Kutcho Copper Announces Results of Feasibility Study

Kutcho Copper Corp. (TSX-V: KC, OTCQX: KCCFF) is pleased to announce the results of the 2021 Feasibility Study for the development of the 100% owned Kutcho copper and zinc project in northern British Columbia.

- ROBUST PROJECT ECONOMICS

- Base case metal prices(1) of $3.50/lb Cu, $1.15/lb Zn

- Pre-tax NPV7% C$737 million, IRR 31%

- After-tax NPV7% C$461 million, IRR 25%

- Spot metal prices(2) of $4.50/lb Cu, $1.57/lb Zn

- Pre-tax NPV7% of C$1,467 million; IRR 51%

- After-tax NPV7% of C$931 million; IRR 41%

- Base case metal prices(1) of $3.50/lb Cu, $1.15/lb Zn

- LOW COST PRODUCTION

- Cash costs of US$1.11/lb of CuEq(3)

- All-in sustaining costs(4) of US$1.80/lb of CuEq

- Initial capital cost of C$483 million

- ELEVEN-YEAR OPEN PIT AND UNDERGROUND MINE LIFE

- Metal production of 533 Mlbs Cu, 841 Mlbs Zn, 10.6 Moz Ag, 129.7 koz Au

- HIGH GRADE MINERAL RESOURCE(5)

- 22.8 million tonnes grading 2.26% CuEq containing 1.1 Blbs CuEq (764 Mlbs Cu, 1,096 Mlbs Zn)

- An additional 12.9 million tonnes grading 1.62% CuEq containing 460 Mlbs CuEq in the inferred category (312 Mlbs Cu, 449 Mlbs Zn)

- STABLE MINING JURISDICTION SITUATED IN NORTHERN BRITISH COLUMBIA, CANADA

- One of the safest global mining jurisdictions, located in the traditional territories of the Tahltan Nation and Kaska Dena Nation

Vince Sorace, President & CEO of Kutcho Copper commented: “The Feasibility Study represents a major milestone for Kutcho Copper as we continue to advance the high-grade Kutcho copper-zinc project towards a development decision. The significant redesign and engineering of the Project delivers a mine plan that is a predominantly open pit mining operation with the concurrent development of two underground mines. The mine plan has resulted in a technically robust and capital efficient Project with a minimised footprint. The results of the Feasibility Study highlight the attractive economics of the Kutcho project which are resilient at lower metal prices, very attractive at base case prices and exhibit significant leverage to rising prices as reflected in spot metal prices with a C$931 million after-tax NPV7% and a 41% IRR. We believe that the results of the Feasibility Study mean that Kutcho Copper is now one of the most undervalued copper investment opportunities in North America.”

- Refer to Table 1 for base case metal prices

- Refer to Figure 1 for spot metal prices

- Pounds of copper equivalent calculated on base case metal prices stated in Table 1

- Refer to Table 8 for all-in sustaining cost (AISC) calculation methodology

- Refer to Table 2: Estimate of Mineral Resources for the Kutcho Project

Table 1: Feasibility Study Headline Results is available at

https://www.globenewswire.com/NewsRoom/AttachmentNg/ec9126c4-68ad-4050-bf04-b86610a9713b

Notes:

- Tonnages are reported in metric tonnes (t), copper and zinc in pounds (lbs), silver and gold reported in troy ounces (oz).

- “M” = million, “k” = thousand

- All tables report rounded figures and may not sum precisely.

- The financial model is based on 100% of the Project being financed through equity (no equity from other projects can be used to offset the cost of capital). No debt or equity schedule is included.

- All values, unless otherwise stated, are undiscounted.

- The highlights refer to the Feasibility Study base case. The Wheaton Precious Metals Purchase Agreement is not applied to the base case.

- Net smelter revenue (NSR) includes royalty payments.

- On-site construction period excludes the access road construction and a 3 month commissioning period.

- Operating costs exclude the pre-production period which are allocated to Pre-Production Capital).

- Cash or operating costs are operating expenses for mining, plant operations and administration to the point of production of the concentrate at the Kutcho site. It excludes off-site concentrate costs, sustaining capital, closure/rehabilitation and royalties. CuEq calculation assumes metal base case prices.

- All-in sustaining costs includes all cash costs, sustaining capital expenses to support on-going operations (such as TMF construction, major plant equipment replacement and repair), concentrate charges, and royalties. It includes closure and rehabilitation costs.

- No inflation or depreciation of costs were applied; all costs are in 2021 money values. Major underground mobile equipment, all open pit mobile equipment and the power plant are leased. Contingencies included.

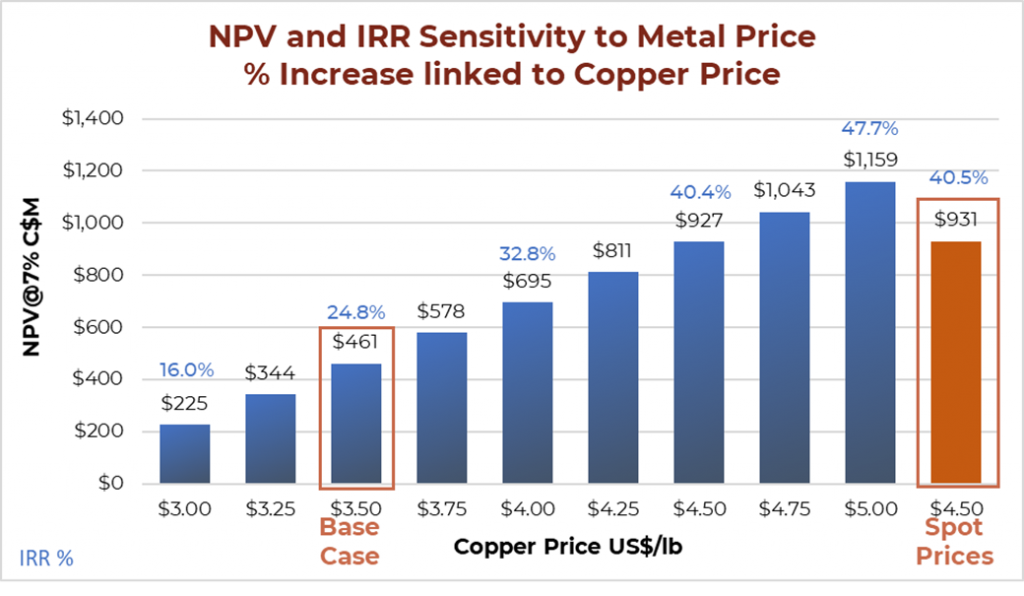

Figure 1: Sensitivity of Base Case After-Tax NPV7% and IRR to Metal Prices (US$:C$ FX Rate at 0.76)

