Kingsmen Intersects 1,742 g/t Silver Equivalent over 0.7 Meters (190.85 – 191.55 m) in Its First Drill Program at Its Las Coloradas Silver Project, Chihuahua, Mexico

Kingsmen Resources Ltd. (TSX-V: KNG) (OTCQB: KNGRF) (FSE: TUY) is pleased to report first assays from hole LC-25-010 that intersected significant mineralization. The hole was drilled as part of the recently completed 12 hole – 3,227.2 meter drill program on its 100% owned Las Coloradas silver project. The Las Coloradas project is in the Parral mining district of the Central Mexican Silver Belt, Chihuahua, Mexico.

Four Key Highlights:

- HIGH GRADE SILVER DISCOVERY

*1,028 g/t silver equivalent over 1.45 meters (455 g/t silver) from 190.25-191.70m.

including 1,742 g/t silver equivalent over 0.70 meters (770 g/t silver) from 190.85-191.55m.

*See Tables 1 and 2 for zinc, lead and gold grades used in the silver equivalent calculation.

- WIDE MINERALIZED ZONE

*138 g/t silver equivalent over 13.35 meters (64.3 g/t silver) from 178.35-191.70m.

*Drilled previously untested areas below historic ASARCO mining 1943-1952 - SHALLOW, NEAR-SURFACE MINERALIZATION

Intercept from only 125 Meters Depth

*Multiple mineralization styles including massive sulphides

*Strong pathfinder elements (antimony, indium, bismuth) indicate larger system - SIGNIFICANT DISCOVERY POTENTIAL

Less than 5% of property explored

*8.5 km2 consolidated historic mining district

*Multiple untested structures and veins

*Located in Mexico’s prolific Parral Silver District

President, Scott Emerson, commented, “Our first hole confirms our thesis to drill below historic mining areas and has demonstrated the two essential elements of both grade and scale. Since the Company’s inception, our approach has been laser-focused on creating sustainable value for our stakeholders. Hole LC-25-010 delivered high-grade, shallow silver mineralization in the Mine zone of the Soledad structure demonstrating the potential for the discovery of additional high-grade mineralization in this area.

The Company is awaiting assays from eleven additional holes and targets that have been drilled as part of this initial drill program. With its growing understanding of the geochemistry and controls on mineralization, and less than 5% of the project area covered with comprehensive exploration work, the property remains under explored. Kingsmen has only just begun to unlock the true potential of this high-grade silver system.”

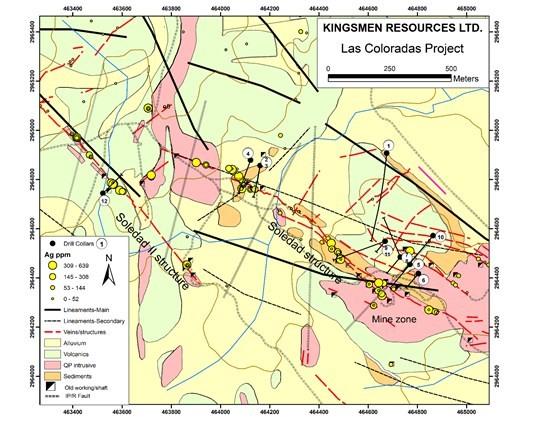

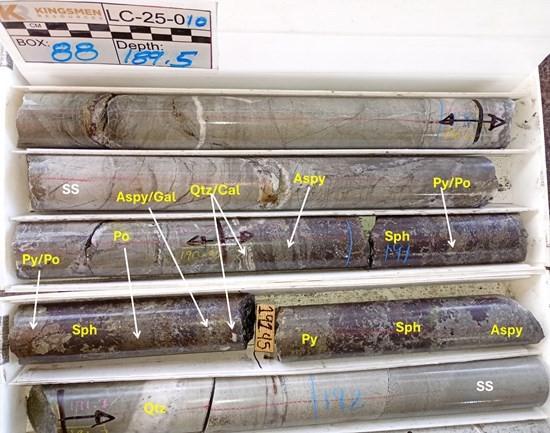

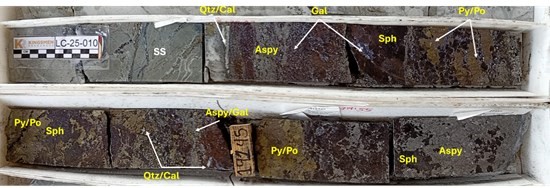

Hole LC-25-010 (Figure 1; Table 1; Table 2; Table 3) was drilled on the Soledad structure to test for depth extensions to the mineralization mined by ASARCO in the period 1943-1952. The hole intersected an alteration zone with massive sulphide mineralization from 178.35 to 191.70 meters (13.35 meters) downhole. The silver rich massive sulphide mineralization (190.85 to 191.55 meters) comprises sphalerite, galena, arsenopyrite, pyrrhotite, and pyrite (Figure 2). The mineralization is strongly anomalous in pathfinder elements antimony, bismuth, indium and arsenic. The values for bismuth, antimony and indium are very anomalous and underscore the value of these elements as pathfinders that map the alteration zone that contains the high grade mineralization (Table 1). Significant gold of 0.60 g/t is associated with an arsenopyrite rich zone indicating the potential for the development of this type of mineralization. The high-grade silver values are comparable to the reported historical grades that ASARCO mined confirming the drilling is testing an extension to the historic mineralization.

