LUNDIN GOLD DRILLS 491.62 G/T AU OVER 5.20M; EXPLORATION CONFIRMS LARGER MINERALIZED SYSTEMS AT BOTH FDNS AND FDN EAST

Lundin Gold Inc. (TSX: LUG) (Nasdaq Stockholm: LUG) (OTCQX: LUGDF) announces strong results from its conversion and near-mine exploration drilling programs at its 100% owned Fruta del Norte gold mine in southeast Ecuador. The Company has completed the 2025 conversion program at Fruta del Norte South on a portion of the existing Inferred Mineral Resource, advancing engineering studies toward an initial Mineral Reserve estimate in early 2026. In addition, exploration drilling continues to return strong results at FDNS and FDN East, confirming larger mineralized systems and providing confidence in their potential for future growth. Highlights from drilling programs at FDNS and FDN East are outlined below, with detailed results provided in Appendix 1.

Jamie Beck, President and CEO, commented, “I’m pleased to report outstanding results from our 2025 programs, which continue to demonstrate the significant potential around Fruta del Norte. At FDNS, the conversion program achieved the highest-grade intercept ever drilled, a major milestone as we advance toward an initial Mineral Reserve estimate early next year—less than two years since discovery. Exploration drilling also confirms that FDNS is a larger mineralized system and now, FDN East emerges as a new epithermal vein deposit near existing infrastructure, offering meaningful upside. Based on these successes as well as the results on the emerging porphyries, we expanded our 2025 drilling program to a minimum of 120,000 metres with 17 rigs, the largest program ever undertaken on the FDN land package.”

FDNS Conversion Program Drilling Highlights (not true widths):

- Drill hole FDN-C25-305 intersected 491.62 grams per tonne of gold over 5.20m from 40.60m, including:

- 2,286 g/t Au over 1.10m

- Drill hole FDN-C25-260 intersected 41.46 g/t Au over 6.30m from 59.60m, including:

- 469.0 g/t Au over 0.50m

- Drill hole FDN-C25-261 intersected 22.76 g/t Au over 10.50m from 80.0m, including:

- 83.38 g/t Au over 1.95m

- Drill hole FDN-C25-259 intersected 33.71 g/t Au over 6.30m from 38.90m, including:

- 485.0 g/t Au over 0.40m

Drill results confirmed the gold mineralization with several outstanding intercepts and defined new mineralized zones within the main vein system. The 2025 conversion program targeted a portion of the existing Inferred Mineral Resource. Engineering studies and mine design are well advanced to support an initial Mineral Reserve estimate in Q1 2026 as well as inclusion into FDN’s long term mine plan.

FDNS Exploration Program Drilling Highlights (not true widths):

- Drill hole UGE-S-25-338 intersected 23.23 g/t Au over 7.70m from 51.35m, including:

- 329.0 g/t Au over 0.40m

- Drill hole FDN-C25-325 intersected 55.78 g/t Au over 3.15m from 283.45m, including:

- 256.0 g/t Au over 0.65

Exploration drilling at FDNS continues to return strong results and has expanded the limits of the deposit and confirmed a larger mineralized system than previously understood, providing confidence in further growth potential.

FDN East Exploration Program Drilling Highlights (not true widths):

- Drill hole UGE-E-25-328 intersected 14.10 g/t Au over 10.80 m from 332.00m including:

- 56.09 g/t Au over 2.40m

- Drill hole UGE-E-25-360 intersected 9.27 g/t Au over 15.05m from 226.35m, including:

- 17.51 g/t Au over 4.20m

The initial geological model reveals an emerging epithermal vein-type deposit located approximately 100 metres east of FDN’s current underground infrastructure. Recent intercepts highlight meaningful potential for further growth, with multiple subparallel veins extending 500 metres along the north-south direction and remains open for expansion.

