Meridian Drills Copper Dominated Layers of Ore Grading 28.6m @ 3.5 g/t AuEq (2.6% CuEq) at Cabacal

Highlights:

- Meridian drills more multiple stacked layers of shallow high-grade Au-Cu-Ag ore at Cabaçal;

— CD-702: 28.6m @ 3.5g/t AuEq (2.6% CuEq) from 127.6m; including:

- 3.9m @ 6.1g/t AuEq (4.5% CuEq) from 136.7m;

- 2.8m @ 9.4g/t AuEq (6.9% CuEq) from 143.8;

- 1.8m @ 5.7g/t AuEq (4.3% CuEq) from 149.1m;

- 2.8m @ 9.0g/t AuEq (6.7% CuEq) from 155.9m;

- Multiple zones of high-grade copper with peak grades assaying 10.6% Cu and 11.0% Cu;

— CD-693: 14.3m @ 2.9g/t AuEq (2.1% CuEq) from 77.3m; including:

- 2.3m @ 9.4g/t AuEq (7.0% CuEq) from 86.5m;

— CD-678: 19.6m @ 2.0g/t AuEq (1.5% CuEq) from 67.4m;

- Drill results continue to be consolidated for the final stage of grade and density modelling for Cabaçal’s DFS;

- Exploration results indicate a potentially northern structural repeat of Santa Helena § Exploration programs continue to advance with two new exploration licences granted;

— Including the permit for Cabaçal’s copper prospect “Alvorada” now open for exploration.

Meridian Mining UK S (TSX: MNO) (FSE: 2MM) (OTCQX: MRRDF) is pleased to report the delineation of multiple stacked layers of Au-Cu-Ag ore, drilled at its advanced Cabaçal Au-Cu-Ag VMS project. Results included CD-702’s 28.6m @ 3.5g/t AuEq (2.6% CuEq) from 127.6m, in the more sparsely drilled southeastern sector of the Cabaçal PFS1 open-pit. Stronger than expected zones of copper ore have been encountered here that are expected to improve local grade continuity. Today’s results provide further data to improve both grade and density modelling, as Cabaçal DFS’s infill drilling program nears its final stages. Drilling continues and more results are pending.

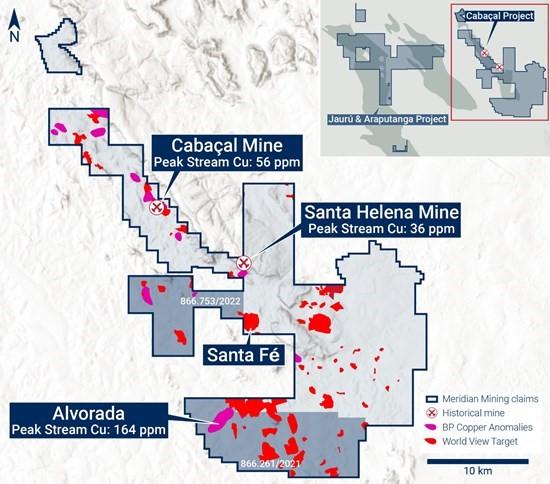

The Company has been granted two exploration licences (866.261/2021 and 866.753/2022). This opens up the Cabaçal belt’s untested historical copper anomaly Alvorada2 to its first modern exploration program.

Mr. Gilbert Clark, CEO, comments: “Our infill program continues to delineate southeasterly projections of strong copper and gold ore within the PFS’s open-pit model. These results will locally improve the ore grades but also the density which is particularly important for modelling the more copper-rich intersections, such as CD-702’s 28.6m @ 3.5g/t AuEq (2.6% CuEq) from 127.6m (1.0g/t Au, 1.9% Cu & 9.7g/t Ag). This interval returned 26 samples grading over 1.0% Cu, up to a peak of 11.0% Cu, in an area with limited historical density data. Effectively, higher density means more tonnes and more metal locally. The Company is entering into a new phase where Cabaçal’s DFS drill program nears completion, and Santa Helena’s resource drill program continues. While the expanded portfolio of new prospects like Cigarra, Santa Fé, Sucuri South, and the recently granted Alvorada, will be tested as part of our expanding regional exploration programs. Across all disciplines, we are focussing our efforts to realize the potential of Cabaçal to emerge as the premier gold-copper VMS belt in South America.”

