Monarch Expands Size of McKenzie Break to 1,100 m by 700 m With Latest Drilling Results

- Monarch reports gold assays for the remaining 16 drill holes of its 2022 McKenzie Break drilling program.

- Hole MK-22-349 intersects 1.26 g/t Au over 23.6 m, followed by another broad zone 47 metres down the hole with 1.41 g/t Au over 17.3 m. This drill hole is located approximately 35 metres beyond the southeast limit of the pit shell defined in the 2021 mineral resource estimate.

- Notable high-grade mineralization between two of the larger mineral resource blocks defined in 2021, include 10.12 g/t Au over 1.73 m and 11.91 g/t Au over 1.84 m, both intersections are located in hole MK-22-350.

- The most northeasterly hole of the McKenzie Break drilling intersected 5.90 g/t Au over 2.12 m (MK-22-361), highlighting that the mineralization is still very open.

- One of the most northwesterly holes, just at the edge of the pit shell, intersected 5.29 g/t Au over 1.93 m and 9.19 g/t Au over 0.66 m. Again, showing the zone is open to the northwest.

- Results from the 2022 drilling program confirm that the pit shell and underground mineral resource can be expanded beyond the limits defined in the 2021 mineral resource estimate.

MONARCH MINING CORPORATION (TSX: GBAR) (OTCQB: GBARF) is pleased to report additional results from the 2022 drilling program on its wholly-owned McKenzie Break gold project, located 25 kilometres north of the Corporation’s wholly owned Beacon mill.

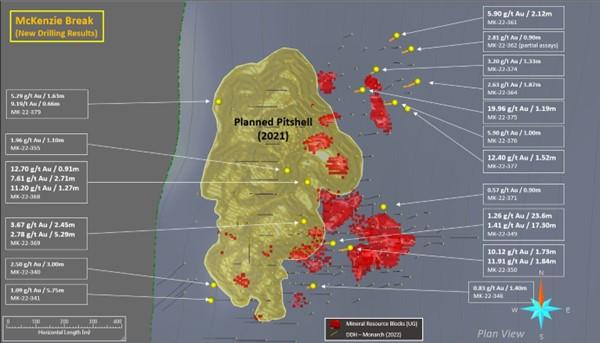

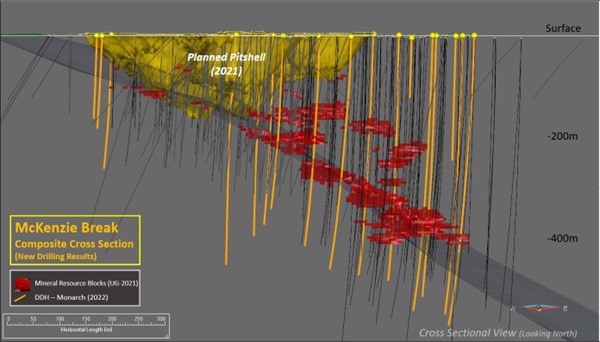

The 2022 drilling program on the McKenzie Break property totaled 16,104 metres in 53 holes. Today, Monarch is reporting the results from the remaining 16 holes totalling 5,950 metres (see Figure 1, Figure 2, and Tables 1 and 2 for complete results. True width is estimated to be between 85% and 90% of core length). Some assays are still pending for one of the holes (MK-22-362).

The drilling program was aimed at expanding the size of the 2021 mineral resource estimate, including the current pit shell in the up-dip direction (to the west and south), and the underground resource to the east and north. The mineralized envelope has increased and now measures 1,100 metres by 700 metres and has been tested down to a maximum vertical depth of 400 metres.

Recent results have defined broad zones of mineralization, including 1.26 g/t Au over 23.6 m, followed by another zone 47 m down the hole with 1.41 g/t Au over 17.3 m (MK-22-349). This drill hole is located approximately 35 metres beyond the southeast limit of the pit shell defined in the 2021 MRE.