Note:

- Spot metal prices as at 26 October 2021: Copper US$4.50/lb, Zinc US$1.57/lb, Silver US$24/oz, Gold US$1,788/oz.

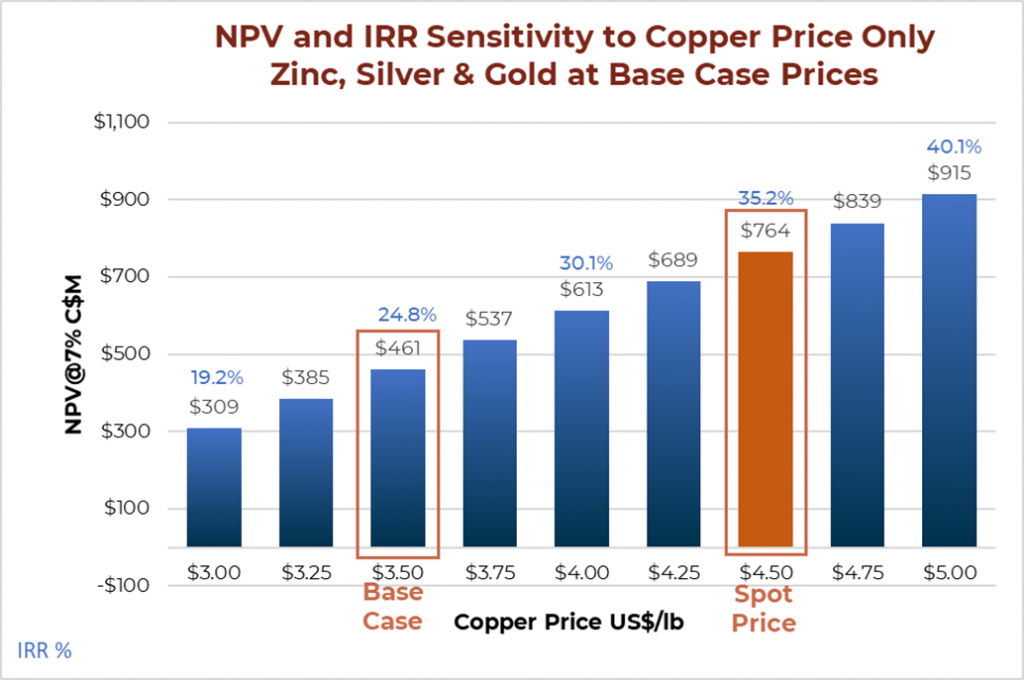

Figure 2: Sensitivity of Base Case After-Tax NPV7% and IRR to Copper Price Only (US$:C$ FX Rate at 0.76)

Note:

1. Only copper price adjusted.

2. Spot copper price as at 26 October 2021: US$4.50/lb.

Project Summary

The Kutcho project is located in northern British Columbia (BC), approximately 100 km east of Dease Lake within the traditional territories of the Tahltan Nation and Kaska Dena Nation. The Project described in the Feasibility Study contemplates mining the Main and Esso deposits to extract mainly copper and zinc, with minor quantities of gold and silver. The Main deposit is designed to be mined primarily as a conventional shovel and truck open pit operation, with a deeper remnant mined by underground longitudinal longhole open stoping (LLHOS) with cemented rock fill (CRF). The underground Esso deposit is also designed to be mined using LLHOS with CRF. A total of 17.3 Mt is planned to be mined over an 11 year mine life, with 14.5 Mt coming from the open pit and 2.8 Mt from the underground mines. A steady-state crusher production rate of 4,500 tonnes per day (tpd) is expected be achieved by the end of the first year of operations.

After primary crushing at an average steady state rate of 4,500 tpd, an ore sorter utilizing an x-ray transmission (XRT) sensor would remove low-grade and waste material from the feed to the SAG and ball mills, followed by conventional flotation, regrind and dewatering circuits. Approximately 3,900 tpd of ore would report to the milling and flotation circuit after ore sorting. A total of 533 Mlbs of copper and 841 Mlbs of zinc as primary products, and 10.6 Moz of silver and 129 koz of gold is anticipated to be recovered to concentrate for sale.

The Project design includes an extensive progressive reclamation programme, including the backfilling of the open pit and water treatment during operations and for the closure period.

The Project is located within the traditional territories of the Tahltan Nation and Kaska Dena Nation. Kutcho has a good working relationship with these Nations and has started discussions with both to develop Economic Participation Agreements that would safeguard their interests, provide employment, and benefit the Nations economically.

Feasibility Study Participation

The study was led by CSA Global and included the support of SIM Geological Inc., Allnorth Consultants Ltd., ABH Engineering Inc., Mineit Consulting Inc., Terrane Geoscience Inc., Piteau Associates, and Onsite Engineering Ltd., all of which are independent of the Company.

