i-80 Gold Announces High-Grade Mineral Resource Estimate for the FAD Project and Confirms Near-Surface Oxide Mineralization

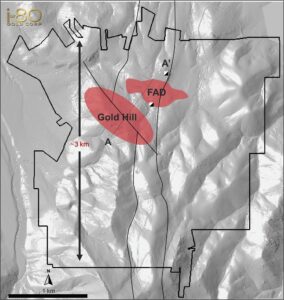

i-80 GOLD CORP. (TSX: IAU) (NYSE: IAUX) is pleased to announce the results of a mineral resource update prepared in accordance with National Instrument 43-101 – Standards of Disclosure for Mineral Projects for its FAD Project, which confirms the presence of high-grade gold, silver, lead and zinc mineralization. The Project is a non-core asset located on the FAD Property, immediately south of i-80 Gold’s Ruby Hill Property along the southeastern extent of the highly prolific Battle Mountain-Eureka Trend in northeastern Nevada, USA (see Figure 1 in Appendix).

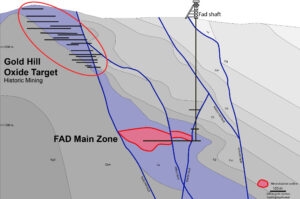

Figure 2: Plan View of the FAD Project and Gold Hill Project Situated on the 100% Wholly Owned FAD Property (CNW Group/i-80 Gold Corp)

Highlights

- Indicated Mineral Resource Estimate of 594 kt at 4.51 g/t Au, 209.7 g/t Ag, 4.34% Pb, and 6.77% Zn containing 86 koz Au, 4.0 Moz Ag, 57 Mlb Pb, and 89 Mlb Zn

- Inferred Mineral Resource Estimate of 2,736 kt at 5.07 g/t Au, 188.6 g/t Ag, 3.69% Pb, and 4.42% Zn containing 446 koz Au, 16.6 Moz Ag, 223 Mlb Pb, and 267 Mlb Zn

- At spot commodity prices, there is approximately 7,360 kt containing 895 koz Au, 31 Mlb Ag, 407 Mlb Pb, and 678 Mlb Zn

- High-grade polymetallic asset with attractive net smelter returns of approximately $430/t and $442/t in the indicated and inferred mineral resource categories, respectively.

- Analysis of two metallurgical composites from FAD sulfide material indicates critical metals such as gallium, indium, antimony, and tin are present in the zinc concentrate with average grades of 126.0 g/t Ga, 122.5 g/t In, 324.0 g/t Sb, and 759.5 g/t Sn, respectively, providing further upside from a metallurgical and permitting standpoint.

- At surface, oxide gold mineralization present at the Gold Hill target on the Property.

“The FAD mineral resource update highlights the high-grade nature of the deposit and supports our geological understanding of the Project,” stated Tyler Hill, Vice President of Geology. “This resource estimate only includes drill holes where quality control measures could be validated and excludes a significant number of historical drill holes where control measures could not be verified. Even with a limited number of drill holes completed to-date, we have significantly enhanced the Project through validation and organization of historic data, and through the metallurgical test work conducted. The deposit remains open at depth, to the east and north where several wide-spaced historic holes have intersected mineralization.”

Mr. Hill added, “We believe FAD has significant upside potential and that the Project could benefit considerably from additional drilling, providing substantial exposure to high-grade polymetallic mineralization in a tier-one mining jurisdiction.”

FAD presents a significant opportunity due to its high-grade nature and further growth potential, however, the Company remains focused on advancing its portfolio of five core gold projects and refurbishing the Lone Tree central processing facility which underpin its development plan to create a Nevada-focused mid-tier gold producer. The Property is considered non-core and is being contemplated for sale in support of the Company’s recapitalization objectives.

The Project was acquired in 2023 through the acquisition of Paycore Minerals Inc. for consideration of approximately US$88 million through an all-share transaction. The Property also hosts gold oxide mineralization near surface at the Gold Hill deposit (see Figures 2 and 3 in the Appendix). Preliminary work conducted by the Company demonstrates opportunity to monetize the near surface gold mineralization at Gold Hill through heap leaching at nearby facilities, including i-80 Gold’s Ruby Hill heap leach facility.

Updated Mineral Resource Estimate

The mineral resource estimate (“MRE”) hosts 594 kt of ore in the indicated category with gold, silver, lead and zinc grades of 4.51 g/t, 209.7 g/t, 4.34%, and 6.77%, respectively. In the inferred category, there are 2,736 kt with respective gold, silver, lead and zinc grades of 5.07 g/t, 188.6 g/t, 3.69%, and 4.42%.

Tables 2 and 3 below illustrate the deposit’s sensitivity to commodity prices and various net smelter return cut-offs.