Notable high-grade mineralization was recently identified between two of the larger mineral resource blocks that were defined in the 2021 MRE. This included 10.12 g/t Au over 1.73 m and 11.91 g/t Au over 1.84 m, both hosted in hole MK-22-350. These intersections confirm the high-grade nature of the gold mineralization in this area.

The most northeasterly holes of the program continue to show encouragement and that the mineralization continues and is very much open in the downdip direction. Better intersections currently being reported included 5.90 g/t Au over 2.12 m (MK-22-361), 2.63 g/t Au over 1.87 m (MK-22-364) and 12.40 g/t Au over 1.52 m (MK-22-377).

Drilling results to expand the pit shell up dip and to the west were positive and included 5.29 g/t Au over 1.63 m and 9.19 g/t Au over 0.66 m (MK-22-379) in the northwest part of the pit shell. The results of the southwest pit shell expansion were also positive with 2.50 g/t Au over 3.0 m (MK-22-340) and 1.09 g/t Au over 5.75 m (MK-22-341). Intersections in both of these areas show a strong probability that the pit shell can be expanded updip to the west.

Several holes were drilled within the limits of the proposed pit shell in order to fill in the larger gaps between the previous drill holes. Best intersections included 12.7 g/t Au over 0.91 m, 7.61 g/t Au over 2.71 m and 11.2 g/t Au over 1.27 m (all within MK-22-368) and 3.67 g/t Au over 2.45 m and 2.78 g/t Au over 5.29 m in hole MK-22-369.

Since the publication of the 2021 MRE by Geologica and GoldMinds (see Table 3), Monarch drilled a total of 41,465 m in 121 drill holes. The holes are relatively shallow and were primarily drilled at the outer edge of the proposed pit shell limits and in the area of the underground mineral resource blocks. This drilling has confirmed that the pit shell and underground mineral resource can be expanded beyond the limits defined in the 2021 MRE.

“The recent drill results confirm that the mineralization remains open downdip to the northeast as well as up dip to the west along the northern and southern edges of the pit shell,” said Jean-Marc Lacoste, President and Chief Executive Officer of Monarch. “Our confirmation drilling, filling in larger gaps for both the underground resource blocks and within the pit shell, continues to give positive results and further our understanding of the known mineralization.”

Drilling and Quality Control

Drill results are obtained by sawing the drill core into equal halves along its main axis and shipping one of the halves to ALS Canada or AGAT Laboratories in Val-d’Or, Québec, for assaying. The samples are crushed, pulverized and assayed by fire assay, with an atomic absorption finish. Samples exceeding 3 g/t Au are re-assayed using the gravity method and samples containing visible gold are assayed using the metallic screen method. Monarch uses a comprehensive QA/QC protocol, including the insertion of standards, blanks and duplicates.

The technical and scientific content of this press release has been reviewed and approved by Louis Martin, P.Geo., the Corporation’s qualified person under National Instrument 43-101.

About Monarch

Monarch Mining Corporation is a gold mining company that owns four projects, including the Beaufor Mine, which is currently on care and maintenance and has produced more than 1 million ounces of gold over the last 30 years. Other assets include the Croinor Gold, McKenzie Break and Swanson properties, all located near Monarch’s wholly owned Beacon Mill with a design capacity of 750 tpd. Monarch owns 29,504 hectares (295 km2) of mining assets in the prolific Abitibi mining camp that host a combined measured and indicated gold resource of 666,882 ounces and a combined inferred resource of 423,193 ounces.

