i-80 Gold Announces Positive Preliminary Economic Assessment on the Granite Creek Open Pit Project, Nevada; After-Tax NPV(5%) of $421 Million with an After-Tax IRR of 30% at US$2,175/oz Au

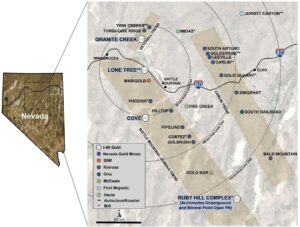

i-80 GOLD CORP. (TSX:IAU) (NYSE:IAUX) is pleased to announce the results of the preliminary economic assessment for the Granite Creek Open Pit Project. Granite Creek Open Pit is located within the Getchell Trend in northern Nevada, United States, immediately south of the Turquoise Ridge Complex of Nevada Gold Mines.

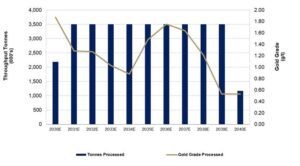

Figure 5: Granite Creek Open Pit LOM Annual Cash Flow (at $2,175/oz gold) (CNW Group/i-80 Gold Corp)

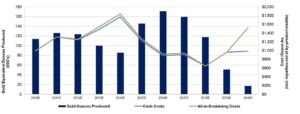

Figure 6: Granite Creek Open Pit LOM Gold Production Profile vs Cost per Ounce (CNW Group/i-80 Gold Corp)

“This Granite Creek Open Pit has all the markings of a top tier project; it is an open pit oxide project in Nevada with very good grades and recoveries leading to robust economics. This project on its own could be a company maker and it’s only one of five projects within the i-80 Gold portfolio. It’s a key component to growing our production profile towards mid-tier status, and our team is working vigorously to permit and move this project forward,” stated Richard Young, Chief Executive Officer.

Granite Creek Open Pit PEA Highlights

Mineral Estimates, Production and Mine Life

- Large open pit carbon-in-leach (“CIL”) gold mine with a life of mine (“LOM”) of approximately 10 years.

- Annual gold production of approximately 130,000 ounces following ramp up.

- Estimated LOM cash costs(1) of $1,185 per ounce and all-in-sustaining costs(1) of $1,225 per ounce.

- Updated mineral resource estimate resulting in an indicated gold mineral resource of 1.44 million ounces at 1.18 grams per tonne (“g/t”).

- Updated mineral resource estimate resulting in an inferred gold mineral resource 0.08 million ounces at 1.09 g/t.

Project Economics

- Based on a $2,175/oz gold price, the Project’s undiscounted after-tax cash flows(2) total $661 million with an after-tax net present value(2)(“NPV”) of $421 million, assuming a 5% discount rate, generating an 30% internal rate of return (“IRR”).

- Based on spot gold of $2,900/oz, the Project’s undiscounted after-tax cash flows total $1,267 million with an after-tax NPV(2) of $866 million, assuming a 5% discount rate, generating an IRR of 50%.

- Mine construction capital, including all pre-production facilities and infrastructure is estimated at approximately $200 million. No capital is included in mine construction capital for mobile equipment as the plan incorporates contract mining. Unit mining costs have been increased accordingly.

- Additionally, 12.9 million tonnes of stripping is required pre-production and 4.7 million tonnes in the first production year, costing $33.9 million.

- LOM sustaining capital is estimated at $30.3 million, primarily for tailings dam expansion and general sustaining costs.

- Total capital includes a contingency of 25%, or $49.1 million.

Mining and Processing

- The primary mining method will be a conventional open pit truck (10 to 12 trucks) and loader (4 loaders) operation, moving approximately 40 million tonnes per year during a steady state of production.

- The LOM strip ratio is 8.2:1, excluding capitalized pre-stripping.

- Material mined will be treated in a CIL process plant on site at a rate of approximately 3.5 million tonnes per year during steady state.

- Overall average gold grade processed of 1.25 g/t with an expected average gold recovery of 86.6%.

All amounts are in United States dollars, unless otherwise stated.

A summary of key valuation, cost, and operating metrics is presented in Table 1 below. For more detailed metrics presented on an annual basis, see Granite Creek Open Pit Detailed Cash Flow Model in Appendix.

