Metallis Announces High-Grade Discovery at “1350 Zone” Including 795 G/T Silver Equivalent* Over 1.48 Meters

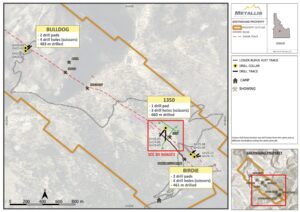

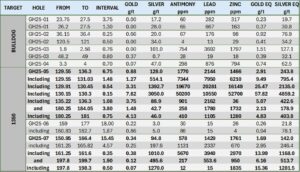

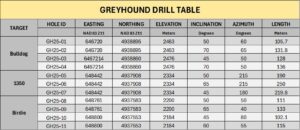

Metallis Resources Inc. (TSX-V: MTS) (OTCQB: MTLFF) announces the discovery of high-grade mineralization from the Company’s inaugural diamond drilling program on the Greyhound Property in central Idaho, USA. This program was designed to test three priority targets along the 3.5 km shear zone, with many other high potential targets remaining untested. The first three drill holes at the 1350 Zone have returned multiple high-grade intervals of silver and gold, accompanied by significant antimony, lead, and zinc mineralization. Highlights include: 0.54 meters of 2,135 g/t AgEq* (including 2.0% Sb) in GH25-05, and 1.90 meters of 514 g/t AgEq* (including 0.50 m of 1,281 g/t AgEq*) in GH25-07 (See Table 1 for full multi-element results).

Fiore Aliperti, Metallis’ President and CEO commented, “This inaugural program has confirmed that the 1350 Zone is a robust, high-grade mineralized zone that warrants significant follow-up drilling to determine its full width, strike length, and vertical extent. The exceptional silver grades, combined with consistently strong gold values that were historically underappreciated, underscore the strength of this system. Antimony grades exceeding 5 percent further reinforce the critical-metal potential of Greyhound and add meaningful value in addition to the precious-metal endowment.” He went on to add, “By identifying the position of the high-grade band within the thick shear and refining our understanding of the structural controls, the team has established a clear framework for expanding this discovery. As soon as seasonal access allows, we plan to return to build on these results and continue advancing what is shaping up to be a potentially transformative opportunity for Metallis and its shareholders. We are committed to unlocking its full value alongside our investors.”

Image 1: 7.82 g/t Au, 3050 g/t Ag, 5.0% Sb, 1.0% Pb, 5.3% Zn ( 4859 g/t AgEq*) over 0.15 m in GH25-05 (CNW Group/Metallis Resources Inc.)

Highlights:

- 5.02% antimony over 0.15 m in GH25-05, confirming strong critical mineral potential;

- High-grade silver intercepts in multiple holes; 3,050 g/t Ag from GH25-05, and 1,010 g/t Ag and 1,270 g/t Ag from GH25-07 (see Table 1);

- Broad intervals of mineralization in multiple holes including 15.45 m of 142 g/t AgEq* in GH25-07;

- Blind discovery of an additional shear zone in GH25-05 and GH25-07 demonstrates significant exploration potential adjacent to the main shear (See Figure 3);

- High gold grades identified such as 1.5 g/t Au over 3.8 m In GH25-05;

- The first three holes have defined an initial mineralized footprint, remaining open in all directions; and

- Successful targeting at the 1350 Zone has elevated the priority of several nearby untested targets, including the 500 and1500 zones.

1350 Target:

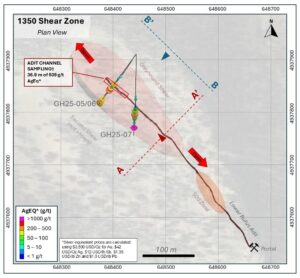

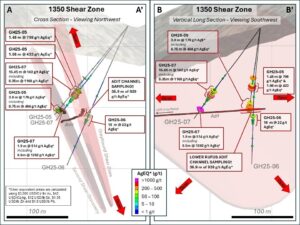

Three drill holes at the 1350 Zone outlined a mineralized panel extending 60 m vertically and 70 m along strike, and also uncovered a previously unknown mineralized structure parallel to the main Greyhound shear. Drilling was designed to test above and below historic channel sampling in the 1350 Zone in the Lower Rufus Adit (939 g/t AgEq* over a strike length of 36.9 m†). The results confirm a steep, well-developed shear zone ranging from 6.7 m to 18 m in width**. A standout high-grade intercept in GH25-05 returned 4,859 g/t AgEq* over 0.15 m. Combined with broad intervals of moderate mineralization (e.g., 15.45 m of 142 g/t AgEq* in GH25-07), the results demonstrate significant high-grade potential and strong continuity within the structure. Gold grades, historically underappreciated on the property, have also been consistently elevated and the zone remains open in all directions.

