Jordan Roy-Byrne – “Gold’s Potential Game Changer Approaching”

Gold’s breakout failed and fell back into the previous consolidation zone at $2300 to $2400/oz. Silver reversed hard and is threatening support at $29.

Precious Metals must work through this technical damage before they can resume their new uptrends.

For years, we have written about the significance of Gold outperforming the stock market and the conventional 60/40 investment portfolio.

A macro development is approaching, which, if it occurs, would be very favorable to precious metals in both nominal and real terms.

The yield curve has been inverted for over two years.

While this is a warning sign, the real warning of imminent negative implications is when the curve steepens to positive territory. It has a near-bulletproof track record of signaling an economic recession.

The steepening is incredibly positive when Gold is in a long-term bull market or secular uptrend.

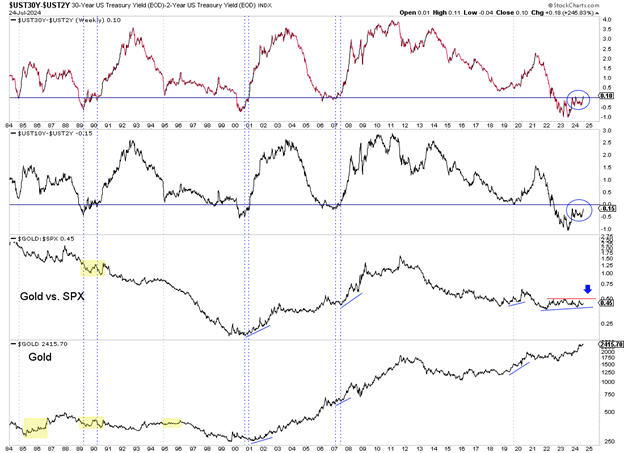

We plot two yield spreads (30s and 2s, 10s and 2s), Gold against the stock market and Gold.

The steepening in 2001, 2007, and 2019 was very positive for Gold and Gold against the stock market. Gold even performed okay while in a long-term downtrend when the curve steepened in 1984, 1990, and 1995.

The yield curve will likely continue to steepen, a recession will occur, and the Fed will begin a new easing cycle.

Gold has and should reliably outperform the stock market in such a scenario. It should reach the measured upside target from its cup and handle pattern breakout of $3000.

The depth and duration of the coming downturn will greatly affect the upside potential of precious metals over the next few years. The worse and longer the downturn, the greater the upside potential.

In any case, the outlook over the next 12 months is quite positive.

I continue to focus on the gold and silver stocks with the best combination of fundamental quality and upside potential.

MORE or "UNCATEGORIZED"

Eloro Resources Announces Closing of Bought Deal LIFE Private Placement for Gross Proceeds of C$17 Million

Eloro Resources Ltd. (TSX: ELO) (FSE: P2QM) is pleased to announce the closing of its previously an... READ MORE

Minera Alamos Updates Resources and Reserves for the Pan Gold Mine in Nevada

Minera Alamos Inc. (TSX-V: MAI) (OTCQX: MAIFF) is pleased to announce updated Mineral Resource and M... READ MORE

Ero Copper Reports Fourth Quarter and Full Year 2025 Operating and Financial Results

Ero Copper Corp. (TSX: ERO) (NYSE: ERO) is pleased to announce its operating and financial results f... READ MORE

Rare Element Resources Announces Results of Oversubscribed Rights Offering of Common Shares

Rare Element Resources Ltd. (OTCQB: REEMF) is pleased to report that its previously announced... READ MORE

TRX Gold Reports Record Q2 2026 Production and Company Update

TRX Gold Corporation (TSX: TRX) (NYSE American: TRX) is pleased to announce preliminary resu... READ MORE