Table 1: Summary of PEA Key Operating and Financial Metrics

| Project Economics | Unit | |

| Gold Price | $/oz | $2,175 |

| Pre-Tax NPV(5%)(2) | $M | $581.3 |

| After-Tax NPV(5%)(2) | $M | $421.2 |

| After-Tax IRR | % | 30 % |

| After-Tax Cash Flow | $M | $660.9 |

| Production Profile | ||

| Mine Life | years | ~10 |

| Mineralized Material Mined | 000s tonnes |

34,854.5 |

| Gold Grade of Mineralized Material Mined | g/t Au | 1.25 |

| Waste Tonnes Mined (excluding Capitalized Stripping) | 000s tonnes |

287,352.9 |

| Capitalized Stripping Tonnes Mined | 000s tonnes |

21,969.9 |

| Total Tonnes Moved (Incl. Capitalized Stripping) | 000s tonnes |

339,845.0 |

| Total Mineralized Material Processed | 000s tonnes |

34,854.5 |

| Gold Grade Processed | g/t Au | 1.25 |

| Strip Ratio (excluding capitalized stripping) | (waste:mineralized material) |

8.2:1 |

| Average Gold Recovery | % | 86.6 % |

| Total Gold Recovered | 000s oz | 1,120 |

| Average Annual Gold Equivalent Production(1) (LOM) |

000s oz | 110.0 |

| Average Annual Gold Production (following production ramp up) |

000s oz | 128.6 |

| Unit Operating Costs | ||

| Mineralized Material Mined | $/t mined | $2.37 |

| Processed (CIL) | $/t processed | $11.83 |

| G&A | $/t processed | $1.83 |

| LOM Total Cash Costs(1) (net of by-product credit) | $/oz | $1,185 |

| LOM All-in Sustaining Costs(1) (net of by-product credit) | $/oz | $1,225 |

| Total Capital Costs | ||

| Permitting | $M | $10.0 |

| Construction Capital | $M | $200.2 |

| Capitalized Stripping | $M | $33.9 |

| Sustaining Capital | $M | $30.3 |

| Reclamation & Surety | $M | $18.0 |

| Total Capital & Closure Costs | $M | $292.4 |

“The steady increase in the gold price has provided the opportunity to reassess the optimal processing stream for the Granite Creek Open Pit Project. The PEA confirms that anchoring entirely on a CIL processing facility adds significant value, primarily through higher gold recoveries, compared to conventional heap leach processing and reduces recovery risk. Additionally, the Project benefits from existing underground infrastructure, such as the dewatering systems, which improve efficiency and reduce capital requirements. Further, with this being a restart of a previously mined open pit, we anticipate an efficient permitting process,” added Matthew Gili, President and Chief Operating Officer.

Mineral Resource Update

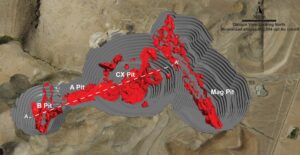

The Project’s open pit mineral resource was estimated in four main zones from west to east: B, A, CX, and Mag pits. In each zone, the geology was modeled using structural domains and grade indicator shells to define the concentrated high-grade and surrounding low-grade zones. The global estimation was then constrained by an optimized pit shell for resource reporting. Whittle shell optimization model has been utilized to create resource pit shells in Table 2.

Table 2: Granite Creek Open Pit Mineral Resource Estimate Statement as of May 4, 2021

