METALLA TO ACQUIRE STRATEGIC SILVER FOCUSED ROYALTY PORTFOLIO FROM FIRST MAJESTIC SILVER

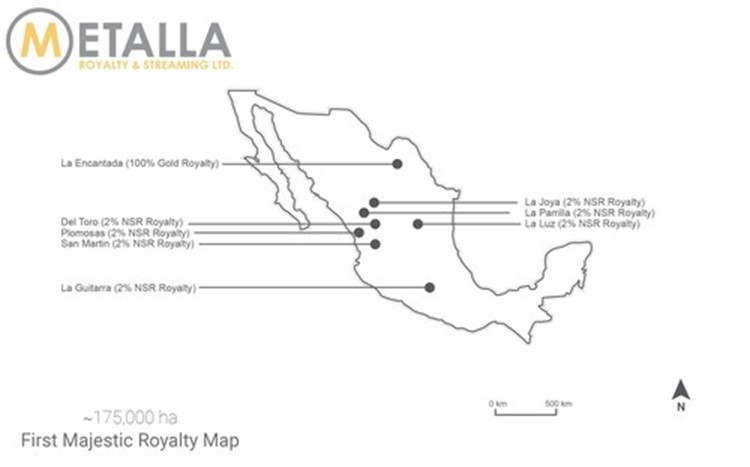

Metalla Royalty & Streaming Ltd. (TSX-V: MTA) (NYSE American: MTA) is pleased to announce that on November 26, 2022 it signed a royalty purchase agreement with First Majestic Silver Corp. (NYSE: AG) (TSX: FR), pursuant to which Metalla will acquire eight royalties for $20 million of common shares of Metalla. First Majestic holds and will originate a portfolio of royalties in Mexico as described below.

TRANSACTION HIGHLIGHTS

- Immediate Cash Flow: The addition of the producing La Encantada gold royalty will provide immediate cash flow to Metalla.

- Near Term Development: The portfolio adds four near term silver development royalties, most of which are fully permitted, have existing infrastructure and mine development for a lower capex and faster timeline to restart production.

- Highly Prospective Properties: The combined land package covers more than 175,000 hectares across some of the most prolific silver camps in Mexico.

- Accretive Growth and Increased Size and Scale: The addition of eight royalties from First Majestic will expand Metalla’s portfolio to 79 royalties and streams, increase cash flow, and significantly enhance Metalla’s industry leading development pipeline.

- Counterparty Diversification: Counterparties include First Majestic, Sierra Madre Gold and Silver Ltd. GR Silver Mining Ltd. and Silver Dollar Resources Inc.

- Substantial Leverage to Silver: The royalty portfolio is predominantly silver and will add approximately 1.7Moz of attributable silver in the measured and indicated categories, and 5.2Moz of attributable silver in the inferred category to Metalla9.

- Adds New Major Shareholder: We are excited to partner with First Majestic, one of the world’s leading silver producers with a market cap of ~$2.5 billion, which will become our largest shareholder at approximately 8.5%.

Brett Heath, President, and CEO of Metalla, commented, “This transaction marks another important milestone in our continued growth at Metalla. It provides shareholders with eight new royalties that have a significant amount of exposure and leverage to silver. It adds immediate cash flow from one producing royalty, bolsters our near-term development pipeline with four development royalties, and three advanced exploration royalties. It also adds a significant amount of exploration upside with over 175,000 hectares of royalty coverage across the most prolific silver trends in Mexico. We want to thank First Majestic for entrusting the Metalla team with unlocking additional value from their royalty assets and welcome them to our registry.”

The aggregate consideration payable by Metalla for the purchase of the royalties will be satisfied by Metalla issuing $20 million of common shares based on the 25-day volume-weighted average price of shares traded on the NYSE American LLC prior to this announcement at a price of US$4.7984 (representing an aggregate of 4,168,056 common shares of Metalla) to be issued upon closing. The Transaction is subject to customary closing conditions and exchange approvals and is expected to close in Q1 2023.

The portfolio comprises of a total of eight royalties, including one producing gold royalty, four development silver royalties, and three advanced exploration silver royalties. The royalties cover 100% of all the concessions on the eight properties.

