Kuya Silver Reports Strong Q2 Production Growth with 87% Increase in Mineralized Material Mined

Kuya Silver Corporation (CSE: KUYA) (OTCQB: KUYAF) (FSE: 6MR1) is pleased to provide an update on operational activities at the Bethania silver project during Q2 2025. The Bethania silver mine was restarted in 2024 and is currently ramping up production.

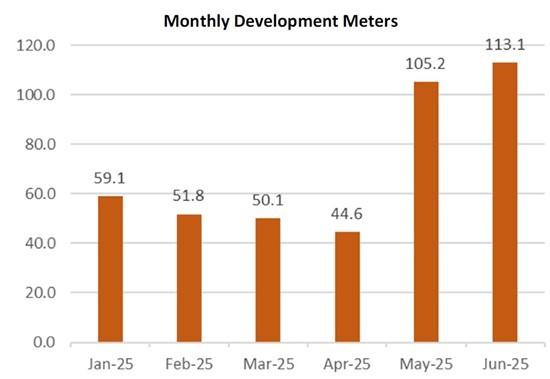

Production of mineralized material continued to increase over Q2 2025 with production from underground almost doubling over the quarter (+87%) while continuing to push development needed to meet the Company’s near-term production goals (+63% in development metres). Underground production accelerated in May as Kuya Silver completed certain critical level development, increased staffing levels and added production drilling equipment. Due to availability at the toll mill, there was no mineral processed in Q2 and Kuya Silver stockpiled mineralized material at site. Normal processing resumed in early July and is on-going.

Christian Aramayo, Kuya Silver Chief Operating Officer, stated, “During the second quarter we achieved significant milestones at Bethania, notably almost doubling mineralized material mined and accelerating development metres, despite the inherent fluctuations of a ramp-up phase. We are confidently on track to achieve our initial short-term goal of 100 tonnes per day by Q3 2025, having developed sufficient working faces (10 operational faces as of early July, with nine required for 100 tpd) and we are actively working to complete the infrastructure and staffing to convert this development into consistent daily production.”

To support the increased production rates, Kuya Silver is bolstering its operational infrastructure with pneumatic shovels planned for installation later this month, as June production was impacted by a temporary shortage of available shovels. However, these critical pieces of equipment have now been secured, including the recent installation of two trailing winches, a larger air compressor, and a bigger power generator. These essential additions will significantly enhance efficiency and facilitate further underground development as we ramp up operations.

