LUCA REPORTS RECORD NET QUARTERLY REVENUE IN Q2 2024 OF US$18.2 MILLION, UP 49% YEAR-OVER-YEAR

Luca Mining Corp. (TSX-V: LUCA) (OTCQX: LUCMF) (Frankfurt: Z68) is pleased to announce its financial results for the six months ended June 30, 2024.

Highlights

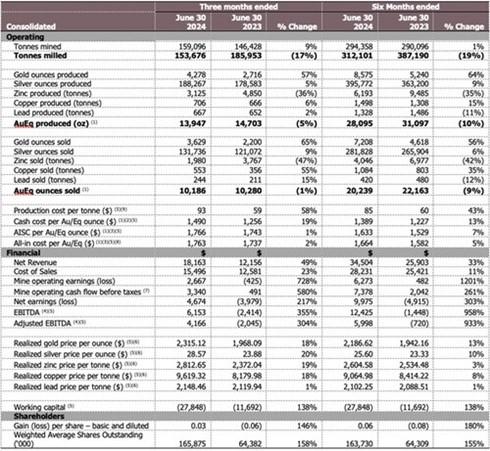

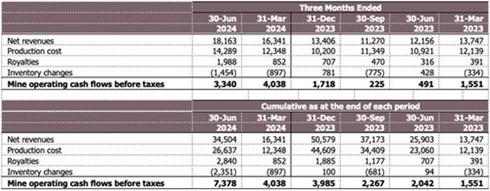

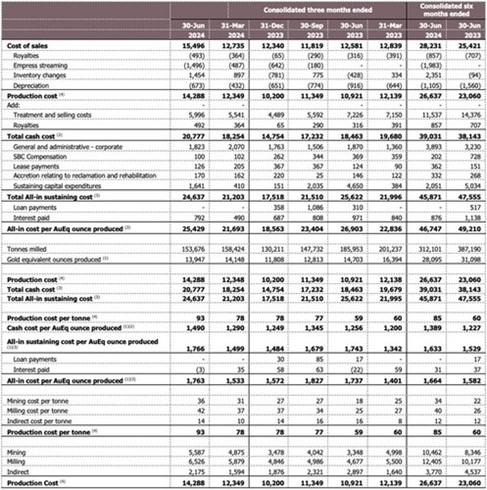

- Record Net Quarterly Revenue for Q2 2024 of US$18.2 million, up 49% from Q2 2023. Total Net Revenue for the six months ended June 30, 2024, of US$34.5 million, an increase of 33% over the same 2023 period.

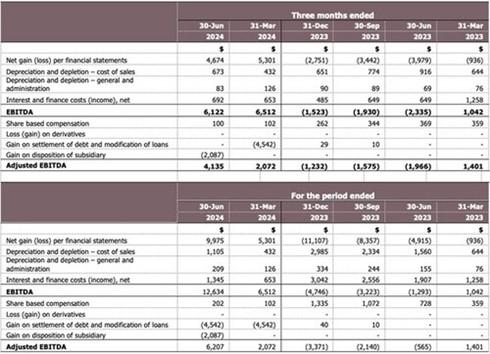

- Positive Net Earnings of US$4.7 million for Q2 2024, an increase of 217% over Q2 2023. Q2 Earnings per share (“EPS”) increased 130% over the same 2023 period at US$0.03 per share. Total Net Earnings for the six months ended June 30, 2024, were US$10.0 million, a 303% increase over the same 2023 period with EPS increasing 175% to US$0.06.

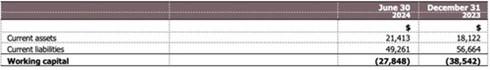

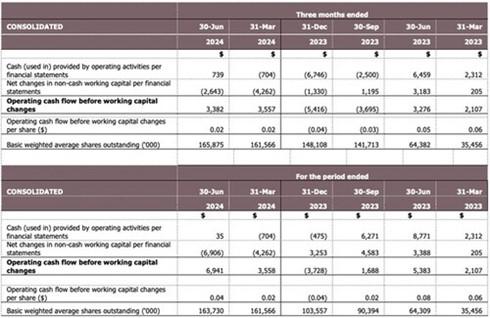

- Cash flow from Operations: US$739,000 in positive cash flow from operations, with cash flow from operations before working capital changes at US$3.4 million.

