METALLA REPORTS FINANCIAL RESULTS FOR THE THIRD QUARTER OF 2023 AND PROVIDES ASSET UPDATES

Metalla Royalty & Streaming Ltd. (TSX-V: MTA) (NYSE American: MTA) announces its operating and financial results for the three and nine months ended September 30, 2023. For complete details of the condensed interim consolidated financial statements and accompanying management’s discussion and analysis for the three and nine months ended September 30, 2023, please see the Company’s filings on SEDAR+ (www.sedarplus.ca) or EDGAR (www.sec.gov). Shareholders are encouraged to visit the Company’s website at www.metallaroyalty.com.

Brett Heath, President, and CEO of Metalla, commented, “In the third quarter of 2023 we announced the largest transaction in the Company’s history, to merge with Nova Royalty, creating one of the most robust growth portfolios in the royalty sector. Financially, we saw strong production led by El Realito and expect to meet or exceed the upper range of guidance for the year. The merger is expected to close in the fourth quarter of 2023, and we look forward to building the combined company into an intermediate royalty company that will deliver long-term value for our shareholders.”

FINANCIAL HIGHLIGHTS

During the nine months ended September 30, 2023, and the subsequent period up to the date of this news release, the Company:

- Announced that it had entered into an arrangement agreement dated September 7, 2023, whereby, the Company would acquire all of the issued and outstanding shares of Nova Royalty Corp. (TSX-V: NOVR) pursuant to a plan of arrangement. Pursuant to the Nova Transaction, Nova shareholders will receive 0.36 of a Metalla common share per common share of Nova (For additional details see Nova Royalty Acquisition);

- On September 8, 2023, announced a strategic partnership with Beedie Capital, whereby concurrent with closing of the Nova Transaction, Beedie, has agreed to: (i) subscribe for an equity placement into Metalla for C$15.0 million at C$5.29 per unit; (ii) amend the convertible loan facility between Metalla and Beedie from to increase the principal amount C$25.0 million to C$50.0 million; (iii) amend the conversion price of the C$4.2 million outstanding under the Beedie Loan Facility to C$6.00 per share; and (iv) drawdown from the Beedie Loan Facility, at closing of the Nova Transaction, an amount equal to the principal and unpaid interest and fees outstanding under the convertible loan agreement with Nova to refinance and retire the Nova Loan Facility (For additional details see Nova Royalty Acquisition);

- Acquired 1 stream and 5 royalties, to bring the total held as at the date of this press release to 82 precious metals assets, through the following transactions:

-

- Acquired an existing 2.5%-3.75% sliding scale Gross Proceeds royalty over gold, together with a 0.25%-3.0% Net Smelter Return royalty on all non-gold and silver metals on the majority of Barrick Gold Corporation’s world-class Lama project in Argentina, from an arm’s length seller for aggregate consideration of $7.5 million. The transaction closed on March 9, 2023, at which time the Company paid the $2.5 million in cash, and issued 466,827 Common Shares to the seller (valued at $5.3553 per share). The remaining $2.5 million, to be paid in cash or Common Shares, is payable within 90 days upon the earlier of a 2 Moz gold Mineral Reserve estimate on the royalty area or 36 months after the closing date;

- Acquired one silver stream and three royalties from Alamos Gold Corp. for $5.0 million in Common Shares valued at $5.3228 per share, representing the 20-day Volume-Weighted Average Price of shares of Metalla traded on the NYSE prior to the announcement of the transaction. The transaction closed on February 23, 2023, at which time the Company issued 939,355 Common Shares to Alamos. The stream and royalties acquired in this transaction include:

-

-

- a 20% silver stream over the Esperanza project located in Morales, Mexico owned by Zacatecas Silver Corp.;

- a 1.4% NSR royalty on the Fenn Gibb South project located in Timmins, Ontario owned by Mayfair Gold Corp.;

- a 2.0% NSR royalty on the Ronda project located in Shining Tree, Ontario owned by Platinex Inc.; and

- a 2.0% NSR royalty on the Northshore West property located in Thunder Bay, Ontario owned by New Path Resources Inc.

