Kiboko Drills 4.2 g/t Au Over 5 m at its Harricana Gold Project

- All assays from Phase 1 exploration program have been reported

- Maiden pit-constrained mineral resource targeted for Q3-2023

Kiboko Gold Inc. (TSX-V: KIB) reported results from the remaining 25 holes (4,846 metres) of its systematic 70-hole (11,269 m) Phase 1 verification exploration program at its Harricana Gold Project, located 55 kilometres north of Val-d’Or, Québec. These 25 holes were drilled at the Hooper-Bunkhouse and Lot 14 zones located west of the drilling at the Marcotte and Claverny zones within the Fontana area that were reported previously.

Select intervals include:

- 4.2 g/t Au over 5 m (DDFON23-015)

- including 19.2 g/t Au over 1 m

- 7.2 g/t Au over 0.85 m (DDFON23-014)

- 6.3 g/t Au over 1 m (DDFON22-012)

- 2.8 g/t Au over 2 m (DDFON22-034)

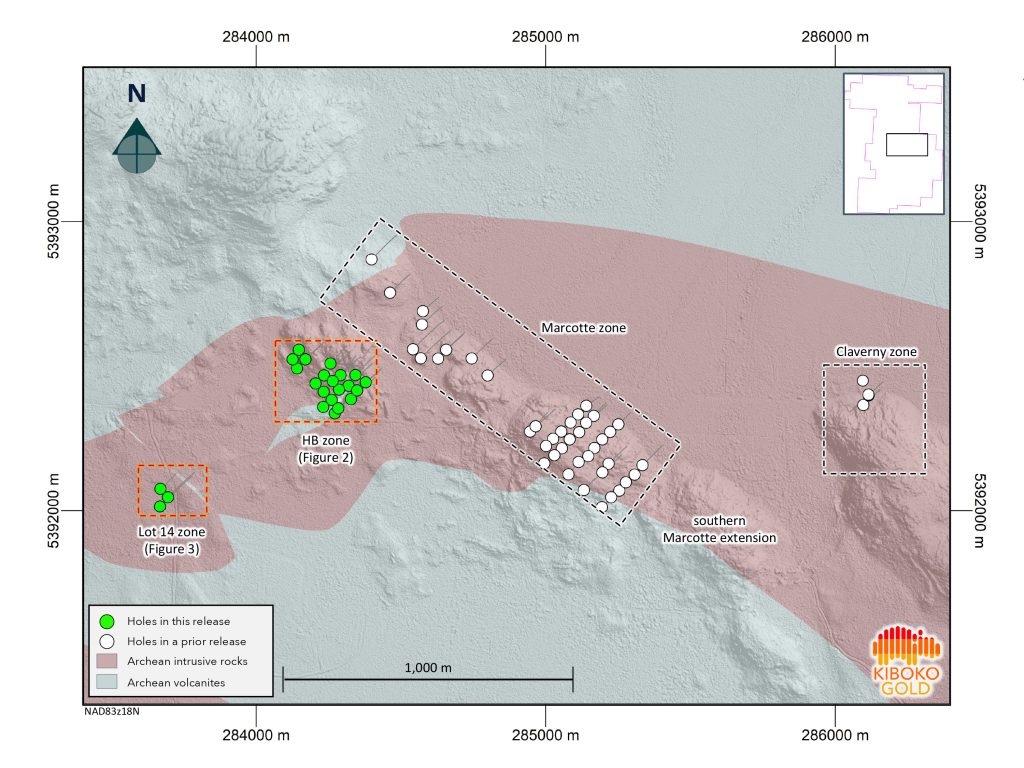

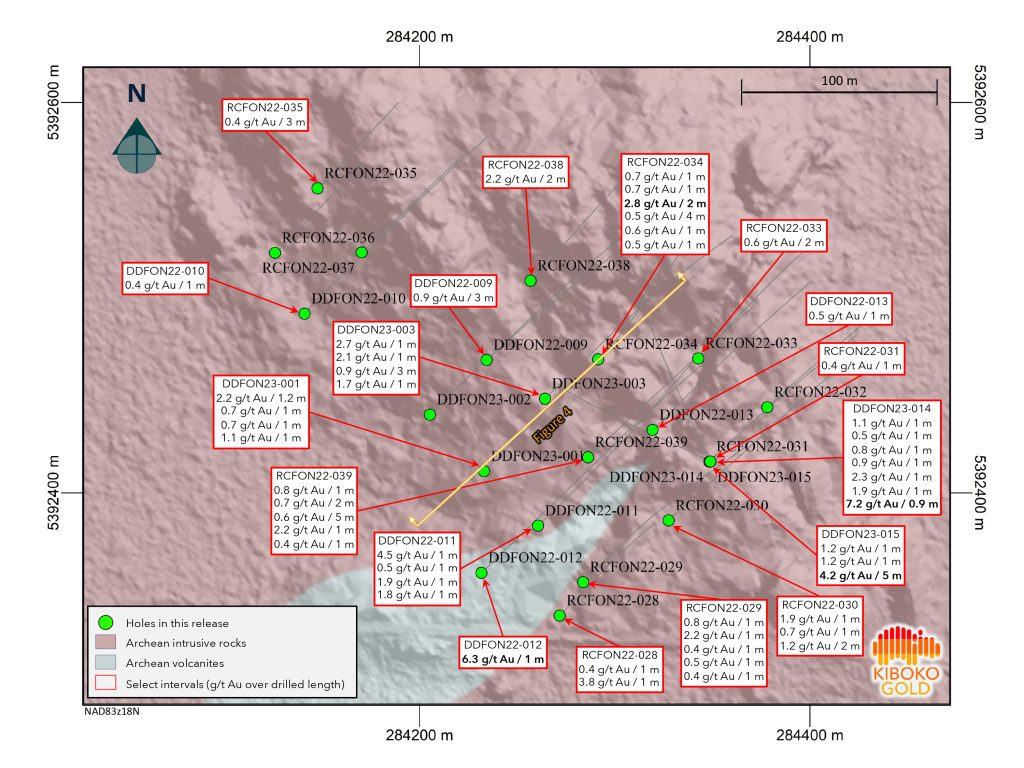

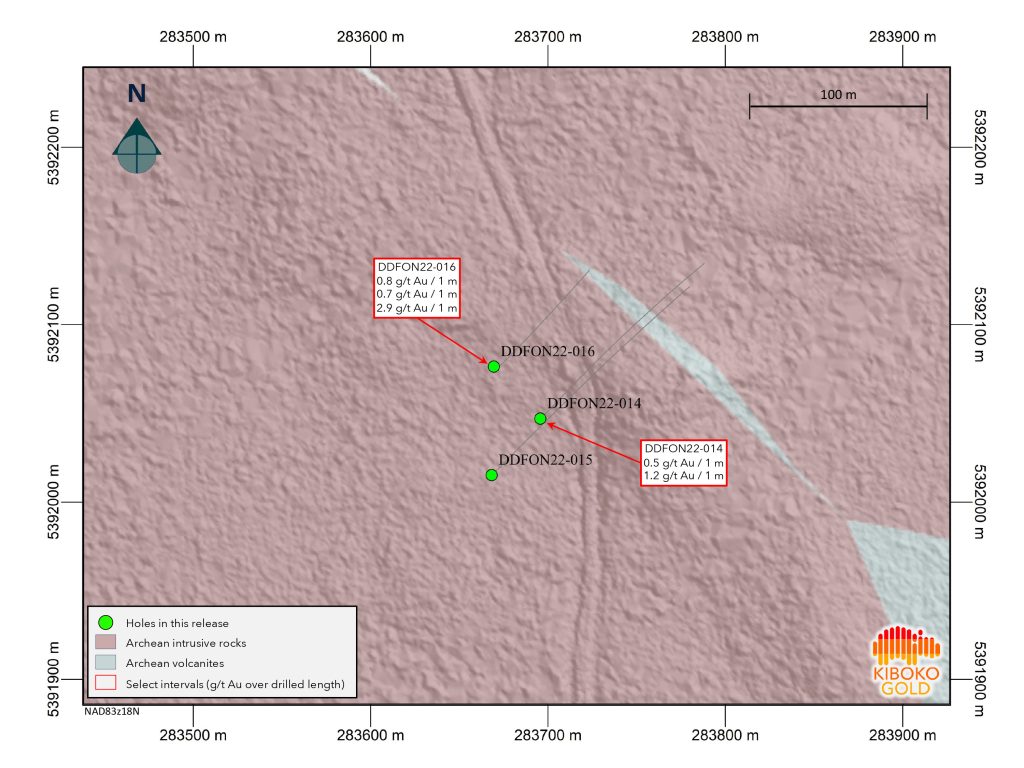

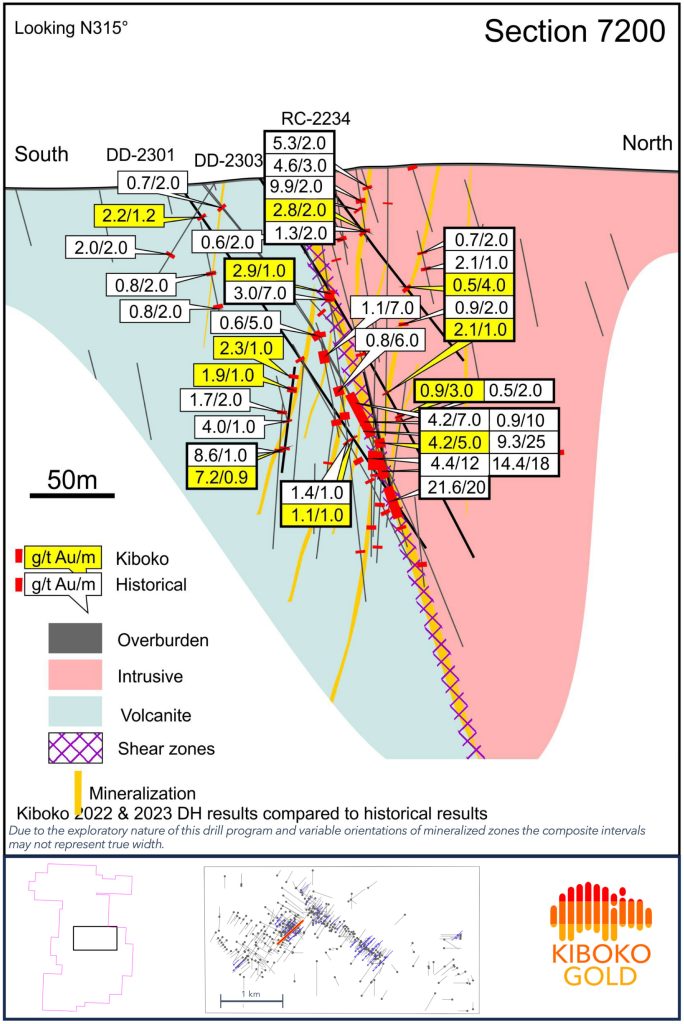

A summary of drilled intervals and drillhole locations are provided in Tables 1 and 2, respectively. Figures 1, 2, and 3 provide maps of Kiboko’s drillhole locations and assay results. Figure 4 is a simplified geological section of the HB zone.

Jeremy Link, President and Chief Executive Officer, stated, “Our drilling at Harricana continues to intersect significant intervals of mineralization, including visible gold. Drilling at Marcotte, Claverny, and Lot 14 has substantially verified historical results and we’re confident they can be relied upon for resource estimation. Although our drilling in the structurally complex Hooper-Bunkhouse zone intersected significant gold mineralization, including visible gold, it did not always replicate the historical intervals. This was not unexpected given the exploratory nature of our program and the anastomosing nature of the veins, veinlets, and shear zones. While the work is still underway, we expect to be able to rely upon much of the historical Hooper-Bunkhouse zone drilling for mineral resource estimation. With the maiden mineral resource targeted for this summer, our team continues to be excited about the potential of the Harricana Gold Project.”

