Jordan Roy-Byrne – “You Should be Buying Gold Stocks Now”

A few weeks ago we noted the bullish setup for 2020.

Macro developments, one way or another will tend to favor Gold. There isn’t a realistic scenario that isn’t Gold bullish.

Note the comments from various Fed-heads last week. They are laying the groundwork to target higher than 2% inflation and won’t consider raising rates anytime soon.

And if they have to resume cutting rates Gold will obviously move higher.

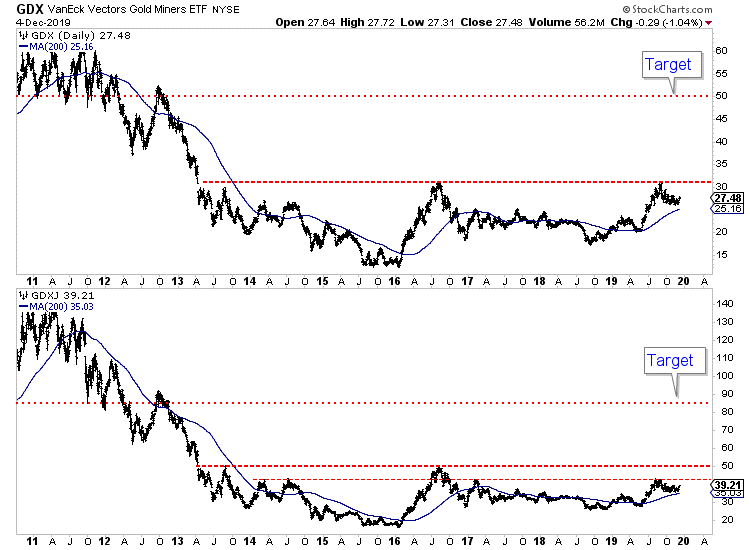

On the technical side, GDX and GDXJ are in solid uptrends and trading within huge long-term bases.

The setup is there for a very profitable 2020 and recent developments should make us even more bullish.

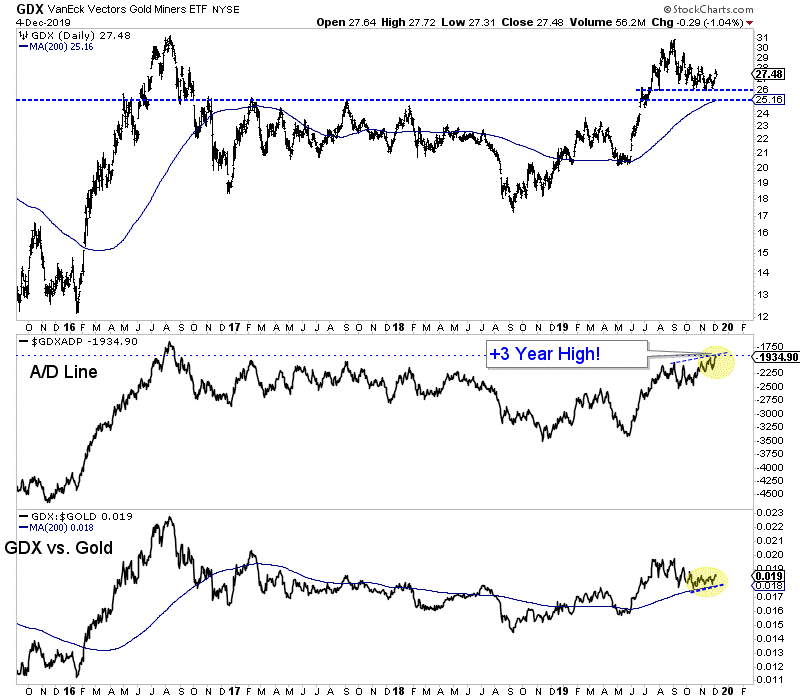

Take a look at the chart of GDX and the GDX advance decline (AD) line below.

There are several very bullish developments.

First, note the price action. GDX has held above $26.00 three times. Its been so strong that it hasn’t tested the 38% retracement from the September 2018 low of $25.70.