- GH25-05

Drill hole GH25-05 encountered two mineralized zones on the hanging wall and footwall of the targeted shear zone. At 129.55 m depth, a quartz sulphide vein was intercepted grading 795 g/t AgEq* over 1.48 m including a distinct high-grade band of 4,859 g/t AgEq* over 0.15 m. Strong shearing was encountered for 6.75 m with a footwall vein returning 423 g/t AgEq* over 1.08 m.

A secondary, previously unknown shear was intersected approximately 50 m down-hole from the main structure, returning 403.8 g/t AgEq* over 0.75 m within 3.8 m of 179 g/t AgEq* starting at 180 m depth. This blind discovery highlights the potential for multiple parallel shears.

- GH25-06

Drill hole GH25-06 targeted down dip extensions of the mineralized 1350 zone and intersected a long interval of sulphide-rich core 60 m vertically below GH25-05 thus confirming the orientation of the shear at this location. High sulphide content was logged across a broad zone and returned moderate grades with 18.0 m of 21.8 g/t AgEq*. Sulphide mineralization and quartz veining was significant in drill core, but the shear lacked the high-grade silver-rich band identified in other holes. More drilling will be necessary to identify the controls of the high-grade band in future programs.

- GH25-07

Drill hole GH25-07 was added following the success of the first two holes, pivoting the drill azimuth 30 degrees and intercepting the shear to the south. GH25-07 returned 15.45 m of 142 g/t AgEq* including 4.57 m of 246 g/t AgEq* with two highly elevated silver assays returning 0.35 m of 1,168 g/t AgEq* and 1.9 m of 514 g/t AgEq*. This drill hole supports the continuity of the system south to the 500 zone where another mineralized shoot was historically mined via the Lower Rufus Adit.

The Bulldog Target

The first four drill holes of the program were completed at the Bulldog target from two drill pads and returned limited intercepts of gold and silver. Unfortunately, due to poor drill recoveries, assays may not reflect the true potential. The shear zone at this location dips shallowly to the southwest resulting in mineralized drill intercepts nearer to surface that were more oxidized and broken than anticipated. Drill cuttings (sludge) were taken from GH25-03 and GH25-04 and may shed light on elements that were lost during drill water circulation. These assays are still pending.

Three out of four holes intercepted minor shear zones containing sulphides, with the best grades occurring at the top of GH25-03 including 0.76 m of 127 AgEq*. The high-grade band sampled at surface was not returned in drill core although it is possible it was lost in drill water circulation. Initial interpretations of the Bulldog suggest the shear is more extensive laterally at this location although it remains strong as it extends 700 m north to the Republican target. Further work will be required in this area.

Critical Mineral Antimony

Elevated antimony grades returned up to 5.02% Sb over 0.15 m in GH25-05 with a strong correlation to silver and gold mineralization. Other intercepts of antimony include 0.56% Sb over 0.35 m in GH25-07. These results confirm this mineralized system as an antimony rich shear and provide additional value to the already well-endowed system. The team is confident that identification of other high-grade silver zones will also yield antimony.

Antimony has been the subject of increased interest over the past year as export restrictions from China have limited supply for this critical mineral used extensively in defense materials. This has created a substantial spike in antimony prices and driven a significant amount of funding across the United States with the recently approved Stibnite gold/antimony mine located only 35 km north of the Greyhound property.

Analytical Techniques

Core samples taken for assay are halved with a diamond saw with one half being sent to ALS Labs (an independent ISO-IEC 17025:2017 and ISO 9001:2015 accredited geo-analytical laboratory ), with the other half being retained on site for future reference. ALS uses four-acid digestion and inductively coupled plasma atomic emission spectroscopy for analytical analysis. All of the samples are analyzed using the ME-MS61 methodology (Four acid ICP Super Trace Analysis). In addition, all samples are fire assayed for gold and silver (ME-GRA21) with 30-gram sample and a gravimetric finish. Known standards and blanks are inserted into the stream of samples on a regular basis. Additionally, all cores are photographed with a high-resolution camera for future viewing.