Alteration starts at approximately 178.0 meters with a weakly mineralized zone from 180.25 to 182.0 meters with elevated silver values (Figure 2 and Figure 3). This zone, which contains elevated pathfinder elements arsenic, antimony, bismuth and indium, may be along strike or down-dip of stronger mineralization. The alteration comprises chlorite-calcite-clays with variable silicification and pyritization with variable low to anomalous values of arsenic, bismuth, indium and antimony. Of note is the discovery of the critical metal indium in the massive sulphide intersection. Further work is required to determine the significance of this discovery.

Mineralization occurs as massive sulfides composed primarily of sphalerite/blende (?), pyrrhotite, arsenopyrite, pyrite, and galena, accompanied by massive white quartz and a smaller proportion of calcite. The host rock is a sedimentary sequence composed of fine- to medium-grained quartzo-feldspathic sandstone and interbedded thin layers of shale/siltstone. This sequence exhibits moderate to pervasive silicification superimposed on chloritic alteration (?), which permeates from layer contacts and in cracks and fractures. Microfaulting, incipient layer elongation, and ductile deformation are evident in the shale/siltstone layers. Multiple cracking and fracture systems and veinlets with different orientations and compositions, which sometimes overlap, are present indicating shear stresses and different mineralization events. Petrographic studies are underway to type the alteration and relative ages of the mineralization.

Table 1 Analyses

| Hole | From | To | Width (m) | Au ppm | Ag ppm | As ppm | Bi ppm | In ppm | Pb ppm | Sb ppm | Zn ppm |

