Lithium Ionic Enters Option Agreement to Acquire Up to 90% Interest in New Itinga Properties totaling 2,983 ha in the Lithium Valley, Minas Gerais, Brazil

Lithium Ionic Corp. (TSX-V: LTH) (OTCQX: LTHCF) (FSE: H3N) is pleased to announce that its wholly-owned subsidiary, Neolit Minerals Participações Ltda, has entered into an option agreement with K2 Mineração e Exportação EIRELI, Super Clássico Comércio, Importação e Exportação Ltda. and Minerales Empreendimentos, Mineração e Participações Ltda. to acquire up to a 90% interest in select properties located in Itinga, within the Curralinho Pegmatite Field of the Araçuaí Pegmatite District, Minas Gerais, Brazil.

Transaction Details:

The Agreement grants Neolit the option to acquire up to a 90% interest in each of three newly formed special purpose vehicles domiciled in Brazil, which collectively hold five mineral claims encompassing a total area of 2,983.22 hectares. Neolit shall initially hold a minority stake in each that can increase up to 90% upon fulfilling the terms of the Agreement.

Key Terms of the Agreement:

- Neolit, at its option, has the right to conduct an exploration program and deliver a feasibility study for each SPV to acquire up to a 90% interest in the applicable SPV.

- To achieve a 90% interest in each SPV, Neolit will be required to invest a minimum of R$21.3 million (~C$5.5 million) by Q1 2030.

- The properties are strategically located within the lithium-rich Araçuaí Pegmatite District, known for its significant spodumene deposits.

Blake Hylands, P.Geo., Chief Executive Officer of Lithium Ionic, commented, “This transaction marks a significant milestone in our growth strategy, allowing us to expand our presence in Brazil’s premier lithium district. We are excited about the potential these properties hold and are committed to advancing them responsibly to create value for our shareholders and stakeholders.”

The Transaction aligns with the Company’s strategy to expand its footprint in one of the most promising lithium districts globally. The properties under option have demonstrated potential for significant lithium mineralization, which the Company aims to further explore and develop.

Next Steps:

Neolit will commence an extensive exploration program, including geological mapping, geochemical surveys, and drilling, to delineate potential resources within these properties. The Company will also engage with local communities and stakeholders to ensure the sustainable development of these projects.

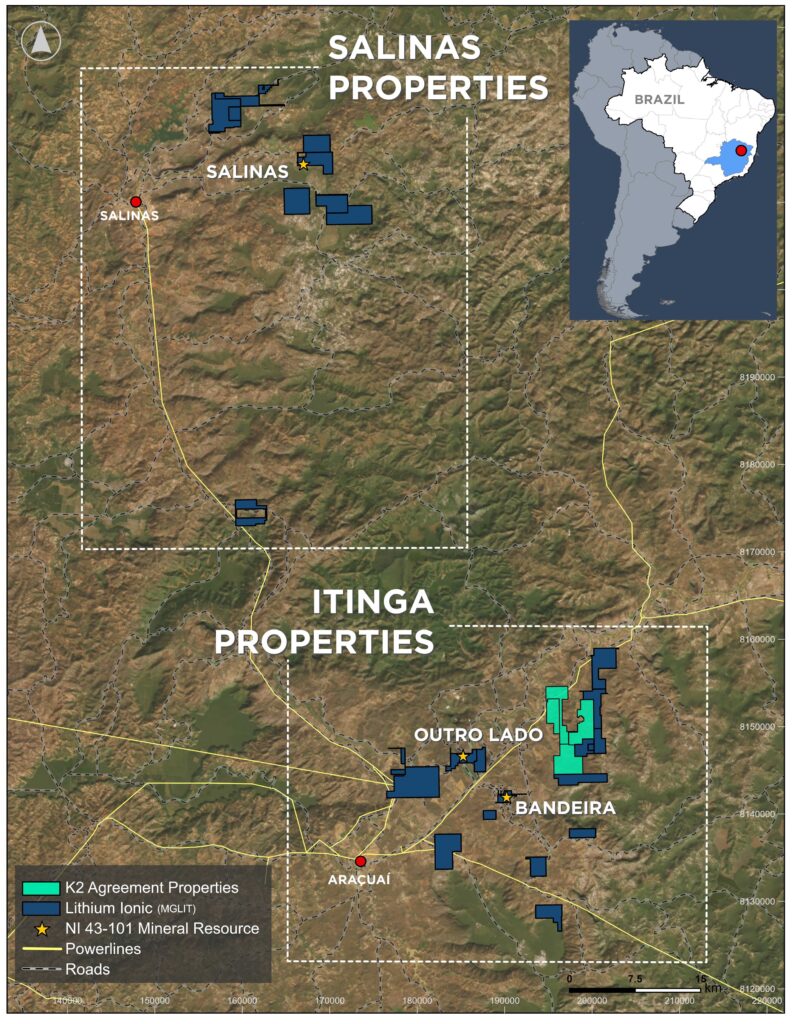

Figure 1. Lithium Ionic Properties in the Lithium Valley and the Agreement Properties

About Lithium Ionic Corp.

Lithium Ionic is a Canadian mining company exploring and developing its lithium properties in Brazil. Its flagship Itinga and Salinas projects cover ~17,000 hectares in the northeastern part of Minas Gerais state, a mining-friendly jurisdiction that is quickly emerging as a world-class hard-rock lithium district. The Itinga Project is situated in the same region as CBL’s Cachoeira lithium mine, which has produced lithium for +30 years, as well as Sigma Lithium Corp.’s Grota do Cirilo project, which hosts the largest hard-rock lithium deposit in the Americas.

Qualified Persons

The scientific and technical information in this news release has been reviewed and approved by Carlos Costa, Vice President Exploration of Lithium Ionic and Blake Hylands, CEO and director of Lithium Ionic, and both are “qualified persons” as defined in NI 43-101.

MORE or "UNCATEGORIZED"

Eloro Resources Announces Closing of Bought Deal LIFE Private Placement for Gross Proceeds of C$17 Million

Eloro Resources Ltd. (TSX: ELO) (FSE: P2QM) is pleased to announce the closing of its previously an... READ MORE

Minera Alamos Updates Resources and Reserves for the Pan Gold Mine in Nevada

Minera Alamos Inc. (TSX-V: MAI) (OTCQX: MAIFF) is pleased to announce updated Mineral Resource and M... READ MORE

Ero Copper Reports Fourth Quarter and Full Year 2025 Operating and Financial Results

Ero Copper Corp. (TSX: ERO) (NYSE: ERO) is pleased to announce its operating and financial results f... READ MORE

Rare Element Resources Announces Results of Oversubscribed Rights Offering of Common Shares

Rare Element Resources Ltd. (OTCQB: REEMF) is pleased to report that its previously announced... READ MORE

TRX Gold Reports Record Q2 2026 Production and Company Update

TRX Gold Corporation (TSX: TRX) (NYSE American: TRX) is pleased to announce preliminary resu... READ MORE