Jordan Roy-Byrne – “Gold’s True Fundamentals are Strengthening”

Gold and precious metals have performed well over the last few years. Central bank demand, De-dollarization, and other foreign sources of demand pushed Gold to break out of its 13-year cup and handle pattern.

However, Gold has not performed well in real terms.

It has not outperformed the stock market and the 60/40 investment portfolio.

Gold’s raw fundamentals revolve around declining real interest rates, economic contraction, and outperforming conventional financial assets.

These drivers have been absent recently. But that is about to change.

Precious Metals have been hit hard recently, but Gold’s monetary-related fundamentals are strengthening.

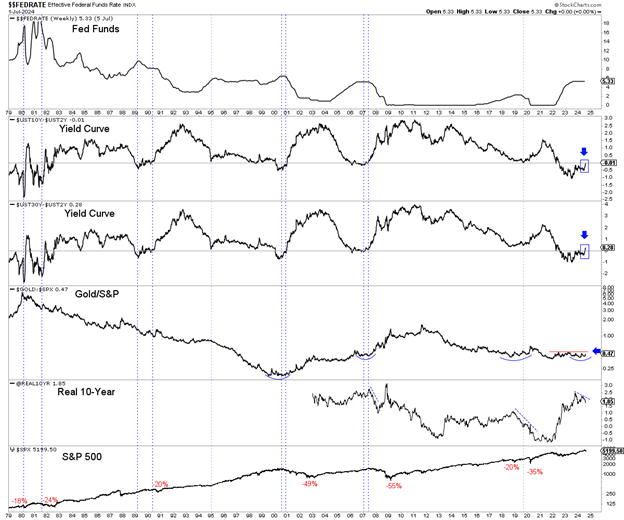

Two weeks ago, we wrote about the steepening of the yield curve on the horizon.

It is no longer on the horizon; it is here.

The spread between the 30-year and 2-year yields, which has led other yield spreads in recent decades, has un-inverted, and the spread between the 10-year and 2-year yields is about to un-invert.

The last three times this occurred, it marked the start of Gold outperforming the stock market, Fed easing, and lower real interest rates.

Risk assets are selling off, including precious metals.

But Gold is outperforming in real terms.

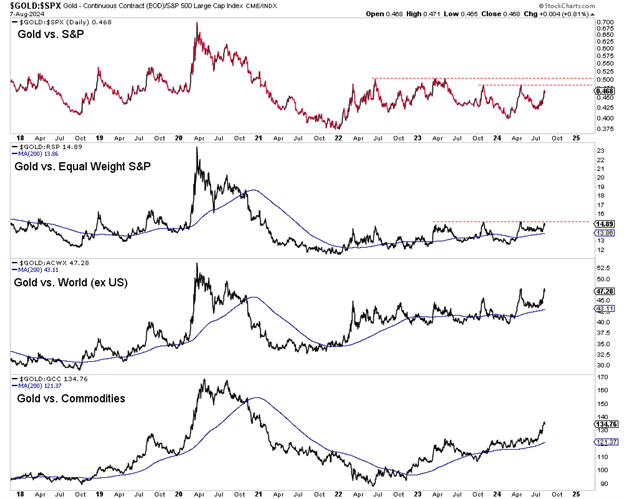

Gold has broken out against Commodities and reached a three-and-a-half-year high.

Gold against the Equal Weight S&P 500 is inches from a major breakout and its own three-and-a-half-year high.

Gold against the S&P 500 could be the last shoe to drop.

It is trending towards four-year resistance. A sustained breakout above 0.50 would be significantly bullish for the precious metals sector.

Although precious metals are selling off, their leader, Gold, is strengthening in real terms as very bullish fundamentals are approaching. This, if sustained, is a precursor to very strong future performance from the entire sector.

The depth and duration of the coming downturn will greatly affect the upside potential of precious metals over the next few years.

In any case, the outlook over the next 12 months is quite positive. A recession should give Gold the ammunition to surpass $3000/oz and reach $4000/oz, eventually carrying Silver well above $50/oz.

I continue to focus on the gold and silver stocks with the best combination of fundamental quality and upside potential.

MORE or "UNCATEGORIZED"

Hudbay Delivers Record Fourth Quarter and Full Year 2025 Results; Achieves 2025 Consolidated Copper and Gold Production and Cost Guidance

Hudbay Minerals Inc. (TSX:HBM) (NYSE: HBM) released its fourth ... READ MORE

Argo to Acquire the Hurdman Silver-Zinc Project

Argo Gold Inc. (CSE: ARQ) (OTC: ARBTF) entered into an agreement ... READ MORE

Centerra Gold Announces 2025 Year-End Mineral Reserves and Resources and Provides Exploration Update; Gold and Copper Reserves Increased 58% and 49%

Centerra Gold Inc. (TSX: CG) (NYSE: CGAU) announces its 2025 year... READ MORE

Eldorado Gold Delivers Strong 2025 Full Year and Fourth Quarter Financial and Operational Results; Significant Free Cash Flow Excluding Skouries and Increased Cash Generated From Operating Activities

Eldorado Gold Corporation (TSX: ELD) (NYSE: EGO) reports the Comp... READ MORE

Centerra Gold Reports Fourth Quarter and Full Year 2025 Results; Delivered Robust Annual Production and Beat Cost Guidance; 2026 Outlook Remains Strong as Centerra Executes its Self-Funded Growth Strategy

Centerra Gold Inc. (TSX: CG) (NYSE: CGAU) reported its fourth qua... READ MORE