Mineros Announces Positive Prefeasibility Study Results for its Porvenir Project, Hemco Property, Nicaragua

Mineros S.A. (TSX: MSA) (CB: MINEROS) is pleased to announce that a positive prefeasibility study has been completed on the gold-silver-zinc Porvenir Project on its Hemco Property, in northeastern Nicaragua, significantly increasing the mine life of the Hemco Property Mineral Reserves from five to thirteen years. In addition to the Porvenir Project, the Hemco Property includes the Panama and Pioneer Mines, and produces gold from material purchased from artisanal mining collectives with whom the Company has a strong collaborative relationship. A new NI 43-101 technical report on the Hemco Property will be filed within 45 days of this news release.

HIGHLIGHTS:

- An eight year increase of life of mine for the Hemco Property, from five to thirteen years.

- First-time disclosure of Porvenir Mineral Reserves as of December 31, 2022:

- 270 kt of Proven Mineral Reserves averaging 2.70 g/t Au, 13.6 g/t Ag and 3.14% Zn, containing 23 koz Au, 118 koz Ag, and 19 Mlb Zn.

- 5,524 kt of Probable Mineral Reserves averaging 3.09 g/t Au, 10.2 g/t Ag and 2.96% Zn, containing 549 koz Au, 1,804 koz Ag, and 360 Mlb Zn.

- Porvenir Project base case economics include an after-tax net present value (using a 10% discount rate) of approximately $42 million, an after-tax internal rate of return of approximately 16% and a payback period of approximately 4 years from start of production in 2027, assuming $1,500/oz Au, $19.00/oz Ag, and $1.27/lb Zn.

- The Porvenir Project will add average annual production over its nine-year mine life of 56,700 oz Au per year, along with 112,300 oz Ag per year and 38.5 Mlb Zn per year to the Hemco Property.

- After-tax net present value (using a 5% discount rate) (“NPV5%“) of $160mm at $1,650/oz Au, $20.90/oz Ag, and $1.40/lb Zn; increasing to $216mm at $1,800/oz Au, $22.80/oz Ag, and $1.52/lb Zn.

- IRR of 21% and after-tax payback period of 3.5 years from start of production at $1,650/oz Au, $20.90/oz Ag, and $1.40/lb Zn.

Andrés Restrepo, President and Chief Executive Officer commented: “We are pleased to have reached this milestone for the Porvenir Project, which is a key project in our pipeline of organic growth projects. The advance of the Porvenir Project would allow us to extend the life of mine at the Hemco Property for eight additional years, allowing us to strengthen our presence in the Bonanza-Siuna-Rosita Mining Triangle district. This would give us the opportunity to make additional contributions to the sustainable development and the well-being of the communities that embrace us, thanks to the trust that we have built by maintaining high standards of environmental and social responsibility. We are continuing to invest in brownfield and greenfield exploration at our Hemco Property, with a view to further expanding the current Mineral Resources and Mineral Reserves and making new discoveries, paving the way for future growth.”

No Mineral Reserves or Mineral Resources for Porvenir have been attributed to material within 30 metres of the topographic surface, which is reserved by law for artisanal mining. In addition to planned production from the Company’s mines, pursuant to the Bonanza Model (described below), the Company purchases and refines mineralized material collected by artisanal mining collectives at the Hemco Property. Purchases of mineralized material under this model are expected to continue consistent with historical levels and are not included in the LOM plan and cash flow model.

