Jordan Roy – Byrne: “What History Says About Gold’s Next Move”

We last wrote two months ago that Gold would undergo a correction that could set up an accelerated leg higher.

Gold has held up very well over the past few months, consolidating in a bullish manner.

The consolidation may need to continue for another month or two. The longer it consolidates, the better position Gold will be in to explode to $4000/oz and Silver to explode towards $50.

Gold is currently in the third major breakout in its history.

In 1972, Gold broke out from over a 100-year-long base in what I have described as the Greatest Breakout of All Time.

The second greatest breakout for Gold, specifically, was its breakout in March 2024 out of a 13-year cup and handle pattern.

Finally, in 2005, Gold broke out from a rough 24-year-long base, surpassing $500/oz. But this was not a breakout to new all-time highs, like the other two.

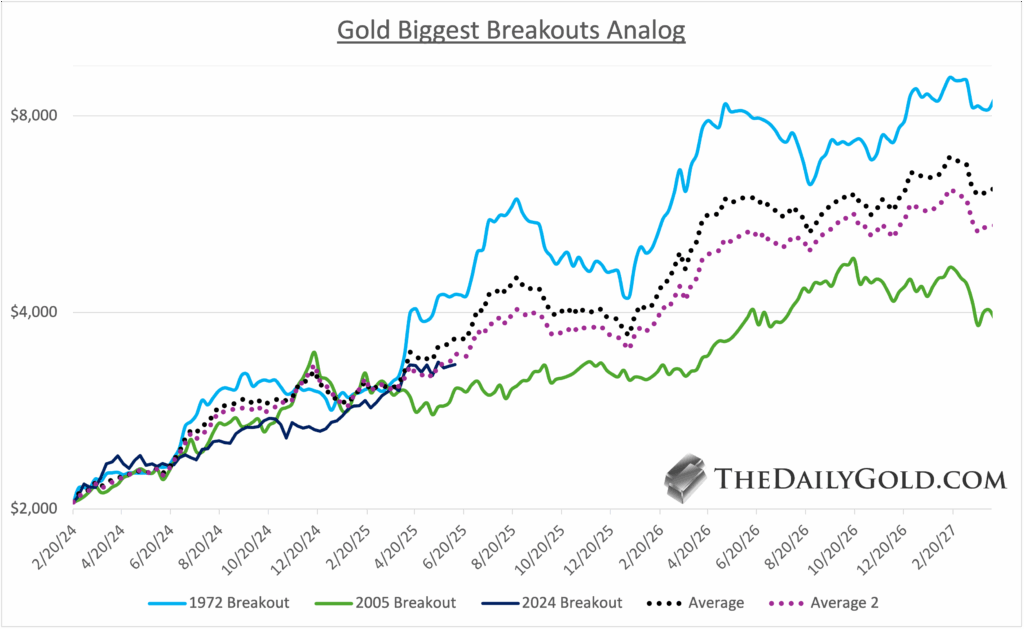

We compare the three breakout moves below on the scale of the breakout that began in March 2024. We also include an average of the 1972 and 2005 breakouts, as well as an average that weights the 1972 breakout by ⅓ and the 2005 breakout by ⅔.

The 1972 breakout move peaked in early 2027 at nearly $ 9,200/oz, while the 2005 breakout move peaked above $ 4,800/oz in late 2026.

The lower average reaches $5,300/oz 12 months from now and almost $5,700/oz 16 months from now.

So far, Gold is doing a good job of staying close to the averages.

Even if it follows the weakest of the five lines, it would reach $4800/oz in 16 months. The weaker of the two averages puts Gold at $5300 in only 12 months.

For Gold to reach those targets, it likely requires a 17%-20% correction along the way.

Coming into this week, the percentage of miners and juniors (GDX, GDXJ, HUI) trading above the 20-day, 50-day, and 200-day moving averages was at least 95% across the board. Our junior silver basket of 10 stocks was up 82% in nine weeks. The sector was fully overbought.

A consolidation for another month or two in Gold and Silver would develop the fuel and buying power needed for the next advance.

We are already positioned in the leading companies but are actively uncovering more companies that could lead the next move higher.

MORE or "UNCATEGORIZED"

Eloro Resources Announces Closing of Bought Deal LIFE Private Placement for Gross Proceeds of C$17 Million

Eloro Resources Ltd. (TSX: ELO) (FSE: P2QM) is pleased to announce the closing of its previously an... READ MORE

Minera Alamos Updates Resources and Reserves for the Pan Gold Mine in Nevada

Minera Alamos Inc. (TSX-V: MAI) (OTCQX: MAIFF) is pleased to announce updated Mineral Resource and M... READ MORE

Ero Copper Reports Fourth Quarter and Full Year 2025 Operating and Financial Results

Ero Copper Corp. (TSX: ERO) (NYSE: ERO) is pleased to announce its operating and financial results f... READ MORE

Rare Element Resources Announces Results of Oversubscribed Rights Offering of Common Shares

Rare Element Resources Ltd. (OTCQB: REEMF) is pleased to report that its previously announced... READ MORE

TRX Gold Reports Record Q2 2026 Production and Company Update

TRX Gold Corporation (TSX: TRX) (NYSE American: TRX) is pleased to announce preliminary resu... READ MORE