The MRE is based on 82 drill holes with a cumulative length of approximately 32,000 meters and 4,613 assays. This is comprised of 61 historical holes totaling approximately 16,000 meters with 664 assays, and 21 holes totaling approximately 16,000 meters, with 3,949 assays from the 2021 to 2023 drilling programs.

From 2021 to 2023, Paycore and i-80 Gold completed 32 surface reverse circulation and diamond drill holes, totaling approximately 22,000 meters, with 5,460 assayed samples. Sample results from the 2023 drilling conducted by i-80 Gold are shown below (see i-80 Gold press release dated January 25, 2024).

- Hole PC23-22: 9.0 g/t Au, 92.4 g/t Ag, 12.2% Zn & 1.0% Pb over 14.6 m

- Hole PC23-28: 3.9 g/t Au, 185.6 g/t Ag, 11.1% Zn & 3.6% Pb over 25.4 m, including 4.1 g/t Au,

350.1 g/t Ag, 13.5% Zn & 7.3% Pb over 11.0 m

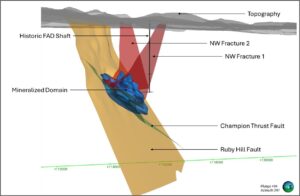

The results from the most recent drilling programs confirmed the historical data on mineralization, which showed mineralization occurs in two main zones: a shallow oxide zone associated with the Hamburg and Eldorado Dolomite in an area of historic mining, and a deeper sulfide zone of mineralization hosted in the Eldorado Dolomite (see Figures 2 to 5 in the Appendix).

Table 1: FAD Mineral Resource Estimate as of October 31, 2025

|

Resource |

Tonnes |

Grades |

NSR |

Contained Metal |

|||||||

|

Au |

Ag |

Pb |

Zn |

Au oz |

Ag oz |

Pb lbs |

Zn lbs |

||||

|

Measured |

– |

– |

– |

– |

– |

– |

– |

– |

– |

– |

|

|

Indicated |

594 |

4.51 |

209.7 |

4.34 |

6.77 |

430.2 |

86 |

4,006 |

56,902 |

88,651 |

|

|

Measured + Indicated |

594 |

4.51 |

209.7 |

4.34 |

6.77 |

430.2 |

86 |

4,006 |

56,902 |

88,651 |

|

|

Inferred |

2,736 |

5.07 |

188.6 |

3.69 |

4.42 |

441.9 |

446 |

16,586 |

222,686 |

266,855 |

|

|

Notes to table above: |

|||||||||||

|

1. MRE is reported using the 2014 CIM Definition Standards, with an effective date of October 31, 2025. The Qualified Person for the estimate is Ms. Terre Lane, a GRE employee. |

|||||||||||

|

2. Mineral resources are not mineral reserves and do not have demonstrated economic viability. |

|||||||||||

|

3. MRE is presented as undiluted and in situ for an underground scenario and is considered to have reasonable prospects for eventual economic extraction. MRE shows sufficient continuity and isolated blocks were removed; therefore, the herein MRE meets the CIM Guidelines published in November 2019. |

|||||||||||

|

4. MRE is reported using an NSR cut-off of $259/tonne, calculated using gold price of US$2,400/oz, silver price of US$26.81/oz, lead price of US$1.04/lbs and zinc price of $1.39/lbs; reference mining cost of $165.35/tonne processed; processing cost of $27.56/tonne processed; general and administrative costs of $ 11.02/tonne processed. |

|||||||||||

|

5. The resources are reported in metric units (Tonnes = metric tonnes and g/t = grams per metric tonnes). |

|||||||||||

|

6. Numbers have been rounded to the nearest thousand and may not sum. |

|||||||||||

|

7. The QP Ms. Terre Lane is not aware of any known environmental, permitting, legal, title-related, taxation, sociopolitical, or marketing issues or any other relevant issues that could affect this MRE. |

Grade – Tonnage Relationship

Table 2 below demonstrates the sensitivity of tonnages and grades to commodity prices. At spot prices there are 7,362 kt of mineralized material for approximately 895 koz of gold, 31Moz of silver, 408 Mlb of lead and 680 Mlb of zinc (see Table 3).

