Midnight Sun Announces Resource Estimate for Kazhiba Main Copper Oxide Deposit

Maiden Indicated Resource of 2.33 Mt at 1.41% Cu

Midnight Sun Mining Corp. (TSX-V: MMA) (OTCQX: MDNGF) is pleased to announce the completion of a maiden Mineral Resource Estimate for the near-surface Kazhiba Main Oxide Copper Deposit, located in Solwezi, Zambia.

The maiden Mineral Resource Estimate consists of 2.33 million tonnes of Indicated mineral resources grading 1.41% copper at a selected base case cut-off of 0.10 % Cu over all rock type categories. The initial MRE was prepared for the Company by DMT Kai Batla PTY Ltd. and has an effective date of January 20, 2026.

Midnight Sun CEO Al Fabbro states: “The delivery of this resource estimate for Kazhiba Main represents a significant milestone for Midnight Sun. Kazhiba Main hosts a meaningful inventory of near-surface, acid-soluble copper within a compact footprint, extending to an average maximum depth of only about 30 metres and grading 1.41%, well above typical economic thresholds for oxide copper. Our goal is to convert this deposit into a non-dilutive funding source to advance our flagship Dumbwa Project. This opportunity is incredibly rare in the mineral exploration sector, and Midnight Sun is well positioned for an exciting future. The Company now intends to move forward with its plan to monetize Kazhiba Main and expects to immediately commence discussions with key counterparties to that end.”

The table below summarizes the MRE of the Kazhiba Main Copper Oxide Deposit.

| Mineral Resource Estimate – Kazhiba Main Oxide Copper Deposit | ||||

| Classification | Grade Cut-off %Cu | Tonnes | % Cu Grade | Cu (Mlbs) |

| Indicated | 0.10 | 2,327,200 | 1.41 | 72.3 |

Notes:

|

||||

The Qualified Person selected a base case cut-off grade scenario of 0.10% copper, based on the following key economic considerations:

- Grade and scale: The 1.41% average grade is well above typical economic thresholds for oxide heap leach operations. The deposit is comprised almost entirely of acid-soluble malachite, and is near surface with an average maximum depth of 30 metres;

- Processing costs: Heap leaching of copper oxides is among the lowest-cost methods, with operating costs typically US$1.50–3.00/lb Cu (or lower for oxides), driven by low energy use and simple infrastructure;

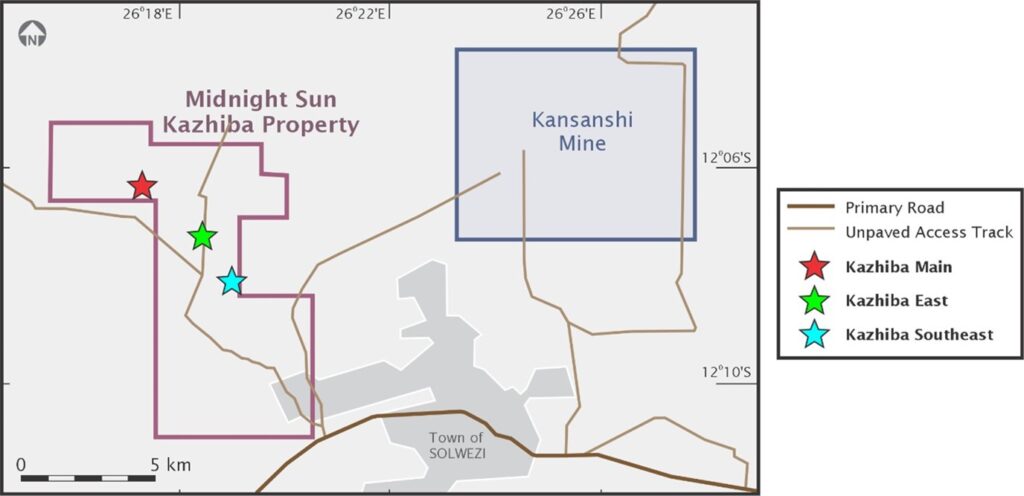

- Proximity to infrastructure: The deposit is strategically located proximal to existing infrastructure, including First Quantum’s Kansanshi Mine, with the deposit located within 6.8 kilometres of the paved bypass road maintained by First Quantum;