Management’s Discussion

Harricana Gold Project – Fontana Area

Kiboko’s interpretation is that the Harricana Gold Project is a collection of parallel sub-vertical shear-hosted mineralized zones contained within a Riedel-type system.

At the Fontana area of the property, the mineralized zones are predominately located along major NW-SE (N135°) shears (the “Fontana Trend”) and along conjugate shears with limited thickness and extension. Accordingly, a planned drilling azimuth of N045° was utilized for the exploration program. This direction was expected to be perpendicular to the primary Fontana Trend (N135°) but also sufficiently oblique to other second and third-order mineralization for deposit evaluation.

Kiboko’s exploration drilling across the Fontana area encountered silicification, ankerite, or carbonate-alteration and chloritization, and variable amounts of disseminated sulphides, which are favourable indicators for gold mineralization. Kiboko’s drilling has also demonstrated that the alteration has a wider extension than the gold-bearing, shear-hosted quartz-carbonate veins.

Hooper-Bunkhouse Zone

In Kiboko’s Phase 1 program, 25 holes (4,846 m) were drilled at the HB and Lot 14 zones of the Fontana area of the Harricana Gold Project, which are identified in Figure 1. The results reported in today’s news release are related to these holes.

Within the HB Zone, the Company interpreted the presence of two significant trends related to gold mineralization, thereby adding structural complexity. In the Phase 1 program, the main Fontana Trend was expected to be the dominant control on gold mineralization within the HB zone, with a secondary conjugate trend striking N025° with limited extension (the “Bunkhouse Trend”).

While there is a large amount of historical drilling within the HB zone, it has a variety of structural features and vein orientations that make interpretation challenging without the structural data obtained in Kiboko’s Phase 1 program. Historical intercepts within the HB zone appeared to be dominated by intersections that were sub-parallel to the main Fontana Trend (N135°) with minor veins in the interpreted conjugate directions.

While Kiboko’s drilling within the HB zone intersected significant mineralization, including visible gold, it did not always reproduce the intervals seen in some of the historical results, but it also encountered unexpected mineralization. The discrepancy in results was not unexpected and is attributed to the nature of the mineralization and not due to geological discontinuity.

As a result, the Company’s current interpretation is that while the HB zone consistently intercepted the favourable alteration that typically surrounds gold mineralization at Fontana, and intercepted the Bunkhouse Trend’s shear zone, Kiboko did not encounter gold mineralization in the Bunkhouse Trend over the same widths as occasionally seen in the historical drilling. While this is disappointing, it was not unexpected, and is attributed to the HB zone’s structural complexity.

The Company completed several drillholes that targeted an area of the Bunkhouse zone where a prior operator had reported spectacular results, including:

- 9.3 g/t Au over 25 m (JB-200)

- 14.4 g/t Au over 18 m (JB-200B)

- 21.6 g/t Au over 20 m (JB-200B)

Using information gathered from holes drilled earlier in the Phase 1 program, the Company drilled two additional holes into the HB zone using different drill directions to target the Bunkhouse Trend (DDFON23-014 at N297° and DDFON23-015 at N334°). Both holes encountered visible gold, coincident with the location of high-grade mineralization within the Company’s exploration model and confirmed that the Bunkhouse Trend is host to higher-grade mineralization.

A comparison of select intervals from Kiboko’s and historical drilling are presented in Figure 4, as a simplified geological section. As a result, the Company has determined that both JB-200 and JB-200B were most likely drilled down a high-grade structure and confirmed the geological continuity of the mineralization in this trend. While the Company was not expecting to replicate JB-200 and JB-200B, the variability in gold grades in other nearby holes is consistent with historical data and is typical of moderate-grade environments containing both fine and coarse grains of native gold.

Lot 14

The Lot 14 Zone is located southwest of the Bunkhouse zone (see Figure 1). Mineralization within Lot 14 is primarily interpreted to be parallel with the main N135° mineralized trend, which was confirmed in the Phase 1 exploration program. Of the three holes drilled in this zone, DDFON22-014 and DDFON23-016 intercepted thin intervals of low to moderate grade mineralization. Results from the Lot 14 zone are summarized in Table 1.

