Jordan Roy-Byrne – “Gold Catalysts Looming but not Imminent”

Gold remains in a bullish big-picture consolidation but has failed to breakout as the Fed was able to quell banking issues and as the economy has avoided recession.

The market has discounted a soft landing as capital has moved out Bonds and into equities.

Inflation expectations have begun to perk up mostly due to the rebound in Oil.

Gold is struggling because the market has discounted a soft landing and inflation that is associated with an economic rebound. Furthermore, real interest rates have moved to the highest level in nearly 15 years.

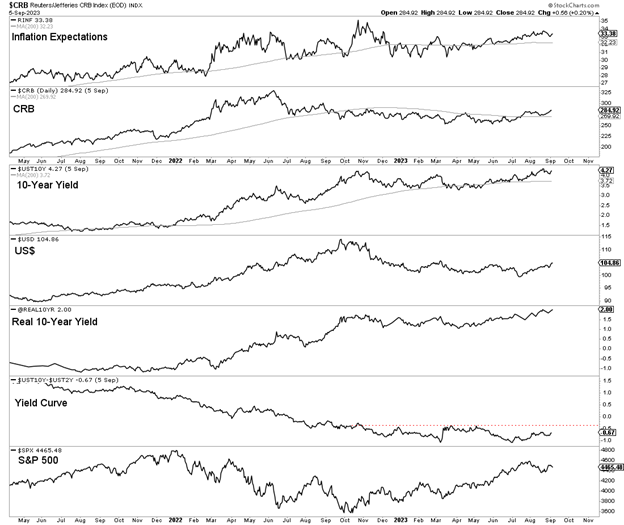

As we can see, inflation expectations and commodity prices are not far from their 2022 highs. Meanwhile, the 10-year yield is breaking out and that has started to pull the dollar higher.

Gold and precious metals could struggle until the yield curve steepens above 0.00, signaling a bear steepener, which is bearish for the stock market. A bear steepener would likely result from a continued steady increase in inflation expectations and the 10-year yield reaching 5%.

The Gold market could be waiting for stagflation, which requires, in addition to inflation, rising unemployment and weak growth.

A continued rise in Oil and bond yields would eventually tip the economy into stagflation territory. The jobs market is already starting to weaken and note that the impact of Fed tightening (according to Apollo Global Management) will be the most severe in Q2 and Q3 2024.

Meanwhile, gold and silver stocks continue to struggle as metals prices have failed to break out and cost pressures remain. Sentiment has turned negative in recent months and valuations have declined further.

As I wrote last month, this is a time to research companies that are poised to benefit from the inevitable breakout and new bull market in Gold.

I continue to focus on finding high-quality gold and silver juniors with 500% to 1000% upside potential over the next few years. To learn the stocks we own and intend to buy, with at least 5x upside potential in the coming bull market, consider learning about our premium service.

MORE or "UNCATEGORIZED"

Eloro Resources Announces Closing of Bought Deal LIFE Private Placement for Gross Proceeds of C$17 Million

Eloro Resources Ltd. (TSX: ELO) (FSE: P2QM) is pleased to announce the closing of its previously an... READ MORE

Minera Alamos Updates Resources and Reserves for the Pan Gold Mine in Nevada

Minera Alamos Inc. (TSX-V: MAI) (OTCQX: MAIFF) is pleased to announce updated Mineral Resource and M... READ MORE

Ero Copper Reports Fourth Quarter and Full Year 2025 Operating and Financial Results

Ero Copper Corp. (TSX: ERO) (NYSE: ERO) is pleased to announce its operating and financial results f... READ MORE

Rare Element Resources Announces Results of Oversubscribed Rights Offering of Common Shares

Rare Element Resources Ltd. (OTCQB: REEMF) is pleased to report that its previously announced... READ MORE

TRX Gold Reports Record Q2 2026 Production and Company Update

TRX Gold Corporation (TSX: TRX) (NYSE American: TRX) is pleased to announce preliminary resu... READ MORE