LAHONTAN ACQUIRES STRATEGIC CLAIMS SOUTH OF THE YORK PIT, EXPANDING THE SANTA FE MINE PROJECT

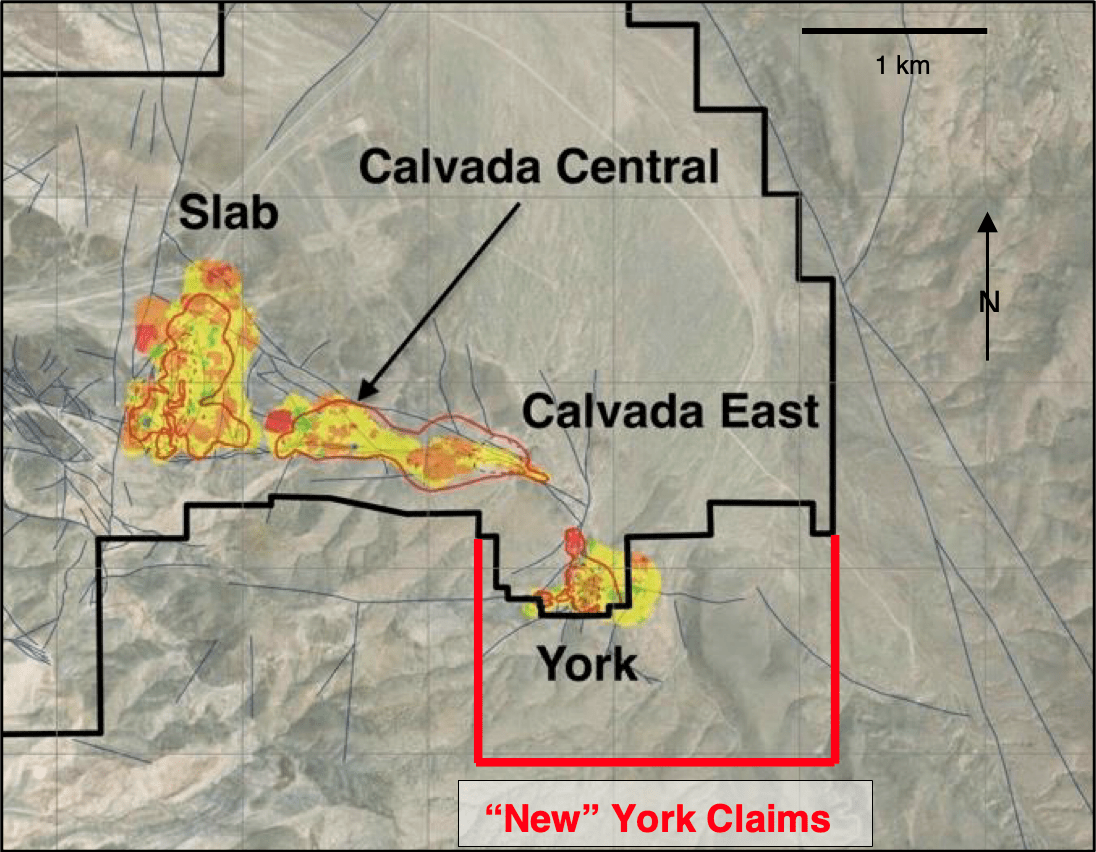

Lahontan Gold Corp. (TSX-V: LG) (OTCQB: LGCXF) (FSE: Y2F) is pleased to announce that the Company signed a binding term sheet on August 18, 2025 to acquire 27 unpatented lode mineral claims from Emergent Metals Corp. adding approximately 2.1 km2 of strategic mineral rights to the Santa Fe Mine Project. The claims adjoin the Santa Fe Mine Project immediately south and southeast of the York open pit and gold mineral resource* (please see map below). Resource modeling completed as part of the recent Preliminary Economic Assessment of the Santa Fe Mine Project* demonstrated that gold-silver mineral resources extended in the direction of the York Claims. The acquisition of the York claims will allow the expansion of the York open pit and potentially, a substantial increase of mineral resources in the York area.

Detailed map of the eastern portion of the Santa Fe Mine Project, Mineral County, Nevada. Modeled gold and silver mineral resource blocks are shown in yellow, red and orange; the conceptual pit shells used to constrain the mineral resource estimate* are shown in red. An approximate outline of the newly acquired York Claims is shown in bold red.

Kimberly Ann, Lahontan Gold Corp CEO, Executive Chair, and Founder commented: “Lahontan is very excited to acquire the York Claims that are directly adjacent to the York gold mineral resource*. The newly acquired claims will allow a considerable layback of the York pit during mine planning and in mineral resource estimation. Modeling of gold and silver mineralization at York in the Santa Fe Mine Project PEA was constrained by a pit shell that must honor the property boundary*. With the addition of the York Claims, that pit can be greatly expanded, potentially adding resource ounces plus opening up compelling targets for further gold and silver mineral resource expansion. Coupled with recently completed exploration drilling, the Company continues its path of growing size and scale of the Santa Fe Mine Project and enhancing shareholder value”.