- Positive EBITDA and Adjusted EBITDA: US$6.1 million in positive EBITDA and US$4.1 million in positive Adjusted EBITDA for Q2

- Production of 13,947 troy oz of gold equivalent: being comprised of 4,278 ounces of gold, 188,267 ounces of silver, 3,125 tonnes of zinc, 706 tons of copper and 667 tonnes of lead.

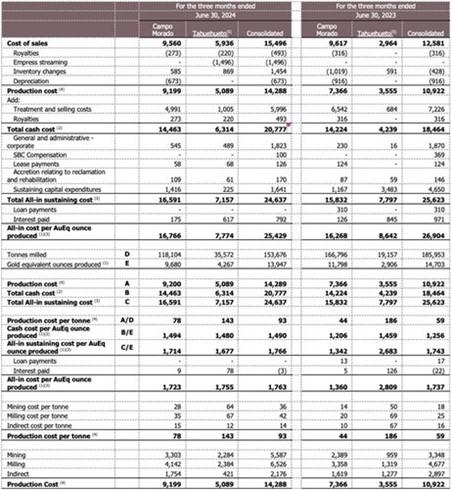

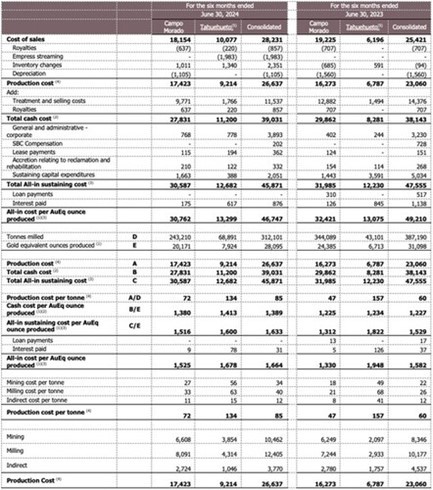

- Operating Costs: All-in Sustaining costs per AuEq oz produced (“AISC“) was US$1,714 at Campo Morado and US$1,677 at Tahuehueto resulting in a consolidated AISC of US$1,766. AISC increased in Q2 due to a reduction in tonnes milled over Q1, offset by reduced overall sustaining capital expenditure as Tahuehueto construction completed. AISC is expected to decrease at both Tahuehueto and at Campo Morado as production ramps up in the second half of 2024.

- Tahuehueto Construction Completed: The installation of the third filter press in August 2024 marked the completion of major construction at Tahuehueto. The Company is now commissioning the plant and anticipates ramping up to full production by Q4 2024.

- Campo Morado Improvement Project (“CMIP”): Progress continues on refurbishment of float cells, thickeners and filters to ensure reliable plant operation. The focus remains on two key objectives: increasing mill throughput, and sustaining plant performance. The copper-lead separation stage of the project is advancing and is expected to be completed by Q4 2024.

Dan Barnholden, CEO stated, “I am very pleased with our Q2 2024 results. We have achieved positive net income, positive EBITDA and positive Adjusted EBITDA for the second quarter in a row, as well as positive cash flow from operations. I fully expect this trend to continue as Campo Morado and Tahuehueto continue to ramp up to full capacity. We have engaged a leading mine contractor, Cominvi, S.A. de C.V., for our Campo Morado operations which will improve our mobile equipment availability as well as provide enhanced efficiencies going forward. These improvements, along with the ongoing Campo Morado Improvement Project and Tahuehueto achieving commercial production in the near future, sets the stage for exciting growth in the second half and substantial cash flows in 2025.”

“Lisa Dea, CFO, commented, “It has been gratifying to witness the transformation of the Company over the past several months. The numbers show that the Company has truly turned a corner, and I look forward to further growth ahead.”

