Jordan Roy-Byrne – “Two Roads for Gold & Both are Bullish”

The macro fundamentals are not bullish for Gold at this moment.

The Fed is still tightening. The economy has picked up a bit, and so too, have inflation expectations.

This means higher real rates for now. Not bullish.

However, the market discounts and anticipates in advance.

And both of the most realistic economic outcomes are bullish for Gold.

Let me explain why.

History shows us that a soft landing is impossible when trying to kill or decrease inflation significantly. Policymakers may be able to engineer a very temporary soft landing, but inflation is primed to reaccelerate in such a scenario.

The reacceleration of inflation in late 2023 or 2024 would be far more damaging to the economy than in 2021 and 2022, when the economy was recovering from a major shock. It would be more stagflationary and recessionary, which drove Gold in the 1970s.

This outcome is why a hard landing is required to kill inflation.

Under a hard landing scenario, the Fed hikes several more times, and after they pause, the stock market rolls over, and the economy follows suit.

Bond yields, which would peak before the Fed’s final hike, plummet lower as inflation expectations crash and the market discounts Fed easing. Gold would move towards a breakout shortly before the Fed begins easing.

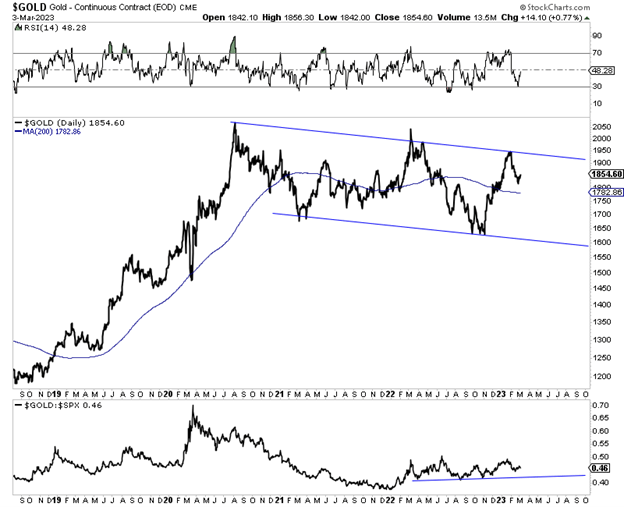

Technically, Gold remains in a bullish consolidation from a bird’s eye view as it continues to hold above the 38% retracement from the 2016 to 2020 rebound. However, neither of those two aforementioned economic scenarios will appear imminent unless Gold moves back above $1950 and Gold vs. S&P 500 makes a higher high.

The economy has yet to reach that fork in the road, but it will.

The threat of lower prices and more time until a breakout move gives us another chance to buy the highest quality juniors with the most potential. Recently, I have introduced a larger watch list of these types of companies for my subscribers.

I focus on finding high-quality juniors with 500% upside potential over the next few years. To learn the stocks we own and intend to buy, with at least 5x upside potential in the coming bull market, consider learning about our premium service.

MORE or "UNCATEGORIZED"

Labrador Gold Announces Closing of Change of Business and Acquisition of Units of Northern Shield

Labrador Gold Corp. (TSX-V: LAB) (FNR: 2N6) is pleased to announc... READ MORE

La Mancha Exercises Right to Subscribe for Additional Shares of G Mining Ventures

G Mining Ventures Corp. (TSX:GMIN) (OTCQX:GMINF) announces that t... READ MORE

Osisko Development Announces Proceeds of $24.9 Million From Warrant Exercise

Osisko Development Corp. (NYSE: ODV, TSX-V: ODV) announces that i... READ MORE

LIFT Closes Acquisition with SOQUEM for an Additional 25% Interest in the Galinée Property, Quebec

Li-FT Power Ltd. (TSX-V: LIFT) (OTCQX: LIFFF) (Frankfurt: WS0) i... READ MORE

Eloro Resources Announces Closing of Bought Deal LIFE Private Placement for Gross Proceeds of C$17 Million

Eloro Resources Ltd. (TSX: ELO) (FSE: P2QM) is pleased to announce the closing of its previously an... READ MORE