Figure 1: McKenzie Break Significant Intervals from Press Release

Figure 2: McKenzie Break – Composite Cross Section

Table 1: McKenzie Break Assay Results and Significant Intervals

| Hole | From (m) | To (m) | Width (m)* | Au (g/t) |

| MK-22-340 | 92.00 | 95.00 | 3.00 | 2.50 |

| MK-22-340 | 111.00 | 113.00 | 2.00 | 1.81 |

| MK-22-341 | 78.80 | 79.40 | 0.60 | 2.89 |

| MK-22-341 | 126.50 | 132.25 | 5.75 | 1.09 |

| MK-22-346 | 180.14 | 181.54 | 1.40 | 0.83 |

| MK-22-349 | 228.50 | 252.10 | 23.60 | 1.26 |

| MK-22-349 | 285.00 | 286.00 | 1.00 | 2.01 |

| MK-22-349 | 298.70 | 316.00 | 17.30 | 1.41 |

| MK-22-350 | 87.40 | 88.72 | 1.32 | 2.20 |

| MK-22-350 | 257.91 | 261.39 | 3.48 | 1.85 |

| MK-22-350 | 277.14 | 278.87 | 1.73 | 10.12 |

| MK-22-350 | 316.35 | 318.19 | 1.84 | 11.91 |

| MK-22-355 | 84.90 | 86.00 | 1.10 | 1.96 |

| MK-22-361 | 391.43 | 393.55 | 2.12 | 5.90 |

| MK-22-362 | 276.50 | 280.50 | 4.00 | 1.06 |

| MK-22-362 | 308.57 | 309.50 | 0.93 | 2.32 |

| MK-22-362 | 332.00 | 336.00 | 4.00 | 0.92 |

| MK-22-362 | 374.10 | 375.00 | 0.90 | 2.81 |

| MK-22-364 | 313.83 | 315.70 | 1.87 | 2.63 |

| MK-22-368 | 18.06 | 19.38 | 1.32 | 2.50 |

| MK-22-368 | 93.75 | 94.66 | 0.91 | 12.70 |

| MK-22-368 | 151.97 | 154.68 | 2.71 | 7.61 |

| MK-22-368 | 202.76 | 204.03 | 1.27 | 11.20 |

| MK-22-368 | 234.00 | 234.97 | 0.97 | 2.57 |

| MK-22-369 | 43.48 | 45.93 | 2.45 | 3.67 |

| MK-22-369 | 241.71 | 247.00 | 5.29 | 2.78 |

| MK-22-369 | 255.72 | 257.23 | 1.51 | 1.38 |

| MK-22-374 | 274.89 | 275.39 | 0.50 | 3.00 |

| MK-22-374 | 309.95 | 311.00 | 1.05 | 2.90 |

| MK-22-374 | 319.67 | 321.00 | 1.33 | 3.20 |

| MK-22-375 | 233.96 | 235.15 | 1.19 | 19.96 |

| MK-22-375 | 245.10 | 245.66 | 0.56 | 5.60 |

| MK-22-375 | 268.16 | 271.10 | 2.94 | 2.02 |

| MK-22-375 | 293.93 | 297.77 | 3.84 | 1.11 |

| MK-22-376 | 250.28 | 251.18 | 0.9 | 4.60 |

| MK-22-376 | 358.77 | 359.74 | 1.0 | 5.90 |

| MK-22-377 | 119.16 | 120.68 | 1.52 | 12.40 |

| MK-22-379 | 16.71 | 18.34 | 1.63 | 5.29 |

| MK-22-379 | 96.83 | 98.44 | 1.61 | 2.21 |

| MK-22-379 | 106.00 | 106.66 | 0.66 | 9.19 |

*The width shown is the core length. True width is estimated to be between 85% and 90% of core length.