-

- Sold the JR mineral claims that make up the Pine Valley property, which is part of the Cortez complex in Nevada, to Nevada Gold Mines LLC an entity formed by Barrick and Newmont Corporation, for $5.0 million in cash. The Company will retain a 3.0% NSR royalty on the property. Additionally, sold the Conmee mineral claims that make up the Tower Mountain property to Thunder Gold Corp. for 4,000,000 common shares of Thunder Gold, valued at $0.1 million upon closing. The Company will retain a 2.0% NSR royalty on the property;

- Paid a special dividend payment in the amount of C$0.03 per share on September 15, 2023, with a record date of August 1, 2023;

- For the three months ended September 30, 2023, received or accrued payments on 1,095 attributable Gold Equivalent Ounces at an average realized price of $1,901 and an average cash cost of $5 per attributable GEO. For the nine months ended September 30, 2023, received or accrued payments on 2,878 attributable GEOs at an average realized price of $1,893 and an average cash cost of $6 per attributable GEO (see Non-IFRS Financial Measures);

- For the three months ended September 30, 2023, recognized revenue from royalty and stream interests, including fixed royalty payments, of $1.4 million, net loss of $2.1 million, and Adjusted EBITDA of $0.5 million. For the nine months ended September 30, 2023, recognized revenue from royalty and stream interests, including fixed royalty payments, of $3.3 million, net loss of $4.0 million, and Adjusted EBITDA of $0.9 million (see Non-IFRS Financial Measures);

- For the three months ended September 30, 2023, generated operating cash margin of $1,896 per attributable GEO, and for the nine months ended September 30, 2023, generated operating cash margin of $1,887 per attributable GEO from the Wharf, El Realito, La Encantada, the New Luika Gold Mine stream held by Silverback Ltd. the Higginsville derivative royalty asset, and other royalty interests (see Non-IFRS Financial Measures);

- For the three months ended September 30, 2023, recognized payments due or received (not included in revenue) from the Higginsville derivative royalty asset of $0.7 million, and for the nine months ended September 30, 2023, recognized payments due or received (not included in revenue) from the Higginsville derivative royalty asset of $2.1 million (see Non-IFRS Financial Measures);

- On May 27, 2022, the Company announced that it had entered into a new equity distribution agreement with a syndicate of agents to establish an ATM equity program under which the Company may distribute up to $50.0 million (or the equivalent in Canadian Dollars) in Common Shares of the Company. From inception to the date of this press release, the Company distributed 1,328,078 Common Shares under the 2022 ATM Program at an average price of $5.01 per share for gross proceeds of $6.6 million, of which none were sold during the three months ended September 30, 2023; and

- On May 19, 2023, the Company closed a second supplemental loan agreement to amend its loan facility by:

-

- extending the maturity date to May 9, 2027;

- increasing the loan facility by C$5.0 million from C$20.0 million to C$25.0 million, of which C$21.0 million will be undrawn after giving effect to the C$4.0 million conversion described below;

- increasing the interest rate from 8.0% to 10.0% per annum;

- amending the conversion price of the fourth drawdown from C$11.16 per share to C$8.67 per share, being a 30% premium to the 30-day VWAP of the Company shares measured at market close on the day prior to announcement of the amendment;

- amending the conversion price of C$4.0 million of the third drawdown from C$14.30 per share to C$7.33 per share, being the 5-day VWAP of the Company shares measured at market close on the day prior to announcement of the amendment, and converting the C$4.0 million into shares at the new conversion price. Upon closing the Company issued Beedie 545,702 Common Shares for the conversion of the C$4.0 million;

- amending the conversion price of the remaining C$1.0 million of the Third Drawdown from C$14.30 per share to C$8.67 per share, being to the 30-day VWAP of the Company shares measured at market close on the day prior to announcement of the amendment; and

- All other terms of the loan facility remain unchanged.

NOVA ROYALTY ACQUISITION

On September 7, 2023, the Company entered into an arrangement agreement pursuant to which the Company agreed, subject to certain terms and conditions, to acquire all of the issued and outstanding common shares of Nova. Pursuant to the Arrangement Agreement, Nova shareholders will receive 0.36 of a Metalla Common Share for each Nova common share held prior to the Nova Transaction (other than with respect to holders of Nova common shares exercising dissent rights). In accordance with the Arrangement Agreement, each Nova restricted share unit will vest into a Nova common share at the close of the Nova Transaction and will be exchanged for 0.36 of a Metalla Common Share, and each Nova stock option will be replaced with a fully vested replacement option. All replacement options will be adjusted as per the terms of the Arrangement Agreement and be exercisable into Metalla Common Shares.