Second, on Tuesday the AD line (an important leading indicator) hit a three year high! That is an incredibly strong and significant positive divergence.

Finally, GDX has been outperforming Gold. The GDX to Gold ratio closed Tuesday at a two month high. Keep in mind, this is during a correction for GDX.

While there are quite a few positives for GDX, it isn’t even the strongest part of the sector! The riskier parts of the sector such as juniors and silver stocks are outperforming.

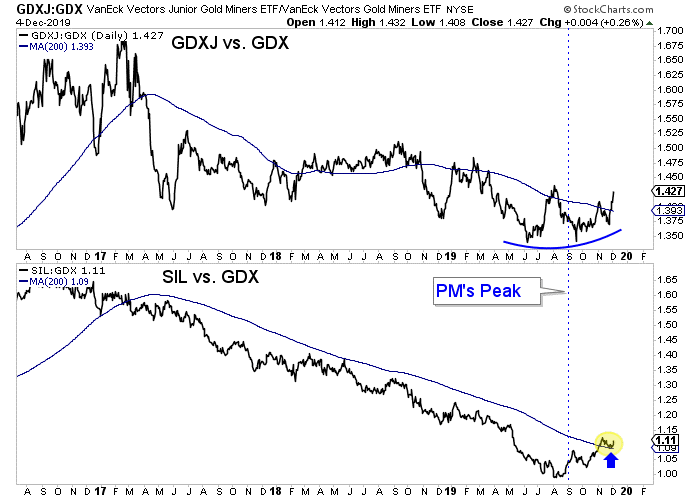

Below we plot GDXJ against GDX and SIL against GDX.

The sector peaked at the start of September and even as it has corrected, both SIL and GDXJ have clearly outperformed GDX and the ratios have broken above their 200-day moving averages.

There are quite a few bullish developments as the sector has corrected and when we consider the massive bases in GDX and GDXJ (see below), it should make us all the more bullish for the next 12 to 18 months.

The strong breadth (GDX AD line), the outperformance against Gold and the outperformance of the riskier groups (SIL, GDXJ) are exactly the things we want to see ahead of a major breakout. In other words, the market is leaving hints.

If you have followed my work, you know that I’m usually conservative. At times over the past few years I have been too cautious. But I have been a long-term bull.

Make no mistake. The next 12 to 18 months have a chance to be extremely profitable in gold stocks, silver stocks and gold and silver juniors.

Get positioned soon, buy on weakness and hold.

We continue to focus on identifying and accumulating the juniors with significant upside potential in 2020. To learn the stocks we own and intend to buy that have 3x to 5x potential, consider learning more about our premium service.

MORE or "UNCATEGORIZED"

Koryx Copper Intersects 338.61 Meters At 0.38% Cu Eq Including 230.61 Meters At 0.45% Cu Eq and Multiple 2 Meters Intersections Over 1.00% Cu Eq

Significant copper and molybdenum intersections include: HM09: 13... READ MORE

Aya Gold & Silver Reports Q1-2024 Results; Maintains Guidance; Zgounder Expansion on Track

Aya Gold & Silver Inc. (TSX: AYA) (OTCQX: AYASF) is pleased t... READ MORE

Silver Mountain Delivers Positive Preliminary Economic Assessment For Its Reliquias Project, Peru; Pre-Tax NPV 5% Of C$107 million, Pre-Tax IRR Of 57%, And Payback Of 1.8 Years

Key Highlights – Preliminary Economic Assessment Pre-Tax Net Pr... READ MORE

ARIS MINING REPORTS Q1 2024 RESULTS WITH SEGOVIA GENERATING $13.8 MILLION IN OPERATING CASH FLOW

Aris Mining Corporation (TSX: ARIS) (NYSE-A: ARMN) announces its ... READ MORE

Orla Mining Reports First Quarter 2024 Results

Orla Mining Ltd. (TSX: OLA) (NYSE: ORLA) announces the results fo... READ MORE