| Measured and Indicated Mineral Resources | ||||||

| Class | Deposit | Tonnes | Au | Au | ||

| (Mt) | (g/t) | (Moz ) | ||||

| Measured | Pit B | 2.91 | 1.32 | 0.123 | ||

| Pit A | 0.56 | 1.07 | 0.019 | |||

| CX | 10.89 | 1.30 | 0.455 | |||

| Mag | 12.00 | 1.21 | 0.468 | |||

| Total Measured | 26.36 | 1.26 | 1.066 | |||

| Indicated | Pit B | 0.36 | 1.10 | 0.013 | ||

| Pit A | 0.69 | 0.80 | 0.018 | |||

| CX | 2.97 | 1.25 | 0.120 | |||

| Mag | 7.32 | 0.93 | 0.219 | |||

| Total Indicated | 11.34 | 1.01 | 0.369 | |||

| Measured and Indicated |

Pit B | 3.27 | 1.29 | 0.136 | ||

| Pit A | 1.25 | 0.92 | 0.037 | |||

| CX | 13.86 | 1.29 | 0.575 | |||

| Mag | 19.32 | 1.11 | 0.687 | |||

| Total Measured & Indicated | 37.70 | 1.18 | 1.435 | |||

| Inferred Mineral Resources | ||||||

| Class | Deposit | Tonnes | Au | Au | ||

| (000s) | (g/t) | (000s oz) | ||||

| Inferred | Pit B | 0.03 | 0.64 | 0.001 | ||

| Pit A | 0.21 | 0.59 | 0.004 | |||

| CX | 1.35 | 1.16 | 0.050 | |||

| Mag | 0.56 | 1.11 | 0.020 | |||

| Total Inferred | 2.15 | 1.09 | 0.075 | |||

Notes to table above:

- The effective date of the mineral resources estimate is May 4, 2021.

- The qualified persons for the estimate are Terre Lane QP-MMSA and Hamid Samari QP-MMSA of GRE, Inc.

- Mineral resources, which are not mineral reserves, do not have demonstrated economic viability. The estimate of mineral resources may be materially affected by environmental, permitting, legal, title, socio-political, marketing, or other relevant factors. Mineral resources are not ore reserves and are not demonstrably economically recoverable.

- Mineral resources are reported at a 0.30 g/t cutoff, an assumed gold price of 2,040 $/tr. oz, using variable recovery, a slope angle of 41 degrees, 6% royalty, heap leach processing cost $9.04 per tonne (includes admin costs), CIL processing cost of $17.22 per tonne (includes admin costs).

- An inferred mineral resource is that part of a mineral resource for which quantity and grade or quality are estimated on the basis of limited geological evidence and sampling. Geological evidence is sufficient to imply but not verify geological and grade or quality continuity. An inferred mineral resource has a lower level of confidence than that applying to an indicated mineral resource and must not be converted to a mineral reserve. It is reasonably expected that the majority of inferred mineral resources could be upgraded to indicated mineral resources with continued exploration.

- The reference point for mineral resources is in situ.

Economic Analysis

The project economics shown in the PEA are favorable, providing positive NPV values at varying gold prices, capital costs, and operating costs. The Project’s NPV and IRR in relation to fluctuations in the gold price are outlined in Table 3.

Table 3: Granite Creek Open Pit Gold Price Sensitivity After-tax Analysis

| Gold Price ($/oz) | |||||||

| $1,850 | $2,000 | $2,175 | $2,500 | $2,750 | $2,900 | $3,000 | |

| NPV5% ($M)(2) | $260 | $361 | $421 | $624 | $776 | $866 | $926 |

| IRR (%) | 21 % | 26 % | 30 % | 39 % | 46 % | 50 % | 52 % |

Project Overview

Granite Creek Open Pit is a large open pit CIL gold development project. The Granite Creek property (the “Property”) also includes the Granite Creek Underground Project, a fully permitted, constructed and operating mine currently in the production ramp up phase. The Property is located at the intersection of the highly prolific Battle Mountain-Eureka and Getchell gold trends, near Nevada Gold Mines’ Turquoise Ridge Complex (see Figure 2). Situated in the Potosi mining district, the Project lies approximately 27 miles northeast of Winnemucca, within Humboldt County, Nevada.

Access to the Property is provided by a combination of paved interstate and state highways and well-maintained, unpaved private roads. The towns of Winnemucca and Battle Mountain are located 35 miles by road to the southwest and 60 miles to the southeast of the Property, respectively.

Between 1980 and 1999, approximately 987,000 ounces of gold was produced from various open pit mining operations on the site. The Granite Creek Open Pit is an expansion of the previously mined areas.