Table 2: Sensitivity of Mineral Resources to Metal Price Assumptions

|

Tonnes (000 ) |

Grades |

NSR |

Contained Metal |

|||||||

|

Au |

Ag |

Pb |

Zn |

Au oz |

Ag oz |

Pb lbs |

Zn lbs |

|||

|

(g/t) |

(g/t) |

( %) |

( %) |

(000) |

(000) |

(000) |

(000) |

|||

|

Scenario 1 (Base) |

3,330 |

4.97 |

192.3 |

3.81 |

4.84 |

439.8 |

532 |

20,588 |

279,704 |

355,320 |

|

Scenario 2 |

4,775 |

4.46 |

161.8 |

3.18 |

4.56 |

466.9 |

685 |

24,839 |

334,757 |

480,030 |

|

Scenario 3 |

6,071 |

4.08 |

143.6 |

2.81 |

4.35 |

489.9 |

796 |

28,029 |

376,094 |

582,210 |

|

Scenario 4 (Spot) |

7,362 |

3.78 |

129.8 |

2.51 |

4.18 |

512.2 |

895 |

30,723 |

407,380 |

678,425 |

Table 3: Commodity Price Assumptions for Scenario Analysis

|

Commodity Price Assumptions |

||||

|

Au |

Ag |

Pb |

Zn |

|

|

($/oz) |

($/oz) |

($/lb) |

($/lb) |

|

|

Scenario 1 (Base) |

$2,400 |

$26.81 |

$1.04 |

$1.39 |

|

Scenario 2 |

$3,000 |

$33.00 |

$1.04 |

$1.39 |

|

Scenario 3 |

$3,500 |

$40.00 |

$1.04 |

$1.39 |

|

Scenario 4 (Spot) |

$4,000 |

$50.00 |

$0.85 |

$1.35 |

Project Background

FAD is located along the southeastern extent of the Battle Mountain-Eureka Trend and sits contiguous with the Ruby Hill Property (see Figure 1 in the Appendix). The Company acquired FAD in 2023 through the acquisition of Paycore. Paycore completed approximately 11,000 meters of drilling, expanding the deposit, prior to the sale of the asset to i-80 Gold who completed approximately 10,000 meters of drilling during 2023.

The FAD deposit was explored by several prior leaseholders in the mid-20th century, with a consortium led by Hecla Mining Company completing the most significant quantity of work. This exploration effort included the creation of two shafts (Locan and FAD) to access the deposit, about 120 borings and approximately 3,000 meters of exploration drilling.

Historical exploration programs included both surface and underground drilling augmented by channel samples collected from drifts developed from the FAD shaft, and approximately 3,000 meters of development drilling, some of which was sampled. This work occurred during an exploration period of approximately 20 years with most of the work completed between 1948 and 1963.

The Property consists of 75 unpatented lode mining claims, and 110 patented mine claims. There are approximately 1,733 acres within the Property boundary, consisting of 981 acres of unpatented claims, 705 acres of patented mine claims, 47 acres at the mills site (see Figure 5 in the Appendix). The Company has modified the original FAD boundary lines purchased in 2023, to provide flexibility for the development of its adjacent Mineral Point project.

Known mineralized zones on the Property are mostly contained within private patented land with existing disturbance which allows for immediate drilling to take place.

Metallurgical Testing

Preliminary assumptions for the MRE are based on the expectation that lead-silver and zinc-silver concentrates can be produced and shipped to a variety of smelter options. Preliminary test work indicates the lead-silver and zinc-silver concentrates are salable. Further, the MRE assumes a gold-silver pyrite concentrate can be processed at an autoclave facility. These assumptions were used to develop NSR values and cut-off grades for resource reporting. The average recoveries for the different concentrate products derived from the mineralized material are summarized in Table 4 and were determined by work completed by Blue Coast Research in 2023. Test work indicates that the majority of the gold mineralization reports to the rougher and cleaner tails in pyrite concentrate. Notably, the sulfide composites contain low silica and low deleterious metals, enhancing the expected quality potential of future concentrates.

Table 4: Average Concentrate Recoveries

|

Concentrates |

Gold (%) |

Silver (%) |

Lead (%) |

Zinc (%) |

|

Lead-Silver Concentrate |

– |

60.5 |

80.5 |

1.6 |

|

Zinc-Silver Concentrate |

– |

15.6 |

4.5 |

75.7 |

|

Pyrite Gold-Silver Concentrate |

80.0 |

5.0 |

– |

– |

Future work should include systematic metallurgical test programs to confirm recovery assumptions, evaluate concentrate characteristics, and provide reliable inputs for economic studies. This testing will be essential to de-risk the Project and support advancement toward more advanced technical studies.

Additionally, critical metals such as gallium and indium are present in the zinc concentrate, with average grades of 126.0 g/t and 122.5 g/t, respectively, providing further upside from a metallurgical and permitting standpoint.

Geology and Mineralization

The Eureka district is characterized by gold-silver-lead-zinc polymetallic carbonate replacement and Carlin-type gold deposits, which are the two primary deposit-types within the district. The FAD deposit is a mid-Cretaceous gold-rich carbonate replacement deposit and is hosted by the Eldorado dolomite of middle Cambrian age. The source of hydrothermal mineralized material forming fluids remains enigmatic, but may be one of the proximal Cretaceous intrusions, including the Ruby Hill stock.