Based on the assumptions set out above, upon completion of the Nova Transaction, the Company expects that existing Metalla and Nova shareholders would own approximately 60.41% and 39.59% of the combined company, respectively, on a fully diluted basis. The Nova Transaction is subject to approval at a special meeting of Nova shareholders which is scheduled for November 27, 2023. Additionally, the Nova Transaction is also subject to certain approvals of the British Columbia Supreme Court, the TSX-V, the NYSE, the receipt of all necessary regulatory and third-party approvals, and other customary conditions.

Nova Royalty

Nova is a royalty and streaming company that is focused on acquiring copper royalties and as at the date of this press release, has a portfolio of 23 royalties including the following key royalties:

- 0.42% NSR royalty on Taca Taca operated by First Quantum Minerals Ltd.;

- 0.315% NSR royalty on the Copper World Complex operated by Hudbay Minerals Inc.;

- 1.0% NSR royalty on Aranzazu operated by Aura Minerals Inc.;

- 0.08% NPI royalty on Josemaria operated by Lundin Mining Corp.;

- 0.98% NSR royalty on open pit operations and 0.49% NSR royalty on underground operations on Vizcachitas operated by Los Andes Copper Ltd.;

- 0.25% NSR royalty on Tatogga operated by Newmont Corp.;

- 2.0% NSR royalty on NuevaUnion operated as a 50/50 joint venture between Teck Resources Ltd. and Newmont Corp.; and

- 1.0% NPR royalty on West Wall operated as a 50/50 joint venture between Anglo American plc and Glencore plc.

Beedie Capital Strategic Partnership

Beedie has agreed, concurrent with closing of the Nova Transaction, to:

- subscribe to C$15.0 million in an equity placement into Metalla;

- amend and increase the existing Beedie Loan Facility; and

- repay and terminate the Nova Loan Facility.

Equity Placement

Beedie entered into a subscription agreement to complete a C$15.0 million equity placement in Metalla, pursuant to which it agreed, subject to certain conditions, to subscribe for 2.8 million subscription receipts of Metalla, at a price of C$5.29 per Subscription Receipt, which was the closing price of the Metalla Common Shares on the TSX-Venture Exchange on September 7, 2023, the day prior to the announcement of the Nova Transaction. Beedie completed funding of the Equity Placement into escrow on October 23, 2023. Upon closing of the Nova Transaction, and subject to certain customary conversion conditions for a transaction of this nature, each Subscription Receipt will convert into one Metalla Common Share, without payment of additional consideration or further action and the subscription funds will be released to the Company from escrow. The Company expects that the proceeds of the Equity Placement will be used for the future acquisition of royalties and streams, and general and administrative expenses.

Metalla Convertible Loan

Metalla and Beedie have entered into an amended and restated convertible loan facility agreement to amend and restate the Beedie Loan Facility dated July 28, 2020, between Metalla and Beedie. The A&R Loan Facility will be effective as of the closing of the Nova Transaction, provided that certain conditions have been satisfied. Pursuant to the A&R Loan Facility, the parties agreed to:

-

- increase the maximum aggregate principal amount of the loan from C$25.0 million to C$50.0 million;

- drawdown C$4.2 million from the A&R Loan Facility with a conversion price of C$6.00 per share to refinance the principal amount due under the Beedie Loan Facility;

- drawdown C$12.2 million from the A&R Loan Facility with a conversion price of C$6.00 per share to refinance the principal amount due under the Nova Loan Facility;

- drawdown an amount equal to the accrued and unpaid interest outstanding under the Nova Loan Facility at the close of the Nova Transaction, to refinance such amount, with a conversion price equal to the market price of the shares of Metalla at the time of conversion. As at September 30, 2023, the accrued and unpaid interest due under the Nova Loan Facility was C$1.8 million;

