Jordan Roy-Byrne – “Short-Term Risk Rising but Trend Remains Very Bullish”

Trying to assess the potential for a correction in precious metals (and in miners especially) is quite tricky, given the current context.

Last week we argued that markets often make powerful and sustained upside advances following significant breakouts. In this context, an overbought condition can become very overbought and persist for a while, during a post-breakout rise.

The post-breakout advance in gold stocks and junior gold stocks is just starting.

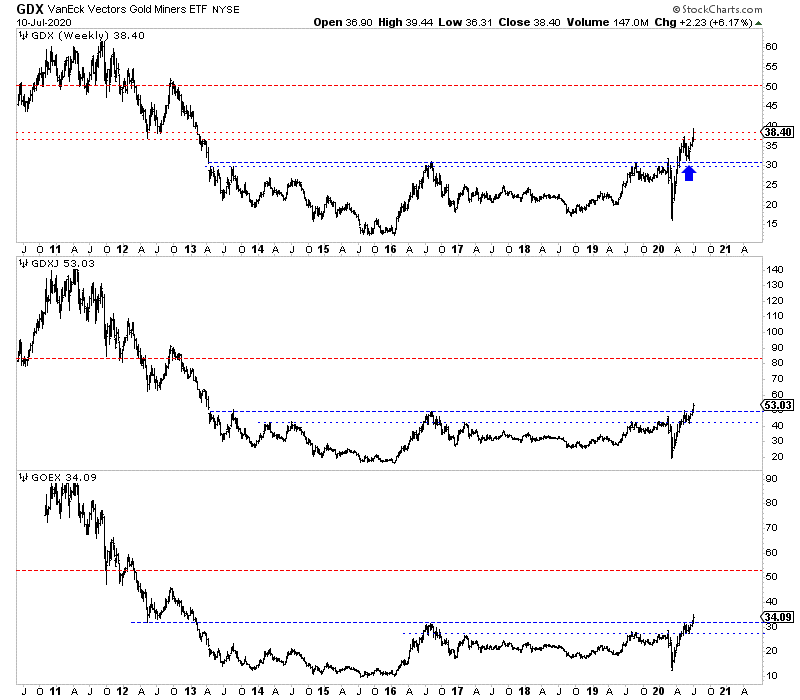

We can see that GDX (large miners) has broken out and successfully retested that breakout. Meanwhile, GDXJ (juniors) and GOEX (explorers) has just broken out to fresh 7-year highs.

This is not the context in which we should anticipate a correction.

Furthermore, note that gold stocks have endured two corrections in just the past four months.

Let’s use GDX as a proxy.

It corrected 17% in June. That correction ended only a few weeks ago. Before that, GDX shed 49% in only a few weeks!

