LAHONTAN DRILLS 41 METRES GRADING 0.90 g/t Au Eq incl. 16.8 METRES GRADING 1.41 g/t Au Eq at SANTA FE

Lahontan Gold Corp (TSX-V:LG) (OTCQB:LGCXF) is pleased to announce results from six reverse-circulation rotary drill holes from the Company’s 2024 Phase One drilling campaign at the Company’s 26 km2 Santa Fe Mine project located in Nevada’s prolific Walker Lane gold and silver belt. These drill holes were completed in the Slab-Calvada Complex at the Santa Fe Mine where previous Lahontan drilling had outlined significant shallow oxide domain gold and silver resources (Canadian NI 43-101 compliant) that remained open along strike and down-dip*. The six drill holes reported herein, totaling 1,309 metres, targeted potential extensions to these gold and silver resources and were also designed to confirm pit boundaries for the upcoming updated Mineral Resource Estimate and Preliminary Economic Assessment for the Santa Fe Mine project. Highlights include:

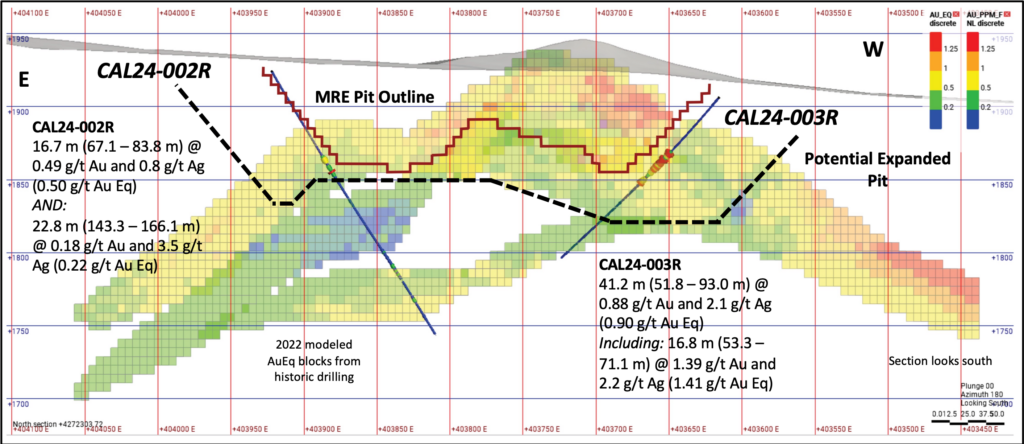

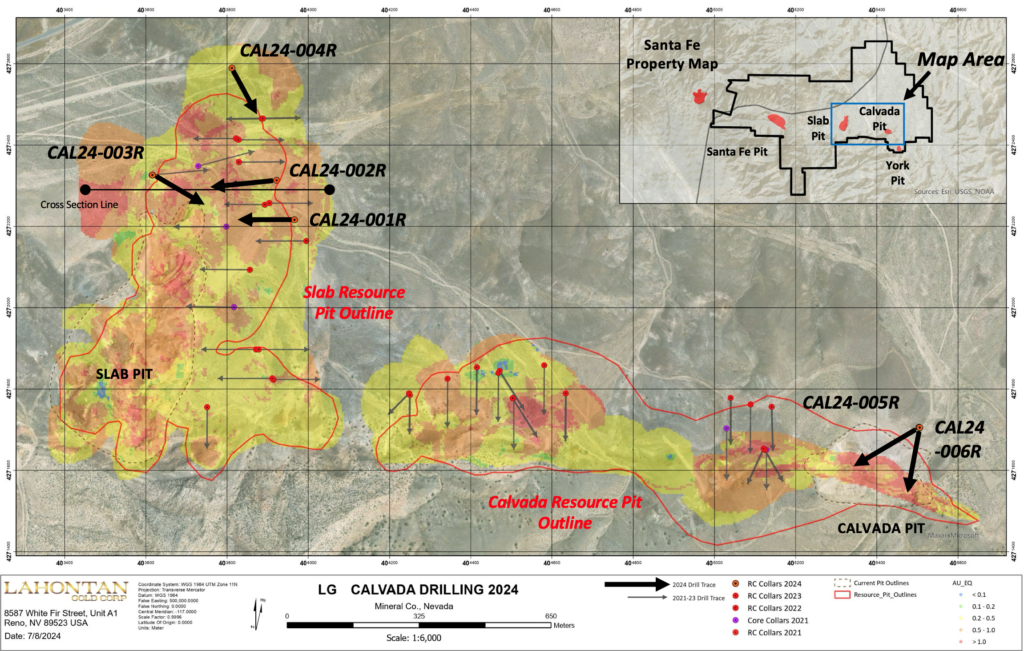

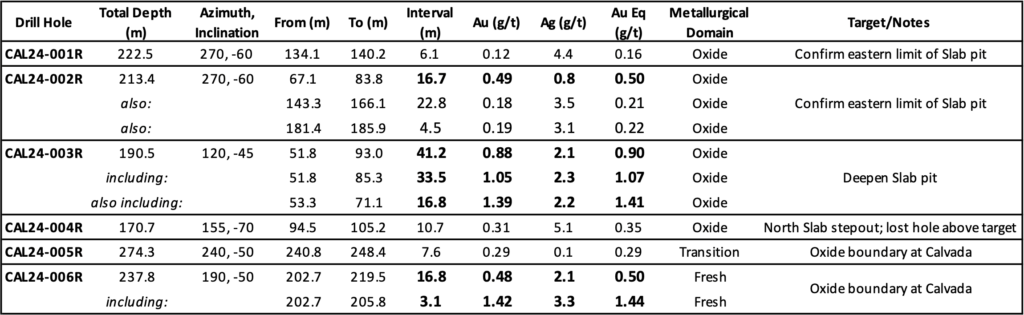

- 41.2 metres grading 0.88 g/t Au and 2.1 g/t Ag (0.90 g/t Au Eq) of very shallow oxide mineralization in drill hole CAL24-003R including 16.8 metres grading 1.39 g/t Au and 2.2 g/t Ag (1.41 g/t Au Eq). This drill hole, and others previously completed by Lahontan, intercepted significant widths of oxide metallurgical domain gold and silver mineralization below the MRE conceptual pit shell at the Slab open pit (please see location map, cross section, and table below). These drill holes will expand the scale of the conceptual pit shell used to constrain mineral resources for the updated MRE, expected in August 2024.

- 16.8 metres grading 0.48 g/t Au and 2.1 g/t Ag (0.50 g/t Au Eq) in drill hole CAL24-006R including 3.1 metres grading 1.42 g/t Au and 3.3 g/t Ag (1.44 g/t Au Eq). This drill hole demonstrates that mineralization remains unconstrained by drilling at depth and provides important information regarding the depth of the sulfide/oxide transition at Calvada, crucial data for mine planning in the PEA process.

