the resource calculation was reviewed and approved by F. Bakker P.Geo. This included two site visits (April 2025 and September 2025) by the author. Sampling methods, QAQC programs and databases were examined. As the database contains approximately 360,000 individual assays and over 290,000 drill holes (reverse circulation, diamond drill and blast holes) it was not possible to verify the entire data set due to the volume of data and as many of the holes no longer exist. The assay data was verified by comparing to Endako written reports, filed assessment reports and month end statements and work undertaken by previous authors. The author is of the opinion that the accuracy of the data was sufficient for a mineral resource statement.

The mineral resource was calculated utilizing commercial 3D Block Modelling Software (HxGN Mine Plantm 3D). The model utilized geological domains based on geostatistics, lithology, a grade limit design of approximately 0.01% MoS2 and limits imposed by both existing pit walls and potentially new pit wall limits. This resource model was used for determining the mineral resources estimate and to undertake open pit optimisation of a mine production plan utilizing the potentially mineable resource.

The effective date of the mineral resource is the upcoming publication date of the PEA.

The author is unaware of any known legal, political, environmental, or other risks that could materially affect the potential development of the mineral resources or mineral reserves as this was an existing operating mine.

Table 1.1 presents the mineral resource estimate for the Endako Mine at various cut-off grades. Inferred mineral resources were not included in the PEA economic analysis.

Table 1.1 Mineral Resources

| MEASURED RESOURCE |

INDICATED RESOURCE |

MEASURED AND INDICATED | INFERRED RESOURCE |

||||||||||

| ZONE | TONNES | %MoS2 | TONNES | %MoS2 | TONNES | %MoS2 | TONNES | %MoS2 | |||||

| Total | >= | 0.010 | 237,413,000 | 0.0468 | 435,641,000 | 0.049 | 673,054,000 | 0.048 | 164,564,000 | 0.038 | |||

| Total | >= | 0.015 | 206,183,000 | 0.0522 | 409,652,000 | 0.052 | 615,835,000 | 0.052 | 144,091,000 | 0.037 | |||

| Total | >= | 0.020 | 183,642,000 | 0.0565 | 382,707,000 | 0.054 | 566,349,000 | 0.055 | 128,689,000 | 0.040 | |||

| Total | >= | 0.025 | 157,962,000 | 0.0621 | 347,564,000 | 0.057 | 505,526,000 | 0.059 | 112,503,000 | 0.043 | |||

| Total | >= | 0.030 | 138,289,000 | 0.0671 | 311,767,000 | 0.061 | 450,056,000 | 0.063 | 93,871,000 | 0.046 | |||

| Total | >= | 0.035 | 117,593,000 | 0.0733 | 271,696,000 | 0.065 | 389,289,000 | 0.067 | 76,928,000 | 0.050 | |||

| Total | >= | 0.040 | 100,673,000 | 0.0794 | 234,981,000 | 0.069 | 335,654,000 | 0.072 | 60,127,000 | 0.054 | |||

| Total | >= | 0.045 | 85,723,000 | 0.0860 | 187,826,000 | 0.074 | 273,549,000 | 0.078 | 45,770,000 | 0.060 | |||

| Total | >= | 0.050 | 73,121,000 | 0.0927 | 158,985,000 | 0.079 | 232,106,000 | 0.084 | 34,961,000 | 0.066 | |||

| Total | >= | 0.055 | 62,662,000 | 0.0996 | 132,436,000 | 0.085 | 195,098,000 | 0.090 | 27,753,000 | 0.072 | |||

| Total | >= | 0.060 | 54,246,000 | 0.1061 | 112,264,000 | 0.090 | 166,510,000 | 0.095 | 22,864,000 | 0.077 | |||

| Total | >= | 0.065 | 46,871,000 | 0.1131 | 93,091,000 | 0.096 | 139,962,000 | 0.102 | 18,903,000 | 0.083 | |||

| Total | >= | 0.070 | 40,936,000 | 0.1198 | 78,354,000 | 0.101 | 119,290,000 | 0.108 | 15,875,000 | 0.087 | |||

| Total | >= | 0.075 | 35,776,000 | 0.1267 | 64,680,000 | 0.107 | 100,456,000 | 0.114 | 13,276,000 | 0.092 | |||

| Total | >= | 0.080 | 31,269,000 | 0.1339 | 54,004,000 | 0.113 | 85,273,000 | 0.121 | 11,042,000 | 0.097 | |||