PORVENIR PROJECT PFS

MINERAL RESOURCES

Table 1: Porvenir Mineral Resources – Effective December 31, 2022

| Mineral Resource Category |

Tonnes | Gold Grade |

Silver Grade |

Zinc Grade |

Contained Metal |

Contained Metal |

Contained Metal |

| (kt) | (g/t Au) | (g/t Ag) | (% Zn) | (koz Au) | (koz Ag) | (Mlb Zn) | |

| Measured | 59 | 1.75 | 8.08 | 2.11 | 3 | 15 | 3 |

| Indicated | 974 | 2.39 | 8.13 | 2.56 | 75 | 255 | 55 |

| Total M+I | 1,033 | 2.35 | 8.13 | 2.53 | 78 | 270 | 58 |

| Inferred | 1,694 | 2.42 | 12.10 | 3.64 | 132 | 656 | 136 |

| Notes: | |||||||

| 1. Canadian Institute of Mining, Metallurgy and Petroleum (“CIM”) “CIM Definition Standards – For Mineral Resources and Mineral Reserves” (2014) adopted by the CIM Council (as amended, the “CIM Definition Standards”) were followed for Mineral Resources. | |||||||

| 2. Mineral Resources are exclusive of Mineral Reserves. | |||||||

| 3. Mineral Resources are estimated at a net smelter return (“NSR”) cut-off value of US$82.30/t for sub-level stoping resource shapes. | |||||||

| 4. A minimum mining width of 0.8 m was used to create resource shapes. | |||||||

| 5. Mineral Resources are estimated using a long-term gold price of US$1,700/oz Au, a silver price of US$20/oz Ag, and a zinc price of US$1.36/lb Zn. | |||||||

| 6. Bulk density is between 2.65 t/m3 and 2.9 t/m3. | |||||||

| 7. Metallurgical recoveries applied on a block-by-block basis and average 63.4% for gold, 52.6% for silver and 84.1% for zinc. | |||||||

| 8. Mineral Resources that are not Mineral Reserves do not have demonstrated economic viability. | |||||||

| 9. Material within 30 m of the topographic surface has been excluded from Mineral Resources to allow for artisanal mining. This material is exclusive of the artisanal areas. | |||||||

| 10.Totals may differ due to rounding. | |||||||

Porvenir Project Mineral Resources were estimated by SLR Consulting (Canada) Ltd. The geological model, block model estimates, and resource classification criteria have not changed since the Mineral Resource estimate disclosed in the prior Hemco Property technical report dated September 15, 2021, as amended on October 29, 2021. However, the updated Mineral Resource estimate effective December 31, 2022, accounts for updated metal prices, cost estimates, metallurgical recoveries, and resource reporting using a US$82.30/t NSR cut-off for sub-level stoping resource shapes.

MINERAL RESERVES

Table 2: Porvenir Mineral Reserves – Effective December 31, 2022

| Mineral Reserve Category |

Tonnes | Gold

Grade |

Silver

Grade |

Zinc

Grade |

Contained Metal |

Contained Metal |

Contained Metal |

| (kt) | (g/t Au) | (g/t Ag) | (% Zn) | (koz Au) | (koz Ag) | (Mlb Zn) | |

| Proven | 270 | 2.70 | 13.61 | 3.14 | 23 | 118 | 19 |

| Probable | 5,524 | 3.09 | 10.16 | 2.96 | 549 | 1,804 | 360 |

| Proven and Probable |

5,794 | 3.07 | 10.32 | 2.96 | 572 | 1,922 | 379 |

| Notes: | |||||||

| 1. Material within 30 m of the topographic surface has been excluded from the Porvenir Project Mineral Reserves to allow for artisanal mining. This material is exclusive of the artisanal areas. | |||||||

| 2. The CIM Definition Standards were followed for Mineral Reserves. | |||||||

| 3. Mining is by cut-and-fill stoping and sub-level stoping. The assumed minimum mining width is 1.55 m. | |||||||

| 4. Includes dilution skins 0.25 m thick on stope footwalls and 0.5 m thick on hanging walls. | |||||||

| 5. Mining extraction factors for cut-and-fill with pillars was 78%, 90% for cut-and-fill with by-pass drifts, and 90% for sub-level stoping. | |||||||

| 6. Economic cut-offs are based on NSR value per tonne determinations using assumed metal prices, metal recoveries, and smelter terms. Breakeven NSR cut-off values vary from $81.34/t to $83.10/t, depending upon the mining method. | |||||||

| 7. Metallurgical recoveries were applied on a block-by-block basis and average 85.6% for gold, 52.8% for silver and 91.1% for zinc. | |||||||

