“Mercenary Alert: It’s About Timing for This Nevada Gold Explorer”

A Special Alert Musing from Mickey the Mercenary Geologist

June 24, 2020

Picking junior resource stocks is generally a hit or miss affair (Mercenary Musing, June 22, 2020). Sometimes the timing is right and sometimes it’s not.

Our standards are set high at MercenaryGeologist.com. We consider a double in share price within 12 months or less as a hit; anything less than a double after a year is scored a miss. My 11-year career batting average is over .500.

Today I recall a swing and miss from early 2018. In retrospect, the timing was wrong. Now I think it’s right, and I present my case below.

Upon the inauguration of Donald J. Trump as the 45th President of the United States of America in January 2017, the nation’s federal bureaucracy underwent a 180-degree change after Obama’s eight years of anti-development policies, onerous regulations, delay tactics, and permit denials.

For exploration and mining companies, US federal bureaucrats immediately adopted a “can-do” versus the previous administration’s “can’t-do attitude”. The changes have been astounding with restrictions eased, regulations rolled back, permits approved, and projects developed on time and within budget. In addition, Trump’s initiatives reduced US corporate taxes to peer levels worldwide.

As a result, old gold projects in the Western U.S. were revived and new projects started. Numerous junior companies have been spawned to exploit the pro-business and pro-development platform.

In late January 2018, Allegiant Gold Ltd (AUAU.V; AUXXF.OTCQX) was officially spun out of Columbus Gold Corp, now rebranded as Orea Mining. Orea is an explorer-developer in French Guiana that owns 45% of a gold deposit with reserves of 2.75 million ounces.

The 1:5 divestiture of Allegiant Gold included 14 gold exploration projects in the Western United States that had been commanding little value in the market capitalization of the parent company.

Allegiant raised $4.2 million at 60 cents in advance of the spin-out. This financing occurred while the price of gold was taking a dive and closed at much less than the targeted amount.

I participated in the spinco financing and covered the company in its very early days (Mercenary Musings: December 8, 2017; January 29, 2018; February 8, 2018).

Allegiant Gold’s initial plan was to drill 10 of the 14 projects within a year. A significant program to expand resources via step-out drilling at its flagship Eastside project was completed in the late summer of 2018.

Also that summer, Allegiant Gold reeled in a strategic investment from Goldcorp at $2.1 million for a 9.7% interest. It was part of a larger raise of $5.0 million at 35 cents. I participated in that financing.

However, lackluster interest in the junior gold industry scuttled a portion of the company’s plans.

As a result, the six highest-priority Nevada projects were drilled: Adularia Hill (part of the Eastside project and a few km south of the current resource), Hughes Canyon, Monitor Hills, North Brown, Red Hills, and Silver Dome. These programs were completed from the late summer of 2018 to the early summer of 2019. After drilling, Adularia Hill and North Brown were kept; the other four projects had negative results and were dropped.

In January 2019, Allegiant Gold optioned its Bolo, Nevada and Mogollon, New Mexico projects to a new issuer, Barrian Mining. This junior rolled back a year after its public listing and has been renamed New Placer Gold Minerals. It recently returned the Mogollon project to AUAU having done no exploration. But it remains active at Bolo with a modest drill program scheduled this summer.

At the same time, Allegiant optioned the Four Metals project in southeast Arizona to Barksdale Capital, now renamed Barksdale Resources.

In September, the company announced significant management changes: Robert Giustra moved to Chairman of the Board and is no longer a Director; Director Peter Gianulis was appointed CEO; Sean McGrath named CFO; and Shawn Nichols appointed Director. Andy Wallace of Cordex Syndicate fame returned as the Chief Geologist and his cadre of experienced economic geologists continue to explore for the company.

In conjunction with the shakeup at the top, Allegiant Gold announced a revamped corporate strategy:

- Focus on expanding resources at its flagship Eastside project;

- Farm-out non-core properties;

- Reduce overhead costs and self-fund said costs with option payments from farm-outs.