PORTFOLIO OVERVIEW

| Asset | Operator | State | Stage | Terms |

| La Encantada | First Majestic | Coahuila | Production | 100% Au GVR |

| Del Toro | First Majestic | Zacatecas | Development | 2% NSR |

| La Guitarra | Sierra Madre* | Mexico State | Development | 2% NSR |

| Plomosas | GR Silver | Sinaloa | Advanced Exploration | 2% NSR |

| San Martin | First Majestic | Jalisco | Development | 2% NSR |

| La Parrilla | First Majestic | Durango | Development | 2% NSR |

| La Joya | Silver Dollar | Durango | Advanced Exploration | 2% NSR |

| La Luz | First Majestic | San Luis Potosi | Advanced Exploration | 2% NSR |

| *Assuming completion of sale by First Majestic to Sierra Madre |

La Encantada (100.0% GVR)1,2,7,8

The producing La Encantada Silver Mine in Coahuila, Mexico is 100% owned by First Majestic and has become one of the First Majestic’s largest producing silver mines with 2021 production of 3.2 Moz of silver and 460 ounces of gold over its 4,076 ha land package. The underground silver mine has been in production under First Majestic’s tenure since 2006, and through various improvements, the processing plant was upgraded to 4,000 tons per day and includes a roasting circuit to further enhance recoveries and recover tailings. In the first three quarters of 2022, La Encantada produced 305 ounces of gold. In late 2021, First Majestic announced the successful completion of a land surface agreement on the 4,076 ha property package which opened up a significant amount of near mine exploration opportunities. First Majestic expects to complete 19,000 meters of exploration on the mine in 2022 and expects 2022 production guidance to be in the range of 2.9 – 3.2 Moz silver.

Metalla will be granted a 100% gross value royalty on the gold produced at the La Encantada mine limited to 1,000 ounces annually.

| Reserve & Resource Estimate | |||

| Tonnes | Ag-Equivalent | ||

| (000’s) | (g/t) | (Koz) | |

| Probable Reserves | 2,260 | 170 | 12,350 |

| Proven & Probable Reserves | 2,260 | 170 | 12,350 |

| Indicated Resources | 4,308 | 169 | 23,410 |

| Indicated Resources (Tailings) | 2,459 | 119 | 9,410 |

| Measured & Indicated Resources |

6,767 | 151 | 32,820 |

| Inferred Resources | 3,470 | 170 | 18,930 |

| Inferred Resources (Tailings) | 428 | 118 | 1,620 |

Del Toro (2.0% NSR)1,2,7,8

Del Toro is an underground silver mine and processing facility located in Zacatecas, Mexico, which was operated by First Majestic from 2013 until 2020 when it was placed on temporary suspension subject to further exploration in order to improve overall operating cash flows and profit margins. Exploration at Del Toro has been primarily focused on the investigation of two areas: the San Juan and Perseverancia areas within the project’s holdings. Both the San Juan and Perseverancia were historic mines; Perseverancia was mined for high grade silver rich sulphide ore and San Juan is believed to be the oldest mine in the district, possibly dating back 500 years. More recently, the San Nicolas and Dolores areas that consist of breccia chimney and vein deposits have been receiving attention.

In 2018, silver equivalent production totaled 1.4 Moz silver, meanwhile 2017 silver equivalent production totaled 2.2 Moz. The operation is in close vicinity and similar in nature to Pan American Silver Corp.’s (NASDAQ: PAAS) La Colorada mine. The mine infrastructure includes a 2,000 tpd flotation circuit, as well as a 2,000 tpd cyanidation circuit with a 3,815 ha property package.

| Reserve & Resource Estimate | |||

| Tonnes | Ag-Equivalent | ||

| (000’s) | (g/t) | (Koz) | |

| Indicated Resources | 440 | 414 | 5,850 |

| Indicated Resources (Transitional) |

153 | 351 | 1,720 |

| Measured & Indicated Resources |

592 | 398 | 7,570 |

| Inferred Resources | 496 | 322 | 5,130 |

| Inferred Resources (Transitional) | 690 | 273 | 6,050 |

| Total Inferred | 1,186 | 293 | 11,180 |

San Martin (2.0% NSR)1,2,7,8

San Martin is an underground silver mine and 1,300 tpd cyanidation processing facility in Jalisco State, Mexico with a 38,512-ha property package. The 1,300 tpd mill and processing plant consists of crushing, grinding and conventional cyanidation by agitation in tanks and a Merrill-Crowe doré production system. At full capacity of 1,300 tpd, San Martin’s annual silver production has reached over 2 million ounces of silver in the form of doré bars. In 2018, First Majestic produced 2.2 Moz AgEq from the mine and in 2017, produced 2.3 Moz AgEq. First Majestic operated the mine from 2006 until 2019 when it was place on temporary suspension. First Majestic continues to work with government authorities to secure the mine site for a potential reopening. Drilling has been focused on deeper ore shoots of the Rosario vein for continuation of mineralization. Since the acquisition of the mine, First Majestic completed 195,628 meters in 1,125 diamond drill-holes on the property.