| 8. Mineral Reserves estimated using an average long term gold price of US$1,500/oz Au, $19.00/oz Ag, and $1.27/lb Zn. | |||||||

| 9. Totals may differ due to rounding. | |||||||

Mineral Reserves, which were estimated by BISA Ingenieria de Proyectos S.A. and reviewed by SLR, use the Mineral Resource estimate disclosed in the 2021 Hemco Technical Report, and Deswik stope optimizer software to prepare stope designs for cut-and-fill and sub-level long hole stoping of the deposit. Mine access designs assume the use of mechanized equipment for mucking and haulage and conventional ventilation and backfill systems. Dilution was added to the footwall and hanging wall of stopes and mining extraction factors were included to account for pillars and practical ore extraction from stopes.

The Porvenir Mineral Reserves represent 79% of the total tonnes of Proven and Probable Mineral Reserves on the Hemco Property. The gold only Hemco Property Mineral Reserves, including Porvenir, effective December 31, 2022, are presented in Table 3.

Table 3: Hemco Property Mineral Reserves (Gold only) – Effective December 31, 2022

| Category | Deposit | Tonnes | Grade | Metal |

| (kt) | (g/t Au) | (koz Au) | ||

| Proven | Panama | 47 | 3.36 | 5 |

| Pioneer | 110 | 6.06 | 21 | |

| Porvenir | 270 | 2.70 | 23 | |

| Total | 428 | 3.64 | 50 | |

| Probable | Panama | 983 | 4.05 | 128 |

| Pioneer | 427 | 4.53 | 62 | |

| Porvenir | 5,524 | 3.09 | 549 | |

| Total | 6,934 | 3.31 | 739 | |

| Proven + Probable |

Panama | 1,031 | 4.02 | 133 |

| Pioneer | 537 | 4.84 | 84 | |

| Porvenir | 5,794 | 3.07 | 572 | |

| Total | 7,362 | 3.33 | 789 | |

| Notes: | ||||

| 1. Material within 30 m of the topographic surface has been excluded from the Pioneer Mine and Porvenir Project Mineral Reserves to allow for artisanal mining. This material is exclusive of the artisanal areas. | ||||

| 2. CIM Definition Standards were followed for Mineral Reserves. | ||||

| 3. Mining method: | ||||

| a. Panama and Pioneer: shrinkage stoping, sub-level open stoping (SLOS), and sub-level stoping (SLS) with backfill. | ||||

| b. Porvenir: cut-and-fill stoping and sub-level stoping. | ||||

| 4. Minimum mining width: | ||||

| a. Panama and Pioneer: 0.90 m for shrinkage stoping and between 1.80 m and 2.00 m for mechanized mining methods. | ||||

| b. Porvenir: 1.55 m. | ||||

| 5. Economic cut-offs: | ||||

| a. Panama and Pioneer: marginal and break-even cut-off grades of 2.80 g/t Au and 3.56 g/t Au, 2.12 g/t Au and 2.31 g/t Au, and 2.45 g/t Au and 2.78 g/t Au were applied to shrinkage, SLOS, and SLS with backfill mining methods respectively. | ||||

| b. Porvenir: based on NSR value per tonne determinations using metal prices, metal recoveries, and smelter terms. Breakeven NSR cut-off values vary from $81.34/t to $83.10/t depending on the mining method. | ||||

| 6. Metallurgical recoveries: | ||||

| a. Panama and Pioneer: 90% for gold. | ||||

| b. Porvenir: were applied on a block-by-block basis and average 85.6% for gold, 52.8% for silver, and 91.1% for zinc. | ||||

| 7. Dilution: | ||||

| a. Panama and Pioneer: dilution skins of 0.25 m were applied to shrinkage stopes and between 0.6 m to 0.8 m to mechanized stopes. | ||||

| b. Porvenir: dilution skins 0.25 m thick on stope footwalls and 0.5 m thick on hanging walls. | ||||