Maiden pit-constrained mineral resource targeted for Q3-2023

The Company is targeting the reporting of a maiden mineral resource for a portion of the Fontana area in the third quarter of 2023. While this work is ongoing, there appears to be consistency between the historical drilling and the new drilling, and the Company’s exploration model.

Exploration intended to verify historical Fontana drilling and partially validate Exploration Targets

The Phase 1 program is intended to verify a significant portion of the 79,565 m of historical Fontana area drilling, characterize gold mineralization in the wall rock surrounding the main vein systems, and partially validate the Fontana area Exploration Targets.

The near-surface Exploration Targets for the Fontana area of the Project range from 13.6 million to 23.1 million tonnes at a range of grades of 3.0 to 3.4 g/t Au. The primary Exploration Targets for the Harricana Project are summarized in Table 3 at the end of this release. For further details regarding scientific or technical information relating to the Harricana Project, including the recommended exploration programs to validate the Exploration Targets, please refer to the technical report entitled, “Harricana Gold Project Technical Report, Duverny Township, Québec” with an effective date of April 1, 2022, and an issue date of May 2, 2022 (the “Harricana Technical Report”), which is filed under the Company’s SEDAR profile at www.sedar.com and on the Company’s website at www.kibokogold.com.

The Company cautions that while the Exploration Targets are based upon results from historical drilling, the potential quantity and grade of the Exploration Targets are conceptual in nature, there has been insufficient verifiable exploration to define a mineral resource, and it is uncertain if further exploration will result in any of the Exploration Targets being delineated as a mineral resource.

The Phase 1 exploration program is only intended to partially validate a portion of the Exploration Targets for the Fontana area of the Project, which does not have any mineral resources or mineral reserves. For further details regarding scientific or technical information relating to the Harricana Project, including the recommended exploration programs to validate the Exploration Targets, please refer to the technical report entitled “Harricana Gold Project Technical Report, Duverny Township, Québec” with an effective date of April 1, 2022, and an issue date of May 2, 2022 (the “Harricana Technical Report”), which is filed under the Company’s SEDAR profile at www.sedar.com and on the Company’s website at www.kibokogold.com.

Sampling, Quality Assurance and Quality Control

Orientated HQ-size drill core was delivered directly from the drill site to Kiboko’s field office in Amos, Québec, where it was systematically logged, photographed, cut in half, and sampled on 1 m intervals by a geologist. Core was cut in half lengthwise along a pre-determined line, with one half bagged, securely sealed, labelled, and submitted for analysis. The other half of the core is stored securely at Kiboko’s core logging facility as a witness sample.

For each metre of RC drilling, the stream of RC chips was split into three samples. Two nominal 5 kg samples were collected for analysis, and the remnant nominal 25 kg was bagged for future use if required. The samples were collected directly from the RC drill rig’s cyclone, where they were bagged and labeled. The two 5 kg samples were delivered by Kiboko personnel to Kiboko’s field office in Amos, Québec, for processing. One of the 5 kg samples was submitted to the laboratory for analysis, and the other was stored securely as a witness sample until the results of the first stream of samples were received. At site, a small sub-sample of RC chips was collected from the remnant 25 kg, washed, placed in chip trays, and then delivered by Kiboko personnel to the field office in Amos, where they were systematically logged by a geologist.

In addition to the laboratory’s QA/QC practices, Kiboko personnel inserted certified reference materials (standards) and blank samples at regular intervals into the sample stream to monitor laboratory performance. Duplicates were inserted at the laboratory, and selected intervals were analyzed as field duplicates. Only results that have met the requirements of Kiboko’s quality control program are considered final and are reported.

Bagged samples were collected in larger bags by Kiboko personnel to ensure an appropriate chain of custody until the samples were delivered to the laboratory. Samples were delivered by either courier or Kiboko personnel on pallets to ensure an appropriate chain of custody during transport to MSALABS INC.’s (“MSA”) secure facility in Val-d’Or, Québec for processing and analysis.