- Market context: As of early 2026, copper prices exceeded US$5.50/lb, providing substantial headroom over costs even at conservative recoveries (70% to 80%) and moderate acid consumption;

Figure 1: Kazhiba location, showing proximity to First Quantum’s Kansanshi Mine, and location of Kazhiba Main Copper Oxide Deposit

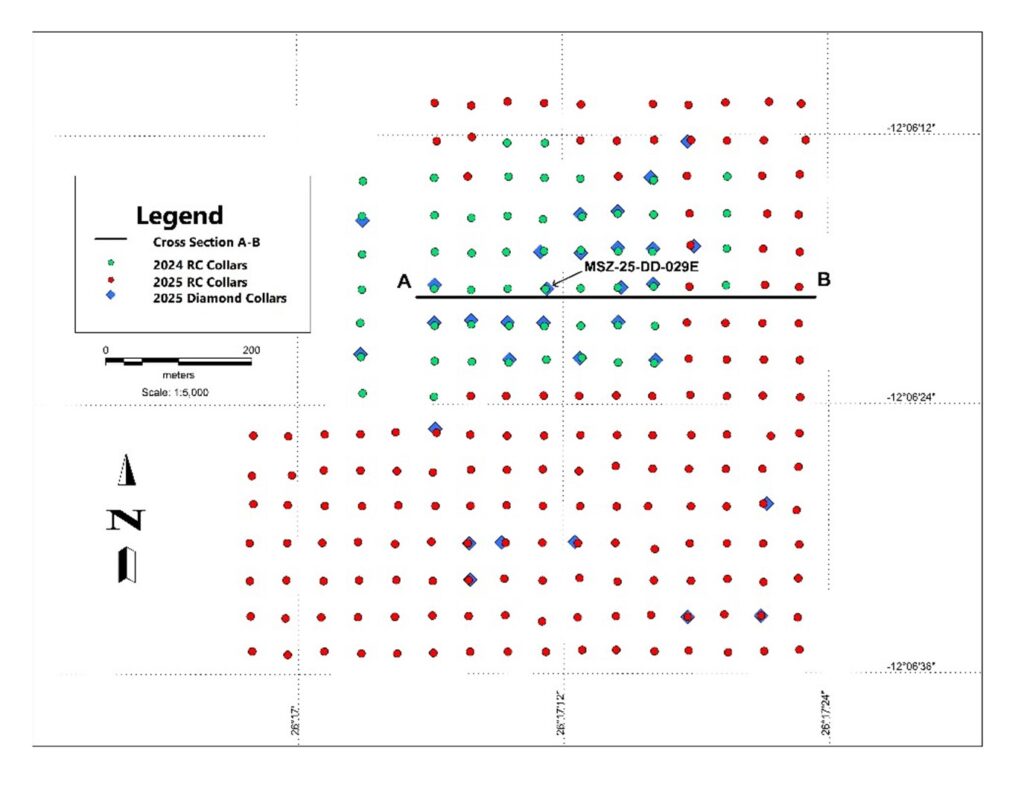

Figure 2: Kazhiba Main 2024 and 2025 drill hole locations. Note: Location of MSZ-25-DD-029E and location of section shown in Figure 4 (A to B).

Figure 3: Malachite mineralization in Drill Hole MSZ-25-DD-029E. See Figure 2 for location.