| 8. Mining Extraction: | ||||

| a. Panama and Pioneer: a factor of 70% was applied to shrinkage stopes and between 75% and 95% to mechanized stopes. | ||||

| b. Porvenir: cut-and-fill 78% to 90% and 90% for sub-level stoping. | ||||

| 9. Mineral Reserves estimated using an average long term metal prices of US$1,500/oz Au, $19.00/oz Ag, and $1.27/lb Zn. | ||||

| 10. Totals may not add due to rounding. | ||||

Economic Analysis

- The Porvenir Project base case economics include a NPV10% of approximately $42 million, an after-tax IRR of approximately 16% and a payback period from start of production in 2027 of approximately 4 years assuming $1,500/oz Au, $19.00/oz Ag, and $1.27/lb Zn.

- The Porvenir Project will add average annual production over its nine-year mine life of 56,700 oz Au per year, along with 112,300 oz Ag per year and 38.5 Mlb Zn per year to the Hemco Property.

- Porvenir Project initial capital costs, including contingency, of approximately $161 million. Porvenir Project expansion and sustaining capital costs (including reclamation and closure) of approximately $88 million.

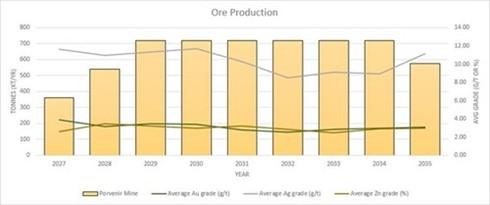

Although located on the Hemco Property, the Porvenir Project is planned to be independent of the Panama and Pioneer Mines, with its own mine access, process plant, tailings facilities, and other required infrastructure. Mining and processing operations are planned to commence at a rate of 1,000 tonnes per day (“tpd”) in 2027, ramping up to 2,000 tpd beginning in 2029 (Figures 1 and 2). Ore will be mined by cut-and-fill stoping and sub-level long hole stoping. Ore will be processed using cyanidation and a Merrill-Crowe circuit for gold and silver recovery, and a flotation circuit for the recovery of zinc and minor gold to a zinc concentrate.

Under the PFS LOM plan, the Porvenir Project will be developed in two stages. In Stage 1 (2027 and 2028), average annual production will be 43 koz Au and 89 koz Ag in doré, plus 28 Mlb Zn and 1.7 koz Au in zinc concentrates. In Stage 2 (2029 through 2035), average annual production will be 60 koz Au and 119 koz Ag in doré, plus 42 Mlb Zn and 2.2 koz Au in zinc concentrates.

Average LOM all-in sustaining cost1 per ounce of gold equivalent2 sold is estimated at $929/oz AuEq.3 Initial and expansion capital costs are estimated at $161 million and $17 million, respectively, with LOM sustaining capital costs (including reclamation and closure) estimated at $71 million .

Base case cash flow is based on metal prices of $1,500/oz Au, $19.00/oz Ag, and $1.27/lb Zn, and generates an after-tax NPV10% of $42 million and an after-tax IRR of 16%.

Applying the same economic assumptions, using a discount rate of 5%, the Porvenir Project generates an after-tax NPV5% of $98 million.

Sensitivity analysis on the base case is provided below (Table 4).

Table 4: After-tax sensitivity analysis

| Metal Prices (US$/oz Au) |

NPV10% (US$000) |

NPV5% (US$000) |

| $1,200 | (59,595) | (40,486) |

| $1,350 | (7,263) | 31,147 |

| $1,500 (Base Case) | 41,750 | 98,537 |

| $1,650 | 86,359 | 159,571 |

| $1,800 | 127,902 | 216,236 |

The PFS was managed by Mineros, completed by BISA, and reviewed by SLR. Both BISA and SLR are independent of Mineros.