Kimberly Ann, Lahontan Founder, CEO, President, and Director commented: “The drill results at the Slab open pit target area were successful on two fronts: Identifying additional high grade oxide gold and silver mineralization at depth and while also increasing drill hole density along the eastern margin of the Slab deposit to aid in mine planning. As we enter the PEA process, it is crucial to have the proper drill hole density to build an accurate mine plan including designing an optimized open pit for each resource area at Santa Fe. Drill hole CAL24-003R was very encouraging as it cut a thick zone of oxide mineralization below the current MRE pit shell, including some very high grade intervals, e.g. 3.1 metres grading 1.91 g/t Au, 2.3 g/t Ag (53.3 – 56.4m; 1.93 g/t Au Eq) at shallow levels. The Phase Two portion of our 2024 focused on stepping out to the north of this drill hole in order to expand oxide resources at Slab.”

It should be noted that all the drill holes were drilled at an angle with inclinations ranging from -45 to -70 degrees. Therefore, the depth from the surface to any given intercept is less than the down-hole distance of the intercept (please see cross section below).

The cross section above shows all Au Eq blocks modeled from historic drilling, both within and outside of the current MRE pit shell. The drill hole coloration in the cross section uses the same grades as the resource blocks, but the value only includes g/t Au rather than Au Eq. For the updated MRE, reinterpretation of the block model will increase grade between the current pit shell (red) and the potential new pit shell (black). Note the shallow depth of the new intercepts in the 2024 drill holes.

Plan view of the Calvada Central and Slab pit area, Santa Fe Mine, Nevada. The outline of the MRE conceptual pits is shown in dashed red, which encompass both the current Slab and Calvada East pits shown in dashed black. Resource blocks are color-coded for Au Eq grade in g/t. The six drill holes reported herein are shown with heavy black drill hole traces, the line of the cross section (above) is also shown.

Notes: Au Eq equals Au (g/t) + ((Ag g/t/75)*0.66). Silver grade for calculating Au Eq is adjusted to consider historic metallurgical recovery as described in the Santa Fe Project Technical Report*. True thickness of the intercepts is estimated to be 80-90% of the drilled interval. Numbers may not total precisely due to rounding.