Environment, Social and Governance

Environmental

The Kutcho Project is designed with environmental protection in mind; final closure and reclamation were key drivers in the design process. Various environmental protection and impact mitigations are incorporated, with the highlights being:

- Upgrading the site access road to minimize impact on water quality and natural resources, including run-off control and clear span bridge crossings

- Use of liquified natural gas for power generation as opposed to diesel, significantly reducing the generation of greenhouse gases and reducing the potential for fuel spills

- The tailings management facility (TMF) is designed to be a fully-lined impoundment with the rockfill embankment comprising non-potentially acid generating (nPAG) waste rock and built using downstream construction methods

- On closure, the TMF would be capped with nPAG waste rock and revegetated

- Waste rock not required for construction would be placed on a stockpile, most of which would be backfilled into the pit during operations and revegetated

- Potentially acid generating (PAG) waste rock would be placed on temporary stockpiles, all of which would be rehandled back into the pit at the end of the mine life to reduce the risk of future acid generation or metal leaching

- No infrastructure is located within fish-bearing streams

- The water management system would divert non-contact water around proposed mine facilities

- Contact water would be collected for operational re-use or treated in a water treatment plant prior to discharge to the environment to ensure adherence to provincial and federal water quality guidelines

- At closure all buildings would be removed, disturbed lands rehabilitated, and the property returned to functional use according to as yet to be developed and approved reclamation plans and accepted practices at the time of closure

Social

- The Project is located within the traditional territories of the Tahltan Nation and Kaska Dena Nation

- Kutcho has a good working relationship with these Nations and commenced discussions with both to develop Economic Participation Agreements that would safeguard their interests, provide employment, and benefit them economically

- Kutcho Copper remains committed to de-risking and advancing the Kutcho project in close consultation with the Tahltan and Kaska Dena Nations

Governance

- Kutcho Copper is committed to the principles of good governance, openness and transparency in all its activities and has begun developing appropriate policies, controls and practices for the next phase of the Project’s development.

Location and Access

The Kutcho project is located in northern British Columbia, approximately 100 km east of Dease Lake and 425 km north of Terrace, BC. Access to the site during construction and operations would be via an upgraded 120 km gravel road that joins the Stewart–Cassiar Highway 37 directly south of Dease Lake. In addition, a 1,000 m long airstrip is located about 10 km to the northwest of the mine site.

First Nations and Local Communities

The Kutcho project is located within the traditional territories of the Tahltan Nation and Kaska Dena Nation. The closest community to the mine site is Dease Lake. Traditional use of lands and resources in the vicinity of the Project have been documented for both the Tahltan Nation and Kaska Dena Nation. Kutcho Copper is committed to working and consulting with the First Nations following a jointly developed Consultation Plan. To this end, Kutcho Copper and the Tahltan Nation and Kaska Dena Nation have already signed several agreements. Kutcho Copper has also initiated discussions to develop the access road to the Project site in partnership with Tahltan Nation and Kaska Dena Nation.

Mineral Resource Estimate

The mineral resource estimate for the Kutcho project was prepared by SIM Geological Inc. in accordance with current CIM standards, definitions and guidelines, with an effective date of 30 July 2021. Mineral resources tabulated below are inclusive of mineral reserves.

Table 2: Kutcho Project – Estimate of Mineral Resources Inclusive of Reserves (effective 30 July 2021) is available at

https://www.globenewswire.com/NewsRoom/AttachmentNg/04b7333f-a379-4f3b-8d1c-21a923e944dd

Notes:

- The mineral resource estimates in the table above form coherent bodies of mineralisation that are considered amenable to a combination of open pit and underground extraction methods based on the following parameters: Base Case Metal Prices: Copper US$3.50/lb, Zinc US$1.15/lb, Silver US$20.00/oz, Gold US$1600/oz. Projected operating costs: Mining (underground) C$56.58/t, Mining (open pit) C$3.49/t, Processing C$26.97/t, G&A C$7.89/t. Process recoveries Main and Sumac: Copper 87.6%, Zinc 64.3%, Gold 58.0%, Silver 57.9%. Process recoveries Esso: Copper 94.5%, Zinc 89.3%, Gold 66.0%, Silver 71.2%. Pit slope angle 48.9 degrees.

- Copper-equivalent grades at Main and Sumac are calculated based on the formula: CuEq = (Cu% x 0.876) + (Zn% x 0.241) + (Au g/t x 0.441) + (Ag g/t x 0.006). Copper-equivalent grades at Esso are calculated based on the formula: CuEq = (Cu% x 0.945) + (Zn% x 0.310)+(Ag g/t x 0.006)+(Au g/t x 0.466). The base case cut-off grade for mineral resources considered amenable to open pit extraction methods at the Main deposit is 0.45% CuEq while the cut-off grade for mineral resources considered amenable to underground extraction methods at Main and Sumac deposits is 1.05% CuEq and is 0.95% Cu at the Esso deposit.

- Mineral resources are not mineral reserves and do not have demonstrated economic viability. These mineral resource estimates include inferred mineral resources that are considered too speculative geologically to have economic considerations applied to them that would enable them to be categorized as mineral reserves. It is reasonably expected that the majority of inferred mineral resources could be upgraded to measured or indicated mineral resource with continued exploration.

- All figures are rounded to reflect the relative accuracy of the estimate and therefore numbers may not appear to add precisely.

- The estimate of mineral resources was calculated based on the Canadian Institute of Mining, Metallurgy and Petroleum (“CIM”), CIM Standards on Mineral Resources and Reserves, Definitions and Guidelines prepared by the CIM Standing Committee on Reserve Definitions.

- The effective date of the estimate of mineral resources is July 30, 2021. Kutcho Copper is not aware of political, environmental, or other risks that could materially affect the potential development of the mineral resources.

Mineral Reserve Estimate

The mineral reserve estimate for the Kutcho project, with an effective date of 4 November 2021, was prepared by CSA Global Pty Ltd and reported in accordance with the National Instrument 43-101. The mineral reserves are estimated using current CIM standards, definitions and guidelines. Mineral reserves for the Project are a subset of the measured and indicated mineral resources. The mineral reserves are inclusive of diluting material that would be mined and delivered to the processing plant, and include suitable discounting to allow for losses typically incurred during mining.

