Jordan Roy-Byrne – “Key Levels in Gold into November”

Gold touched $2000/oz resistance last Friday but has so far held most of its gains in a bullish fashion. It closed Wednesday at $1995/oz.

Next Tuesday marks the monthly close.

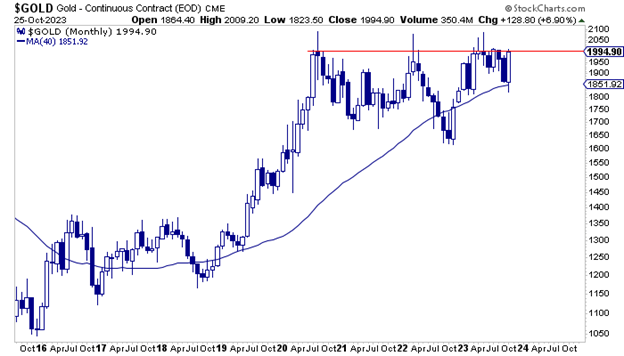

The monthly candle chart of Gold is below, with the resistance line at $2000. Gold has tested $2000/oz in seven of the past eight months.

After many tests of resistance, we need a convincing monthly close to qualify as a breakout. Think of $2020/oz at a minimum.

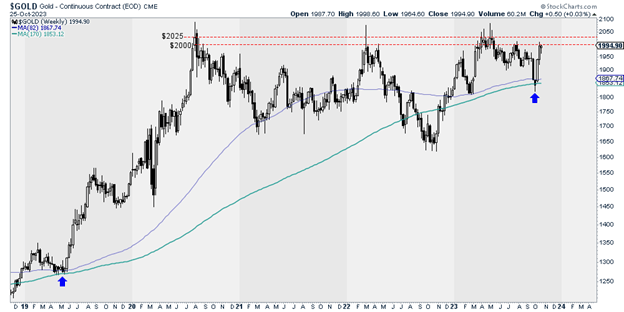

The $2000 level is also important resistance on the weekly chart.

Below, we plot the weekly candle chart with the equivalent to the 20-month and 40-month moving averages.

Weekly resistance is at $2000 and $2025 to $2030. The weekly high in 2020 was $2028; this past spring, Gold tested $2025 in six out of seven weeks.

Turning to potential support levels, Gold should find initial support at $1960 or $1940 should it lose more short-term momentum.

Gold has often tested its 150-day moving average a few months before major breakouts.

One possibility is Gold trades up to $2030-$2050 before correcting to the 150-day moving average, currently at $1962 and sloping higher.

Gold’s strength in recent days leads me to think it has a chance to test $2030-$2050 before a retracement. If that comes to pass, look for support at the 150-day moving average.

On the other hand, if $2000 resistance holds firm in November, then look for a test of $1940 and perhaps $1920.

Gold rallying back to $2000 so quickly is a positive sign for an eventual breakout. The miners, juniors, and Silver space need Gold to surpass $2100 before they can outperform.

Until then, I will focus on finding high-quality gold and silver juniors with 500% to 1000% upside potential over the next few years. To learn the stocks we own and intend to buy, with at least 5x upside potential in the coming bull market, consider learning about our premium service.

MORE or "UNCATEGORIZED"

Surge Copper Announces Closing of First Tranche of $20 Million Private Placement

Surge Copper Corp. (TSX-V: SURG) (OTCQB: SRGXF) (Frankfurt: G6D2) is pleased to announce that it has... READ MORE

Spanish Mountain Gold Drilling Intersects 205.87 Metres Grading 0.58 G/T Gold, 142.00 Metres of 0.77 G/T Gold, and 69.40 Metres of 0.99 G/T Gold in Three Separate Drill Holes Containing Numberous Higher-Grade Sub-Intervals

Spanish Mountain Gold Ltd. (TSX-V: SPA) (FSE: S3Y) (OTCQB: SPAUF) is pleased to report additi... READ MORE

Aura Signed the Agreement to Relocate Road at Borborema Mine, Unlocking an additional 670 Koz of gold in Mineral Reserves, totaling 1.5 Moz

Aura Minerals Inc. (Nasdaq: AUGO) (B3: AURA33) is pleased to announce that it has signed the agreem... READ MORE

Aura Announces Q4 2025 and FY 2025 Financial and Operational Results

Aura Minerals Inc. (NASDAQ: AUGO) (B3: AURA33) announces that it has filed its audited consolidated ... READ MORE

Endeavour Silver Announces Q4 2025 Financial Results; Earnings Call at 10AM PST (1PM EST) Today

Endeavour Silver Corp. (NYSE: EXK) (TSX: EDR) announces its financial and operating results ... READ MORE