QA/QC Protocols:

Lahontan conducts an industry standard QA/QC program for its core and RC drilling programs. The QA/QC program consisted of the insertion of coarse blanks and Certified Reference Materials (CRM) into the sample stream at random intervals. The targeted rate of insertion was one QA/QC sample for every 16 to 20 samples. Coarse blanks were inserted at a rate of one coarse blank for every 65 samples or approximately 1.5% of the total samples. CRM’s were inserted at a rate of one CRM for every 20 samples or approximately 5% of the total samples.

The standards utilized include three gold CRM’s and one blank CRM that were purchased from MEG, LLC of Lamoille, Nevada (formerly Shea Clark Smith Laboratories of Reno, Nevada). Expected gold values are 0.188 g/t, 1.107 g/t, 10.188 g/t, and -0.005 g/t, respectively. CRM’s with similar grades are inserted as the initial CRM’s run out. The coarse blank material comprised of commercially available landscape gravel with an expected gold value of -0.005 g/t.

As part of the RC drilling QA/QC process, duplicate samples were collected of every 20th sample interval at the drill rig to evaluate sampling methodology. Samples were collected from the reject splitter on the drill rig cyclone splitter. Samples were collected at each 95- to 100-foot (28.96 – 30.48m) mark and labeled with a “D” suffix on the sample bag. No duplicates were submitted for core.

All drill samples were sent to American Assay Laboratories (AAL) in Sparks, Nevada, USA for analyses. Delivery to the lab was either by a Lahontan Gold employee or by an AAL driver. Analyses for all RC and core samples consisted of Au analysis using 30-gram fire assay with ICP finish, along with a 36-element geochemistry analysis performed on each sample utilizing two acid digestion ICP-AES method. Tellurium or 50-element analyses were performed on select drill holes utilizing ICP-MS method. Cyanide leach analyses, using a tumble time of 2 hours and analyzed with ICP-AES method, were performed on select drill holes for Au and Ag recovery. AAL inserts their own blanks, standards and conducts duplicate analyses to ensure proper sample preparation and equipment calibration. We have all results reported in grams per tonne (g/t).

About Lahontan Gold Corp:

Lahontan Gold Corp. is a Canadian mine development and mineral exploration company that holds, through its US subsidiaries, four top-tier gold and silver exploration properties in the Walker Lane of mining friendly Nevada. Lahontan’s flagship property, the 26.4 km2 Santa Fe Mine project, had past production of 345,000 ounces of gold and 711,000 ounces of silver between 1988 and 1995 from open pit mines utilizing heap-leach processing (Nevada Bureau of Mines and Geology, 1995). The Santa Fe Mine has a Canadian National Instrument 43-101 compliant Indicated Mineral Resource of 1,112,000 oz Au Eq (grading 1.14 g/t Au Eq) and an Inferred Mineral Resource of 544,000 oz Au Eq (grading 1.00 g/t Au Eq), all pit constrained (Au Eq is inclusive of recovery, please see Santa Fe Project Technical Report*). The Company will continue to aggressively explore Santa Fe during 2024 and complete a Preliminary Economic Assessment evaluating development scenarios to bring the Santa Fe Mine back into production. The technical content of this news release and the Company’s technical disclosure has been reviewed and approved by Quentin J. Browne, P.Geo., Independent Consulting Geologist to Lahontan Gold Corp., who is a Qualified Person as defined in National Instrument 43-101 — Standards of Disclosure for Mineral Projects.

MORE or "UNCATEGORIZED"

Eloro Resources Announces Closing of Bought Deal LIFE Private Placement for Gross Proceeds of C$17 Million

Eloro Resources Ltd. (TSX: ELO) (FSE: P2QM) is pleased to announce the closing of its previously an... READ MORE

Minera Alamos Updates Resources and Reserves for the Pan Gold Mine in Nevada

Minera Alamos Inc. (TSX-V: MAI) (OTCQX: MAIFF) is pleased to announce updated Mineral Resource and M... READ MORE

Ero Copper Reports Fourth Quarter and Full Year 2025 Operating and Financial Results

Ero Copper Corp. (TSX: ERO) (NYSE: ERO) is pleased to announce its operating and financial results f... READ MORE

Rare Element Resources Announces Results of Oversubscribed Rights Offering of Common Shares

Rare Element Resources Ltd. (OTCQB: REEMF) is pleased to report that its previously announced... READ MORE

TRX Gold Reports Record Q2 2026 Production and Company Update

TRX Gold Corporation (TSX: TRX) (NYSE American: TRX) is pleased to announce preliminary resu... READ MORE