Table 3: Kutcho Project – Mineral Reserve Estimate (effective 4 November 2021) is available at

https://www.globenewswire.com/NewsRoom/AttachmentNg/cb6cbca9-e773-48b5-90d6-8ee1900eda0a

Notes:

-

CIM definitions were followed for Mineral Reserves.

2. Mineral Resources are reported inclusive of Mineral Reserves.

3. The Inferred Mineral Resource does not contribute to the financial performance of the Project and is treated in the same way as waste.

4. Sum of individual amounts may not appear to equal the totals due to rounding.

5. Metal prices – copper US$3.50/lb, zinc US$1.15/lb, silver US$20/oz, and gold US$1,600/oz.

6. No previous mining has occurred at the Project site.

7. The reference point at which the Mineral Reserves are defined is where the ore is delivered to the crusher.

8. There is no known likely value of the following factors of mining, metallurgical, infrastructure, permitting or other relevant factor that could materially affect the estimate.

9. A complex NSR formula has been applied that varies for oxide and sulphide rock types and also varies for head grade and is fully documented within the NI43-101 Technical Report of the Feasibility Study.

9a. The oxide NSR formula can be approximated to +/- 1% accuracy for average head grades as: NSR ($/t) = 50.26 x Cu% + 7.09 x Zn% + 0.14 x Ag_gpt + 8.94 x Au_gpt.

9b. The sulphide NSR formula can be approximated to +/- 1% accuracy for average head grades as: NSR ($/t) = 57.82 x Cu% + 9.94 x Zn% + 0.34 x Ag_gpt + 22.52 x Au gpt.

Underground Specific Notes:

-

Underground Mineral Reserve cut-off grade was C$129.45/t NSR.

11. The minimum pre-dilution mineable width applied was 2.5m, average stope dimensions of 25m height, 13.1m wide and length of 42m and a minimum footwall dip of 47 degrees.

12. A 0.75m footwall and a 0.75m hanging wall dilution is applied and wall dilution grades were taken from estimated block grades in these locations.

13. A net mining recovery and mining loss estimate after wall dilution was estimated as +2.2% tonnage and -6.2% grade.

14. Total net mining dilution, recovery and mining loss of the Mineral Resource is estimated at 0.34Mt (+12.0%) tonnes at 0.50% Cu, 1.13% Zn, 13 gpt Ag, and 0.12 gpt Au.

15. All stopes included in the Mineral Reserve were optimized to maximise net cashflow and must be cashflow positive including access capital.

Open Pit Specific Notes:

16. Open Pit Mineral Reserve cut-off grade was C$38.40/t NSR for oxide and C$55.00/t NSR for sulphide. The sulphide grade is an operational cut-off and is above the break-even cut-off of C$38.40/t NSR.

17. Mineral resource between the break even and operational cut-off not included in the Mineral Reserve amounts to 1.24 Mt at 0.53% Cu, 0.63% Zn, 9.6 gpt Ag and 0.13 gpt Au (Measured and Indicated).

18. The mining SMU is 5m x 5m x 5m. All ore is diluted to this block dimension and is considered the minimum recoverable dimension for the mining equipment and mining method selected.

19. Average dilution is estimated as 1.17Mt (+8.1% of Mineral Reserve total) tonnes and grades are taken from waste materials, estimated as 0.12% Cu, 0.13% Zn, 1.0 gpt Ag and 0.08 gpt Au.

20. Mining loss for material above the operational cut-off is estimated as 0.79 Mt (2.6% of Mineral Reserve total) at a grade of 0.91% Cu, 0.98% Zn, 4.8 gpt Ag and 0.53 gpt Au.

21. The Open Pit Mineral Reserve lies within a pit design that is supported by geotechnical drilling and studies and optimized for net present value.

Considerations

British Columbia, Canada is a stable geopolitical region with a well-understood mining regulatory regime and rule of law. There are no known legal, political, environmental, or other risks that could materially affect the potential development of the mineral resources or mineral reserves. Reporting and modelling of financial results were evaluated in H2/2021 and terminated 5 November 2021 (the reserve statement effective date). The NSR method was used to determine mineral reserves and considers on-site operating costs, selling costs, geotechnical analysis, metallurgical recoveries, allowances for mining recovery and dilution, and overall economic viability as detailed in the Feasibility Study.

Project Development and Closure Plan

Development of the Project would comprise the construction, operation, and closure of an open pit and underground mining operation with associated processing and ancillary surface structures. Excluding the access road, the mine would have a two-year construction period (including commissioning) and a 10.75-year operational life. A small amount of ore would be mined and processed towards the end of the construction period.

The existing 120 km long Boulder Trail access road from Highway 37 would be upgraded to accommodate construction vehicles and trucks transporting consumables, services and concentrate. Road construction activities would commence approximately three years prior to mine commissioning and would include upgrading of the existing road surface, realignment along small sections, and the construction of clear-span bridges and culverts to facilitate creek crossings.

Construction of the mine site infrastructure would commence one and three quarter years before plant commissioning. This would include construction of the Main and Esso underground mines’ shared portal, and waste development to access, initially, the Main underground mine and, subsequently, the Esso underground mine. Approximately 23% of the nPAG waste rock from the pit would be used for the construction of the tailings management facility. The open pit mine plan maximises direct backfill of PAG waste rock into completed parts of the pit when available. Any excess PAG waste rock would be stored in a discrete area of the surface waste rock stockpile that will be underlain by buffering nPAG waste. The plan also includes the development of a low-grade ore stockpile which would be consumed after termination of open pit mining. During this final operational rehandle phase of the Project the surface PAG waste stockpile would be returned to the open pit and capped by nPAG waste. The mine plan and rehabilitation strategy are an integrated package and important outcomes of that strategy would be that no PAG rocks are to remain outside of the pit area after closure. The waste rock rehandle strategy will produce a final landform that promotes water runoff, and the placement of all PAG material to the lower depths of the open pit mine.

