Jordan Roy-Byrne – “The Mistake Many Could Make with Gold Stocks”

The Sahm Rule recession indicator has been triggered. The yield curve (2s and 10s) has finally un-inverted, which, if it steepens aggressively, is a sure-fire recession signal.

Out come the tweets and subscriber emails about buying gold stocks after the downturn.

After all, the precious metals sector has performed poorly during the last three bear markets in stocks.

However, investors, speculators, and even gold bugs are falling victim to recency bias. This cognitive bias favors recent events over historical ones and gives greater importance to the most recent events.

The current context for precious metals is completely different than it was heading into the last three bear markets for stocks.

In fact, the current context is most similar to the two points in history when precious metals diverged from stock market bears.

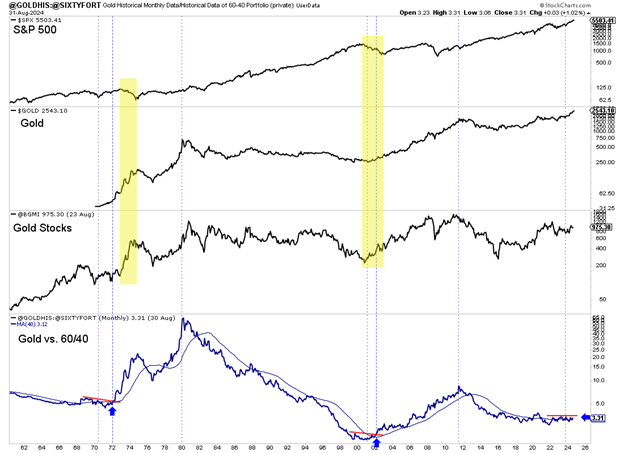

As the chart below shows, Gold and gold stocks trended higher during the bear markets of 1972-1973 and 2000-2002.

That negative correlation transpired as Gold broke out against and outperformed the 60/40 portfolio, which confirmed a new secular bull market. This is the major development we have been anticipating.

It is all connected.

Gold will have no acceleration phase until it breaks out against the 60/40 portfolio. That requires a bear market in the stock market.

Precious Metals will diverge as capital flows out of conventional stocks and into precious metals, which are massively under-owned relative to conventional stocks.

The divergence or non-correlation transpires only around the beginning of a secular bull market because precious metals are so under-owned and there are so few sellers.

In early 2008, all Gold ETFs amounted to 4% of all ETF assets. Several months ago, that figure was barely more than 1%.

Sure, there would be some selling and corrections along the way. There were multiple 20% declines in gold stocks during 1972-1973 and 2001-2002.

Rather than panic selling out of positions, one should take advantage of market-induced weakness. Tweak your portfolio and focus on the high-quality juniors that have the most value and upside potential.

MORE or "UNCATEGORIZED"

First Phosphate Receives Conditional Approval for up to $16.7 Million Non-Repayable Contribution from the Government of Canada

First Phosphate Corp. (CSE: PHOS) (OTCQX: FRSPF) (OTCQX ADR: FPHOY) (FSE: KD0) has been cond... READ MORE

Gold X2 Drills 117m of 1.21 g/t Au, Including 10m of 4.37g/t Au; High-Grade Zone Intersected 280m Beneath the Resource Pit Demonstrating Underground Potential at the Moss Gold Deposit

Gold X2 Mining Inc. (TSX-V: AUXX) (OTCQB: GSHRF) (FWB: DF8), is pleased to announce initial drilling... READ MORE

Tectonic Raises Over C$92 Million; Completes Upsized Private Placement With Full Over-Allotment Exercised

Tectonic Metals Inc. (TSX-V: TECT) is pleased to announce the successful closing of the Company’s ... READ MORE

Cerro de Pasco Resources Enters Project Development Funding Agreement with U.S. International Development Finance Corporation for Quiulacocha

Cerro de Pasco Resources Inc. (TSX-V: CDPR) (OTCQB: GPPRF) (BVL: CDPR) announces that it has ... READ MORE

NorthWest Announces Updated Mineral Resource at Kwanika Reflecting Strategic Shift to Higher-Grade Copper-Gold Focus

NorthWest Copper Corp. (TSX-V: NWST) is pleased to announce an updated mineral resource estimate for... READ MORE