Jordan Roy-Byrne – “Gold’s Upside Potential in the Next 3 Years”

I have focused on the coming secular shift in Gold and precious metals because it has massive implications over the coming years and into the 2030s.

However, I will discuss the cyclical potential of the current move in Gold today. With a strong close above $2100, Gold is in a new cyclical bull market.

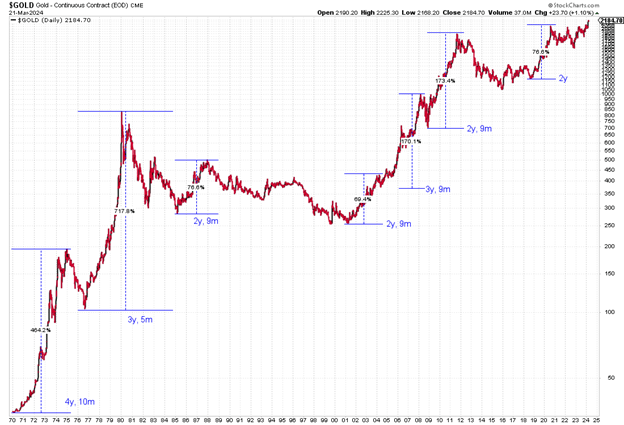

The chart below notes the historical cyclical bull moves in Gold.

Other than the first cyclical bull (which did not begin in earnest until late 1971) and the most recent, every cyclical bull lasted roughly three years, give or take a few months.

The cyclical bulls were far more powerful and volatile in the 1970s than in the 2000s.

Gold’s breakout from a super bullish cup and handle pattern, which we have written about since 2021, triggers a measured upside target of $3000/oz.

In researching historical and similar breakouts, we found that the market at hand moved from its measured upside target to its logarithmic target in six to 12 months.

Gold’s logarithmic target is around $4000/oz. That equates to a 117% cyclical bull market from the October 2023 low or 146% from the October 2022 low.

However, a breakout from a 13-year pattern around all-time highs will likely produce a more explosive move to the upside.

I do not expect the move to be as big as those in the 1970s (464% and 718%), but I do expect it to surpass the moves in the 2000s. A 200% gain from the 2022 low takes Gold to nearly $5000, while a 200% gain from the 2023 low takes Gold to $5500.

I am looking at the end of 2026 as a potential peak for the cyclical bull. That is four years from the 2022 low or three years from the 2023 low.

Gold fulfilling this potential requires a recession and downturn and strongly outperforming the conventional 60/40 portfolio. Gold has broken out against Bonds but has yet to against Stocks.

At present, Gold is only days past, potentially its most significant breakout in 50 years. Should the breakout hold, we should expect gold stocks, especially junior gold stocks, to dramatically outperform Gold over the next year or two.

MORE or "UNCATEGORIZED"

Eloro Resources Announces Closing of Bought Deal LIFE Private Placement for Gross Proceeds of C$17 Million

Eloro Resources Ltd. (TSX: ELO) (FSE: P2QM) is pleased to announce the closing of its previously an... READ MORE

Minera Alamos Updates Resources and Reserves for the Pan Gold Mine in Nevada

Minera Alamos Inc. (TSX-V: MAI) (OTCQX: MAIFF) is pleased to announce updated Mineral Resource and M... READ MORE

Ero Copper Reports Fourth Quarter and Full Year 2025 Operating and Financial Results

Ero Copper Corp. (TSX: ERO) (NYSE: ERO) is pleased to announce its operating and financial results f... READ MORE

Rare Element Resources Announces Results of Oversubscribed Rights Offering of Common Shares

Rare Element Resources Ltd. (OTCQB: REEMF) is pleased to report that its previously announced... READ MORE

TRX Gold Reports Record Q2 2026 Production and Company Update

TRX Gold Corporation (TSX: TRX) (NYSE American: TRX) is pleased to announce preliminary resu... READ MORE