Geology and Mineralization

Mineralization at Granite Creek is Carlin-type, with gold hosted in fine-grained arsenian pyrite similar to nearby deposits at Nevada Gold Mines’ Turquoise Ridge Complex which hosts approximately 20 million measured and indicated ounces of gold(3). The primary host rocks at Granite Creek are interbedded shale, siltstone, and limestone of the Ordovician Comus Formation. Open-pit mineralization at Granite Creek is hosted in Upper Comus siltstone and shale in the Mag pit.

Conversely, mineralization is hosted in the Lower Comus marble, limestone, and siltstone in the CX and B pits. In the CX and B pits, mineralization is strongly structurally controlled, typically by inverted thrust faults and normal faults trending north to northeast. In the Mag pit, mineralization has a stronger stratigraphic control with mineralization along bedding in the footwall of the northwest trending Mag fault.

Mining and Processing

The PEA demonstrates an initial mine life of approximately 10 years with an annual gold production of approximately 130,000 ounces following production ramp up. The PEA represents a preliminary point-in-time estimate of the mine plan. The previous preliminary economic assessment released on Granite Creek in 2021, envisioned a predominately heap leach operation with a small-scale CIL plant for Granite Creek open pit. Further work and higher gold prices have demonstrated better economics by migrating to a full CIL scenario.

The Project’s above ground mine plan will be accomplished using conventional open pit mining techniques with 10 to 12 haul trucks (133 tonne) and four loaders (nine cubic yard bucket). Mineralized material will be mined at a rate of 10,000 tonnes per day, assuming 350 days of mining a year, for a total of 3.5 million tonnes annually.

Waste rock would be placed in waste rock storage facilities and as pit backfill as the mining sequence allows. Pits were designed with overall 41-degree side wall slopes and 90-foot haul roads with a maximum of 10% grade.

The study envisions the construction of 10,000 tonne per day CIL plant on-site. The process plant for Granite Creek was selected based on the material characteristics, in particular the presence of organic carbon (“TOC”) and the associated cyanide leach performance. The variable organic carbon concentrations in the material make the use of conventional cyanide heap leaching less robust and require more strict ore control measures to divert high TOC materials to an alternative leach process. Given this, a CIL process was selected, CIL also showed a significant gold recovery advantage over heap leaching.

The Project’s process design includes primary crushing via a large jaw crusher with an intermediate stockpile. The crushed material is fed to a sag and ball mill circuit consisting of a semi-autogenous mill in closed circuit with a ball mill. Pebble crushing has not been included at this stage. The target throughput is 10,000 tonnes per day at a 90% availability. The ground material is directed to a thickener and the thickener underflow to the CIL tanks.

The CIL circuit employs simultaneous cyanide gold leaching and activated carbon gold adsorption with the carbon advancing countercurrent to the leach slurry. The presence of active carbon during the leaching mitigates the impact of gold adsorption by the organic carbon present in the material.

The loaded carbon is stripped of the gold in a modified Zadra elution circuit. Hot cyanide and sodium hydroxide solutions remove the gold from the carbon into a concentrated stream that reports to an electrowinning circuit. The electrowon gold is further thermally refined into doré bars prior to shipment.

A conventional tailings storage facility would be constructed near the CIL plant.

Capital Cost Summary

Mine construction capital and sustaining capital over LOM is estimated to total approximately $292.4 million. This includes $33.9 million in capitalized stripping cost, $200.2 million in construction capital, $30.3 million in sustaining capital, $18 million in reclamation costs, and $10 million for permitting. There is a 25% or $49.1 million contingency included in the capital figures. Approximately 12.9 million tonnes of stripping is required in the year prior to production and 4.7 million tonnes in the first year of production to gain access to the body or mineralized material costing $37.7 million. The Project is a former producing mine with a large portion of the necessary infrastructure in place.

Granite Creek Open Pit is expected to generate an estimated $660.9 million in after-tax cash flow over the current mine life (see Figure 5).