| Production Highlights | Unit | 2024(1) | Q1 2025 | Q2 2025 |

| Mineralized material, mined | tonnes | 528.4 | 654.8 | 1,224.4 |

| Mineralized material, processed | tonnes | 767.0 | 871.8 | – |

| Meters advanced | m | 111.1 | 161.0 | 262.9 |

| Development | tonnes | 558.0 | 1,929.6 | 1,773.6 |

| Average head grades | ||||

| Silver | oz/t | 6.93 | 9.05 | 10.73 |

| Lead | % | 2.45 | 2.60 | 3.64 |

| Zinc Silver Equivalent(2) Silver Equivalent(2) |

% oz/t g/t |

1.70 10.31 320.6 |

2.23 12.39 385.3 |

2.52 14.89 463.2 |

| Average recoveries (3) | ||||

| Silver | % | 84.76 | 90.94 | – |

| Lead | % | 80.61 | 87.40 | – |

| Zinc | % | 25.63 | 55.40 | – |

| Metal processed | ||||

| Silver | oz | 5,177.32 | 7,445.25 | – |

| Lead | tonnes | 18.32 | 21.41 | – |

| Zinc | tonnes | 12.72 | 18.37 | – |

| Concentrates sold (wet) | ||||

| Silver Specialty (Silver Kings Project) Silver-Lead |

tonnes tonnes |

37.93 | 38.79 | 1799.88 – |

| Zinc | tonnes | 13.43 | 29.30 | – |

| Metal sold | ||||

| Silver | oz | 4,248.11 | 6,759.83 | 58,078 |

| Gold | oz | 2.44 | 2.28 | – |

| Lead | tonnes | 14.88 | 18.40 | – |

| Zinc Silver equivalent (2) Percent silver production |

tonnes oz |

4.34 5,904.15 |

10.38 8,887.57 |

– 58,078 |

| % | 72 | 76 | 100 | |

| Average realized price (4) | ||||

| Silver | $/oz | 31.34 | 32.65 | 36.44 |

| Gold | $/oz | 2,680.78 | 3,017.00 | – |

| Lead | $/tonne | 1,915.28 | 1,983.58 | – |

| Zinc | $/tonne | 2,718.00 | 2,773.23 | – |

| Total revenue USD (4) | $ Thousands | 150 | 229 | 1,150 |

|

Table 1: Production highlights from the Bethania silver mine

(1) production from May 21, 2024 to December 31, 2024 |

||||

Improving Ore Quality Drives Stronger Q2 Performance

Notably, Q2 2025 saw a marked improvement in average head grades, as execution of the mine plan allows for increasing quality of the Bethania mineralized material. Average silver grades rose from 9.05 oz/t in Q1 to 10.73 oz/t in Q2. Similarly, lead grades increased from 2.60% to 3.64%, and silver equivalent grades advanced from 12.39 oz/t to 14.89 oz/t over the same period. This upward trend in metal content reflects enhanced operational efficiency and the effective targeting of higher-grade mineralization during the ramp-up phase.

Development Progress Readies Bethania for Next Jump in Underground Production

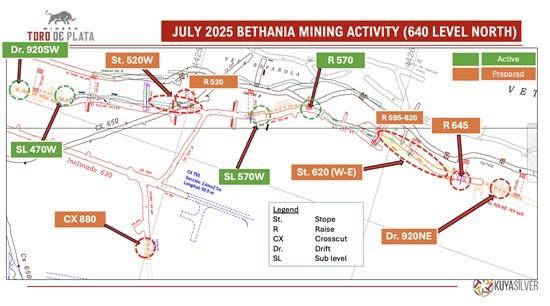

During the second quarter Kuya Silver continued its strategic focus on underground development while maintaining planned daily production growth. Production is planned for the three primary vein systems (Española, 12 de Mayo, Victoria) as well as other mineralized structures over the coming years. At present, sufficient material has been developed to ramp up to our initial short-term goal of 100 tpd exclusively from the Española vein solely from the 640 (current) mining level.

Figure 1: Development metres by month at the Bethania silver mine

Given the mining method (ascending cut and fill), it is important to note that a portion of the development activities occur in mineralized material and therefore these double as productive working faces in addition to the more traditional mining stope. Over the long term, mining stopes will produce the majority of the mineralized material from the mine however have in the early stages of development (ramp-up) there is a large proportion of productive development faces in the plan, required to prepare new stopes and expand the mine workings for future production.

We are pleased that as of the first week of July, the Bethania mine had opened ten different working faces. A minimum of nine working faces is required to produce 100 tpd. Four of those working faces are actively operating, while the remainder are prepared and ready to be added to daily production totals over the next two months as the materials handling infrastructure is expanded. Some of the tasks to be completed in the near term are installation of an additional pneumatic shovel, ventilation expansion, additional hiring, and the development of a new underground storage area on the 640 level.

Beyond direct operational advancements, Kuya Silver also prioritizes its commitment to the local community as well as efficient and safe site access. As part of this commitment, we initiated an important road maintenance program on July 7th, covering a total of 11.6 kilometers. To date, 2.2 kilometers of this project has already been completed. Maintaining access roads is vital for the safety of our personnel, the efficient transport of equipment and materials, and ensuring seamless logistics for the ongoing ramp-up of the Bethania mine.

Figure 2: Plan view of Bethania mine, 640 level, north section (Española vein system) showing working faces in production and prepared for future production.