Power for the operation would be provided by four 2.5 MW LNG generators plus one on standby. A 2 MW diesel generator would provide occasional plant start-up assistance.

In order to minimise potential environmental effects, no infrastructure is located within fish-bearing streams. All contact water would be treated prior to discharge to the environment to ensure adherence to provincial and federal water quality guidelines.

At closure, all buildings would be removed, disturbed lands rehabilitated, and the property returned to functional use according to as yet to be developed and approved reclamation plans and accepted practices at the time of closure. By closure the open pit is planned to be almost completely backfilled; topsoiling and revegetation will follow. The TMF would be capped with nPAG waste rock and revegetated. Contact water discharged into the environment would be treated until water qualities meet discharge criteria. It is anticipated that the site’s active and passive post-closure environmental management would continue for approximately eight to ten years after closure. However, provision is made for 25 years of active water treatment and a total of thirty years of monitoring.

Mining

Mining is expected to be conducted by conventional shovel and truck open pit and underground LLHOS methods.

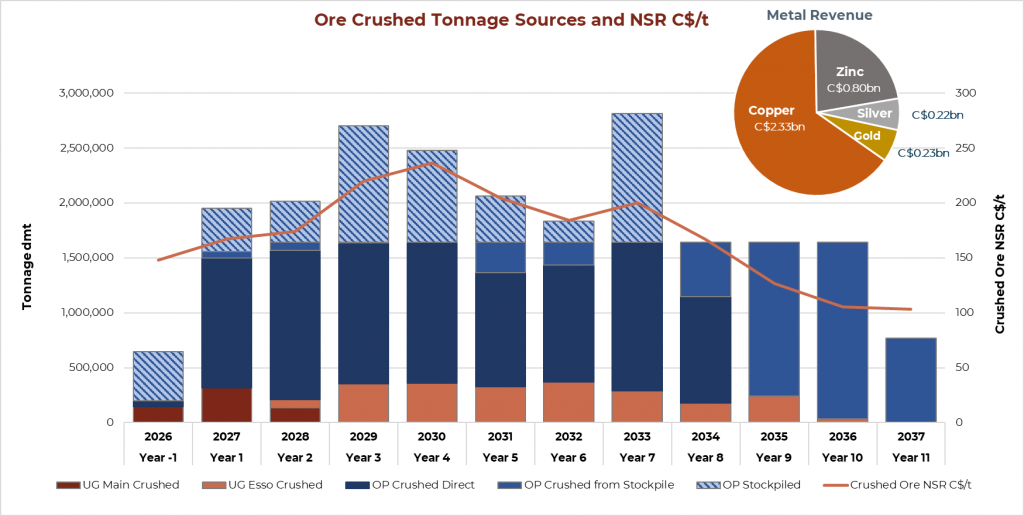

Open pit mining at Main is expected to commence during the construction period and ramps up over a two-year period before reaching an estimated average steady production rate of 1.8 Mtpa of ore at the end of Year 2. The open pit has an estimated eight-year life with a total of 14.5 Mt of ore mined at an average strip ratio of 5.6:1.

Figure 3: Ore by Source and NSR

Underground mine development is expected to commence two years before production. A single portal would be used to access both the Main and Esso ore bodies. Access to the Main underground mine would be via an initial 340 m long decline. The Main underground mine would be located beneath the Main open pit and is separated from it by a crown pillar. The top of the Esso deposit is approximately 400 m below surface and would be accessed by an 1,800 m decline extending from the Main ramp. Further decline ramps are required to access the production stopes in the Main and Esso mines.

Underground mining of both the Main and Esso deposits is expected to be by longitudinal long-hole open stoping. The stopes would be backfilled using cemented rock fill (mostly ore sorter reject from the processing plant) and are planned to utilize temporary rib pillars and cable bolting as primary stope support measures. The underground portion of the Main deposit is expected to have a three-year mine life, extending from Year -1 to Year 2. Total ore production from Main underground would be 0.6 Mt at an average rate of 600 tpd. Underground mining of the Main deposit would be completed early in the life of the open pit with minimal interference between the two operations anticipated. The 25 m crown pillar is not planned for recovery.

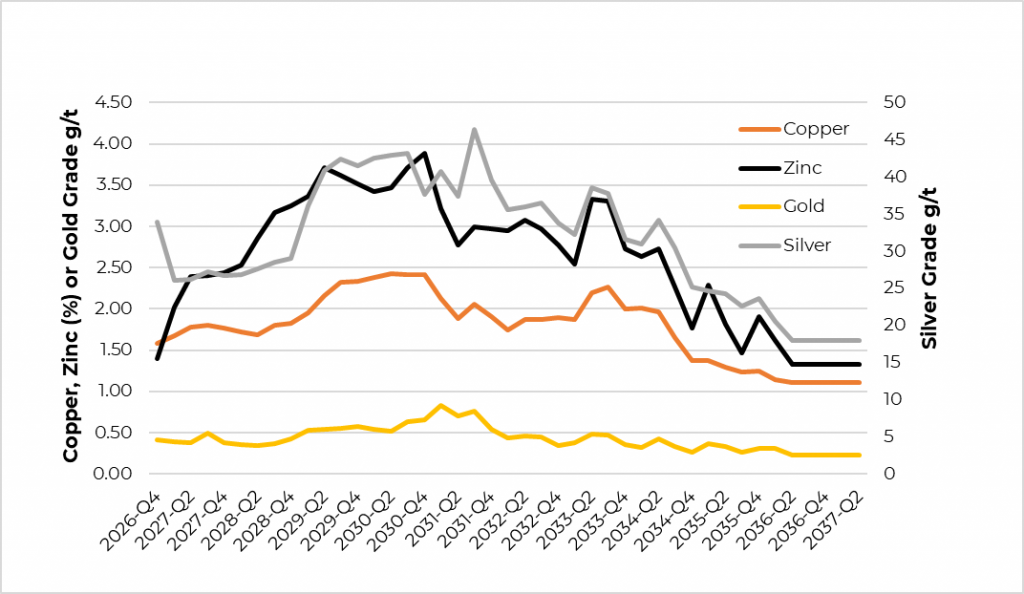

Production from the Esso deposit is expected to commence in Year 2 and ramp up to full production in the following year. Total projected ore production from Esso is 2.2 Mt at a steady state average rate of 0.3 Mtpa or 860 tpd. At these production rates, mine life for Esso is estimated at nine years. As reflected in Table 3, Esso ore contains higher average grades of copper and zinc than the Main deposit. Consequently, even at the higher cost of underground mining, ore production from Esso would be scheduled as early as possible.