- drawdown an amount equal to the accrued and unpaid fees outstanding under the Nova Loan Facility at the close of the Nova Transaction, to refinance such amount, which will not be convertible into shares of Metalla. As at September 30, 2023, the accrued and unpaid fees due under the Nova Loan Facility were C$0.7 million;

- establish for an 18-month period, paid-in-kind interest of a cash 10.0% per annum compounded monthly to the principal effective at closing of the Nova Transaction, and thereafter reverting to interest payment of 10.0% on a monthly basis;

- payment of an amendment fee of C$0.1 million and any outstanding costs and expenses payable by Metalla; and

- update the existing security arrangements to include security to be provided by Nova and certain other subsidiaries of Metalla and Nova for the A&R Loan Facility.

Nova Convertible Loan

As per the A&R Loan Facility and as discussed above, concurrent with closing of the Nova Transaction, Metalla will draw down on the A&R Loan Facility and pay out and discharge all obligations under the Nova Loan Facility, which will be terminated concurrently.

ASSET UPDATES

Below are updates during the three months ended September 30, 2023, and subsequent period to certain of the Company’s assets, based on information publicly filed by the applicable project owner:

La Encantada

On October 12, 2023, First Majestic Silver Corp. announced production of 94 ounces of gold and 0.6 Moz of silver from La Encantada in the third quarter of 2023. On July 20, 2023, First Majestic provided 2023 guidance in the range of 3.1 – 3.3 Moz silver.

Metalla received 99 GEOs from La Encantada for the third quarter of 2023.

Metalla holds a 100% GVR royalty on gold produced at the La Encantada mine limited to 1.0 Koz annually.

El Realito

On October 25, 2023, Agnico Eagle Mines Ltd. reported that gold production from La India totaled 22,269 oz gold for the third quarter of 2023. As reported by Agnico on July 26, 2023, an investigation is ongoing for additional sulphide mineralization with a plan to drill 4,000 meters at the Chipriona target which is northwest and adjacent to El Realito royalty boundary.

Metalla received 398 GEOs from El Realito for the third quarter of 2023.

Metalla holds a 2.0% NSR royalty on the El Realito deposit which is subject to a 1.0% buyback right for $4.0 million.

Wharf Royalty

On November 8, 2023, Coeur Mining Inc. reported third quarter production of 22.7 Koz gold and updated the full year guidance for Wharf to 88 – 95 Koz gold. Exploration efforts in 2023 will focus on geological modelling and planning for 2024.

Metalla received 192 GEOs from Wharf for the third quarter of 2023.

Metalla holds a 1.0% GVR royalty on the Wharf mine.

New Luika Silver Stream

On October 23, 2023, Shanta Gold Limited reported that it produced 18.3 Koz of gold and 27.2 Koz of silver at NLGM in Tanzania in the third quarter of 2023. Shanta also reiterated their guidance of 66 – 72 Koz of gold from NLGM in 2023.

Metalla holds a 15% interest in Silverback, whose sole business is receipt and distribution of a 100% silver stream on NLGM at an ongoing cost of 10% of the spot silver price.

Côté-Gosselin

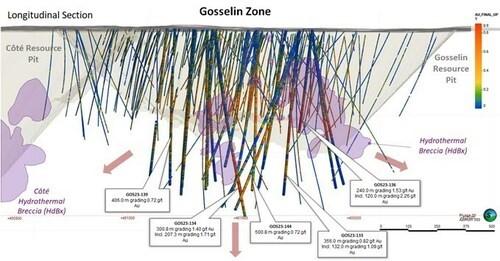

On October 23, 2023, IAMGOLD Corporation reported that it had completed 90.6% of the construction at the Côté Gold Project. IAMGOLD also announced the completion of another successful drill campaign at Gosselin and reported additional results. IAMGOLD stated that recent drilling at Gosselin provides evidence that the 5 Moz gold Gosselin deposit is approaching similar dimensions to the adjacent 14 Moz gold Côté deposit. IAMGOLD expects to incorporate recent drill results into an updated resource estimate for Gosselin in the IAMGOLD year end Mineral Resources disclosure. In addition, IAMGOLD continues to advance technical studies on Gosselin, including metallurgical testing, mining, and infrastructure studies to review alternatives to optimize the possible inclusion of the Gosselin deposit into a future Côté Gold life-of-mine plan. Significant intervals from the Gosselin drilling program include:

- 0.65 g/t gold over 472 meters including 1.59 g/t gold over 51 meters;

- 0.82 g/t gold over 356 meters including 1.09 g/t gold over 132 meters;

- 1.40 g/t gold over 300.8 meters including 1.71 g/t gold over 207.3 meters;

- 1.53 g/t gold over 240 meters including 2.26 g/t gold over 120 meters; and

- 0.72 g/t gold over 500.8 meters.