Table 2: McKenzie Break Drill Hole Location

| Hole | UTM_E (m) | UTM_N (m) | Azimut (°) | Dip (°) | Length (m) |

| MK-22-340 | 309604 | 5358352 | 230 | -88 | 177 |

| MK-22-341 | 309594 | 5358298 | 230 | -88 | 159 |

| MK-22-346 | 309948 | 5358348 | 230 | -88 | 330 |

| MK-22-349 | 310017 | 5358495 | 230 | -88 | 399 |

| MK-22-350 | 310077 | 5358480 | 230 | -88 | 444 |

| MK-22-355 | 309859 | 5358747 | 230 | -88 | 438 |

| MK-22-361 | 310239 | 5359214 | 230 | -88 | 498 |

| MK-22-362 | 310289 | 5359168 | 230 | -88 | 531 |

| MK-22-364 | 310311 | 5359055 | 230 | -88 | 555 |

| MK-22-368 | 309929 | 5358707 | 230 | -88 | 360 |

| MK-22-371 | 310192 | 5358621 | 230 | -88 | 115 |

| MK-22-374 | 310168 | 5359097 | 230 | -88 | 468 |

| MK-22-375 | 310120 | 5359026 | 230 | -88 | 459 |

| MK-22-376 | 310232 | 5358982 | 230 | -88 | 525 |

| MK-22-377 | 310276 | 5358960 | 230 | -88 | 237 |

| MK-22-379 | 309622 | 5358986 | 230 | -88 | 255 |

Table 3: 2021 MRE for McKenzie Break

| Area (cut-off grade) | Indicated resource | Inferred resource | ||||

| Tonnes (t) |

Grade (g/t) |

Ounces (Au) |

Tonnes (t) |

Grade (g/t) |

Ounces (Au) |

|

| Pit-constrained (0.50 g/t Au) | 1,441,377 | 1.80 | 83,305 | 2,243,562 | 1.44 | 104,038 |

| Underground (2.38 g/t Au) | 387,720 | 5.03 | 62,677 | 1,083,503 | 4.21 | 146,555 |

| TOTAL | 1,829,097 | 145,982 | 3,327,065 | 250,593 | ||

Notes :

- Mineral resources which are not mineral reserves do not have demonstrated economic viability. An Inferred Mineral Resource has a lower level of confidence than that applying to a Measured and Indicated Mineral Resource and must not be converted to a Mineral Reserve. The estimate of mineral resources may be materially affected by environmental, permitting, legal, title, market or other relevant issues. The quantity and grade of reported inferred resources are uncertain in nature and there has not been sufficient work to define these inferred resources as indicated or measured resources.

- The database used for this mineral estimate includes drill results obtained from historical records and up to the recent 2018-2020 drill program.

- Mineral resources are reported at a cut-off grade of 0.50 g/t Au for the pit-constrained and underground mineral resources are reported at a cut-off grade of 2.38 g/t Au within reasonably mineable volumes.

- These cut-offs were calculated at a gold price of C$1,980 ounce.

- The pit-constrained resources were based on the following parameters: mining cost $3.5/t, processing, transportation + G&A costs $27/t, Au recovery 95%, pit slopes 15 degrees for overburden and 50 degrees for rock.

- The underground reasonably mineable volumes were based on the following parameters: mining cost $98/t, processing, transportation + G&A costs $27/t, Au recovery 95%, dilution of 15% at 0 g/t Au with a minimum stope dimension of 10m x 10m x 5m.

- The geological interpretation of the deposits was based on lithologies and the typical mineralized interval mainly composed by diorite hosted shear zones.

- The mineral resource presented here was estimated with a block size of 5m x 5m x 5m for the pit-constrained and for underground.

- The blocks were interpolated from equal length composites calculated from the mineralized intervals. Prior to compositing, high-grade gold assays were capped to 60 g/t Au applied on 0.6-metre composites.

- The mineral estimation was completed using the inverse distance squared methodology utilizing two passes. For each pass, search ellipsoids followed the geological interpretation trends were used.

- Tonnage estimates are based on rock specific gravity of 2.77 tonnes per cubic metre for all the zones. Results are presented undiluted and in situ.

- Estimates use metric units (metres, tonnes and g/t). Metal contents are presented in troy ounces (metric tonne x grade / 31.10348).

- This MRE is dated February 11, 2021, and with an amended date of October 14, 2021. The effective date for the drillhole database used to produce this updated mineral resource estimate is February 1, 2021. Tonnages and ounces in the tables are rounded to the nearest hundred. Numbers may not total due to rounding.

- No economic evaluation of the resources has been produced.

- The MRE was prepared by Alain-Jean Beauregard, P.Geo., Daniel Gaudreault, P.Eng. of Geologica Groupe-Conseil Inc., and Merouane Rachidi, P.Geo., Claude Duplessi, P.Eng. of GoldMinds GeoServices, all qualified persons under National Instrument 43-101.