Sulfide replacement deposit on the FAD property consists mainly of subequal amounts of pyrite, sphalerite, and galena, with subordinate amounts of hydrothermal dolomite, calcite, arsenopyrite, tennantite, pyrrhotite, quartz, and chalcopyrite. Locally, relatively pure pods of pyrite, galena, and sphalerite are found with thicknesses in the range of tens of centimeters within sulfide replacement masses at FAD. Gold occurs mostly as inclusions in pyrite or in a solid solution in pyrite or arsenian pyrite, based on metallurgical tests.

Gold Hill Oxide Target

The Property hosts the historic original high-grade Ruby Hill mine (currently Gold Hill) (see Figures 2, 3, and 5 in the Appendix). The Eureka district produced an estimated 1,800,000 tonnes from 1866 through 1964 and is estimated to have contained 1,650,000 ounces of gold, 39,000,000 ounces of silver, and 625 million pounds of lead(1). Although the exact figures are unknown, the majority of this production came from the original Ruby Hill mine, now known as Gold Hill on the FAD property.

In 2022, Paycore drill tested the potential for an open pit mine in the vicinity of the historic mine. Sample results(2) include:

- 1.0 g/t Au, 25.7 g/t Ag, 4.3% Zn & 1.0% Pb over 28.0 m

- 2.3 g/t Au, 23.8 g/t Ag, 4.1% Zn & 0.4% Pb over 23.9 m

Initial metallurgical work indicated excellent leachability with gold recoveries of approximately 85% in 48-hour cyanidation bottle roll tests (see press release dated June 27, 2024 for additional detail). Oxide material from Gold Hill could be processed at nearly by heap leaching facilities, including i-80 Gold’s Ruby Hill heap leach through a joint venture or tolling arrangement. Very limited drilling has been conducted in this area, and the system remains open on strike.

Technical Disclosure and Qualified Persons

The Report was prepared in accordance with NI 43-101. The Company does not consider the Project a material property for the purposes of NI 43-101 or S-K 1300, therefore, the technical report for the Project will not be filed on SEDAR+ or EDGAR. The Company’s focus is on the execution of its new development plan, which includes advancing five gold projects and the refurbishment of its central processing facility, which underpins its growth strategy to create a mid-tier gold producer in the region.

The technical information contained in this press release has been prepared under the supervision of, and has been reviewed and approved by Terre Lane, Principal Mining Engineer of Global Resource Engineering Ltd., and a registered member of SME and a Qualified Professional in Ore Reserves and Mining with Mining & Metallurgical Society of America (MMSA) (#01407QP), and Tyler Hill CPG., Vice President Geology for the Company, who are all qualified persons within the meaning of NI 43-101.

|

Endnotes |

|

|

(1) |

Source: Nolan, Thomas B. The Eureka Mining District Nevada: Geological Survey Professional Paper 406. Washington, DC: United States Government Printing Office, 1962. 78pp. & Nolan, T.B., and Hunt, R. N., 1968, The Eureka Mining District, Nevada, in Ridge, J. D., ed., Ore deposits of the United States, 1933-1967 (Graton-Sales Vol.): New York, American Institute of Mining Metallurgy Petroleum Engineers. v. 1. P. 966-991. |

|

(2) |

The sample drill results merely represent certain sample results which may not be indicative of total drill results. |

About i-80 Gold Corp.

i-80 Gold Corp. is a Nevada-focused mining company committed to building a mid-tier gold producer through a new development plan to advance its high-quality asset portfolio. The Company is the fourth largest gold mineral resource holder in the state with a pipeline of high-grade development and production-stage projects strategically located in Nevada’s most prolific gold-producing trends. Leveraging its central processing facility following an anticipated refurbishment, i-80 Gold is executing a hub-and-spoke regional mining and processing strategy to maximize efficiency and growth. i-80 Gold’s shares are listed on the Toronto Stock Exchange (TSX: IAU) and the NYSE American (NYSE: IAUX). For more information, visit www.i80gold.com.

MORE or "UNCATEGORIZED"

Delta Reports New Gold Intercept at Nova Target in Wedge Area, 4 Kilometres West of Eureka; Follow-Up Drill Program Underway

Delta Reports New Gold Intercept at Nova Target in Wedge Area, 4 ... READ MORE

Silver One Announces Closing Of Final Tranche Of $32 Million Financing

Silver One Resources Inc. (TSX-V: SVE) (OTCQX: SLVRF) (FSE: BRK1)... READ MORE

SAGA Metals Achieves 100% Drilling Success in 2025—Reports Final Assays from Trapper South at Radar Critical Minerals Project in Labrador

Exceptional grades of Titanium, Vanadium and Iron in all 15 drill... READ MORE

Near Surface Intersection Yields 6.58 g/t gold over 10.35 metres

Intersection is within 33 metres from surface and contained in a ... READ MORE

Alamos Gold Provides Three-Year Operating Guidance Outlining 46% Production Growth by 2028 at Significantly Lower Costs

Further production growth to one million ounces annually expected... READ MORE