Metalla holds a 1.35% NSR royalty that covers less than 10% of the Côté Reserves and Resources estimate and covers all of the 5 Moz gold Gosselin Resource estimate.

Endeavor

On October 16, 2023, Polymetals Resources Inc released a robust mine restart study at Endeavor. Polymetals declared an initial 10-year mine life producing 9.8 Moz silver, 210 kt zinc and 62 kt lead over life of mine with first concentrate production targeted for H2-2024. The study produced A$201 million in pre-tax net present value at an 8% discount rate and an internal rate of return of 91%, with expenditures estimated to be A$23.7 million.

In addition, Polymetals released an updated ore Reserve estimate at Endeavor where Proven and Probable Reserves totaled 14 Moz silver, 226 kt zinc and 100 kt lead at grades of 78 g/t, 4.04% and 1.79%, respectively.

Metalla holds a 4.0% NSR royalty on all lead, zinc and silver produced from Endeavor.

Amalgamated Kirkland Property

On October 25, 2023, Agnico announced that it is evaluating the opportunity to process near surface and Amalgamated Kirkland ore at the LaRonde complex. Average annual production from the near surface deposit and AK deposit could be between 20 Koz and 40 Koz of gold, commencing in 2024. The results of an internal evaluation on the AK deposit will be reported in the first half of 2024.

Metalla holds a 0.45% NSR royalty on the Amalgamated Kirkland property.

Fifteen Mile Stream

On October 10, 2023, St. Barbara Limited reported results of an updated pre-feasibility study for Fifteen Mile Stream as a standalone project via the relocation of the Touquoy processing plant. The PFS proposes an eleven-year mine life producing an average of 55-60 Koz per annum at a cash cost of $992/oz. The PFS results include strong project economics including a post-tax net present value at 5% of C$174 million and post-tax internal rate of return of 20.3%, from a capital outlay of C$182 million. As part of the PFS, an updated Proven and Probable Reserve estimate was declared, including the 149 deposit, with a total of 618 Koz at 1 g/t gold and a total Measured and Indicated Resource estimate of 739 Koz at 1 g/t gold and a total Inferred Resource estimate of 98 Koz at 1.3 g/t gold. St. Barbara will focus on the preparation of an updated environmental and social impact assessment for the new project design and stated that development could begin as early as FY2026.

Metalla holds a 1.0% NSR royalty on the Fifteen Mile Stream project, and 3.0% NSR royalty on the Plenty and Seloam Brook deposits.

Tocantinzinho

On September 12, 2023, G Mining Ventures reported that the Tocantinzinho project is 51% complete and remains on track for commercial production in H2-2024. G Mining also reported that the project remains on budget and is fully funded through completion and ramp-up to commercial production.

Metalla holds a 0.75% GVR Royalty on Tocantinzinho.

La Guitarra

On November 1, 2023, Sierra Madre Gold & Silver Ltd reported an updated resource estimate at the La Guitarra silver-gold mine where Indicated Resources totaled 27.2 Moz AgEq at 220 g/t AgEq and Inferred Resources totaled 20.2 Moz AgEq at 153 g/t AgEq. Sierra Madre plan to release a mine restart study on the La Guitarra mine in Q1 2024.

Metalla holds a 2.0% NSR Royalty on La Guitarra, subject to a 1.0% buy back for $2.0 million.

Fosterville

On August 25, 2023, Agnico reported that gold production from Fosterville for the third quarter of 2023 totalled 59.8 Koz gold. Drilling during the quarter targeted the Lower Phoenix where a key target called the Cardinal fault, a hanging wall splay of the Swan structure, returned a highlight intercept of 10.8 g/t gold over 10 meters including 96.4 g/t over 0.4 meters.