Table 4: Granite Creek Open Pit Capital Cost Estimates (excludes permitting and reclamation costs)

| Mine Construction | Sustaining | |

| ($M) | ($M) | |

| Capitalized Waste | $30.1 | |

| Construction Capital | $160.8 | |

| Sustaining Capital | $24.2 | |

| Contingency (25% on capital and 20% on capitalized waste) |

$43.1 | $6.1 |

| Total Capital Cost | $234.0 | $30.3 |

Operating Cost Summary

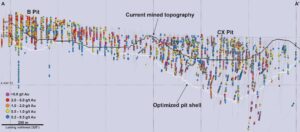

The PEA estimates cash costs(1) of $1,185 per ounce of gold and all-in sustaining costs(1) of $1,225 per ounce of gold for the LOM (see Table 5). Figure 6 illustrates these operating costs over the Project’s estimated production profile.

Table 5: Granite Creek Open Pit Total and Unit Operating Costs

| Total Costs | Unit Cost | Cost per Ounce | |

| ($M) | ($/t ) | ($/oz Au) | |

| Mining | $764.4 | $21.93 | $632 |

| Processing | $412.3 | $11.83 | $341 |

| G&A | $63.9 | $1.83 | $53 |

| Refining, Royalties & Net Proceeds Tax | $193.3 | $5.55 | $160 |

| Total Operating Cost/Cash Costs(1) | $2,511.0 | $40.8 | $1,185 |

| Closure & Reclamation | $18.00 | $0.5 | $15 |

| Sustaining Capital | $30.3 | $0.9 | $25 |

| All-in Sustaining Costs(1) | $1,482.3 | $42.5 | $1,225 |

Permitting

The Project has the necessary permits for the ongoing small-scale underground mining operation.

In order to execute the project plan, additional state and federal permits are required. The Project will extend to non-patented mining claims and will require a permit under the National Environmental Policy Act which is the regulation that requires an Environmental Impact Statement. The EIS requires significant effort to acquire; however, i-80 Gold currently expects to successfully permit the Project in a reasonable time frame of three years.

State permits are required for air quality protection, groundwater protection, surface water protection, and water rights. The current PEA includes a timeline for acquiring these permits, and the costs associated with the permitting effort.

Water Management

The underground mine will abstract up to 3,000 gpm of dewatering water coming from the underground mine sumps and the dewatering wells required to dewater the mine. The MAG pit is currently flooded and must be dewatered. Many of the types of dewatering water contain elevated arsenic concentrations above Nevada Reference Values, as does much of Nevada’s natural groundwater. As a result, the site has a plan for the management and treatment of any Mine Influenced Water (“MIW”) that does not meet discharge standards. This plan includes preferentially consuming MIW for operations, treating water in a metal-precipitator treatment plant, and the entrainment of MIW in the tailings pond, followed by forced evaporation over the tailings pond. The majority of pumped groundwater will be reinfiltrated in several already-permitted Rapid Infiltration Basins (“RIBs”) which return the water to the Humboldt basin aquifers.

Closure

The site closure costs are estimated at $18.0 million. The closure plan involves covering the tailings facility and mine waste with industry-standard engineered covers which will prevent groundwater and surface water quality impacts. Upon closure, no long-term liabilities are currently predicted to exist which may complicate bond release and a walk-away post-closure condition.

Next Steps to Feasibility Study

A feasibility study in accordance with National Instrument 43-101 – Standards of Disclosure for Mineral Projects and Subpart 1300 of Regulation S-K with an updated mineral resource estimate is expected to be completed in Q4 2025. Below is a summary of additional work to be conducted.

Metallurgical

- Improved geo-metallurgical analysis by increasing the range of materials tested to include grade (gold, silver, carbon and sulfur), spatial (elevation and strike), and geologic domains.

- Additional CIL testing to improve the gold extraction relationships.

- Comminution testing examining the SAG and ball mill work index.

- Infill the drill hole database with TOC and sulfur assays.

- Conduct arsenic and mercury assays on all samples employed for metallurgical testing.

Technical Disclosure and Qualified Persons

The PEA was prepared in accordance with NI 43-101. The PEA will be filed within 45 days of the date of this press release under the Company’s issuer profile on SEDAR+ at www.sedarplus.ca. An Initial Assessment for the Granite Creek Open Pit Project was also prepared in accordance with S-K 1300 and Item 601 of the Regulation S-K and the S-K 1300 Report will be filed on EDGAR at www.sec.gov. Both reports will be available on the Company’s website at www.i80gold.com. The mineral estimates and project economics are the same under the PEA and the S-K 1300 Report.