Emergent and Lahontan contemplate completing a Definitive Agreement within 30 days of signing the Term Sheet. The transaction is subject to all necessary approvals, including regulatory approval. Terms of the Transaction include:

- On signing the Term Sheet, Lahontan will pay Emergent’s U.S. subsidiary, Golden Arrow Mining Corporation, a sum of US$10,000.

- On signing the Agreement, Lahontan will issue GAMC a US$50,000 promissory note, with a 1% per month interest rate, and payable within six months of signing the Agreement.

- On signing the Agreement, Lahontan will issue 2,000,000 common shares of Lahontan Gold Corp. to GAMC or its designee.

- On signing of the Agreement, payment of the cash, issuance of the shares, and issuance of the promissory note outlined above, GAMC will facilitate the transfer of the York Claims to Lahontan or its designee, to be completed within 30 days.

- As part of the transfer, Lahontan will grant GAMC a 1% NSR royalty on the York Claims. At any time before the third anniversary of the Agreement, Lahontan may purchase the Royalty for US$500,000. After the third and before the seventh anniversary of the Agreement, Lahontan may purchase the Royalty for US$1,000,000. The terms and conditions of the Royalty will be defined in the Agreement.

Regarding scientific data on the York Claims by provided previous claimants, the QP has been unable to verify the information and that the information is not necessarily indicative to the mineralization on the York Claims property that is subject to the disclosure.

About Lahontan Gold Corp

Lahontan Gold Corp. is a Canadian mine development and mineral exploration company that holds, through its US subsidiaries, four top-tier gold and silver exploration properties in the Walker Lane of mining friendly Nevada. Lahontan’s flagship property, the 26.4 km2 Santa Fe Mine project, had past production of 359,202 ounces of gold and 702,067 ounces of silver between 1988 and 1995 from open pit mines utilizing heap-leach processing. The Santa Fe Mine has a Canadian National Instrument 43-101 compliant Indicated Mineral Resource of 1,539,000 oz Au Eq (48,393,000 tonnes grading 0.92 g/t Au and 7.18 g/t Ag, together grading 0.99 g/t Au Eq) and an Inferred Mineral Resource of 411,000 oz Au Eq (16,760,000 grading 0.74 g/t Au and 3.25 g/t Ag, together grading 0.76 g/t Au Eq), all pit constrained (Au Eq is inclusive of recovery, please see Santa Fe Project Technical Report and note below*). The Company plans to continue advancing the Santa Fe Mine project towards production, update the Santa Fe Preliminary Economic Assessment, and drill test its satellite West Santa Fe project during 2025. The technical content of this news release and the Company’s technical disclosure has been reviewed and approved by Michael Lindholm, CPG, Independent Consulting Geologist to Lahontan Gold Corp., who is a Qualified Person as defined in National Instrument 43-101 — Standards of Disclosure for Mineral Projects. Mr. Lindholm was not an author for the Technical Report* and does not take responsibility for the resource calculation but can confirm that the grade and ounces in this press release are the same as those given in the Technical Report. For more information, please visit our website: www.lahontangoldcorp.com

* Please see the “Preliminary Economic Assessment, NI 43-101 Technical Report, Santa Fe Project”, Authors: Kenji Umeno, P. Eng., Thomas Dyer, PE, Kyle Murphy, PE, Trevor Rabb, P. Geo, Darcy Baker, PhD, P. Geo., and John M. Young, SME-RM; Effective Date: December 10, 2024, Report Date: January 24, 2025. The Technical Report is available on the Company’s website and SEDAR+. Mineral resources are reported using a cut-off grade of 0.15 g/t AuEq for oxide resources and 0.60 g/t AuEq for non-oxide resources. AuEq for the purpose of cut-off grade and reporting the Mineral Resources is based on the following assumptions gold price of US$1,950/oz gold, silver price of US$23.50/oz silver, and oxide gold recoveries ranging from 28% to 79%, oxide silver recoveries ranging from 8% to 30%, and non-oxide gold and silver recoveries of 71%.

MORE or "UNCATEGORIZED"

Cerro de Pasco Resources Enters Project Development Funding Agreement with U.S. International Development Finance Corporation for Quiulacocha

Cerro de Pasco Resources Inc. (TSX-V: CDPR) (OTCQB: GPPRF) (BVL: CDPR) announces that it has ... READ MORE

NorthWest Announces Updated Mineral Resource at Kwanika Reflecting Strategic Shift to Higher-Grade Copper-Gold Focus

NorthWest Copper Corp. (TSX-V: NWST) is pleased to announce an updated mineral resource estimate for... READ MORE

Monument Reports Second Quarter Fiscal 2026 Results

Monument Mining Limited (TSX-V: MMY) (FSE: D7Q1) today announced its financial results for the three... READ MORE

Taseko announces First Cathode Harvest at Florence Copper

Taseko Mines Limited (TSX: TKO) (NYSE American: TGB) (LSE: TKO) is pleased to announce its F... READ MORE

Highland Copper Closes Sale of 34% Interest in White Pine for US$30 Million

Highland Copper Company Inc. (TSX-V: HI) (OTCQB: HDRSF) is pleased to announce, further to its press... READ MORE