Cabaçal Drilling Update

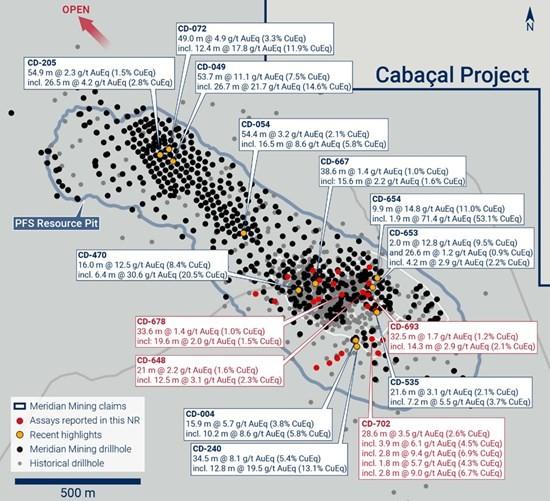

The ongoing drill program at Cabaçal has returned further strong intersections as the DFS infill drilling program nears its final stages (“Figure 1”; “Table 1”). Most holes are targeting the first 5-year production area, whilst some peripheral holes were drilled in the southwestern sector of the mine area to close drill spacing in some hanging wall mineralization positions.

Figure 1: Cabaçal plan view with results reported today.

Drilling is providing additional constraints on grade distribution but also on deposit density. The historical database has 1798 assay interval records with over 1.0% Cu, to a peak of 21.8% Cu, of which <10% have density readings. This lack of density data can contribute to an under-call in tonnes and Au-Cu metal contents. Copper dominant intersections were not a focus of historical mining, leaving wide copper mineralization intervals available to the planned Cabaçal open pit development.

CD-702 targeted the southern sector of the CCZ, in a more sparsely drilled area. The intersection provides a good example of the copper-dominant mineralization which although intersected by a mining void from 146.6 – 149.1m, was left extensively intact due to the past underground mining focus on gold. The hole intersected 28.6m @ 3.5g/t AuEq (2.6% CuEq) (1.0g/t Au, 1.9% Cu & 9.7g/t Ag) from 127.6m, with multiple high-grade sub-zones:

— CD-702: 28.6m @ 3.5g/t AuEq (2.6% CuEq) from 127.6m; including:

- 3.9m @ 6.1g/t AuEq (4.5% CuEq) from 136.7m;

- 2.8m @ 9.4g/t AuEq (6.9% CuEq) from 143.8;

- 1.8m @ 5.7g/t AuEq (4.3% CuEq) from 149.1m; and

- 2.8m @ 9.0g/t AuEq (6.7% CuEq) from 155.9m.

Over 26 samples in the composite contain >1.0% Cu, with peak grades in samples CBDS105591 (10.6% Cu) and CBDS105594 (11.0% Cu). The peak density value of 3.257 is already higher than the highest of the values in the historical dataset, highlighting the value in augmenting this dataset. Individual sub-zones can reach composited densities of 3.05, higher than the modelled density and locally contributing to a positive refinement of the DFS block model.

Highlights from additional Central Copper Zone holes include:

— CD-694: 20.8m @ 1.9g/t AuEq (1.4% CuEq) from 132.0m; including:

- 4.1m @ 7.7g/t AuEq (5.7% CuEq) from 148.8m;

— CD-695: 38.9m @ 0.9g/t AuEq (0.7% CuEq) from 64.4m; including:

- 13.3m @ 1.8g/t AuEq (1.4% CuEq) from 67.0m; including:

- 0.7m @ 15.8g/t AuEq (11.8% CuEq) from 67.0m; and

— CD-678: 33.6m @ 1.4g/t AuEq (1.0% CuEq) from 57.0m; including:

- 19.6m @ 2.0g/t AuEq (1.5% CuEq) from 67.4m.

Results were reported for two holes targeting the down-dip region of Eastern Copper Zone hole CD-654, which returned 9.9m @ 14.8g/t AuEq (11.0% CuEq) from 29.3m3. Results included:

— CD-648: 21.0m @ 2.2g/t AuEq (1.6% CuEq) from 68.6m; including:

- 12.5m @ 3.1g/t AuEq (2.3% CuEq) from 77.0m; and

— CD-693: 32.5m @ 1.7g/t AuEq (1.2% CuEq) from 64.2m; including

- 14.3m @ 2.9g/t AuEq (2.1% CuEq) from 77.3m; including

- 2.3m @ 9.4g/t AuEq (7.0% CuEq) from 86.5m.

Southern Copper Zone hole CD-679 returned:

— CD-679: 48.2m @ 0.8g/t AuEq from 48.0m; including:

- 3.4m @ 2.1g/t AuEq (1.6% CuEq) from 49.0m and

- 2.7m @ 4.5g/t AuEq (3.4% CuEq) from 68.7m.

A series of holes were drilled into the far southwestern sector of the pit shell to better model the position of local hanging wall mineralized extensions. Infilling an area with previously wider spaced drill data.