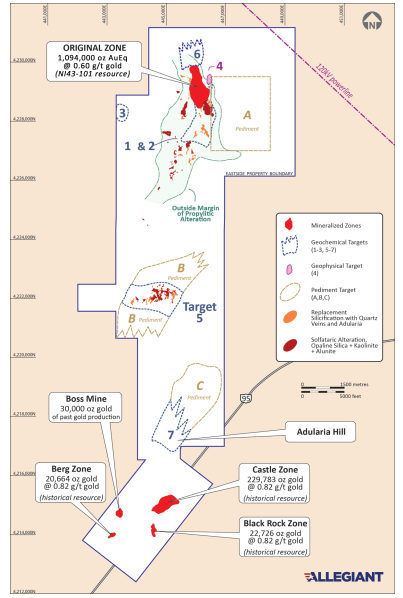

This map shows the company’s current roster of ten projects:

In January, Allegiant tabled an updated 43-101 resource estimate for its Eastside project based on 22 drill holes drilled in 2018. The inferred mineral resource stands at 57.1 million tonnes grading 0.60 g/t Au-eq for a pit-constrained 1.1 million ounces Au-eq. The estimate was done by Mine Development Associates of Reno, Nevada employing that firm’s usual conservative parameters and treatment.

The Eastside property comprises 72 sq km and is located 32 km west of Tonopah, Nevada. In addition to the qualified resource at the Eastside Original Zone, the property hosts historic gold resources of over 270,000 ounces in a southern block of targets. AUAU is currently evaluating historic data from five companies to guide drill programs designed to incorporate these mineralized areas into the project’s qualified resource estimate.

The company estimates less than 10% of the property area has been explored to date. There are many other undrilled geology, alteration, geochemistry, and/or geophysics targets.

AUAU’s main focus is three high priority targets near the Eastside Original Zone defined by geological mapping, alteration, and geochemistry:

- A 2.0 km by 2.0 km block immediately south and southwest of the resource.

- A 2.0 km by 2.5 km block in the pediment to the east with small outcrops and float.

- A 0.5 x 0.5 km area about three km to the west with narrow, high-grade gold veins.

AUAU will drill 80 to 100 holes totaling 15,000-17,000 meters at the Eastside project commencing in late summer. It has filed an application with the BLM to expand the operating permit from 600 to 3600 acres with approval expected in early Q4.

In late May, Allegiant Gold announced a $3 million private placement at 25 cents with an 18-month half warrant at 40 cents, callable at 60 cents. It closed the retail tranche of $1.2 million last week and a second tranche will close soon. Again, I am in on the financing.

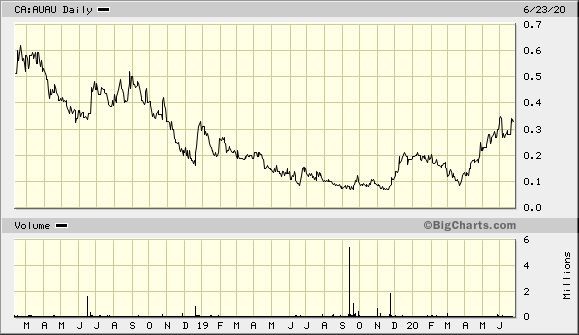

We are up-to-date on company activities; let’s now review the company’s price history from its inception in February 2018. As you can see, my timing was not good as the stock dropped from its listing price of 60 cents to the mid-40 cent range during my initial coverage:

The stock has generally traded at a discount to the price of its latest financing: 60 cents upon listing in February 2018 and 35 cents in July and August of 2018. It closed today at 33 cents.

The volume and price spike in mid-June of 2018 occurred as the spinco financing became free-trading and on no news. Sources indicate this was a gypsy swap facilitated by a major brokerage firm in advance of the second financing. A strategic alliance with major miner Goldcorp was announced in early July and completed in mid- August.

Subsequently, poor drill results and tax-loss selling led to a long stretch of downticks that bottomed in mid-December of 2018 and was quickly followed by a sharp recovery to year’s end.

The company languished throughout 2019 when there was little interest in junior gold stocks. The huge volume traded in mid-September was Newmont Goldcorp exiting its 5.9 million share strategic position at the stock’s all-time low of 7 cents. Company insiders bought most of this stock on the open market.

In late November, a US gold fund liquidated its position and management likewise bought most of this stock at as low as 7 cents.

AUAU rallied along with the junior resource market from early December into early February. It briefly fell below 10 cents during the flu fear sell-off in the third week in March when all markets melted down and gold was sold to meet margin calls.