| ____________________________________________ 1 AISC per ounce of AuEq sold is a non-IFRS ratio based on AISC, which is a forward-looking non-IFRS financial measure with no standardized meaning under IFRS, which may not be comparable to similar measures presented by other issuers. For the year ended December 31, 2022, the following historical non-IFRS financial measures were reported in the Company’s management’s discussion and analysis (“MD&A”) for the year ended December 31, 2022: AISC – $392,648,000; AISC per ounce of gold sold – $1,365. AISC and AISC per ounce of AuEq sold disclosed in this press release and the PFS differ from the equivalent historical non-IFRS financial measures reported in the Company’s MD&A. For further information, see “Non-IFRS Financial Measures” in this news release. 2 Gold equivalent sold includes Au and equivalent values for Ag and Zn assuming long-term metal prices of US$1,500/oz Au, $19.00/oz Ag, and $1.27/lb Zn. 3 Based on estimated AISC per ounce of AuEq sold for the Porvenir Project of $929/oz AuEq. AISC per ounce of gold sold (excluding silver and zinc) is estimated at $1,411/oz Au. |

NEXT STEPS

Future work on the Porvenir Project will focus on Mineral Resource conversion and ongoing metallurgical and economic optimization activities. These opportunities are not included in the PFS economic analysis.

Alternative mining methods will be evaluated to convert part of the current Mineral Resources into Mineral Reserves, as small structures were not considered in the current LOM due to minimum mining width criteria. The mineralization at Porvenir remains open laterally and at depth, representing opportunities for mine life extension.

In 2023, the Company is planning a 6,000 metre metallurgical diamond drilling program with the objectives of improving the current metallurgical model and evaluating the viability of ore sorting.

The Company continues to investigate opportunities to further improve the economics of the Porvenir Project, including further optimizing of capital and operating costs, evaluating different ore processing alternatives.

ABOUT THE HEMCO PROPERTY

The Hemco Property was acquired by Mineros in 2013. It is located in northeastern Nicaragua in the Mining Triangle, in the vicinity of the town of Bonanza, approximately 230 km northeast of the capital of Managua. The Hemco Property includes the Panama and Pioneer Mines, the Porvenir Project, the Luna Roja Deposit, the Caribe Exploration Target, artisanal mining, and the Hemco, La Curva, and Vesmisa processing plants.

Since acquisition, the Company has worked extensively with artisanal miners through the “Bonanza Model” which aims to maintain a reliable supply of mineralized material from artisanal mining by exploring and identifying areas for artisanal miners to work, offering a fair price for their production, promoting enhanced working conditions, including health and safety, supporting their organization in cooperatives, and ensuring the participation of miner groups, and local and national authorities in the steering committee that organizes the artisanal miners.

ABOUT MINEROS S.A.

Mineros is a Latin American gold mining company headquartered in Medellin, Colombia. The Company has a diversified asset base, with mines in Colombia, Nicaragua, and Argentina and a pipeline of development and exploration projects throughout the region.

The Board of Directors and management of Mineros have extensive experience in mining, corporate development, finance, and sustainability. Mineros has a long track record of maximizing shareholder value and delivering solid annual dividends. For almost 50 years, Mineros has operated with a focus on safety and sustainability at all its operations.

Mineros’ common shares are listed on the Toronto Stock Exchange under the symbol “MSA”, and on the Colombia Stock Exchange under the symbol “MINEROS”.

The Company has been granted an exemption from the individual voting and majority voting requirements applicable to listed issuers under Toronto Stock Exchange policies, on grounds that compliance with such requirements would constitute a breach of Colombian laws and regulations which require the directors to be elected on the basis of a slate of nominees proposed for election pursuant to an electoral quotient system. For further information, please see the Company’s most recent annual information form filed on SEDAR at www.sedar.com.

QUALIFIED PERSON, TECHNICAL INFORMATION, AND QUALITY CONTROL

The Mineral Resource and Mineral Reserve estimates summarized in this news release have an effective date of December 31, 2022.

The Mineral Resource estimate, including verification of the data disclosed, was prepared by SLR. Sean Horan, P.Geo., who is Technical Manager – Geology and Principal Geologist with SLR, is responsible for the Mineral Resource estimate. Mr. Horan is an independent “qualified person”, as defined by NI 43-101 and has reviewed and approved the information relating to the Mineral Resource estimate that is contained in this news release.