The entire half-drill core sample was crushed to approximately 70% passing 2 millimetres. RC chips required no crushing. Sub-samples were rotary split to fill a 350 ml sealed plastic jar for PhotonAssay containing approximately 0.5 kg of sample material. MSA operates numerous laboratories worldwide and maintains ISO-17025 accreditation for many metal determination methods. Accreditation of the PhotonAssay method at MSA’s Val-d’Or laboratory is in progress.

About the Harricana Gold Project

Kiboko’s Harricana Gold Project is a consolidated 100+ km2 prospective mineral claim package that is located 55 km north of Val-d’Or, Québec, in the world-renowned Abitibi greenstone belt. Historical records compiled and digitized by Kiboko into a new geospatial dataset include data from 937 historical diamond drillholes totalling 139,397 m.

The Harricana Project benefits from an exceptional location, close to operating mines, with excellent access and proximity to existing infrastructure, including road, rail, and clean, low-cost, renewable hydroelectric grid power. The Harricana Project also benefits from low royalty coverage with the most significant royalty being a 2% NSR production royalty held by Globex Mining Enterprises Inc. on 195 claims covering an area of 85 km2, which includes the areas drilled in the Company’s Phase 1 drill program.

Additional information about Kiboko and its Harricana Gold Project can be found on SEDAR at www.sedar.com and on the Company’s website at www.kibokogold.com.

Qualified Person

Ivor W.O. Jones, B.Sc. (Hons), M.Sc., FAusIMM, P. Geo., (OGQ Special Authorization Permit 74658), Kiboko’s Vice-President, Technical Services & Project Evaluation, has reviewed and approved the pertinent technical or scientific information contained in this news release. Mr. Jones is the Company’s designated “Qualified Person” as defined by Canadian Securities Administrators within the meaning of National Instrument 43-101 Standards of Disclosure for Mineral Projects (“NI 43-101”). Exploration programs at the Harricana Project are managed by Mr. Jones and Yves Caron, M.Sc., géo (OGQ 548), both of whom are “Qualified Persons” as defined by NI 43-101.

About Kiboko Gold Inc.

Kiboko is a Canadian-based exploration company focussed on advancing its 100+ km2 Harricana Gold Project, located 55 km north of Val-d’Or, Québec, within the world-renowned southern Abitibi gold belt.

Figure 1: Harricana Gold Project – Fontana Phase 1 exploration program drilling locations (Photo: Business Wire)

Figure 2: Harricana Gold Project – Kiboko’s Fontana Phase 1 Hooper Bunkhouse zone drilling locations (Photo: Business Wire)

Figure 3: Harricana Gold Project: Kiboko’s Fontana Phase 1 Lot 14 Zone drilling locations (Photo: Business Wire)

Figure 4: Harricana Gold Project: Simplified HB Zone geological section looking N315° (Photo: Business Wire)

MORE or "UNCATEGORIZED"

Eloro Resources Announces Closing of Bought Deal LIFE Private Placement for Gross Proceeds of C$17 Million

Eloro Resources Ltd. (TSX: ELO) (FSE: P2QM) is pleased to announce the closing of its previously an... READ MORE

Minera Alamos Updates Resources and Reserves for the Pan Gold Mine in Nevada

Minera Alamos Inc. (TSX-V: MAI) (OTCQX: MAIFF) is pleased to announce updated Mineral Resource and M... READ MORE

Ero Copper Reports Fourth Quarter and Full Year 2025 Operating and Financial Results

Ero Copper Corp. (TSX: ERO) (NYSE: ERO) is pleased to announce its operating and financial results f... READ MORE

Rare Element Resources Announces Results of Oversubscribed Rights Offering of Common Shares

Rare Element Resources Ltd. (OTCQB: REEMF) is pleased to report that its previously announced... READ MORE

TRX Gold Reports Record Q2 2026 Production and Company Update

TRX Gold Corporation (TSX: TRX) (NYSE American: TRX) is pleased to announce preliminary resu... READ MORE