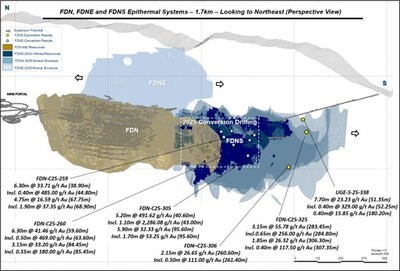

DRILLING PROGRAMS

Lundin Gold’s near-mine exploration strategy is focused on extending mine life by identifying and delineating new mineralized zones close to FDN’s operations. Over recent years, these programs have driven resource growth and led to the discovery of new sectors, contributing to Mineral Reserve expansion since commercial production was achieved, ultimately resulting in successful Reserve replacement in 2023 and 2024. In 2025, underground drilling prioritized conversion of Inferred Resources at FDNS while continuing exploration along its extensions and at FDN East (see Figure 1).

Earlier in the year, the Company expanded its 2025 drilling program from 80,000 metres to a minimum of 120,000 metres, reflecting recent exploration success. Seventeen rigs are currently active across conversion and near-mine exploration programs, marking the largest drill program ever undertaken on the FDN land package.

FDNS

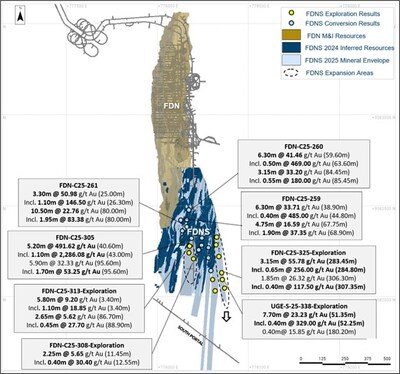

Since January, underground drilling at FDNS has focused on converting Inferred Resources to Indicated status, with the ultimate goal of integrating the deposit into FDN’s long-term mine plan in 2026. The program also targeted areas for potential expansion.

Discovered in 2024, FDNS is an epithermal vein system located along the southern limit of FDN and currently hosts an Inferred Resource of approximately 2.09 Moz from 12.35 Mt at an average grade of 5.25 g/t Au. For details on FDN’s Mineral Reserve and Resource estimate as at December 31, 2024, please refer to the Company’s Annual Information Form dated March 17, 2025 (the “AIF”), available at www.sedarplus.ca.

During the past several months, conversion and expansion drilling advanced significantly, with 16,282 metres drilled across 97 holes. Results have improved confidence in the geological model, confirmed continuity of mineralization, and defined higher-grade zones within the vein system (see Figures 1 and 2). Notably, hole FDN-C25-305 returned 491.62 g/t Au over 5.20m, including 2,286 g/t Au over 1.10m, the highest-grade intercept ever recorded at FDNS. Assay results are presented in Table 1.

Exploration drilling also confirmed mineralization continuity beyond FDNS’s eastern and southern limits (Figures 1 and 2). For example, UGE-S-25-338 (23.23 g/t Au over 7.70m) and FDN-C25-325 (55.78 g/t Au over 3.15m) defined new high-grade veins and indicate further potential in these sectors. Complete assay results received to date are presented in Tables 1 and 3; some results remain pending.

All results are being incorporated into the geological model and will support the initial Mineral Reserve and updated Mineral Resource estimate in Q1 2026, while conversion and exploration drilling continues. Mine engineering work is also advancing to evaluate geotechnical, metallurgical, and infrastructure requirements for integration into FDN’s 2026 long-term mine plan.

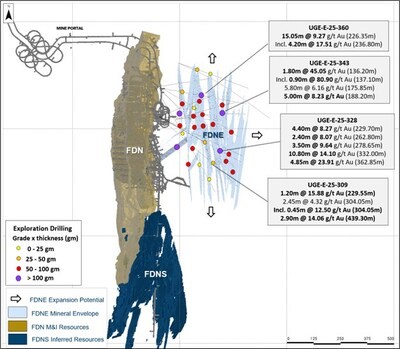

FDN EAST

At FDN East, exploration continues to define and expand a new buried epithermal vein system located approximately 100 metres east of FDN’s existing underground infrastructure. Since its discovery, drilling has delineated multiple subparallel veins trending north-south over a strike length of approximately 500 metres, which remains open (see Figure 3).