Production and Financial Overview

| 1. | Gold equivalents are calculated using an 81.00:1 (Ag/Au), 0.0005:1 (Au/Zn), 0.0019:1 (Au/Cu) and 0.0004:1 (Au/Pb) ratio for Q2 2024; 81.80:1 (Ag/Au), 0.0006:1 (Au/Zn), 0.0019:1 (Au/Cu) and 0.0005:1 (Au/Pb) ratio for Q2 2023, an 84.46:1 (Ag/Au), 0.0005:1 (Au/Zn), 0.0019:1 (Au/Cu) and 0.0004:1 (Au/Pb) ratio for YTD 2024; and an 83.02:1 (Ag/Au), 0.0006:1 (Au/Zn), 0.0020:1 (Au/Cu) and 0.0005:1 (Au/Pb) ratio for YTD 2023, respectively. |

| 2. | Cash cost per gold equivalent ounce includes mining, processing, and direct overhead costs. See Reconciliation to IFRS on page 29 of the June 30, 2024 MD&A. |

| 3. | AISC per AuEq oz includes mining, processing, direct overhead, corporate general and administration expenses, reclamation, and sustaining capital on page 29 of the June 30, 2024 MD&A. |

| 4. | See Reconciliation of earnings before interest, taxes, depreciation, and amortization on page 26 of the June 30, 2024 MD&A. |

| 5. | See “Non-IFRS Financial Measures” on page 25 of the June 30, 2024 MD&A. |

| 6. | Based on provisional sales before final price adjustments, treatment, and refining charges. |

| 7. | Mine operating cash flow before taxes is calculated by adding back royalties, changes in inventory and depreciation and depletion to mine operating loss. See Reconciliation to IFRS on page 25 of the June 30, 2024 MD&A. |

| 8. | All-in cost per AuEq oz includes AISC plus interest paid and loan payments. See page 29 of the June 30, 2024 MD&A. |

| 9. | Production costs include mining, milling, and direct overhead cost at the operation sites. See reconciliation on page 29 of the June 30, 2024 MD&A. |

About Luca Mining Corp.

Luca Mining is a diversified Canadian mining company with two 100%-owned producing mines in Mexico. The Company produces gold, silver, zinc, copper and lead from these mines that each have considerable development and resource upside.

The Campo Morado mine, is an underground operation located in Guerrero State, a prolific mining region in Mexico. It produces copper-zinc-lead concentrates with precious metals credits. It is currently undergoing an optimisation program which is already generating significant improvements in recoveries and grades, efficiencies, and cashflows.

The Tahuehueto Gold, Silver Mine is a new underground operation in Durango State, Mexico, within the Sierra Madre Mineral Belt which hosts numerous producing and historic mines along its trend. The Company has completed the installation of major equipment and is commissioning its mill capacity to 1,000 tonnes per day, with key test work and production ramp-up underway, to achieve full production by Q4 2024.

The Company expects its operations to start generating positive cash flows in 2024. Luca Mining is focused on growth with the aim of maximizing shareholder returns.

(CNW Group/Luca Mining Corp.)

(CNW Group/Luca Mining Corp.)

(CNW Group/Luca Mining Corp.)

(CNW Group/Luca Mining Corp.)

(CNW Group/Luca Mining Corp.)

(CNW Group/Luca Mining Corp.)

(CNW Group/Luca Mining Corp.)

(CNW Group/Luca Mining Corp.)

MORE or "UNCATEGORIZED"

Eloro Resources Announces Closing of Bought Deal LIFE Private Placement for Gross Proceeds of C$17 Million

Eloro Resources Ltd. (TSX: ELO) (FSE: P2QM) is pleased to announce the closing of its previously an... READ MORE

Minera Alamos Updates Resources and Reserves for the Pan Gold Mine in Nevada

Minera Alamos Inc. (TSX-V: MAI) (OTCQX: MAIFF) is pleased to announce updated Mineral Resource and M... READ MORE

Ero Copper Reports Fourth Quarter and Full Year 2025 Operating and Financial Results

Ero Copper Corp. (TSX: ERO) (NYSE: ERO) is pleased to announce its operating and financial results f... READ MORE

Rare Element Resources Announces Results of Oversubscribed Rights Offering of Common Shares

Rare Element Resources Ltd. (OTCQB: REEMF) is pleased to report that its previously announced... READ MORE

TRX Gold Reports Record Q2 2026 Production and Company Update

TRX Gold Corporation (TSX: TRX) (NYSE American: TRX) is pleased to announce preliminary resu... READ MORE