Jordan Roy-Byrne – “Gold Secular Bull Depends on This”

I have written about this topic quite a few times. I am writing about it again today because it will become an extremely important indicator for precious metals within the next 12 months.

Gold has enjoyed a great rebound and has approached its 2020 and 2021 highs. But the stock market has also rebounded and has outperformed Gold strongly in the past few weeks.

The latest rebound in the stock market has removed it from the course of what I deem a mega-bear market. Nevertheless, economic data is slowly getting worse, and a recession and rate cuts are, eventually, likely.

In the meantime, to get a better picture of precious metals’ current standing, we should consult history.

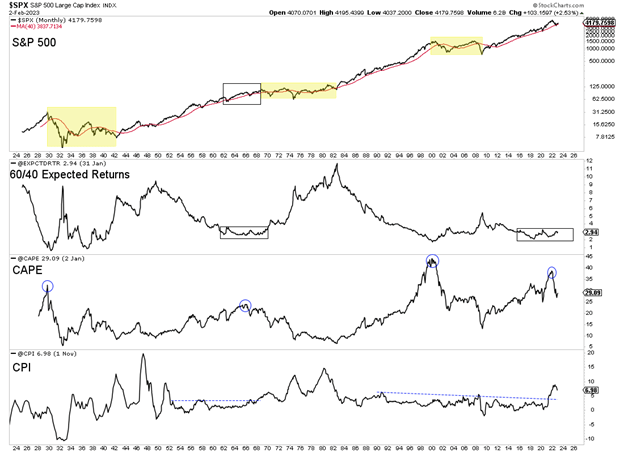

The chart below plots the S&P 500 with our 60/40 expected returns data set, the CAPE ratio (10-year PE Ratio), and CPI Inflation. The yellow is the secular bear markets.

Today appears much like the mid-1960s. In both cases, expected returns were very low, valuations were historically extreme, and the inflation rate had just broken out after being dormant for many years.

Gold today could be where the gold stocks were in the early to mid-1960s.

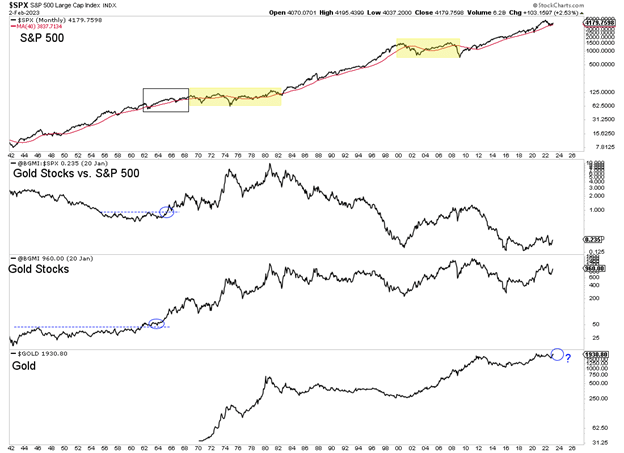

In the chart below, we plot the S&P 500, the gold stocks against the S&P 500, the gold stocks, and at the bottom, Gold. The gold stock data is from the Barron’s Gold Mining Index.

In the 1960s, the gold stocks were the proxy for precious metals, as one could not own Gold.

The gold stocks made a multi-decade breakout in 1964, which was powered by the ratio (gold stocks against the S&P 500) breaking out from a 9-year-long base.

Gold today could be in a similar position.

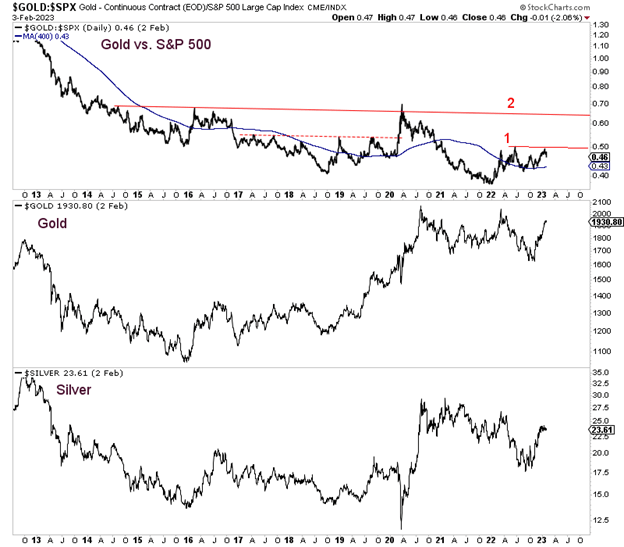

For precious metals to embark on a real and secular bull market, Gold against the S&P 500 must break above its 2016 and 2020 highs, signified by the “2” in the chart below.

If the Gold to S&P 500 ratio can break above 1, Gold should move above $2100 and Silver to at least $30. However, breaking above 2 would confirm a new secular bull market in precious metals.

Last week we wrote that there were signs that precious metals would correct.

With the correction underway, keeping an eye on the stock market will be important. The stronger the stock market and the better the economic data, the longer the precious metals will correct.

If the stock market reverses lower before spring and economic data falters, precious metals will quickly sniff out the approaching rate cuts.

Even in a mild recession, the Fed will have to cut rates, and Gold should climb to at least $2400.

I continue to focus on finding high-quality juniors with 500% upside potential over the next few years. To learn the stocks we own and intend to buy, with at least 5x upside potential in the coming bull market, consider learning about our premium service.

MORE or "UNCATEGORIZED"

Founders Metals Closes C$20M Bought Deal Financing

Founders Metals Inc. (TSX-V:FDR) is pleased to announce the closi... READ MORE

ATEX Announces US$40 Million Strategic Investment by Agnico Eagle

Settlement of credit facility with cornerstone investors provides... READ MORE

K2 Gold Closes Oversubscribed Second/Final Tranche of Private Placement Financing

K2 Gold Corporation (TSX-V: KTO) (OTCQB: KTGDF) (FSE: 23K) announ... READ MORE

Atico Produces 2.91 Million Pounds of Cu and 2,055 Ounces of Au in Third Quarter 2024

Atico Mining Corporation (TSX.V: ATY) (OTCQX: ATCMF) announces it... READ MORE

West Red Lake Gold Announces Closing of $29 Million Bought Deal Public Offering

West Red Lake Gold Mines Ltd. (TSX-V: WRLG) (OTCQB: WRLGF) is pleased to... READ MORE