Exploration Update

The Company is pleased to report that two of its exploration title applications, 866.261/2021 and 866.753/2022, have been approved, adding 14,933 Ha to areas licensed for exploration (“Figure 2”). The Company is mobilizing its staff to commence land access agreements for these newly granted areas in this increasingly prospective southern sector of the Cabaçal VMS Belt. The granted areas include the Alvorada target, where georeferencing and digitizing of historical BP Minerals data identified the belt’s strongest peak copper-in-stream geochemical value of 164ppm Cu. This surpasses the original copper anomalies of Cabaçal (56ppm Cu) and Santa Helena (36ppm Cu). With BP’s 1980s exploration focus on gold, and Alvorada, having no associated gold anomaly, this was not followed up at the time despite its high copper content.

Figure 2: Location of licences newly approved for exploration, including the Alvorada Target.

Reconnaissance teams have continued with data collection and drill planning in the Santa Fé and Cigarra areas. At Cigarra, the Company has defined a 2km-long target corridor associated with elevated chargeability responses and Cu-Au & Zn soil geochemical anomalies, with peak values in Meridian infill samples of 722ppm Cu; 1211ppm Zn; 180 ppm Au (non-coincident), in an undrilled sector of the mine sequence stratigraphy to the northwest of Cabaçal. Gold has been recovered from now exhausted historical alluvial workings. Reconnaissance drilling is planned to be initiated during this second half of the year.

The Company has received results from two holes to date from the Santa Fé area, which have shown some affinity to Cabaçal-style VMS mineralization, having broader zones of disseminated copper sulphide mineralization with low Pb-Zn contents. Economic grades are yet to be intersected, but mineralization was encountered over a wide interval, in CD-722 (21.4m @ 0.1% Cu from 10m), and CD-717 (16.6m @ 0.2% Cu). Drilling and down-hole bore hole EM surveys are planned.

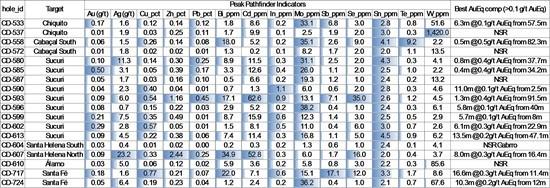

Results from a number of other regional scout exploration holes in the mine corridor have added further context to early-stage targets outside of the Cabaçal and Santa Helena spheres. Hole CD-615 drilled at the Chiquito[4] Au-Ag discovery returned 15.0m @ 1.3g/t AuEq (1.0g/t Au, 0.1% Cu & 23.5g/t Ag) from 79.0m, confirming the down-dip continuity of the mineralization. The core of the intersection hosts a higher-grade interval of 5.4m @ 2.1g/t Au & 29.2g/t Ag from 81.9m, including 9.4g/t Au, 104 g/t Ag over 0.4m (Sample CBDS90212). The Company has sent a sample to SGS Canada for gold deportment testwork to better understand the characteristics of this mineralization.

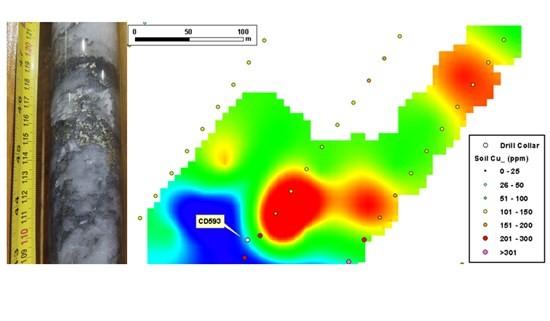

Initial holes testing other regional targets have verified active hydrothermal systems with positive indicator elements. The Company will use the information generated to build in a vectoring study in prioritizing ongoing drilling. The base metal, precious metal and indicator element assemblages are consistent with hydrothermal fluids driven from a tonalitic subvolcanic intrusion. Some areas of interest include the CD-593 drill site at Sucuri South where drilling shows strong quartz-sulphide veining in a hole directed to the south, with a peak response from a bore-hole Mise a la Masse survey showing a stronger chargeable source to the north-east (Figure 1).

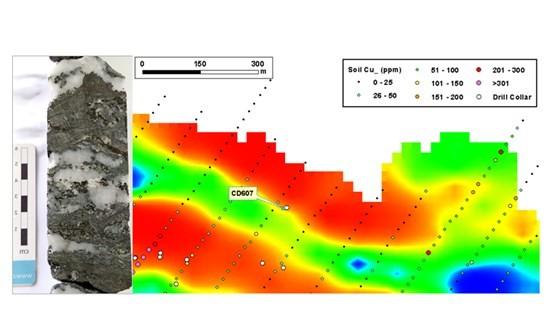

CD-607 also verified that the Induced Polarization survey anomaly north of Santa Helena, largely covered by colluvial scree masking the basement, has correlative geochemical responses with the Santa Helena horizon and likely represents a structural repeat, defining a new target corridor, “Santa Helena North”.

