Jordan Roy-Byrne – “When Will Gold Stocks and Silver Outperform?”

Gold mining stocks and Silver are the riskier parts of the precious metals sector. Generalist capital always favors Gold first and second before considering miners and Silver.

The gold stocks and Silver have underperformed Gold so badly because Gold has been in a secular bear market since 2011.

Think of the economics of the average Gold mine 12 years and compare that to today. The revenue is the same, but the production costs are significantly higher.

Silver has underperformed Gold and, badly so, due to economic reasons. Silver outperforms Gold amid rising inflation and increasing inflation expectations. Gold’s secular bear market has occurred amid disinflation.

The good news for Silver and gold stocks is that Gold is about to begin a new secular bull market, and so naturally, Silver and gold stocks will outperform over the years ahead.

However, let me get more specific about how and when this outperformance could transpire. Look at previous Gold breakouts and how Silver and gold stocks performed.

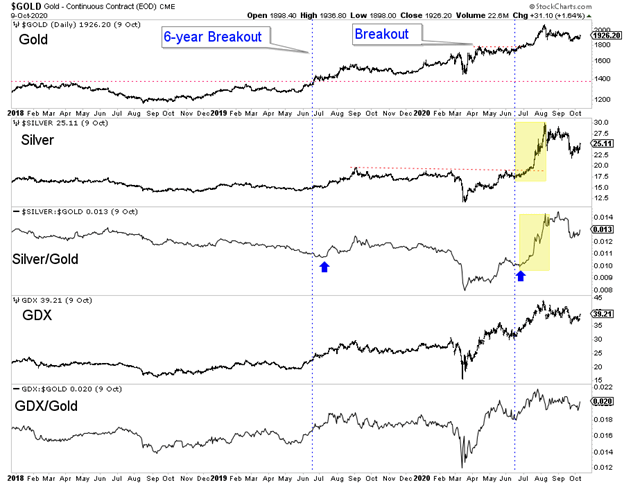

First, we look at the 2018 to 2020 period and the Gold breakout in 2019.

Silver began to outperform Gold one month after Gold’s 2019 breakout, a few weeks after Gold’s second breakout in June 2019. Silver dramatically outperformed Gold after it broke above major resistance near $19 in July 2019.

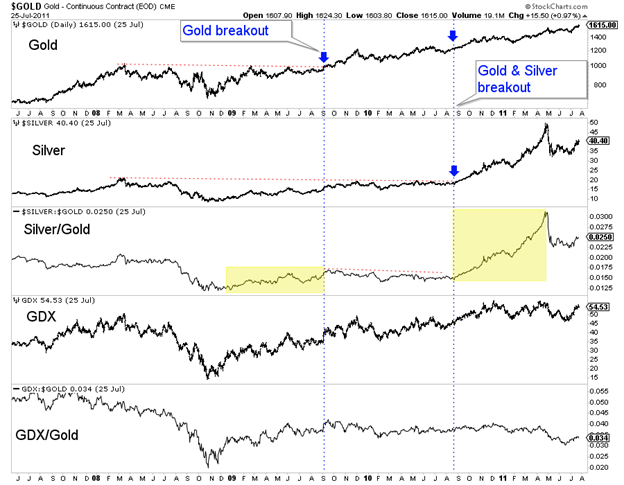

Next, we plot precious metals during the 2008 to 2011 period.

Silver began to outperform Gold two months after the October 2008 low. However, Silver’s outperformance would only accelerate in the second half of 2010 when it broke resistance at $20.

In the late 1970s, Silver began outperforming Gold in late 1978 after Gold successfully retested its 1974 high. Silver began its outperformance a few months before breaking above its own 1974 high.

As for the gold stocks, the GDX to Gold ratio trends alongside GDX (during a cyclical bull) unless the end of a multi-year move is approaching (as seen in 2007 and 2011).

If Gold breaks above $2100 and reaches $3000 within 12 to 18 months, miner margins would balloon. In other words, look for significant outperformance in the miners and select juniors as Gold moves from $2000 to $2400 and higher.

Silver faces significant monthly and quarterly resistance at $26-$28. History shows us that Silver outperforms Gold after Gold breaks out but also after Silver breaks a major resistance level.

Gold will break through $2100 well before Silver breaks past $26-$28. Gold will initially pull Silver higher, but Silver will outperform Gold dramatically as it readies to break through $26-$28.

I focus on finding high-quality gold and silver juniors with 500% upside potential over the next few years. To learn the stocks we own and intend to buy, with at least 5x upside potential in the coming bull market, consider learning about our premium service.

MORE or "UNCATEGORIZED"

Quimbaya Gold Closes $4 Million Financing and Expands Executive Team

Cornerstone investor brings proven regional track record; company... READ MORE

Spanish Mountain Gold Announces Larger Scale Preliminary Economic Assessment With a Base Case NPV5% After-Tax of C$1.0 Billion, 18.2 % IRR and 3.4 Year Payback at US$ 2,450/Oz Gold Price; at US$3,300/Oz Spot Gold Price NPV5% C$2.3 Billion, 32.0% IRR and 2.0 Year Payback; Including an Updated Mineral Resource Estimate for Its Spanish Mountain Gold Project

Spanish Mountain Gold Ltd. (TSX-V: SPA) (FSE: S3Y) (OTCQB: SPAUF)... READ MORE

Aura Announces Preliminary Q2 2025 Production Results

Aura Minerals Inc. (TSX: ORA) (B3: AURA33) (OTCQX: ORAAF) is plea... READ MORE

Cascadia Announces Closing of Financing

Cascadia Minerals Ltd. (TSX-V:CAM) (OTCQB:CAMNF) is pleased to an... READ MORE

Abcourt Closes US$ 8M Loan Facility to Start Sleeping Giant Mine

Abcourt Mines Inc. (TSX-V: ABI) (OTCQB: ABMBF) is pleased to anno... READ MORE