The technical information contained in this press release has been prepared under the supervision of, and has been reviewed and approved by Terre Lane (SME No. 4053005 / MMSA No. 01407QP) of Global Resource Engineering (“GRE”), and Tyler Hill CPG., Vice President Geology for the Company, who are all qualified persons within the meaning of NI 43-101 and S-K 1300.

For a description of the data verification, assay procedures and the quality assurance program and quality control measures applied by the Company, please see the Company’s Annual Information Form dated March 12, 2024 filed under the Company’s profile on SEDAR+ at www.sedarplus.ca and filed with the Company’s Form 40-F under the Company’s profile on EDGAR at www.sec.gov. Further information about the PEA referenced in this news release, including information in respect of data verification, key assumptions, parameters, risks and other factors, will be contained in the PEA.

The PEA is preliminary in nature and includes an economic analysis that is based, in part, on inferred mineral resources. Inferred mineral resources that are considered too speculative geologically to have for the application of economic considerations applied to them that would enable them to be categorized as mineral reserves, and there is no certainty that the results of the PEA will be realized. Mineral resources do not have demonstrated economic viability and are not mineral reserves.

Endnotes

- This is a non-IFRS/non-GAAP measure. Please see the section titled “Non-IFRS Performance Measures/Non-GAAP Financial Performance Measures” below.

- Cash flow and NPV are calculated as of the start of construction, which is anticipated to commence in early 2028, subject to obtaining the necessary permits by December 31, 2027, as anticipated.

- Turquoise Ridge Complex gold mineral resource estimate of approximately 20 million ounces (110 Mt at 5.42 g/t Au) as at December 31, 2023 based on publicly filed technical reports of Barrick Gold Corporation available on SEDAR+ at www.sedarplus.ca and www.barrick.com. No qualified person of the Company has independently verified any mineral resource information in respect of the Turquoise Ridge Complex contained in this news release and such information is not necessarily indicative of the mineralization on the property subject to such technical reports.

About i-80 Gold Corp.

i-80 Gold Corp. is a Nevada-focused mining company committed to building a mid-tier gold producer through a new development plan to advance its high-quality asset portfolio. The Company is the fourth largest gold mineral resource holder in the state with a pipeline of high-grade development and production-stage projects strategically located in Nevada’s most prolific gold-producing trends. Leveraging its fully permitted central processing facility, i-80 Gold is executing a hub-and-spoke regional mining and processing strategy to maximize efficiency and growth. i-80 Gold’s shares are listed on the Toronto Stock Exchange (TSX: IAU) and the NYSE American (NYSE: IAUX). For more information, visit www.i80gold.com.

MORE or "UNCATEGORIZED"

First Phosphate Receives Conditional Approval for up to $16.7 Million Non-Repayable Contribution from the Government of Canada

First Phosphate Corp. (CSE: PHOS) (OTCQX: FRSPF) (OTCQX ADR: FPHOY) (FSE: KD0) has been cond... READ MORE

Gold X2 Drills 117m of 1.21 g/t Au, Including 10m of 4.37g/t Au; High-Grade Zone Intersected 280m Beneath the Resource Pit Demonstrating Underground Potential at the Moss Gold Deposit

Gold X2 Mining Inc. (TSX-V: AUXX) (OTCQB: GSHRF) (FWB: DF8), is pleased to announce initial drilling... READ MORE

Tectonic Raises Over C$92 Million; Completes Upsized Private Placement With Full Over-Allotment Exercised

Tectonic Metals Inc. (TSX-V: TECT) is pleased to announce the successful closing of the Company’s ... READ MORE

Cerro de Pasco Resources Enters Project Development Funding Agreement with U.S. International Development Finance Corporation for Quiulacocha

Cerro de Pasco Resources Inc. (TSX-V: CDPR) (OTCQB: GPPRF) (BVL: CDPR) announces that it has ... READ MORE

NorthWest Announces Updated Mineral Resource at Kwanika Reflecting Strategic Shift to Higher-Grade Copper-Gold Focus

NorthWest Copper Corp. (TSX-V: NWST) is pleased to announce an updated mineral resource estimate for... READ MORE