| LC-25-010 | 178.35 | 179.25 | 0.90 | 0 | 1.12 | 351 | 8.68 | 0.10 | 39.5 | 10.05 | 448 |

| LC-25-010 | 179.25 | 180.25 | 1.00 | 0.006 | 0.78 | 232 | 2.55 | 0.51 | 39.4 | 12.15 | 148 |

| LC-25-010 | 180.25 | 180.75 | 0.50 | 0.013 | 16.00 | 5710 | 215.00 | 0.35 | 377 | 26.40 | 1375 |

| LC-25-010 | 180.75 | 181.40 | 0.65 | 0 | 7.20 | 1185 | 41.10 | 0.89 | 163 | 6.82 | 3290 |

| LC-25-010 | 181.40 | 181.70 | 0.30 | 0 | 2.25 | 446 | 2.80 | 0.08 | 92.5 | 12.05 | 86 |

| LC-25-010 | 181.70 | 182.00 | 0.30 | 0.033 | 19.80 | >10000 | 6.86 | 5.29 | 4660 | 23.90 | 5520 |

| LC-25-010 | 182.00 | 182.40 | 0.40 | 0 | 0.73 | 81.7 | 1.65 | 0.06 | 40.8 | 3.89 | 83 |

| LC-25-010 | 182.40 | 183.40 | 1.00 | 0 | 0.93 | 98 | 3.90 | 0.09 | 56.9 | 2.75 | 174 |

| LC-25-010 | 183.40 | 184.20 | 0.80 | 0 | 0.45 | 59.3 | 0.92 | 0.05 | 27.5 | 3.89 | 91 |

| LC-25-010 | 184.20 | 184.70 | 0.50 | 0 | 1.07 | 22.5 | 3.20 | 0.06 | 41.4 | 1.87 | 122 |

| LC-25-010 | 184.70 | 185.40 | 0.70 | 0 | 0.63 | 28.1 | 2.28 | 0.11 | 21.2 | 1.72 | 296 |

| LC-25-010 | 185.40 | 186.00 | 0.60 | 0 | 11.90 | 335 | 29.10 | 0.81 | 483 | 4.85 | 2210 |

| LC-25-010 | 186.00 | 186.40 | 0.40 | 0 | 2.81 | 188.5 | 6.85 | 0.77 | 134 | 8.77 | 1755 |

| LC-25-010 | 186.40 | 186.90 | 0.50 | 0 | 6.05 | 393 | 5.87 | 0.73 | 1250 | 15.50 | 782 |

| LC-25-010 | 186.90 | 187.20 | 0.30 | 0.005 | 51.70 | 2060 | 22.40 | 6.28 | 8510 | 50.70 | 7870 |

| LC-25-010 | 187.20 | 187.55 | 0.35 | 0 | 5.43 | 1190 | 9.58 | 0.71 | 380 | 5.29 | 1105 |

| LC-25-010 | 187.55 | 188.30 | 0.75 | 0.091 | 238.00 | >10000 | 207.00 | 12.10 | 36100 | 466.00 | 18700 |

| LC-25-010 | 188.30 | 189.30 | 1.00 | 0 | 2.79 | 327 | 6.54 | 0.15 | 352 | 8.08 | 236 |

| LC-25-010 | 189.30 | 190.05 | 0.75 | 0 | 4.62 | 839 | 6.01 | 3.37 | 241 | 15.60 | 12350 |

| LC-25-010 | 190.05 | 190.25 | 0.20 | 0.027 | 13.65 | >10000 | 18.05 | 5.00 | 1425 | 29.20 | 13550 |

| LC-25-010 | 190.25 | 190.85 | 0.60 | 0.037 | 100.00 | >10000 | 46.70 | 5.29 | 16150 | 103.50 | 8360 |

| LC-25-010 | 190.85 | 191.55 | 0.70 | 0.297 | 770.00 | >10000 | 630.00 | 145.50 | 126500 | 679.00 | 215000 |

| LC-25-010 | 191.55 | 191.70 | 0.15 | 0.601 | 170.00 | >10000 | 410.00 | 50.40 | 8150 | 519.00 | 144500 |

| LC-25-010 | 191.70 | 192.70 | 1.00 | 0 | 2.93 | 1375 | 5.37 | 0.31 | 284 | 20.10 | 686 |

| LC-25-010 | 192.70 | 193.70 | 1.00 | 0 | 3.22 | 313 | 3.51 | 0.45 | 431 | 8.71 | 684 |

| LC-25-010 | 193.70 | 194.70 | 1.00 | 0 | 2.00 | 629 | 4.74 | 0.26 | 88.5 | 8.79 | 766 |

True width cannot be determined at this time and reported widths are drilled intervals.

Table 2 Silver equivalents

| Hole | From | To | Width (m) | Ag Eq ppm | Ag ppm | Au ppm | Pb % | Zn % | |

| LC-25-010 | 178.35 | 191.70 | 13.35 | 138.0 | 64.3 | 1.0 | 1.6 | ||

| incl | 180.25 | 182.00 | 1.75 | 21.0 | 11.0 | 0.1 | 0.2 | ||

| and | 186.90 | 191.70 | 4.80 | 369.0 | 171.0 | 2.7 | 4.3 | ||

| incl | 190.25 | 191.70 | 1.45 | 1,028.0 | 455.0 | 0.2 | 7.3 | 13.0 | |

| and | 190.85 | 191.55 | 0.70 | 1,742.0 | 770.0 | 0.3 | 12.6 | 21.5 |

The silver equivalent calculation formula is AgEq(g/t) = ((Ag grade (g/t) x (Ag price per ounce/31.10348) x Ag recovery) + (Pb grade (%) x (Pb price per tonne/100) x Pb recovery) + (Zn grade (%) x (Zn price per tonne/100) x Zn recovery) + (Au grade (g/t) x (Au price per ounce/31.10348) x Au recovery)) / (Ag price per ounce/31.10348 x Ag recovery). The prices used were US$3675/oz gold, US$2960/t zinc, US$2003/t lead and US$42/oz silver. Recoveries are estimated at 40% for gold, 91% for lead, 85% for zinc and 92% for silver based on published figures by Kootenay Silver Inc. for sulphide mineralization in the Cigarra deposit, Chihuahua, Mexico, a deposit with similar style mineralization (https://kootenaysilver.com/news/kootenay/2024/kootenay-silver-announces-updated-mineral-resource-estimate-for-la-cigarra-project-chihuahua-mexico).