The highlighted resource at a cutoff grade of 0.040%MoS2, (excluding inferred resources) is the long term potentially economic mineralization that could be available for mining. This cutoff grade was used in determining the mining plan which reflects the mining and processing rate of approximately 27 million tonnes per year at an overall LOM operating cost of $11.84. The 0.040% MoS2 cutoff was chosen as it has an in-situ value of $12.14 per tonne, which is slightly above the LOM mining cost. (Grade/100 x 2204 lbs/tonne x conversion to Mo (0.599%) x Mill Recovery (75.7%) x $22.5 (price/lb) x1.35 (US$ Exchange rate) = $12.14/tonne).

There are no mineral reserves for the Endako Mine. Mineral resources that are not mineral reserves do not have demonstrated economic viability.

CAPITAL EXPENDITURES

Pre-production capital expenditures for the Project Base Case are estimated to total $493.7 million. The total capital expenditure includes contingencies from 20% to 30%. The breakdown of capital expenditures is presented in Table 1.2 below.

| Table 1.2 Pre-production Capital Expenditures – Estimates |

|

| Component | Total Expenditures ($ million) |

| Mine | $35.1 |

| Equipment Lease Deposit and Purchases | $23.3 |

| Processing Plant | $89.2 |

| Tailings Management Facilities | $150.1 |

| Surface Infrastructure | $13.2 |

| Non- Mining Mobile Equipment | $5.0 |

| Water Management | $31.5 |

| Water Treatment | $52.7 |

| Owner’s Costs | $10.0 |

| Contingency | $83.7 |

| Total | $493.7 |

In addition to the capital expenditures, working capital of $57.2 million, based on 3 months of operating costs, has been estimated.

LOM sustaining capital requirements of $3.2 million are estimated. This comprises upgrades to the processing plant and surface infrastructure. Mining equipment is to be leased to own for the LOM. The tailings management facility dam raising costs are included in operating costs as the tailings will be used to increase dam heights as part of the tailings facility management plan.

OPERATING COSTS

The estimated total average Base Case operating cost (excluding smelting and refining) is approximately $11.84 per tonne of potentially mineable resources or the equivalent (exchange rate of CAD$: US$ =1.35) or US$11.61 per pound of molybdenum. Table 1.3 below, presents a summary of the LOM average operating costs for each department on a cost per tonne of potentially mineable resources basis.

| Table 1.3 Project Operating Costs Summary |

|

| Component | Cost/tonne ($) |

| Mining | $5.45 |

| Processing and Tailings | $5.53 |

| Surface Department, Environmental, and G&A | $0.86 |

| Total Operating Cost per Tonne | $11.84 |

| Total Operating Cost per Pound of Molybdenum | US$11.61 |

FINANCIAL RESULTS

The financial returns (Table 1.4) from the potentially mineable resources are presented for the expected parameters and costs at a molybdenum long term three-year trailing average price of US$49.73 per kg (US$22.50 per pound lb.) of molybdenum oxide, at an exchange rate of CAD$ 1.00 = US$0.74.

The Endako Mine is forecast to produce approximately 9.3 million kilograms (20.5 million pounds) per year of molybdenum metal in concentrate. Life of Mine total molybdenum metal in concentrate production is 93.3 million kilograms (205.2 million lbs.).