Table 4: Monarch Combined Mineral Resource Estimates

| Mineral resource estimates | Tonnes (metric) |

Grade (g/t Au) |

Ounces |

| Beaufor Mine1 | |||

| Measured Resources | 328,500 | 5.7 | 59,900 |

| Indicated Resources | 956,400 | 5.2 | 159,300 |

| Total Measured and Indicated | 1,284,900 | 5.3 | 219,200 |

| Total Inferred | 818,900 | 4.7 | 122,500 |

| Croinor Gold2 | |||

| Measured Resources | 97,700 | 6.24 | 19,600 |

| Indicated Resources | 805,900 | 6.50 | 168,300 |

| Total Measured and Indicated | 903,600 | 6.47 | 187,900 |

| Total Inferred | 200,100 | 6.19 | 39,800 |

| McKenzie Break3 | |||

| In-pit | |||

| Total Indicated | 1,441,377 | 1.80 | 83,305 |

| Total Inferred | 2,243,562 | 1.44 | 104,038 |

| Underground | |||

| Total Indicated | 387,720 | 5.03 | 62,677 |

| Total Inferred | 1,083,503 | 4.21 | 146,555 |

| Swanson4 | |||

| In-pit | |||

| Total Indicated | 1,864,000 | 1.76 | 105,400 |

| Total Inferred | 29,000 | 2.46 | 2,300 |

| Underground | |||

| Total Indicated | 91,000 | 2.86 | 8,400 |

| Total Inferred | 87,000 | 2.87 | 8,000 |

| TOTAL COMBINED5 | |||

| Measured and Indicated Resources | 666,882 | ||

| Inferred Resources | 423,193 | ||

| 1 Source: NI 43-101 Technical Report and Mineral Resource Estimate for the Beaufor Mine Project, October 13, 2021, Val-d’Or, Québec, Canada, Charlotte Athurion, P. Geo., Pierre-Luc Richard, P. Geo., and Dario Evangelista, P. Eng., BBA Inc. 2 Source: NI 43-101 Technical Report and Mineral Resource Estimate for the Croinor Gold Project, June 17, 2022, Val-d’Or, Québec, Canada, Olivier Vadnais-Leblanc, P.Geo., Carl Pelletier, P.Geo. and Eric Lecomte, P.Eng., InnovExplo Inc. 3 Source: NI 43-101 Technical Evaluation Report on the McKenzie Break Property, October 14, 2021, Val-d’Or, Québec, Canada, Alain-Jean Beauregard, P.Geo., Daniel Gaudreault, P.Eng., of Geologica Groupe-Conseil Inc., and Merouane Rachidi, P.Geo., Claude Duplessis, P.Eng., of GoldMinds GeoServices Inc. 4 Source: NI 43-101 Technical Report and Mineral Resource Estimate for the Swanson Project, January 22, 2021, Val-d’Or, Québec, Canada, Christine Beausoleil, P. Geo. and Alain Carrier, P. Geo., InnovExplo Inc. 5 Numbers may not add due to rounding. |

|||

MORE or "UNCATEGORIZED"

Eloro Resources Announces Closing of Bought Deal LIFE Private Placement for Gross Proceeds of C$17 Million

Eloro Resources Ltd. (TSX: ELO) (FSE: P2QM) is pleased to announce the closing of its previously an... READ MORE

Minera Alamos Updates Resources and Reserves for the Pan Gold Mine in Nevada

Minera Alamos Inc. (TSX-V: MAI) (OTCQX: MAIFF) is pleased to announce updated Mineral Resource and M... READ MORE

Ero Copper Reports Fourth Quarter and Full Year 2025 Operating and Financial Results

Ero Copper Corp. (TSX: ERO) (NYSE: ERO) is pleased to announce its operating and financial results f... READ MORE

Rare Element Resources Announces Results of Oversubscribed Rights Offering of Common Shares

Rare Element Resources Ltd. (OTCQB: REEMF) is pleased to report that its previously announced... READ MORE

TRX Gold Reports Record Q2 2026 Production and Company Update

TRX Gold Corporation (TSX: TRX) (NYSE American: TRX) is pleased to announce preliminary resu... READ MORE