The mine schedule is expected to allow for the stockpiling of low grade ore from the open pit throughout operations, allowing higher grades to be processed earlier. The lower grade stockpiles would be processed in the final years of mine life (commencing in Year 8, but primarily from Year 9 through Year 11).

Table 4: Kutcho Project – Open Pit and Underground Mining Statistics (Incl Pre-Production) is available at

https://www.globenewswire.com/NewsRoom/AttachmentNg/bc09b8f9-cda1-4ae1-a191-20dcadd1784b

Note:

1. Includes 1.25 years for pre-production and stockpile rehandle periods

2. Mining operational costs and tonnages are inclusive of the pre-production period.

Metallurgy & Processing

The process flowsheet is based on both historical test work and more recent test work carried out under the direction of Kutcho Copper between 2018 and 2021. The ore grade profile reflects the processing of high grade ore when available, and stockpiling of low grade ore for processing in the later years of mine life.

Figure 4: Kutcho Project – Flotation Feed Grades

After crushing, ore >12.5 mm would report to an XRT (X-ray transmission) ore sorting circuit. Ore sorting is based essentially on density and an estimated 15% of the ore reporting to the ore sorter would be rejected, with an overall 12.5% reduction of feed to the milling and flotation circuit. Ore sorter rejects would be used for the underground cemented rock fill. Ore would report to the SAG and ball mill for primary sizing to a P80 of 55µm. Metal recovery is based on the sequential flotation of copper minerals, followed by flotation of zinc minerals. The flotation process uses sulphur dioxide-based reagents for the initial depression of zinc and pyrite in the copper flotation circuit, followed by the re-activation of zinc for the zinc flotation stage using specific collector and frother reagents. The copper rougher concentrate is reground (P80 of 15µm) and upgraded in one cleaner stage to produce a final copper concentrate. The zinc rougher concentrate is reground (P80 of 20µm) and upgraded in three cleaner stages to produce a final zinc concentrate. The flotation tailings would be dewatered, after which they would be pumped to the TMF for storage.

The copper and zinc concentrate grades are anticipated to vary based on the proportion of Main and Esso deposit material being mined, blended, and processed. Respective mass pulls are estimated to be 6.2% and 3.6% (dry tonnage). Gold and silver are contained in both the copper and zinc concentrates. The concentrates would be dewatered by thickening and filtration to reduce the moisture content to about 9%. Concentrates would be loaded separately onto trucks, sampled, and despatched to Stewart, BC, a distance of 510 km, for onward shipping to international smelters and refiners.

Table 5: Kutcho Project – Processing and Concentrate Production is available at

https://www.globenewswire.com/NewsRoom/AttachmentNg/2ad16985-7c54-43ba-8f19-a84e72259fc2

Notes:

-

10.75 years after pre-production, plus 0.25 years in pre-production start-up.

2. 0.25 years for pre-production and 2.75 for stockpile rehandle periods.

3. Metal recovery to concentrates compared to crusher head feed, and includes the effects of metal loss due to the ore sorter and the flotation process.

4. Payable metals include losses due to due to transportation (0.25%) and smelter terms for the respective concentrates. Timing delays due to transport and handling, concentrate allotments, and inventory build-ups are also provided for.

Infrastructure

Proposed infrastructure for the Project includes on-site and off-site facilities. Off-site facilities include access road improvements. On-site facilities include:

- Process plant including comminution, XRT ore sorting, flotation and concentrate handling facilities

- Tailings management facility, which is also designed to store contact water

- Water management system including contact water treatment, stormwater management, water supply, and sediment control

- Power supply by four 2.5 MW LNG generators, plus one in standby and one 2 MW diesel generator to assist with start-up torque demands

- Ancillary services and facilities

- Offices and workforce accommodation

- Truck and maintenance shop, warehouses, and

- Diesel, propane and LNG storage facilities, and explosives magazine

Tailings and Water Management

The tailings management facility would consist of a rockfill embankment built using the downstream method. The construction material would be nPAG waste rock sourced from the open pit. The TMF would be a fully lined impoundment utilizing a composite liner system and appropriate water management features. The facility is designed to contain tailings solids and an annual storage capacity of contact water.

The water management system would divert non-contact water around the proposed mine facilities. Contact water would be collected for operational re-use or treated in a water treatment plant before discharge to the environment.

Labour

The mine is expected to operate on two 12-hour shifts, 365 days per year, with four mining and maintenance crews. Only two crews would be on duty at any time; one on dayshift, the other on night shift, while the other two crews are offsite on break. The majority of personnel would work a two-weeks-on, two-weeks-off (2×2) fly-in/fly-out shift rotation. Some administration personnel would be based in Whitehorse.

During construction, an average of 550 contractors and Kutcho personnel would be employed, with about 270 being on site at any one time. The total workforce during the operational period is expected to be between 350 and 400, reducing to between 200 and 250 when mining ceases and low-grade ore is rehandled to the plant. The workforce is expected to be accommodated on site in the proposed camp.

Capital Cost Estimate

The Feasibility Study outlines an initial (pre-production) capital cost estimate of C$483M, including an average contingency of 10.6%. Sustaining capital costs (undiscounted, including contingency) over the life of the mine are estimated at C$90M.