Table 2: Exploration drill hole geochemical indicators.

Figure 3: Example of regional drill hole with sulphidic vein assemblages and off-hole geophysical target, CD-593, Sucuri South, 4km west of Santa Helena.

Figure 4: Location of CD-607, confirming the presence of mineralization remaining to be tested in a 1km strike length chargeability anomaly: Santa Helena North.

Cabaçal DFS Program

The Company has shipped from site a large selection of diamond core to SGS Canada for the DFS stage of metallurgical studies. The first shipment of material selected is representative of the ore that will be mined in the early phases of open pit at Cabaçal and has arrived in Canada. The second consignment has left the site and is being prepared for export, forming a bulk sample for mini pilot plant testwork, that will also provide the Company with a representative sample of the copper sulphide concentrate (with high gold and silver contents) for marketing purposes with smelter and trading groups.

During the last week of June, the Company also hosted representatives of Ausenco’s expanded DFS engineering and geotechnical team, who combined with the Company’s in-house engineering team to review infrastructure sites from the final stages of DFS planning. The site review included a comprehensive inspection of access routes, plant and waste dump sites, to assist with planning the final programs to data collection for the DFS study.

About Meridian

Meridian Mining is focused on:

- The development and exploration of the advanced stage Cabaçal VMS gold‐copper project;

- The initial resource definition at the second higher-grade VMS asset at Santa Helena as the first stage of the Cabaçal Hub development strategy;

- Regional scale exploration of the Cabaçal VMS belt to expand the Cabaçal Hub strategy; and

- Exploration in the Jaurú & Araputanga Greenstone belts (the above all located in the State of Mato Grosso, Brazil).

The Pre-feasibility Study technical report dated March 31, 2025, entitled: “Cabaçal Gold-Copper Project NI 43-101 Technical Report and Pre-feasibility Study” outlines a base case after-tax NPV5 of USD 984 million and 61.2% IRR from a pre-production capital cost of USD 248 million, leading to capital repayment in 17 months (assuming metals price scenario of USD 2,119 per ounces of gold, USD 4.16 per pound of copper, and USD 26.89 per ounce of silver). Cabaçal has a low All-in-Sustaining-Cost of USD 742 per ounce gold equivalent & production profile of 141,000 ounce gold equivalent life of mine, driven by high metallurgical recovery, a low life-of-mine strip ratio of 2.3:1, and the low operating cost environment of Brazil.

The Cabaçal Mineral Reserve estimate consists of Proven and Probable reserves of 41.7 million tonnes at 0.63g/t gold, 0.44% copper and 1.64g/t silver (at a 0.25 g/t gold equivalent cut-off grade).

Readers are encouraged to read the PFS Technical Report in its entirety. The PFS Technical Report may be found under the Company’s profile on SEDAR+ at www.sedarplus.ca and on the Company’s website at www.meridianmining.co

The PFS Technical Report was prepared for the Company by Tommaso Roberto Raponi (P. Eng), Principal Metallurgist with Ausenco Engineering Canada ULC; Scott Elfen (P. E.), Global Lead Geotechnical and Civil Services with Ausenco Engineering Canada ULC; John Anthony McCartney, C.Geol., Ausenco Chile Ltda.; Porfirio Cabaleiro Rodriguez (Engineer Geologist FAIG), of GE21 Consultoria Mineral; Leonardo Soares (PGeo, MAIG), Senior Geological Consultant of GE21 Consultoria Mineral; Norman Lotter (Mineral Processing Engineer; P.Eng.), of Flowsheets Metallurgical Consulting Inc.; and, Juliano Felix de Lima (Engineer Geologist MAIG), of GE21 Consultoria Mineral.

MORE or "UNCATEGORIZED"

Eloro Resources Announces Closing of Bought Deal LIFE Private Placement for Gross Proceeds of C$17 Million

Eloro Resources Ltd. (TSX: ELO) (FSE: P2QM) is pleased to announce the closing of its previously an... READ MORE

Minera Alamos Updates Resources and Reserves for the Pan Gold Mine in Nevada

Minera Alamos Inc. (TSX-V: MAI) (OTCQX: MAIFF) is pleased to announce updated Mineral Resource and M... READ MORE

Ero Copper Reports Fourth Quarter and Full Year 2025 Operating and Financial Results

Ero Copper Corp. (TSX: ERO) (NYSE: ERO) is pleased to announce its operating and financial results f... READ MORE

Rare Element Resources Announces Results of Oversubscribed Rights Offering of Common Shares

Rare Element Resources Ltd. (OTCQB: REEMF) is pleased to report that its previously announced... READ MORE

TRX Gold Reports Record Q2 2026 Production and Company Update

TRX Gold Corporation (TSX: TRX) (NYSE American: TRX) is pleased to announce preliminary resu... READ MORE