Table 3 Collar and survey table

| Hole_ID | Easting | Northing | Elevation | Az | Dip | EOH |

| LC-25-001 | 464675 | 2964907 | 1630 | 185 | -50 | 594.00 |

| LC-25-002 | 464161 | 2964857 | 1634 | 190 | -50 | 201.00 |

| LC-25-003 | 464161 | 2964857 | 1634 | 190 | -70 | 200.35 |

| LC-25-004 | 464122 | 2964879 | 1634 | 200 | -45 | 203.45 |

| LC-25-005 | 464770 | 2964455 | 1661 | 220 | -60 | 248.45 |

| LC-25-006 | 464804 | 2964418 | 1660 | 220 | -60 | 152.85 |

| LC-25-007 | 464731 | 2964485 | 1662 | 220 | -60 | 167.60 |

| LC-25-008 | 464731 | 2964485 | 1660 | 337 | -70 | 506.80 |

| LC-25-009 | 464669 | 2964549 | 1660 | 220 | -75 | 215.65 |

| LC-25-010 | 464864 | 2964572 | 1651 | 220 | -45 | 269.45 |

| LC-25-011 | 464669 | 2964549 | 1660 | 250 | -45 | 315.80 |

| LC-25-012 | 463522 | 2964744 | 1640 | 45 | -45 | 151.80 |

Figure 1

Figure 2 Mineralization

Figure 3 Mineralization (part) – split core

Holes 5, 6, 7 and 10 tested a 100-meter length of the Soledad system centered on the Soledad shaft. Holes 9 and 11 tested the structure in the area of the Rosario shaft. Holes 2,3 and 4 tested a 50-meter segment of the Soledad structure/vein system in the DBD target. Hole 12 tested under old workings on the Soledad II structure/vein system. Holes1 and 8 tested a geological/geophysical target. The target was the intersection of NW-trending and NE-trending structures/vein systems, in an area of high chargeability and resistivity on an interpreted NW-trending magnetic structure.

QAQC

The drill core (HQ size) is currently being geologically logged and sampled. The full drill core is sawn with a diamond blade rock saw. One half of the sawn drill core is bagged and tagged for analysis. The remaining half portion is returned to the drill core tray and stored. Bagged samples are securely stored prior to submission for analysis. Samples are being submitted to ALS Geochemistry-Chihuahua for multielement analysis following four-acid digestion (code ME-MS61), and gold by fire assay-AA (code Au-AA23). Quality assurance and quality control (QA/QC) is maintained by the systematic insertion of certified standard reference materials (CSRM), blanks and duplicates into the sample stream. Assay results will be announced following receipt, compilation and confirmation. ALS Geochemistry operates under a Global Geochemistry Quality Manual that complies with ISO/IEC 17025:2017.

About Las Coloradas

The Las Coloradas Project (8.5 km2 -3.3 sq miles) represents a consolidation of a historic mining district which covers numerous silver-gold-lead-zinc-copper mines previously exploited by ASARCO (American Smelting and Refining Company), the U.S. based subsidiary of Grupo Mexico.

Las Coloradas is in the Parral mining district of the Central Mexican Silver Belt, and is located approximately 30 kilometers southeast of the city of Hidalgo de Parral and 40 kilometers east of the San Francisco de Oro and Santa Barbara mining districts where several old major mines are located, such as La Prieta, Veta Colorada, Palmilla, Esmeralda, San Francisco del Oro and Santa Barbara. Click here to see locator map: https://www.kingsmenresources.com/area-history.

Qualified Person

Kieran Downes, Ph.D., P.Geo., a director of Kingsmen and Qualified Person as defined by National Instrument 43-101, has reviewed and approved the scientific and technical disclosure set out in this news release.

About Kingsmen Resources

Kingsmen Resources is a mineral exploration company focused on advancing its 100% held projects, the Las Coloradas silver/gold project and Almoloya gold/silver project located in the prolific mining district of Parral Mexico. The projects host historic past producing high-grade silver mines. They are considered to be prospective for hosting further precious metal deposits, being on the same structural and stratigraphic belts that host numerous other, on-trend, high-grade deposits. In addition, the company has a 1% NSR on the La Trini claims which form part of the Los Ricos North project operated by GoGold Resources Inc. in Mexico. Kingsmen is a publicly-traded company and is headquartered in Vancouver, British Columbia.

MORE or "UNCATEGORIZED"

Eloro Resources Announces Closing of Bought Deal LIFE Private Placement for Gross Proceeds of C$17 Million

Eloro Resources Ltd. (TSX: ELO) (FSE: P2QM) is pleased to announce the closing of its previously an... READ MORE

Minera Alamos Updates Resources and Reserves for the Pan Gold Mine in Nevada

Minera Alamos Inc. (TSX-V: MAI) (OTCQX: MAIFF) is pleased to announce updated Mineral Resource and M... READ MORE

Ero Copper Reports Fourth Quarter and Full Year 2025 Operating and Financial Results

Ero Copper Corp. (TSX: ERO) (NYSE: ERO) is pleased to announce its operating and financial results f... READ MORE

Rare Element Resources Announces Results of Oversubscribed Rights Offering of Common Shares

Rare Element Resources Ltd. (OTCQB: REEMF) is pleased to report that its previously announced... READ MORE

TRX Gold Reports Record Q2 2026 Production and Company Update

TRX Gold Corporation (TSX: TRX) (NYSE American: TRX) is pleased to announce preliminary resu... READ MORE