Jordan Roy-Byrne – “Beware of False Breaks in Gold”

Last week I wrote that the stock market had veered away from the course of a mega-bear market.

The rebound in the stock market has triggered several breadth thrusts, which (usually after a correction or bear market) signal more upside in the immediate future. It is not a coincidence that Gold and Silver formed nasty reversals around the same time.

Nevertheless, the risk of a recession remains in place, and the Federal Reserve will not be able to tighten, if any more, much longer.

For Gold, this setup implies potential for immediate headwinds but a turn to clear bullish skies if the economy weakens further, which is a question of if, not when.

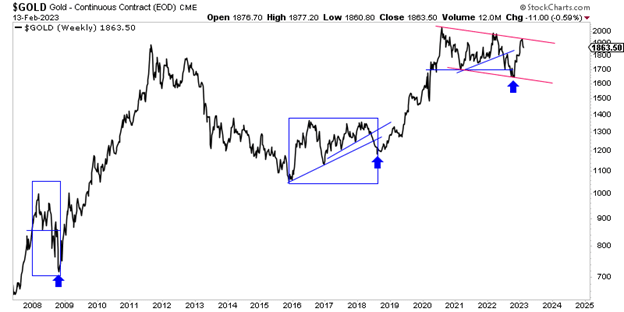

The nature of Gold is one of quite a few false breaks before a big move in the opposite direction. Let me return to that point in a moment.

Gold remains in a very bullish cup and handle pattern. It could trade down to $1600 and remain in this long-term bullish consolidation.

The key level in the medium term is $1800. Numerous moving averages and Fibonacci retracements are filling in around $1800. Holding above $1800 would imply that a move to a breakout is very close.

A sustained move below $1800 would not necessarily be a false breakdown, but we have to be careful about over-emphasizing bearish chart moves in the context of looming bullish fundamentals.

The two major bottoms in the past 15 years (October 2008 and August 2018) occurred soon after technical breakdowns. In addition, note what happened after Gold broke trendline support and $1675.

Gold could struggle in the short term. It could break $1800 and perhaps break another important support level.

But the history of Gold includes many breaks that did not pan out. I showed you three, and another was the breakout to an all-time high in the summer of 2020.

The bird’s eye view shows Gold can break lower while the handle channel (on the cup and handle pattern) remains intact. Gold would remain in position to launch to a breakout when the prevailing narrative changes to a weakening economy and lower interest rates.

The threats of lower prices and more time until a breakout move allow us another chance to buy the highest quality juniors with the most potential. In recent weeks I have introduced a larger watch list of these types of companies for my subscribers.

I continue to focus on finding high-quality juniors with 500% upside potential over the next few years. To learn the stocks we own and intend to buy, with at least 5x upside potential in the coming bull market, consider learning about our premium service.

MORE or "UNCATEGORIZED"

Critical Metals Corp. Proudly Announces the Highest Re-Assay TREO Results From Inception From (33) Drill Holes Results

Also Indicates Massive Geological Upside at the Hill Deposit at F... READ MORE

GoldHaven Confirms Gold Mineralization in Bedrock at Copeçal West Target, Including 39m of Mineralization in First-Ever Drilling

GoldHaven Resources Corp. is pleased to report results from four ... READ MORE

Erdene Expands Mineralization at Zuun Mod Molybedenum-Copper Project

Highlights: Drilling from surface to 150 metres depth returned mu... READ MORE

Supreme Critical Metals Announces Closing Of Second and Final Tranche Of LIFE Offering

Supreme Critical Metals Inc., (CSE: CRIT) (FWB: VR6) is pleased t... READ MORE

Osisko Development Provides Infill Drilling Update on Its 13,000-Meter Lowhee Program at Cariboo Gold Project; Intercepts Include 596.40 g/t Gold Over 2.0 Meters from 6.1 Meters Downhole, Including 2,293.56 g/t Gold Over 0.5 Meters from 6.6 Meters Downhole

HIGHLIGHTS 11,025 m of infill drilling completed (5,043 m new res... READ MORE