| Table 1.4 Base Case Financial Returns |

||

| Pre-Tax | After-Tax | |

| Pre-production CAPEX ($ millions) | $493.7 | $493.7 |

| Undiscounted Net Revenue ($ millions) | $5,854 | $5,854 |

| Undiscounted Total Cash Flow ($ millions) | $2,087 | $1,478 |

| NPV (5%) – millions | $1,405 | $996 |

| NPV (8%) – millions | $1,116 | $790 |

| IRR | 46% | 40% |

| Payback Period | 2.2 years | 2.2 years |

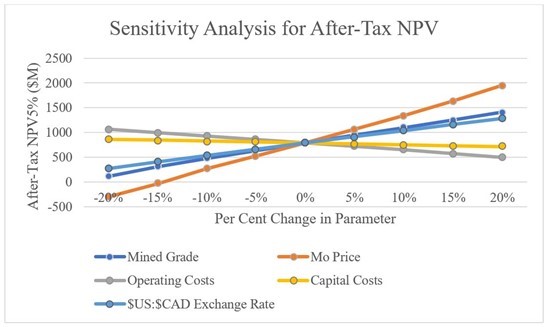

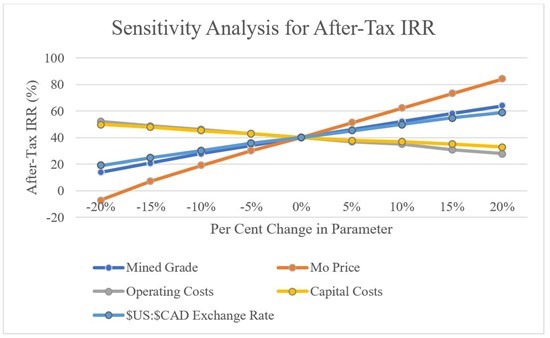

SENSITIVITY ANALYSIS

Sensitivity analysis was performed for molybdenum price, capital expenditures, operating costs, mined grades and exchange rate for ranges up to ±20%. The Project is sensitive to changes in metals prices and reasonably sensitive to changes in all the other variables.

The sensitivity analysis results are shown in Table 1.5 and 1.6 and Figure 1.1 and 1.2. Financial results are most sensitive to grade, exchange rate and molybdenum price changes and least sensitive to capital expenditures and operating costs.

| Table 1.5 Sensitivity Analysis for After-Tax NPV |

|||||||||

| Parameter | After-Tax NPV 8% ($ million) | ||||||||

| -20% | -15% | -10% | -5% | 0% | 5% | 10% | 15% | 20% | |

| Mined Grade | 114 | 313 | 473 | 635 | 790 | 945 | 1100 | 1254 | 1409 |

| Molybdenum Price | -302 | -31 | 265 | 526 | 790 | 1061 | 1344 | 1641 | 1948 |

| Operating Costs | 1071 | 1001 | 931 | 862 | 790 | 719 | 649 | 573 | 502 |

| Capital Costs | 865 | 846 | 828 | 808 | 790 | 771 | 753 | 734 | 716 |

| US$:CAD$ Exchange Rate | 273 | 407 | 536 | 666 | 790 | 915 | 1038 | 1161 | 1284 |

| Table 1.6 Sensitivity Analysis for After-Tax IRR |

|||||||||

| Parameter | After-Tax IRR (%) | ||||||||

| -20% | -15% | -10% | -5% | 0% | 5% | 10% | 15% | 20% | |

| Mined Grade | 14 | 21 | 28 | 34 | 40 | 46 | 52 | 58 | 64 |

| Molybdenum Price | -7 | 7 | 19 | 30 | 40 | 51 | 62 | 73 | 84 |

| Operating Costs | 52 | 49 | 46 | 43 | 40 | 37 | 35 | 31 | 28 |

| Capital Costs | 50 | 48 | 45 | 43 | 40 | 38 | 37 | 35 | 33 |

| US$:CAD$ Exchange Rate | 19 | 25 | 30 | 36 | 40 | 45 | 50 | 55 | 59 |

Figure 1.1 Graph of Net Present Value (NPV) at 8% Discount Rate

Figure 1.2 Graph of IRR Sensitivity Analysis

POTENTIAL PROJECT ENHANCEMENTS

Preliminary assessment of shovel/excavator whole bucket ore and waste differentiation has been investigated. This would potentially facilitate better in-pit grade control and minimize waste rock sent to the processing plant for beneficiation. In-bucket sensors determine if a loaded bucket of material is ore or waste, for placing in the appropriate truck for transport to the primary crusher or waste storage areas.

OPS technology, whereby rock exiting the primary crushers can be screened for an optimum size, should be further investigated. There is currently a 5-tonne representative sample of rock from the Endako pit undergoing testing at a reputable vendor and manufacturer of OPS equipment.