The most recent drilling results continues to confirm the continuity of the gold mineralization with wider mineralized zones in distinct sectors of the system (Figure 3). Drill holes UGE-E-25-328 (14.10 g/t Au over 10.80m and 23.91 g/t Au over 4.85m) and drill hole UGE-E-25-360 (9.27 g/t Au over 15.05m) yielded some of the most notable results ever recorded at FDN East. Assay results from the drilling undertaken at FDN East are presented in Table 2.

These results support our initial geological model, which indicates an emerging epithermal vein-type deposit with meaningful potential for future growth. A second drill rig has been mobilized to accelerate delineation along the system’s extensions. Assay results are presented in Table 2.

Figure 1: Map showing FDN deposit, he FDN East target and FDNS selected drilling results

Figure 2: Map showing FDN and FDNS deposit with selected FDNS conversion and exploration drilling results

Figure 3: Map showing FDNS, FDNS deposit and FDN East with selected FDN East drilling results

Qualified Persons and Technical Notes

The technical information contained in this News Release has been reviewed and approved by Andre Oliveira, P. Geo, Vice President, Exploration of the Company, who is a Qualified Person in accordance with the requirements of National Instrument 43-101 – Standards of Disclosure for Mineral Projects.

Samples consist of half HQ and NQ-size diamond core that are split by diamond saw on site, prepared at the ALS laboratory in Quito, and analyzed by 50g fire assay and multi-element (ICP-AES/ICP-MS) at the ALS Laboratory in Lima, Peru. The quality assurance-quality control (QA-QC) program of Lundin Gold includes the insertion of certified standards of known gold content, blank and duplicate samples. The remaining half core is retained for verification and reference purposes. For further information on the assay, QA-QC, and data verification procedures, please see Lundin Gold’s AIF.

About Lundin Gold

Lundin Gold, headquartered in Vancouver, Canada, owns the Fruta del Norte gold mine in southeast Ecuador. Fruta del Norte is among the highest-grade operating gold mines in the world.

The Company’s board and management team have extensive expertise and are dedicated to operating Fruta del Norte responsibly. The Company operates with transparency and in accordance with international best practices. Lundin Gold is committed to delivering value to its shareholders through operational excellence and growth, while simultaneously providing economic and social benefits to impacted communities, fostering a healthy and safe workplace and minimizing the environmental impact. Furthermore, Lundin Gold is focused on continued exploration on its extensive and highly prospective land package to identify and develop new resource opportunities to ensure long-term sustainability and growth for the Company and its stakeholders.

MORE or "UNCATEGORIZED"

Eloro Resources Announces Closing of Bought Deal LIFE Private Placement for Gross Proceeds of C$17 Million

Eloro Resources Ltd. (TSX: ELO) (FSE: P2QM) is pleased to announce the closing of its previously an... READ MORE

Minera Alamos Updates Resources and Reserves for the Pan Gold Mine in Nevada

Minera Alamos Inc. (TSX-V: MAI) (OTCQX: MAIFF) is pleased to announce updated Mineral Resource and M... READ MORE

Ero Copper Reports Fourth Quarter and Full Year 2025 Operating and Financial Results

Ero Copper Corp. (TSX: ERO) (NYSE: ERO) is pleased to announce its operating and financial results f... READ MORE

Rare Element Resources Announces Results of Oversubscribed Rights Offering of Common Shares

Rare Element Resources Ltd. (OTCQB: REEMF) is pleased to report that its previously announced... READ MORE

TRX Gold Reports Record Q2 2026 Production and Company Update

TRX Gold Corporation (TSX: TRX) (NYSE American: TRX) is pleased to announce preliminary resu... READ MORE