| Reserve & Resource Estimate | |||

| Tonnes | Ag-Equivalent | ||

| (000’s) | (g/t) | (Koz) | |

| Measured Resources | 70 | 255 | 580 |

| Indicated Resources | 958 | 321 | 9,890 |

| Measured & Indicated Resources |

1,028 | 317 | 10,470 |

| Inferred Resources | 2,533 | 256 | 20,870 |

La Parrilla (2.0% NSR)1,2,7,8

La Parrilla is an underground mine complex owned by First Majestic consisting of multiple inter-connected mines within a 69,478-ha land package. The property has known mineralization throughout, with a complex of five underground mines surrounding the mill including Los Rosarios, La Rosa, San Jose, Quebradillas and San Marcos. Full production from the mine for 2018 totaled 2.3 Moz AgEq meanwhile 2017 production totaled 2.5 Moz AgEq. The mine was placed on care and maintenance in 2019 to complete exploration and development work. The mine has a 2,000 tpd processing plant and all associated infrastructure. In 2021, First Majestic completed discussions to continue the long-term land use agreement at La Parrilla and expected to complete a 19,000-meter drill program to test near mine, brownfield, and greenfield targets.

| Reserve & Resource Estimate | |||

| Tonnes | Ag-Equivalent | ||

| (000’s) | (g/t) | (Koz) | |

| Measured Resources | 15 | 250 | 120 |

| Indicated Resources (Sulphides) | 1,028 | 277 | 9,160 |

| Indicated Resources (Oxides) | 76 | 278 | 680 |

| Measured & Indicated Resources |

1,119 | 277 | 9,960 |

| Inferred Resources | 393 | 207 | 2,610 |

| Inferred Resources (Sulphides) | 1,028 | 299 | 9,890 |

| Total Inferred | 1,421 | 274 | 12,500 |

La Joya (2% NSR)2,3,7,8,9

La Joya is a large silver-copper-gold advanced exploration project in Durango, Mexico currently operated by Silver Dollar (CSE: SLV) near Grupo Mexico’s (BMV: GMEXICOB) San Martin Mine. In 2013, a Preliminary Economic Assessment on the first stage of the project proposed a low strip, open pit mine with an initial nine-year life of mine plan with a 5,000 tpd conventional mine and flotation plant producing an average of 3.9 Moz AgEq per year with an IRR of 30.5%. Since assuming ownership of the project, Silver Dollar announced the discovery of the Brazo Zone, ~1 km west of the bulk of the historical resource. Significant intercepts from the discovery include 2,369 g/t AgEq over 1.01 meters and 815 g/t AgEq over 5 meters.

| Historical Reserve & Resource Estimate | |||

| Tonnes | Ag-Equivalent | ||

| (000’s) | (g/t) | (Koz) | |

| Inferred Resources | 71,204 | 70 | 159,750 |

Plomosas (2% NSR)1,2,4,7,8

Plomosas is a permitted, advanced exploration stage silver project in Sinaloa, Mexico owned and operated by GR Silver (TSX-V: GRSL). After assuming ownership of the project, GR Silver announced an updated resource estimate at the Plomosas mine and began an infill drill program to add new zones into the resource model. GR Silver is targeting an updated resource estimate in Q1 2023. Significant results from the infill drilling program at Plomosas include 518 g/t AgEq over 44.5 meters, 1,146 g/t AgEq over 12.5 meters and 471 g/t AgEq over 24.9 meters.