Metallis followed industry standard procedures for the work carried out on the Greyhound Project, incorporating a quality assurance/quality control program. Blank, duplicate, and standard samples were inserted into the sample sequence and sent to the laboratory for analysis. No significant QA/QC issues were detected during the review of the data. Other than some recovery problems at the top of the Bulldog holes, we are not aware of any drilling, sampling, recovery, or other factors that could materially affect the accuracy or reliability of the data referred to herein. Sludge samples were collected from holes with low recovery and those assays are still pending.

About the Greyhound Property

In February 2024, the Company optioned the Property which is in Custer County, Idaho, approximately 42 km northwest of the town of Stanley and 35 km south of Perpetua Resources’ Stibnite Mine. The Property was the center of an active silver mining camp in the early 1900’s and at one point contained a smelter and two active mines situated along the 3.5 km Greyhound shear.

The Greyhound mineralization is hosted by prominent shear zones with polymetallic quartz – sulphide veins containing elevated concentrations of gold, silver, antimony (a critical mineral), lead and zinc.

The Greyhound property shares certain geological characteristics with the Lucky Friday Mine in northern Idaho. Both properties exhibit vein mineralization occurring as fracture-fillings, disseminations, and tabular masses of galena and tetrahedrite along with accessory pyrite in a gangue of siderite, calcite and quartz. The Lucky Friday zone is a singular, curved tabular body that dips almost vertically. The vein at Lucky Friday has a strike length of up to 450 m and a width that varies from centimeters to as much as 6 m. The average varies from 1.2 to 1.8 m over the full length (SLR, 2022).

Metallis’ states that while the Lucky Friday Mine may have some similar geology to Greyhound, we do not suggest that any comparable results or information will be obtained from our exploration of Greyhound.

References

SLR, 2022 Technical Report Summary on the Lucky Friday Mine, Idaho, USA S-K 1300 Report Hecla Mining.

†Historical grades of the Greyhound 1350′ zone cannot be verified by Metallis although there is no reason to believe they are inaccurate. (See New release dated May 14, 2024 for full details).

*Gold and Silver equivalent prices are calculated using $3,500 USD/Oz for Au, $42 USD/Oz for Ag, $12 USD/lb for Sb, $1.35 USD/lb for Zn and $1.0 USD/lb for Pb.

** True widths still unknown at early stage of exploration.

About Metallis

Metallis Resources Inc. is a Vancouver-based company focused on the exploration for gold, copper and silver on its 100%-owned Kirkham Property in Canada, situated in northwest British Columbia’s Golden Triangle, and on the Greyhound Property, a gold/silver/antimony property in Idaho, USA.

Metallis trades under the symbols MTS on the TSX Venture Exchange, MTLFF on the OTCQB Exchange, and 0CVM on the Frankfurt Stock Exchange, and has 85,580,003 common shares issued and outstanding.

On behalf of the Board of Directors:

/s/ “Fiore Aliperti”

Chief Executive Officer, President, and Director

MORE or "UNCATEGORIZED"

Eloro Resources Announces Closing of Bought Deal LIFE Private Placement for Gross Proceeds of C$17 Million

Eloro Resources Ltd. (TSX: ELO) (FSE: P2QM) is pleased to announce the closing of its previously an... READ MORE

Minera Alamos Updates Resources and Reserves for the Pan Gold Mine in Nevada

Minera Alamos Inc. (TSX-V: MAI) (OTCQX: MAIFF) is pleased to announce updated Mineral Resource and M... READ MORE

Rare Element Resources Announces Results of Oversubscribed Rights Offering of Common Shares

Rare Element Resources Ltd. (OTCQB: REEMF) is pleased to report that its previously announced... READ MORE

Ero Copper Reports Fourth Quarter and Full Year 2025 Operating and Financial Results

Ero Copper Corp. (TSX: ERO) (NYSE: ERO) is pleased to announce its operating and financial results f... READ MORE

TRX Gold Reports Record Q2 2026 Production and Company Update

TRX Gold Corporation (TSX: TRX) (NYSE American: TRX) is pleased to announce preliminary resu... READ MORE