RECOMMENDATIONS

Based on this PEA, Endako Mine restart recommendations are:

- Complete a Feasibility Study for mine restart using a mining and processing rate of approximately 75,000 tonnes per day (27 million tonnes per year) of potentially economic mineralization.

- For the Feasibility Study, develop a new geology block model for use in resources estimation, using geological data owned by the joint venture company. A new model should be constructed using metric measures consistent with present Canadian practice and to avoid potential errors with conversions using a mix of Metric and Imperial measures.

- Undertake diamond drilling on nearby known targets of potential resources to expand potentially mineable resources and increase the LOM.

- Develop an updated or new detailed water management model which would include hydrology and tailings management facility leachate seepage data and forecasts.

- Investigate the use of excavator/shovel bucket ore sensing technology and OPS technology for inclusion in the Feasibility Study.

Non-IFRS Financial Measures

The Company has included in this news release certain terms or performance measures commonly used in the mining industry that are not defined under International Financial Reporting Standards as issued by the International Accounting Board (“IFRS”). These include Operating Costs, Cash Cost, AISC, Pre-Production Capital Expenditures, Sustaining Capital Expenditures, and Life of Mine Average Operating Costs. Non-IFRS measures do not have any standardized meaning prescribed under IFRS, and therefore, they may not be comparable to similar measures employed by other companies. The data presented are intended to provide additional information and should not be considered in isolation or as a substitute for measures prepared in accordance with IFRS. Non-IFRS financial measures used in this news release and common to the mining industry are defined.

Operating Costs include mining, processing, general and administrative, concentrate transportation costs, treatment and refining charges, etc.

Cash costs include on-site mining costs plus on-site G&A, royalties/production taxes and permitting/community costs related to current operations.

AISC includes total cash costs plus reclamation costs, exploration and study costs, sustaining capital exploration/development and sustaining capital expenditure.

Technical Report & Qualified Persons

A Technical Report in respect of the PEA prepared in accordance with National Instrument 43-101 Standards of Disclosure for Mineral Projects will be filed on SEDAR+ under the Company’s issuer profile within 45 days of the date of this news release. Readers are encouraged to read the Technical Report in its entirety, including all qualifications, assumptions and exclusions that relate to the mineral resource estimate and the PEA. The Technical Report is intended to be read as a whole, and sections should not be read or relied upon out of context.

Qualified Persons

The scientific and technical content of this news release was reviewed, verified, and approved by Mr. Brian LeBlanc, P. Eng., President of AMPL, an independent “qualified person” as defined by NI 43-101. Mr. LeBlanc is the QP responsible for the scientific and technical information contained in this news release.

About Moon River

Moon River is a Canadian-based resource company focused on the acquisition, exploration and development of mineral projects. Moon River is focused on the development of the Davidson Property which hosts a large molybdenum-copper-tungsten deposit and is located near Smithers, British Columbia. The Company also holds 25% of one of the largest molybdenum mines in North America, the Endako Mine Complex also located in British Columbia.

MORE or "UNCATEGORIZED"

Eloro Resources Announces Closing of Bought Deal LIFE Private Placement for Gross Proceeds of C$17 Million

Eloro Resources Ltd. (TSX: ELO) (FSE: P2QM) is pleased to announce the closing of its previously an... READ MORE

Minera Alamos Updates Resources and Reserves for the Pan Gold Mine in Nevada

Minera Alamos Inc. (TSX-V: MAI) (OTCQX: MAIFF) is pleased to announce updated Mineral Resource and M... READ MORE

Ero Copper Reports Fourth Quarter and Full Year 2025 Operating and Financial Results

Ero Copper Corp. (TSX: ERO) (NYSE: ERO) is pleased to announce its operating and financial results f... READ MORE

Rare Element Resources Announces Results of Oversubscribed Rights Offering of Common Shares

Rare Element Resources Ltd. (OTCQB: REEMF) is pleased to report that its previously announced... READ MORE

TRX Gold Reports Record Q2 2026 Production and Company Update

TRX Gold Corporation (TSX: TRX) (NYSE American: TRX) is pleased to announce preliminary resu... READ MORE