Initial open pit mining capital costs cover site development for the pits, haul roads and stockpiles, and mining to provide construction material and expose ore for processing. Initial underground capital costs include the construction of the underground portal, development to access the Main and Esso deposits, and other infrastructure. The mobile mining fleets would be leased from the equipment suppliers. The initial deposits on leased equipment (typically 25%) are reflected as a capital cost, with the remainder paid off over several years and treated as a mining operating cost.

The TMF embankment material is supplied from the open pit nPAG waste material, with Phase 1 construction captured as a pre-production mining capital cost, and subsequent construction phases as a mining cost. The LNG power generating sets would be leased on the same basis as mobile mining equipment, with repayments reflected as part of the power cost applied to the various operations.

Initial, sustaining and closure capital costs were estimated based on Q2/3-2021, unescalated Canadian dollars and are summarized in the table below. Vendor quotes were obtained for all major equipment. Some of the costs were developed from first principles, while some were estimated based on factored references and experience from similar projects.

A mine closure bond, lodged at the commencement of construction activities and thereafter linked to progressive site disturbance and post-closure management, is allowed for. Physical closure, rehabilitation, and post-closure management costs are estimated at $34M. A salvage value for equipment is applied at the end of mine life.

Table 6: Kutcho Project – Capital Cost Summary(1,2) is available at

https://www.globenewswire.com/NewsRoom/AttachmentNg/08a772e8-5f25-40ec-82ed-e46d92fbec47

Notes:

-

All values stated are undiscounted.

2. No inflation or depreciation of costs were applied; all costs are in 2021 money values. Major underground mobile equipment, all open pit mobile equipment and the power gensets are leased.

3. Includes average contingency of 10.6%.

4. Includes contingency of 15%.

Operating Costs

Operating cost estimates were developed from vendor quotes and first principles based on Q2/3-2021 un-escalated Canadian dollars.

Table 7: Kutcho Project – Operating Cost Summary (Excluding Pre-Production(1)) is available at

https://www.globenewswire.com/NewsRoom/AttachmentNg/45c2348a-b30c-40b0-9234-c379782df694

Notes:

-

Pre-production tonnages and costs are not included in the Life-of-Mine operating cost summary (these are Years -2 and -1 and are capitalized).

2. Year 1 includes pro-rated adjustments for working capital

3. No ore mined, rehandle period

Operating costs include the rehandling of waste material to backfill the pit during mining and the processing of the low-grade ore at the end of the mine life.

Over the life of the mine, the average operating cost is estimated at C$65.89 per tonne of ore crushed.

Table 8: Kutcho Project – Cash Costs and All-In Sustaining Costs is available at

https://www.globenewswire.com/NewsRoom/AttachmentNg/44c8854f-1427-4cda-9c1a-52fa8084d3e9

Notes:

-

Cash or operating costs are operating expenses for mining, plant operations and administration to the point of production of the concentrate at the Kutcho site. It excludes off-site concentrate costs, sustaining capital, closure/rehabilitation and royalties. CuEq calculation assumes metal base prices.

2. All-in sustaining costs includes all cash costs, sustaining capital expenses to support on-going operations (such as TMF construction, major plant equipment replacement and repair), concentrate charges, and royalties. It includes closure and rehabilitation costs.

The average cash cost over the life of the mine is C$1.11 /lb CuEq and the average all-in sustaining cost (AISC) is C$1.80 /lb CuEq.

Concentrate Selling Costs

Table 9: Kutcho Project – Concentrate Selling Costs is available at

https://www.globenewswire.com/NewsRoom/AttachmentNg/30d11112-7d22-45ad-9c0b-16a4e2212906

Royalties

A 2% NSR royalty held by Royal Gold Inc. over certain portions of the Project has been applied to the cash flow model for a total of C$26M (undiscounted).

Taxes

Tax considerations included in the cash flow are:

- BC Mineral Tax 13%

- BC Income tax 12%

- Federal Tax 15%

Investment and new mine allowances have been applied against the BC Mineral Tax. A 2% provincial minimum tax payable on net current proceeds, which is credited against the Mineral Tax, is calculated based on operating profit less applicable capital cost deductions. The mining tax is deductible in computing provincial and federal income tax. Canadian Development Expenses and Canadian Exploration Expenses have been applied to the tax model. Total taxes payable over the life of the Project (undiscounted) are estimated at C$422M after allowing for tax credits of C$30M accumulated by Kutcho Copper to date.

Economic Analysis

The economic analysis undertaken for this Feasibility Study assumes that a copper and a zinc concentrate would be produced. The copper concentrate would obtain value mainly from copper, but also from contained silver and gold. The zinc concentrate would primarily obtain value from zinc, but also gold and sometimes silver. Kutcho Copper intends to sell the concentrates to either traders or refineries and would not directly produce metals. Appropriate deductions for treatment, refining, transport and insurance costs are applied as summarized in Table 9. Penalties for impurities and deleterious elements have been applied to the copper and zinc concentrates as noted in Table 9. The analysis assumes that the Project is 100% equity financed.

The Base Case metal prices and exchange rate used in the economic evaluation of the Project are:

|

US$3.50/lb ($7,716/t) | |

|

US$1.15/lb ($2,525/t) | |

|

US$20.00/oz | |

|

US$1,600/oz | |

|

0.76:1 (US$:C$) |

There is no guarantee that any of the metal prices used in the base case or sensitivities cases are representative of future metals prices. The results of the pre- and after-tax economic analyses are provided in Table 10.

The contribution to the Project economics by metal type is approximately 65% from copper, 23% from zinc, 6% from silver and 6% from gold.

Table 10: Kutcho Project – Summary of Economic Valuation is available at

https://www.globenewswire.com/NewsRoom/AttachmentNg/7f3727bd-6594-498c-ba59-e9abd1374646

Notes:

- Covers production years 1-11 only, pre-production and Year 12 are excluded.