The Mineral Reserve estimate was completed by BISA of Lima, Peru and audited by SLR. The individual responsible for the Mineral Reserve estimate is Dennis Bergen, P.Eng., Associate Principal Mining Engineer with SLR. Mr. Bergen is an independent qualified person and has reviewed and approved the information relating to the Mineral Reserve estimate that is contained in this news release.

All other scientific and technical information contained in this news release has been reviewed and approved by Jorge Aceituno, a Registered Member of the Chilean Mining Commission and the Planning Manager, Resources and Reserves for Mineros and a qualified person.

Mineros has implemented a quality assurance/quality control program aligned with industry best practices, in which certified reference materials, duplicates and blanks are routinely inserted into the sample stream to assess precision, accuracy, contamination and bias. All standards, duplicates and blanks are validated and any batches that fail QA/QC are reanalyzed.

Diamond drill core samples are selected by the geologists on site; sample intervals are typically 1 m in length, but can range from a minimum of 0.2 m to a maximum of 2 m. HTW-diameter diamond drill core to be sampled is cut in half lengthwise, with one half of the core stored on-site in wooden core boxes and the other half sent to the Bureau Veritas Commodities Canada Ltd. (“Bureau Veritas”) laboratory in Managua, Nicaragua for sample preparation, then to the Bureau Veritas laboratory in Vancouver, Canada for geochemical analysis.

The materials sent for sample preparation and analysis are packed by Mineros geologists in plastic bags with tamper-proof seals, with a chain of custody procedure for delivery to Bureau Veritas. Sample preparation is carried out following the PREP70-250 package (crushing of the entire sample to > 70% passing 2 mm screen, pulverization of 250 grams > 85% 75 µm).

Geochemical analysis is certified by SCC (Standards Council of Canada) Standard ISO/IEC 17025:2017 with validation date until 2023-10-07. Samples, standards, duplicates and blanks are analyzed for gold using a standard fire assay method (30 g aliquot) and atomic absorption finish (AAS). Those over 10 ppm are re-analyzed by 30 g fire assay with gravimetric finish, for all analyses a 45-element suite is run with a 4-acid digestion and an ICP-ES/MS finish. All coarse rejects and pulps are returned by the laboratory and stored by the Company in as secure warehouse. Pulps from 5% of the materials analyzed are sent to a certified secondary laboratory (ALS Chemex, in Medellín, Colombia) to be analyzed using methods analogous to those used at Bureau Veritas.

Figure 1: Porvenir Project Ore Production Profile (CNW Group/Mineros S.A.)

MORE or "UNCATEGORIZED"

Quimbaya Gold Closes $4 Million Financing and Expands Executive Team

Cornerstone investor brings proven regional track record; company... READ MORE

Spanish Mountain Gold Announces Larger Scale Preliminary Economic Assessment With a Base Case NPV5% After-Tax of C$1.0 Billion, 18.2 % IRR and 3.4 Year Payback at US$ 2,450/Oz Gold Price; at US$3,300/Oz Spot Gold Price NPV5% C$2.3 Billion, 32.0% IRR and 2.0 Year Payback; Including an Updated Mineral Resource Estimate for Its Spanish Mountain Gold Project

Spanish Mountain Gold Ltd. (TSX-V: SPA) (FSE: S3Y) (OTCQB: SPAUF)... READ MORE

Aura Announces Preliminary Q2 2025 Production Results

Aura Minerals Inc. (TSX: ORA) (B3: AURA33) (OTCQX: ORAAF) is plea... READ MORE

Cascadia Announces Closing of Financing

Cascadia Minerals Ltd. (TSX-V:CAM) (OTCQB:CAMNF) is pleased to an... READ MORE

Abcourt Closes US$ 8M Loan Facility to Start Sleeping Giant Mine

Abcourt Mines Inc. (TSX-V: ABI) (OTCQB: ABMBF) is pleased to anno... READ MORE