Historical Silver Concentrate from Silver Kings Project

Kuya Silver identified several piles of historical silver concentrate at the Silver Kings Project and undertook a process to market this resource, successfully shipping the concentrate for sale in Q2 2025. Due to the unique chemistry in the Cobalt camp, this concentrate is unconventional and there is no benchmark for this product. Based on what is known about the history of the Cobalt mining camp properties, the primary product would have been silver doré produced from gravity separation of coarse native silver and this concentrate would be a secondary product. Kuya Silver ran a marketing process and established interest from multiple parties. While in the short-term this sale was a one-off event, beyond the immediate impact of this cash flow, Kuya Silver has importantly established a process to further optimize potential income from any future mining operations at the Silver Kings project by proving that concentrate from this camp can be a value by-product or co-product. A total of 1761 wet tonnes of silver concentrate were shipped generating provisional revenue of USD $1.18 million, as customary this revenue is subject to final adjustments upon final settlement once all the sales conditions are met.

Quality Assurance and Quality Control

Quality assurance and quality control include two sampling procedures. Underground vein material from stopes are sampled to confirm vein grades and to reconcile against the mine model; and sampling of freshly mined material in stockpiles to determine dilution and the head grade that is sent to the processing plant.

Underground vein sampling was conducted systematically every 4 meters along the galleries. This involved excavating a narrow and continuous channel either parallel to the vein or perpendicular to its orientation. The entire volume of material excavated from the channel was collected as a sample.

Freshly mined material in the stockpiles and concentrate stockpiles were sampled using trenching, a method involving the excavation of narrow trenches perpendicular to the major axis of the pile. Trenches were systematically dug at regular intervals across all depths of the pile. The location of each trench was referenced to a topographic control point and recorded in the sampling log.

All material was carefully collected on plastic sheets, then pulverized at the mine site. The pulverized material was quartered, and one quarter was labeled and secured in vinyl sample bags. The samples were then transported to Dmtri I. Mendelejeff laboratory in Huancayo for processing using fire assay followed by atomic absorption spectroscopy (AAS).

All concentrate assay results are cross-checked against independent analyses conducted by the buyer. Furthermore, sample security protocols include sealed trucks for transporting run-of-mine (ROM) material and concentrate trucks with tamper-proof devices with safety seals, and a documented custody chain overseen by the mine superintendent (Bethania) or senior technician (Silver Kings). Concentrate from the Silver Kings Project was sampled during loading, and assayed at AGAT Laboratories in Calgary, Alberta, by Sodium Peroxide Fusion.

National Instrument 43-101 Disclosure

The technical content of this news release relating to the Bethania Project has been reviewed and approved by Mr. Kevin J. O’Connell, P.E., Independent Technical Advisor to of Kuya Silver and a Qualified Person as defined by National Instrument 43-101. The technical content of this news release relating to the Silver Kings Project has been reviewed and approved by David Lewis, M.Sc., P.Geo., Vice President Exploration with Kuya Silver Corp. and a Qualified Person as defined by National Instrument 43-101.

About Kuya Silver Corporation

Kuya Silver is a Canadian‐based mineral exploration and development company with a focus on acquiring, exploring, and advancing precious metals assets in Peru and Canada.

MORE or "UNCATEGORIZED"

Eloro Resources Announces Closing of Bought Deal LIFE Private Placement for Gross Proceeds of C$17 Million

Eloro Resources Ltd. (TSX: ELO) (FSE: P2QM) is pleased to announce the closing of its previously an... READ MORE

Minera Alamos Updates Resources and Reserves for the Pan Gold Mine in Nevada

Minera Alamos Inc. (TSX-V: MAI) (OTCQX: MAIFF) is pleased to announce updated Mineral Resource and M... READ MORE

Ero Copper Reports Fourth Quarter and Full Year 2025 Operating and Financial Results

Ero Copper Corp. (TSX: ERO) (NYSE: ERO) is pleased to announce its operating and financial results f... READ MORE

Rare Element Resources Announces Results of Oversubscribed Rights Offering of Common Shares

Rare Element Resources Ltd. (OTCQB: REEMF) is pleased to report that its previously announced... READ MORE

TRX Gold Reports Record Q2 2026 Production and Company Update

TRX Gold Corporation (TSX: TRX) (NYSE American: TRX) is pleased to announce preliminary resu... READ MORE