Metalla holds a 2.5% GVR royalty on the northern and southern extensions of the Fosterville mining license and other areas in the land package.

Wasamac

On October 26, 2023, Agnico reported that during the quarter, it further advanced internal studies to assess potential production opportunities at Wasamac along with alternative processing scenarios at either LaRonde or the Canadian Malartic mill. Agnico also stated that it was updating studies that were previously completed at Wasamac and believes it has the potential to be a low-cost mine with annual production of 150 – 200 Koz of gold with moderate capital outlays and initial production commencing in 2029. The results of the Wasamac internal evaluation will be reported through the first half of 2024.

Metalla holds a 1.5% NSR royalty on the Wasamac project subject to a buy back of 0.5% for C$7.5 million.

Lama

On November 2, 2023, Barrick reported that a geological review of results received from drilling in the first quarter of 2023 was ongoing to generate new drill targets for the fourth quarter of 2023. Total exploration, evaluation and project expenses for the whole Pascua-Lama project totaled $5 million for the third quarter of 2023.

Metalla holds a 2.5%-3.75% GP royalty on gold and a 0.25%-3.0% NSR royalty on all other metals (other than gold and silver) at Lama.

Castle Mountain

On October 31, 2023, Equinox Gold Corp. reported that 8,411 meters of exploration drilling was completed during the quarter to infill drill at the South Overburden and JSLA dumps. In addition, a surface exploration program of geological mapping and channel sampling was ongoing with the primary goal to sample previously identified mineralization exposed on surface such that data can be used in future Mineral Resource estimation. The mine permitting amendment plan was submitted to the lead county and BLM agencies which reviewed the plan for completeness in early 2023. Work on the preliminary draft Environmental Impact Statement will occur throughout 2024. A total of $4.4 million was spent on Phase 2 permitting and optimization for the quarter.

Metalla holds a 5.0% NSR royalty on the South Domes area of the Castle Mountain mine.

La Parrilla

On August 14, 2023, Silver Storm Mining Ltd. reported an updated resource estimate for the La Parrilla silver mine complex. Total Indicated Resources were 5.19 Moz at 263 g/t AgEq and Inferred Resources totaled 10.3 Moz at 256 g/t AgEq. On November 2, 2023, Silver Storm extended mineralization beyond the mineral resources with highlight intercepts of 206 g/t AgEq over 5.2 meters, 414 g/t AgEq over 0.8 meters and 225 g/t AgEq over 1.5 meters.

Metalla holds a 2.0% NSR royalty on La Parrilla.

Akasaba West

On October 26, 2023, Agnico announced that the Akasaba West project remained on schedule through the third quarter with achievement of commercial production expected to occur in the first quarter of 2024.

Metalla holds a 2.0% NSR royalty on the Akasaba West project subject to a 210 Koz gold exemption.

Beaufor

On November 3, 2023, Monarch Mining Corporation announced that one of its creditors, that is owed C$10.1 million, had provided notice of its intention to exercise certain rights in respect of the security for its loan, with the loan secured by all assets of Monarch. The Beaufor mine was put on care and maintenance in September 2022, and Monarch’s financial statements for the year ended June 30, 2023, released on September 28, 2023, noted a material uncertainty that may cast significant doubt upon Monarch’s ability to continue as a going concern. The Company considered the serving of notice by one of its creditors, and the disclosure by Monarch about its ability to continue as a going concern, as indicators of impairment on Beaufor and fully impaired the royalty to $Nil, and for the nine months ended September 30, 2023, recorded an impairment charge of $1.1 million.

Metalla holds a 1.0% NSR royalty on the Beaufor mine, and while it has written down the royalty to $Nil for accounting purposes, it will continue to monitor the project, and if the project is restarted or sold to an entity with a plan to restart mining and processing activities, the Company will do a further analysis to see if any part of the impairment can be reversed in the future.

Montclerg

On September 6, 2023, GFG Resources Inc. reported the deepest high-grade lower footwall intercept at the Montclerg gold project yielding 10.21 g/t gold over 2.7 meters Additional holes included highlight intercepts of 0.92 g/t gold over 33 meters and 5.78 g/t gold over 1.1 meters.