The Plomosas royalty is subject to a 1% buyback for $1 million.

| Reserve & Resource Estimate | |||

| Tonnes | Ag-Equivalent | ||

| (000’s) | (g/t) | (Koz) | |

| Indicated Resources (OP) | 300 | 114 | 1,300 |

| Indicated Resources (Underground) |

2,100 | 136 | 9,100 |

| Measured & Indicated Resources | 2,400 | 133 | 10,300 |

| Inferred Resources (OP) | 1,400 | 103 | 4,800 |

| Inferred Resources (Underground) | 4,400 | 116 | 16,200 |

| Total Inferred | 5,800 | 113 | 21,000 |

La Guitarra (2% NSR)1,5,7,8,9

La Guitarra is a fully permitted underground silver mine in Temascaltepec, Mexico, 100% owned by First Majestic and subject to a binding purchase agreement with Sierra Madre (TSX-V: SM). The mine was in production in 2018 where production averaged between 1 million to 1.5 million AgEq ounces annually between 2015 and 2018. Sierra Madre has announced a fast-track restart strategy for the mine whereby a district-scale exploration and mine development program will be initiated, thereafter a resource report is planned with mine restart studies and finally, reprocessing the tailings. The potential target for tailings at La Guitarra is 2-2.5 Mt at 0.4-0.6 g/t gold and 35 – 40 g/t silver where initial metallurgical tests show 80% gold recovery and 70% silver recovery.

La Guitarra is subject to a 1% buyback for $2 million.

| Historical Reserve & Resource Estimate | |||

| Tonnes | Ag-Equivalent | ||

| (000’s) | (g/t) | (Koz) | |

| Measured Resources | 57 | 347 | 640 |

| Indicated Resources | 644 | 328 | 6,800 |

| Measured & Indicated Resources |

701 | 330 | 7,440 |

| Inferred Resources | 1,044 | 299 | 10,030 |

La Luz (2% NSR)1,2,6,7,8,9

La Luz is a silver advanced exploration project owned by First Majestic in San Luis Potosi, Mexico. The project is located within Real de Catorce, a historically significant mining district with an estimate historical production of 230 Moz of silver between 1773 and 1990.

| Historical Resource Estimate (Including Tailings) | |||

| Tonnes | Ag-Equivalent | ||

| (000’s) | (g/t) | (Koz) | |

| Inferred Resources | 5,005 | 204 | 32,008 |

SECURITY RIGHTS HOLDER AGREEMENT

Pursuant to the Transaction, First Majestic and Metalla will enter into the Security Holder Rights and Obligations Agreement in respect of the common shares of Metalla being issued to First Majestic, which will include certain transfer restrictions, a customary shareholder lockup and voting rights.

ADVISORS

DLA Piper (Canada) LLP acted as legal counsel to Metalla, and Bennett Jones LLP acted as legal counsel to First Majestic for the Transaction.

No finder’s fee or other commission is payable by Metalla in connection with the Transaction.

QUALIFIED PERSON

The technical information contained in this news release has been reviewed and approved by Charles Beaudry, geologist M.Sc., member of the Association of Professional Geoscientists of Ontario and the Ordre des Géologues du Québec and a consultant to Metalla. Mr. Beaudry is a Qualified Person as defined in National Instrument 43-101, Standards of Disclosure for Mineral Projects.

ABOUT METALLA

Metalla is a precious metals royalty and streaming company. Metalla provides shareholders with leveraged precious metal exposure through a diversified and growing portfolio of royalties and streams. Our strong foundation of current and future cash-generating asset base, combined with an experienced team gives Metalla a path to become one of the leading gold and silver companies for the next commodities cycle.

First Majestic Royalty Map (CNW Group/Metalla Royalty and Streaming Ltd.)

MORE or "UNCATEGORIZED"

Eloro Resources Announces Closing of Bought Deal LIFE Private Placement for Gross Proceeds of C$17 Million

Eloro Resources Ltd. (TSX: ELO) (FSE: P2QM) is pleased to announce the closing of its previously an... READ MORE

Minera Alamos Updates Resources and Reserves for the Pan Gold Mine in Nevada

Minera Alamos Inc. (TSX-V: MAI) (OTCQX: MAIFF) is pleased to announce updated Mineral Resource and M... READ MORE

Ero Copper Reports Fourth Quarter and Full Year 2025 Operating and Financial Results

Ero Copper Corp. (TSX: ERO) (NYSE: ERO) is pleased to announce its operating and financial results f... READ MORE

Rare Element Resources Announces Results of Oversubscribed Rights Offering of Common Shares

Rare Element Resources Ltd. (OTCQB: REEMF) is pleased to report that its previously announced... READ MORE

TRX Gold Reports Record Q2 2026 Production and Company Update

TRX Gold Corporation (TSX: TRX) (NYSE American: TRX) is pleased to announce preliminary resu... READ MORE