Table 11: Kutcho Project – Cash Flow Summary is available at

https://www.globenewswire.com/NewsRoom/AttachmentNg/c20e0f51-0479-44bb-bddf-cad0d4d47634

Precious Metals Purchase Agreement

Kutcho Copper entered into a Precious Metal Purchase Agreement with Wheaton Precious Metals Corp. on 14 December 2017. The terms of this agreement are not included in the Feasibility Study as it only comes into effect should Wheaton elect to participate after the completion of the Feasibility Study. Should Wheaton elect to participate, certain revenue parameters will change. Full details of the Wheaton Precious Metal Purchase Agreement will be stated in the Feasibility Study Technical Report which will be released within 45 days of the publication of this News Release.

Environmental Studies and Permitting

Kutcho Copper does not anticipate that the Project will trigger a federal impact assessment under the federal Impact Assessment Act (S.C. 2019, c. 28, s. 1). The Project is already in the BC assessment process and will require the preparation of an application to the BC Environmental Assessment Office (BCEAO) for an environmental assessment certificate under the BC Environmental Assessment Act. Due to Feasibility Study mine design changes, an amended Project Description will be submitted to BCEAO.

Since acquiring the Kutcho project from Capstone Mining in 2017, Kutcho Copper has undertaken baseline studies that have continued to date. In 2021, Kutcho Copper embarked on an extensive program to complete baseline studies for the Environmental Assessment (EA) in addition to environmental studies to support the Feasibility Study. These studies represent a substantial dataset collected over a long period of time and will support solid decision-making for the EA process. Kutcho Copper intends to run a separate and parallel process for the EA process and permitting.

Based on initial discussions between Kutcho Copper, Tahltan Nation and Kaska Dena Nation, the BCEAO has indicated that the access road could be removed from the EA process.

Closure and reclamation activities will be carried out concurrent with mine operations wherever possible and consistent with an approved Reclamation and Closure Plan developed in consultation with First Nations and regulators.

Qualified Persons

Robert Sim, P.Geo., a Qualified Person as defined by NI 43-101, is responsible for the estimate of mineral resources presented in this news release and has reviewed, verified and approved the contents of this news release as they relate to the mineral resource estimate, including the sampling, analytical, and test data underlying the mineral resource estimate. Mr. Sim is a consultant to the Company, independent from Kutcho Copper and confirms there were no limitations from the Company in verifying the drilling and sample data with site visit observations and monitoring of the QA/QC program.

Andrew Sharp, P.Eng., (CSA Global), Paul Heaney (CSA Global), Shervin Teymouri, P.Eng. (Mineit), Andre de Ruijter P.Eng. (Mineit), James Garner P.Eng. (Tahltan Allnorth), Kelly McCleod, P.Eng. (Tahltan Allnorth), Brent Hilscher, P.Eng. (ABH Engineering), are Qualified Persons as defined by NI 43-101. They were involved in the preparation of the Feasibility Study and they have reviewed, verified and approved the technical and scientific contents of this news release. The aforementioned are consultants to the Company and independent from Kutcho Copper.

Mr. Garth Kirkham, P.Geo., Technical Advisor for Kutcho Copper Corp., who serves as a Qualified Person under the definition of NI 43-101, has reviewed and approved the technical and scientific information in this news release.

Technical Disclosure

Data verification programs have included review of QA/QC data, re-sampling and sample analysis programs, and database verification. Validation checks were performed on data, and comprise checks on surveys, collar co-ordinates and assay data. In the opinion of CSA, sufficient verification checks were undertaken on the database to provide confidence that the database is virtually error free and appropriate to support Mineral Resource and Reserve estimation.

For readers to fully understand the information in this News Release, they should read the Technical Report (to be available on www.SEDAR.com within 45 days of November 8, 2021) in its entirety, including all qualifications, assumptions and exclusions that relate to the information set out in this news release that qualifies the technical information contained in the Technical Report. The Technical Report is intended to be read as a whole, and sections should not be read or relied upon out of context. The technical information in this News Release is subject to the assumptions and qualifications contained in the Technical Report.

About Kutcho Copper Corp.

Kutcho Copper Corp. is a Canadian resource development company focused on expanding and developing the Kutcho high grade copper-zinc project in northern British Columbia. Committed to social responsibility and the highest environmental standards, the Company intends to progress the Kutcho project through the Feasibility Study and permitting to a positive construction decision.

About CSA Global Consultants Canada Inc.

CSA Global is an ERM Group Company that has been providing services to clients across all mineral commodities and regions globally for over 35 years. The team of geologists, engineers, mining consultants and data specialists are some of the most experienced and sought-after professionals across the mining industry. The ERM Group provides further depth through a diverse team of world-class experts that supports clients across the breadth of their organizations to operationalise sustainability, underpinned by a deep technical expertise in addressing their environmental, health, safety, risk and social issues.

MORE or "UNCATEGORIZED"

Delta Reports New Gold Intercept at Nova Target in Wedge Area, 4 Kilometres West of Eureka; Follow-Up Drill Program Underway

Delta Reports New Gold Intercept at Nova Target in Wedge Area, 4 ... READ MORE

Silver One Announces Closing Of Final Tranche Of $32 Million Financing

Silver One Resources Inc. (TSX-V: SVE) (OTCQX: SLVRF) (FSE: BRK1)... READ MORE

SAGA Metals Achieves 100% Drilling Success in 2025—Reports Final Assays from Trapper South at Radar Critical Minerals Project in Labrador

Exceptional grades of Titanium, Vanadium and Iron in all 15 drill... READ MORE

Near Surface Intersection Yields 6.58 g/t gold over 10.35 metres

Intersection is within 33 metres from surface and contained in a ... READ MORE

Alamos Gold Provides Three-Year Operating Guidance Outlining 46% Production Growth by 2028 at Significantly Lower Costs

Further production growth to one million ounces annually expected... READ MORE