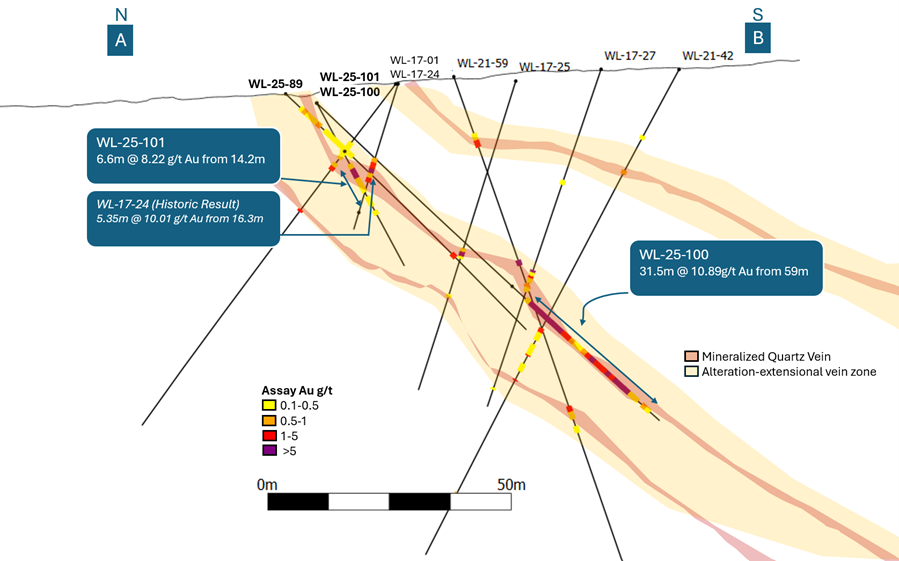

Figure 4: Kazhiba Main Copper Oxide Deposit section. Location detail showing in Figure 2, denoted A to B.

National Instrument 43-101 Disclosure

The Company will file a National Instrument 43-101 (NI 43-101) technical report on SEDAR+ within the mandated 45-day period following the date of this press release.

Dexter Ferreira, of DMT Kai Batla Pty Ltd, who is independent of the Company, has reviewed and approved the scientific and technical information herein regarding the Kazhiba Copper Oxide project. Mr. Ferreira was responsible for the Kazhiba Copper Oxide Mineral Resource Estimate and has approved the scientific and technical information pertaining to the Mineral Resource Estimate in this news release.

Darin Labrenz, P.Geo., a consulting geologist for the Company, is the Qualified Person for this news release and has reviewed and verified that the technical information contained in this news release is accurate and approves of the written disclosure of the same.

Each of Mr. Ferreira, and Mr. Labrenz are Qualified Persons as defined in NI 43-101.

The Qualified Persons have reviewed and verified the sampling and analytical procedures, results of the Quality Assurance / Quality Control program, the database, domain interpretation, estimation parameters, and validation of the block model and are of the opinion that a generally prudent and acceptable approach has been adopted in developing the estimate. There was no limitation on the verification process.

About Midnight Sun and Kazhiba Main

Midnight Sun is focused on exploring our flagship Solwezi Project, located in Zambia. Situated in the heart of the Zambia-Congo Copperbelt, the second largest copper producing region in the world, our property is vast and highly prospective. Our property is comprised of three exploration licences, with the Kazhiba Main Oxide Copper Deposit contained within exploration licence 21509-HQ-LEL, held by the Company’s subsidiary, Zambian High Light Mining Investment Ltd. The Solwezi Project is surrounded by producing copper mines, including Africa’s largest copper mining complex right next door, First Quantum’s Kansanshi Mine. Led by an experienced geological team with multiple discoveries and mines around the world to their credit, Midnight Sun’s goal is to find and develop Zambia’s next generational copper deposit.

MORE or "UNCATEGORIZED"

Eloro Resources Announces Closing of Bought Deal LIFE Private Placement for Gross Proceeds of C$17 Million

Eloro Resources Ltd. (TSX: ELO) (FSE: P2QM) is pleased to announce the closing of its previously an... READ MORE

Minera Alamos Updates Resources and Reserves for the Pan Gold Mine in Nevada

Minera Alamos Inc. (TSX-V: MAI) (OTCQX: MAIFF) is pleased to announce updated Mineral Resource and M... READ MORE

Ero Copper Reports Fourth Quarter and Full Year 2025 Operating and Financial Results

Ero Copper Corp. (TSX: ERO) (NYSE: ERO) is pleased to announce its operating and financial results f... READ MORE

Rare Element Resources Announces Results of Oversubscribed Rights Offering of Common Shares

Rare Element Resources Ltd. (OTCQB: REEMF) is pleased to report that its previously announced... READ MORE

TRX Gold Reports Record Q2 2026 Production and Company Update

TRX Gold Corporation (TSX: TRX) (NYSE American: TRX) is pleased to announce preliminary resu... READ MORE