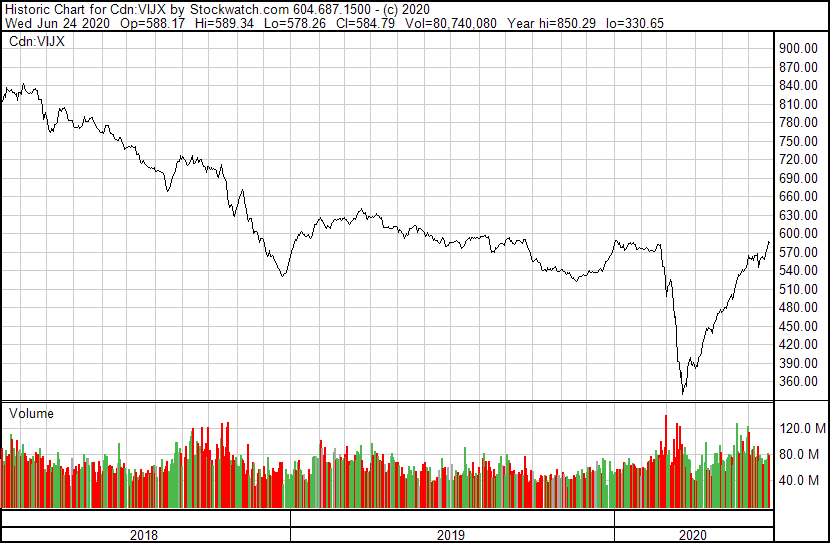

Mimicking the TSXV Index, the stock then went on a steady run up thru early June when it briefly touched a 52-week high at 36 cents. It has since consolidated in the upper 20 to low 30 cent range.

It is also noteworthy that over its short history, Allegiant Gold has largely tracked performance of the Toronto Venture Exchange Index:

The current structure is 61.8 million shares outstanding and 66.8 fully diluted. There are 3.0 million restricted share units held by management, directors, employees, and consultants along with 1.9 million options. The company has a tight share structure with dedicated shareholders controlling nearly 52% of the stock.

Management holds a significant 16.1% of outstanding shares. A US-based private equity fund owns the largest position at 15.6%; Orea Mining controls 9.9%; its JV partner, Russian-owned Nord Gold owns 3.9%; and IAM Gold has 6.3%. The latter four positions came mostly from the spinco event.

With today’s close of 33 cents, AUAU’s market capitalization stands at $20 million. Once the current financing is completed, the working capital will be about $3.5 million in cash and tradable securities.

Doing the math on the share structure gives a retail float of about 30 million shares. Therefore, liquidity should be available when catalysts occur.

Allegiant Gold stock has not rewarded its dedicated shareholders since it began trading two years and four months ago. Therefore, a legitimate question can be posed:

“So why now? … Let me count the ways:

- Allegiant is led by a new management team committed to increasing gold resources at its flagship Eastside project.

- The company’s focus has changed from a hybrid project generator that drills its own prospects to one that will option most of them at drill-ready stage to other junior explorers.

- It has cut overhead and will fund recurring expenses with monies generated from option payments and share sales. Unlike many juniors, Allegiant has pledged not to dilute existing shareholders to pay pubco costs.

- A new marketing and awareness campaign includes select, traditional newsletter coverage; podcasts and webinars with mining industry media; social media promotion with two groups; and meetings with US family-owned private equity.

- The gold price is up over 16% year-to-date and at its highest in over 7.5 years. Consensus opinion is for strong upside potential.

- The robust gold price has led to more speculator interest in junior gold explorers and especially for those working in Nevada (Mercenary Musing, January 29, 2018).

- New explorers are seeking good exploration projects in Nevada and the company owns a stable that are available for option.

- The company is currently undervalued with respect to its peers. Given post-financing shares outstanding and today’s closing price, Allegiant’s market valuation is only about $22 per ounce of gold in-the-ground.

These are eight reasons why I think the timing is right for Allegiant Gold Ltd.

But I saved the best one for last.

In my opinion, Eastside is the best project with the highest potential for adding gold resources of all the projects held by juniors in Nevada.

And folks, that’s a big, bold statement considering that this State is the world’s 4th largest gold producer.