Metalla holds a 1.0% NSR royalty on the Montclerg property.

Camflo

On October 26, 2023, Agnico reported that the next phase of exploration drilling began at the Camflo property. On June 20, 2023, Agnico reported that it completed more than 14,000 meters of drilling, which marks the first exploration drill program since the 1.6 Moz past-producing deposit was closed in 1992. Significant results reported over multiple zones include 1.5 g/t gold over 81 meters, 3.3 g/t gold over 38.7 meters, 3.2 g/t gold over 16.2 meters, 3.7 g/t gold over 7.1 meters, and 1.6 g/t gold over 20.3 meters. The second phase of exploration drilling at Camflo will test for potential lateral extensions of mineralization and infill known zones. Agnico believes the mineralization could be mined via an open-pit and processed at the Canadian Malartic Mill, 4 Km away.

Metalla holds a 1.0% NSR royalty on the Camflo mine, located ~4km northeast of the Canadian Malartic operation.

Green Springs

On August 17, 2023, and September 6, 2023, Contact Gold Corp announced the results from step out drilling at Green Springs. Highlight intercepts from the X-ray zone include 1.9 g/t gold over 25.91 meters, 1.41 g/t gold over 12.19 meters and 0.86 g/t gold over 35.05 meters.

Metalla holds a 2.0% NSR royalty on the Green Springs project.

Tower Mountain

On June 12, 2023, Thunder Gold reported they expanded the footprint at Tower Mountain adding 565 hectares from Metalla. On May 15, 2023, Thunder Gold reported final results from the 4,000-meter phase one drilling program at Tower Mountain with significant results of 0.59 g/t gold over 36.3 meters, 0.53 g/t gold over 24.5 meters and 0.56 g/t gold over 10.5 meters.

Metalla holds a 2.0% NSR royalty on the Tower Mountain property.

Detour DNA

On July 26, 2023, Agnico reported a drill hole two kilometers west of the open pit mineral reserves with a highlight of 2.8 g/t gold over 14.4 meters, further demonstrating continuity of mineralization along the Detour horizon past the area identified for underground mining potential.

Metalla holds a 2.0% NSR royalty on the Detour DNA property which is approximately 7 km west of the Detour West reserve pit margin.

QUALIFIED PERSON

The technical information contained in this news release has been reviewed and approved by Charles Beaudry, geologist M.Sc., member of the Association of Professional Geoscientists of Ontario and of the Ordre des Géologues du Québec and a director of Metalla. Mr. Beaudry is a QP as defined in National Instrument 43-101 – Standards of Disclosure for Mineral Projects.

ABOUT METALLA

Metalla is a precious metals royalty and streaming company. Metalla provides shareholders with leveraged precious metal exposure through a diversified and growing portfolio of royalties and streams. Our strong foundation of current and future cash-generating asset base, combined with an experienced team gives Metalla a path to become one of the leading gold and silver companies for the next commodities cycle.

Figure 1: Gosselin Composite Longitudinal Section (CNW Group/Metalla Royalty and Streaming Ltd.)

MORE or "UNCATEGORIZED"

Ascot Announces Closing of C$34 Million Bought Deal Financing

Ascot Resources Ltd. (TSX: AOT) (OTCQX: AOTVF) is pleased to anno... READ MORE

RUA GOLD Closes C$8 Million Brokered Offering and Announces Commencement of Trading on the TSX Venture Exchange

Highlights Closing the fully subscribed brokered offering for C$8... READ MORE

Mosaic Acquires 100% of the Amanda Project

Mosaic Minerals Corporation (CSE: MOC) announces that it has sign... READ MORE

First Phosphate Confirms Significant High-Quality Igneous Phosphate Deposit at Its Bégin-Lamarche Project in the Saguenay-Lac-St-Jean Region, Quebec au Canada

First Phosphate Corp. (CSE: PHOS) (OTC: FRSPF) (FSE: KD0) is ple... READ MORE

PROSPECT RIDGE ANNOUNCES FINAL CLOSING OF ITS OVERSUBSCRIBED PRIVATE PLACEMENT

Prospect Ridge Resources Corp. (CSE: PRR) (OTC: PRRSF) (FRA: OE... READ MORE