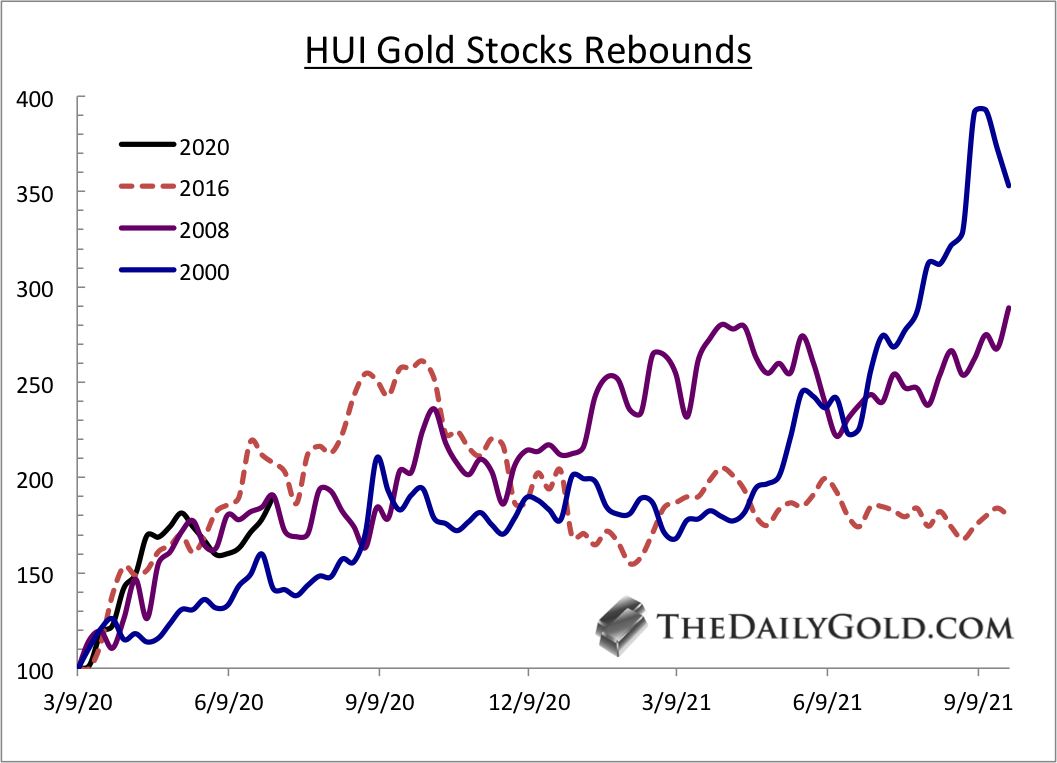

We used the following analog chart in May to argue for a correction. Gold stocks were overextended then.

At present, gold stocks are not over-extended. They would be a better buy after a week or two of selling or sideways action.

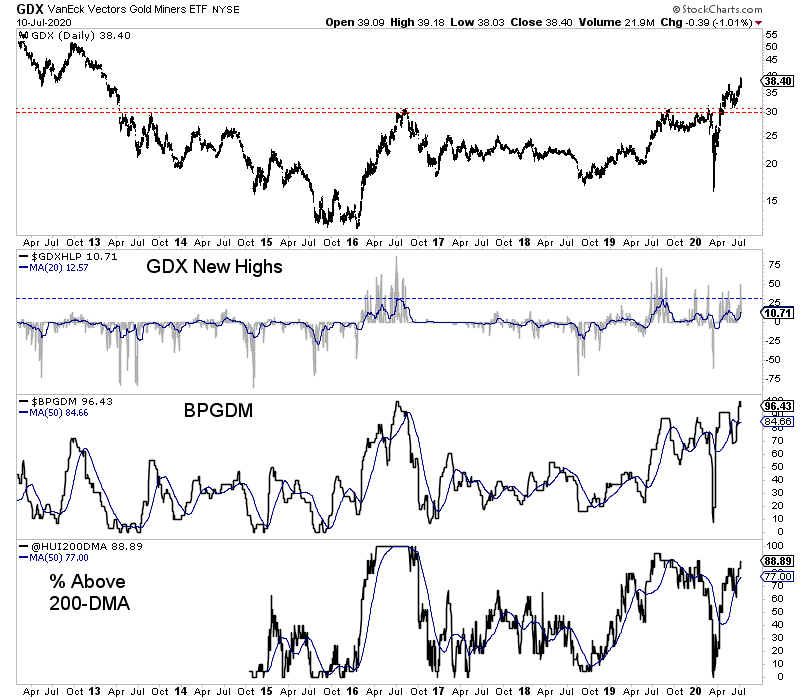

Breadth indicators are running hot, which is a good problem to have.

Note that the indicators are extended, and some correction is needed. However, they remain some ways away from the 2016 and 2019 peaks.

The weight of the evidence suggests gold stocks are running hot at the moment but not quite warm enough to fear a sustained correction or even a 20% correction, like the ones experienced during the 2008-2009 recovery.

A 10% correction or several weeks of consolidation is possible.

Individual juniors that have surged higher in recent weeks are ripe for a quick snapback or several weeks of consolidation. Let them settle down and then make your buys.

The wind will be at your back over the months and quarters ahead.

We continue to focus on identifying and accumulating those stocks with significant upside potential over the next 12 to 24 months. To learn the stocks we own and intend to buy that have 3x to 5x potential, consider learning more about our premium service.

MORE or "UNCATEGORIZED"

NEW GOLD COMPLETES US$173 MILLION BOUGHT DEAL FINANCING

New Gold Inc. (TSX: NGD) (NYSE American: NGD) is pleased to annou... READ MORE

SILVER VIPER CLOSES LIFE OFFERING

Silver Viper Minerals Corp. (TSX-V: VIPR) (OTC: VIPRF) announces... READ MORE

MAX Power Closes $1.9 Million Private Placement

MAX Power Mining Corp. (CSE: MAXX) (OTC: MAXXF) (FRANKFURT: 89N) ... READ MORE

McEwen Copper Announces Completion of the Feasibility Drilling Program

70,000 meters completed, highlights include: 349.0 m of 0.77... READ MORE

Rupert Resources Reports Results From Project Drilling Including 120m at 6.2g/t Gold

Rupert Resources Ltd. (TSX:RUP) reports assay results from projec... READ MORE