As always, the drill will tell the truth. A big effort to build more ounces at Eastside will start in the late summer. I expect it to be successful.

So catalysts are coming.

Say hey, you can’t accept my opinions willy-nilly. I have participated in all three Allegiant Gold financings and have dropped lots of bucks into this play; my cost basis is higher than its current price; and the company pays me to cover it. So I have a vested interest in the company’s success and a higher share price.

You must do your own research and due diligence to determine if Allegiant Gold Ltd meets your speculative criteria and if the timing is right for you.

Ciao for now,

Mickey Fulp

Mercenary Geologist

The Mercenary Geologist Michael S. “Mickey” Fulp is a Certified Professional Geologist with a B.Sc. in Earth Sciences with honor from the University of Tulsa, and M.Sc. in Geology from the University of New Mexico. Mickey has 40 years of experience as an exploration geologist and analyst searching for economic deposits of base and precious metals, industrial minerals, uranium, coal, oil and gas, and water in North and South America, Europe, and Asia.

Mickey worked for junior explorers, major mining companies, private companies, and investors as a consulting economic geologist for over 20 years, specializing in geological mapping, property evaluation, and business development. In addition to Mickey’s professional credentials and experience, he is high-altitude proficient, and is bilingual in English and Spanish. From 2003 to 2006, he made four outcrop ore discoveries in Peru, Nevada, Chile, and British Columbia.

Mickey is well-known and highly respected throughout the mining and exploration community due to his ongoing work as an analyst, writer, and speaker.

Contact: Contact@MercenaryGeologist.com

Disclaimer and Notice: I am a shareholder of Allegiant Gold Ltd and it pays a fee of $5000 per month as a sponsor of this website. I am not a certified financial analyst, broker, or professional qualified to offer investment advice. Nothing in any report, commentary, this website, interview, and other content constitutes or can be construed as investment advice or an offer or solicitation or advice to buy or sell stock or any asset or investment. All of my presentations should be considered an opinion and my opinions may be based upon information obtained from research of public documents and content available on the company’s website, regulatory filings, various stock exchange websites, and stock information services, through discussions with company representatives, agents, other professionals and investors, and field visits. My opinions are based upon information believed to be accurate and reliable, but my opinions are not guaranteed or implied to be so. The opinions presented may not be complete or correct; all information is provided without any legal responsibility or obligation to provide future updates. I accept no responsibility and no liability, whatsoever, for any direct, indirect, special, punitive, or consequential damages or loss arising from the use of my opinions or information . The information contained in a report, commentary, this website, interview, and other content is subject to change without notice, may become outdated, and may not be updated. A report, commentary, this website, interview, and other content reflect my personal opinions and views and nothing more. All content of this website is subject to international copyright protection and no part or portion of this website, report, commentary, interview, and other content may be altered, reproduced, copied, emailed, faxed, or distributed in any form without the express written consent of Michael S. (Mickey) Fulp, MercenaryGeologist.com LLC.

Copyright © 2020 Mercenary Geologist.com, LLC. All Rights Reserved.

MORE or "UNCATEGORIZED"

Minera’s Copper Subsidiary Acquires Suaqui Verde Copper Project in Sonora, Mexico

Minera Alamos Inc. (TSX-V:MAI) is pleased to announce the executi... READ MORE

SILVERCORP TO ACQUIRE ADVENTUS, CREATING A GEOGRAPHICALLY DIVERSIFIED MINING COMPANY BY ADDING THE ADVANCED EL DOMO PROJECT

Silvercorp Metals Inc. (TSX: SVM) (NYSE American: SVM) and Advent... READ MORE

Vortex Metals Announces Closing of Upsized Private Placement

Vortex Metals Inc. (TSXV: VMS) (FSE: DM8) (OTCQB: VMSSF) is plea... READ MORE

Gatos Silver Reports South-East Deeps Drilling Results at Cerro Los Gatos and Announces Executive Appointment

Gatos Silver, Inc. (NYSE:GATO) (TSX: GATO) provided an update on ... READ MORE

Eldorado Gold Reports First Quarter 2024 Financial and Operational Results; Steady Start to 2024

Eldorado Gold Corporation (TSX: ELD) (NYSE: EGO) reports the Comp... READ MORE